How much do Canadians need to retire? Surveys show the...

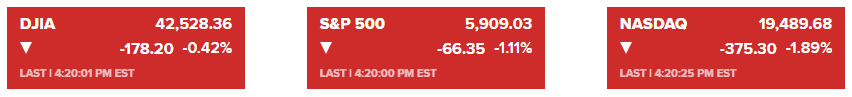

Read MoreStocks Fall as Nvidia Leads Tech Selloff and Bond Rout Fuels Inflation Concerns

Market Overview:

U.S. stocks closed higher on Friday as Wall Street recovered from a rocky start to the new year. The S&P 500 gained 1.26% to close at 5,942.47, while the Dow Jones Industrial Average rose 0.8% to 42,732.13. The Nasdaq Composite advanced 1.77% to 19,621.68.

Investors were encouraged by broad-based gains, snapping a five-day losing streak for the S&P 500 and Nasdaq. However, all major indices ended the week in the red, with the S&P 500 losing 0.48%, the Dow 0.60%, and the Nasdaq 0.51%.

Economic data showed modest growth in U.S. manufacturing in December, as the ISM index rose to 49.3, slightly below the expansion threshold but above expectations. New orders reached their highest levels since early 2023. Bond yields climbed, with the 10-year Treasury yield hitting 4.6% following hawkish comments from Richmond Fed President Tom Barkin.

Corporate News:

- Meta Platforms Inc. will cease third-party fact-checking on its social media platforms in the U.S., instead implementing a community notes system for users to comment on posts’ accuracy. The company stated that this system will promote free expression.

- Uber Technologies Inc. has partnered with Nvidia to accelerate the development of autonomous driving technology.

- Johnson & Johnson reported that its combination therapy for lung cancer outperformed AstraZeneca’s Tagrisso in a head-to-head study, potentially setting a new standard for treating one of the deadliest types of cancer.

- Toronto-Dominion Bank is reviewing its 10.1% stake in Charles Schwab Corp., as part of a strategic review triggered by the Canadian bank’s U.S. money-laundering scandal.

- Getty Images Holdings Inc. has agreed to acquire Shutterstock Inc., forming a combined company worth approximately $3.7 billion.

- UniFirst Corp. saw its shares rise following reports that Cintas Corp. made a $5.1 billion offer to acquire the company.

- Paychex Inc. will acquire rival Paycor HCM Inc. for about $4.1 billion in cash.

- Apollo Global Management Inc. and BC Partners agreed to acquire a controlling stake in GFL Environmental Inc.’s environmental services unit for C$8 billion.

- Phillips 66 will acquire EPIC NGL for $2.2 billion, expanding its natural gas liquids pipeline business in the Permian Basin.

- Southwest Airlines Co. will generate $92 million by selling and leasing back 35 Boeing 737-800 aircraft, as part of a broader strategy to monetize its fleet and aircraft orders.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

Recent Posts

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More