How much do Canadians need to retire? Surveys show the...

Read MoreDow Rises 350+ Points as Tech Sell-Off Weighs on Nasdaq in Wall Street Rebound

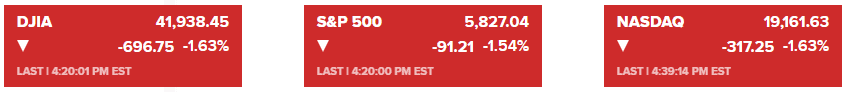

Market Overview:

The Dow Jones Industrial Average rose 0.86%, closing at 42,297.12, driven by gains in non-tech sectors like Caterpillar, JPMorgan, and UnitedHealth. Meanwhile, the Nasdaq Composite fell 0.38% to 19,088.10, weighed down by losses in major tech stocks, and the S&P 500 edged up 0.16% to 5,836.22.

Tech leaders Palantir and Nvidia declined over 3% and nearly 2%, respectively, extending their recent losses. Nvidia has shed almost 6% over the past week. Other tech giants such as Apple and Micron also saw declines.

In contrast, the energy sector outperformed, rising more than 2% as oil prices climbed. Health care and materials sectors also advanced. Surging bond yields, with the 10-year Treasury yield reaching its highest level since November 2023, remain a key factor impacting growth-oriented shares.

Investors are closely watching the start of the fourth-quarter earnings season, with reports expected this week from major banks including JPMorgan Chase, Citigroup, and Goldman Sachs. Economic data releases such as the Consumer Price Index (CPI) and Producer Price Index (PPI) will also influence market sentiment.

Corporate News:

- Apple Inc.: iPhone sales declined 5% globally in Q4, attributed to underwhelming upgrades and competition in China.

- Nvidia Corp.: The White House announced restrictions on the sale of advanced AI chips, affecting Nvidia and peers.

- Tesla Inc.: Surpassed a German premium car brand in 2024 sales despite missing vehicle delivery targets.

- Macy’s Inc.: Issued a weaker sales outlook for the current quarter, citing lower-than-expected holiday shopping performance.

- Honeywell International Inc.: Reportedly moving forward with a breakup under pressure from activist investor Elliott Management.

- Lululemon Athletica Inc.: Expects Q4 sales to exceed market expectations, reflecting resilience against competitors and slowing consumer spending.

- Abercrombie & Fitch Co.: Raised its Q4 sales outlook after better-than-expected holiday performance, though investor concerns persist about sustained growth.

- Shake Shack Inc.: Exceeded Q4 sales expectations, signaling successful efforts to improve service speed and brand visibility.

- Moderna Inc.: Lowered its sales forecast for 2025 due to weak demand for COVID-19 and RSV vaccines.

- Johnson & Johnson: Announced a $14.6 billion acquisition of Intra-Cellular Therapies Inc., focused on central nervous system treatments.

- Eli Lilly & Co.: Agreed to pay up to $2.5 billion to acquire Scorpion Therapeutics’ cancer drug in early trials.

- MicroStrategy Inc.: Purchased $243 million worth of Bitcoin, continuing its trend of leveraging Bitcoin investments.

- Sage Therapeutics Inc.: Shares surged after Biogen Inc. offered a $469 million acquisition bid for the neuroscience-focused company.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

Recent Posts

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More