Invest with RESP

Maximizing Government Education Subsidies – A Must-Read for Parents

RESPs are a great way to save for a child’s post-secondary education. The money invested grows tax-deferred, and the government can contribute up to $7,200 directly to the RESP.

By using an RESP, you can provide strong financial support for your child, freeing them from the burden of loans and debt, and giving them a more flexible future with more choices.

Looking for advice?

We can help.

or call (647)323-3231

What is a RESP?

"I want my child to have the freedom to choose their future without financial constraints."

A Registered Education Savings Plan is a savings vehicle that allows you to put money aside for your children’s post-secondary education or to save for your grandchildren or other relatives.

Not only does the money you deposit in an RESP grow tax-free, but your savings will also be supplemented by Canadian and provincial government grants equivalent to 20% to 40% of your annual contributions, depending on your family income and province of residence.

By leveraging Ai Financial’s investment capabilities, your child will have the opportunity to enter adulthood with greater financial support than others, empowering them to confidently pursue diverse life choices.

You have until the end of the 35th year after the RESP was first opened to use the funds, unless your agreement stipulates otherwise. This allows the child beneficiary to take a break from school and work or travel before continuing their education if they so choose—the funds will be waiting for them for when they decide to go back to school.

Who Qualifies? (Who can be a beneficiary of an RESP)

An RESP can be set up for any “beneficiary,” including your children, grandchildren, nieces, nephews or family friends. Each beneficiary must be a Canadian resident and have a Social Insurance Number (SIN), which can be obtained from a Service Canada Centre.

The Do's and Don'ts of RESP Investments

Requirements for application

When applying for an RESP investment account, the beneficiary must be:

- A Canadian resident and must be under 17 years of age.

- Have a Social Insurance Number (SIN).

- Preparing to attend an eligible post-secondary education program and requiring withdrawals from the RESP account to cover related expenses.

If the beneficiary decides not to pursue higher education, the subscriber can:

Transfer the RESP account to another sibling.

If the subscriber or their spouse has available contribution room in their RRSP (Registered Retirement Savings Plan), funds can be transferred into the RRSP.

Take your time before withdrawing funds from the account while it’s still valid. You can retain them temporarily to prevent any future needs. Typically, RESP accounts have a lifespan of 35 years.

If you wish to withdraw, you’ll need to return the government grant portion to the government, and earnings will be subject to taxation plus a 20% penalty. Some RESP investment plans/types might have additional restrictions; it’s advisable to inquire about these when opening the account.

RESP contributions are limited to a lifetime maximum of $50,000 per beneficiary.

Good to know: an RESP will not affect your child’s eligibility for student loans and bursaries.

How can you open a RESP?

The steps are as follows:

- Apply for SIN for the beneficiary

- Select a financial institution for your RESP investment

- Provide beneficiary information and open the account in the beneficiary’s name (remember to bring the SIN for the subscriber, the beneficiary’s SIN, and the birth certificate).

- Apply for government grants or subsidies

- Make deposits

- Regularly check your account and verify the subsidy amounts received to ensure accurate disbursements.

What types of products can be held in a RESP?

Let your money bring your goals closer

Despite its name, it’s not a typical savings account – it’s a place where you can put investments like segregated funds.

Unlike an RRSP, an RESP does not reduce your taxable income. However, the capital you invest generates investment income that accumulates tax-free.

Returns will, of course, vary depending on the financial market and the investment vehicles you choose. But generally speaking, the sooner you start contributing, the higher your RESP returns will be.

Ai Financial offers this investment opportunity:

Segregated Funds

Segregated fund policies give you the freedom to invest while offering insurance protection to preserve your savings. With our choice of guarantees, you can expand your wealth and secure it at the same time.

You can purchase Segregated Funds using various accounts, including but not limited to TFSA, RRSP, RESP, Non-Reg, etc.

Why do we encourage you to invest in an RESP as early as possible?

We know the best time to invest was 20 years ago, and the second best time is now. For your child, this means having ample time for the assets you set aside to grow, leveraging the benefits of time and compounding interest.

At Ai Financial, our historical investment returns have successfully doubled our clients’ assets within five years.

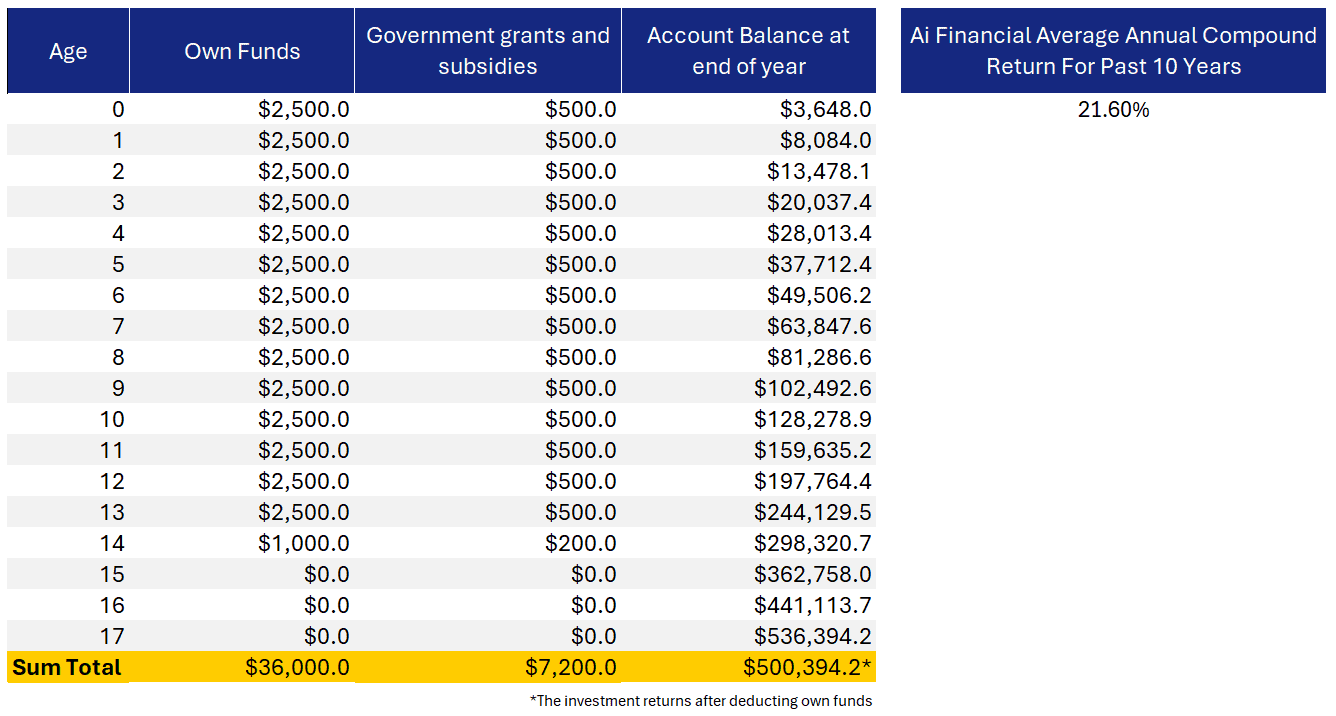

Let’s simulate how much financial support your child could potentially receive from birth to adulthood based on our historical investment returns:

If you maintain annual deposits from the beneficiary‘s birth until they turn 14, you actually only need to save $1,000 in the 14th year to receive the government’s final $200 grant (since the maximum government support is $7,200). If the goal is merely to maximize the grant, we’ve already achieved that, and there’s no need to continue contributing. By the time the beneficiary turns 18 and heads to university, subtracting the actual contributions of $36,000, the account balance will be totals $500,000. For a newly adult child, this is a sum that can enable them to achieve financial freedom ahead of schedule.

Maybe you find the 21.6% return uncertain or not sufficiently reliable, using the annual average return rate of the SPY 500 (approximately 15%), the beneficiary would still receive around $210,000 in financial support.

Young adults is and will be facing greater pressures than imagined in modern society. Many of them struggle with challenges like affording a home, finding their desired job, and managing student loans or other debts. If you can provide substantial assistance to your child when they most need financial support, at a relatively small cost and without adding pressure to your own life, it would be the best coming-of-age gift you could give your loves.

About RESP, you might also want to know...

What happens if your child decides not to continue their education?

Don’t worry, you won’t lose your investments. If your child decides not to pursue post-secondary education, you will be able to recover all of your contributions.

There will be no additional tax impact, since you will have already paid taxes on the money you invested. That said, any gains and income earned on capital will be taxable at the time of withdrawal.

For example, you could transfer money to your RRSP if you have unused contributions, under certain conditions.

Money you’ve saved in an RESP that won’t be used to pay for education is yours to use as you see fit. However, grant money not used for education will have to be returned to the government.

You can also keep the plan open in case the beneficiary changes their mind. Remember that an RESP can be kept open for up to 35 years!

When you make withdrawals from RESP, don’t forget about the tax considerations

Once your child is enrolled in a post-secondary program, they can access the money from their RESP. To start the process, you must contact your provider and send them official proof of enrollment so they can begin making withdrawals.

Education Assistance Payments

The money will be paid out in the form of an Education Assistance Payment (EAP), made up of grant money and investment income (not invested capital). The amount will, of course, depend on the funds you have accumulated in the RESP.

As a subscriber, you may choose to increase the EAP by withdrawing a portion of your contributions as well. Remember, however, that capital can continue to generate returns, even in a period of disbursement. So, it’s a good idea to plan to withdraw grant money first, especially since any grant money remaining after the beneficiary has completed their studies will have to be reimbursed to the government, unless it can be transferred to a sibling under a family plan.

As mentioned above, money paid out as an EAP is taxable to the beneficiary, whereas the capital you invested is not taxable upon withdrawal.

If the beneficiary has other income, such as a summer job, you should check with an expert to determine if additional money received in the form of Educational Assistance Payments (EAP) will result in taxes payable at the end of the year.

Ai Financial doesn’t provide tax services.

Resources

What is an investment loan?

Can this loan last a lifetime? Interest-only payments? Tax-deductible? Is it a private loan? Is the threshold high?