2024 CPP Payment Dates: How Much Longer Can You Rely on CPP for Retirement?

In Canada, relying solely on the CPP for retirement is increasingly risky as the system faces financial strain. Whether you’re nearing retirement or still have years to go, it’s crucial to recognize that the Canada Pension Plan may not provide enough for a comfortable future. How much you can depend on it is becoming more uncertain. You may wonder when to apply, when payments are made, and whether they are taxable—but more importantly, how long will CPP remain viable? With the system under pressure, it’s essential to explore alternative ways to save for retirement. Here’s a brief overview of how the CPP works and why finding other solutions is urgent.

About the Canada Pension Plan (CPP)

The Canada Pension Plan (CPP) is a mandatory retirement pension that provides income replacement when someone retires. It’s funded by contributions from workers and employers, not the government. The CPP covers all of Canada, except Quebec, which has its own Quebec Pension Plan (QPP). Below are the remaining 2024 CPP payment dates.

CPP payment dates for 2024

- January 29, 2024

- February 27, 2024

- March 26, 2024

- April 26, 2024

- May 29, 2024

- June 26, 2024

- July 29, 2024

- August 28, 2024

- September 25, 2024

- October 29, 2024

- November 27, 2024

- December 20, 2024

Where does the CPP money come from?

Unlike OAS and the GIS, the CPP is funded by employers and employees, and by self-employed people. These contributions, which show up as deductions on a paycheque, are aggregated and invested. For self-employed people, the CPP owed on your net business income is added to your tax bill. The principal plus any revenue earned goes back into the program.

In January 2024, CPP contributions were raised as part of a seven-year government initiative, started in 2019, to increase retirement income.

What is changing?

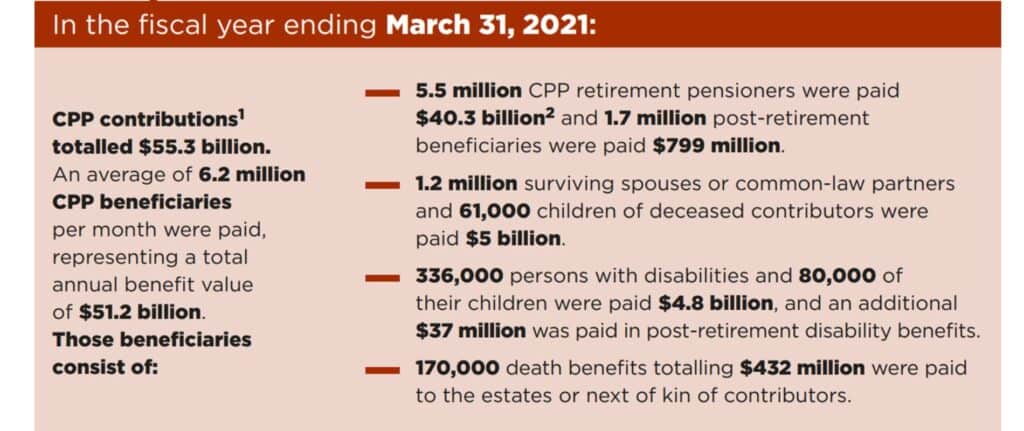

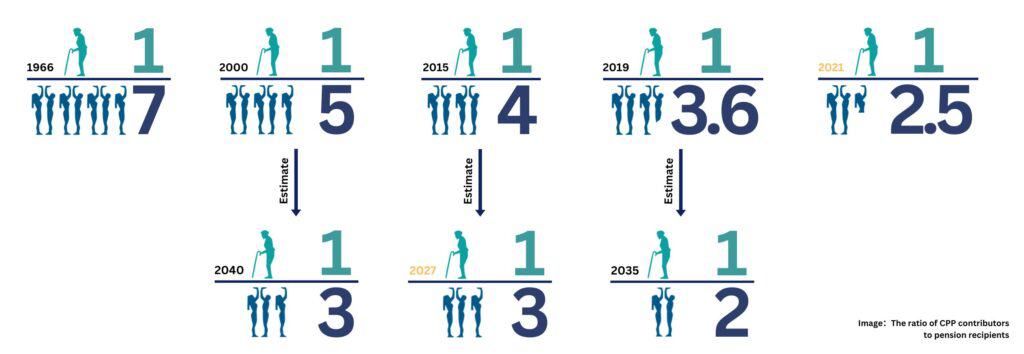

In 2021, there were 6.2 million people receiving CPP benefits, primarily retirees. Dividing this number by the 14 million contributors reveals that approximately 2.5 contributors are needed to support each beneficiary.

This data is crucial as it highlights the historical changes in the ratio of contributors to retirees. In 1966, 7 contributors supported one retiree; by 2000, it was 5; in 2015, it had dropped to 4 workers per retiree. By 2027, it is projected that 3 workers may be needed for each retiree. However, the situation in 2019 already showed a ratio of 3.6 workers per retiree. According to 2021 data, this ratio has further decreased to 2.5 workers per retiree, placing significant pressure on both current and future generations.

Clearly, the original CPP plan designed by the government no longer fits current realities.

Our deep dive into the 2024 CPP report reveals alarming numbers—this funding crisis is no longer theoretical. If you’re 20-30 years from retirement, it’s time to prepare.

Full reading: https://aifinancial.ca/canadian-pension-system-crisis-and-solution/

Most frequently asked questions

If you’re at least 60 years old and have made at least one contribution to the CPP, you are eligible to receive CPP payments. You may also be eligible if you’ve received CPP credits from a former partner or spouse who paid into the plan. CPP benefits are available to Canadian citizens, permanent residents, legal residents or landed immigrants.

You’re eligible to start receiving your pension anytime between the ages of 60 and 70 years old, but the younger you are when you begin receiving CPP, the smaller your monthly payouts will be. Many Canadians choose to begin receiving payouts at age 65.

Yes, as CPP is a taxable benefit. You can request that the Canada Revenue Agency (CRA) deduct federal income tax from each payment, via your My Service Canada Account or by downloading and filling out a PDF request form. If you don’t, you may have to pay income tax quarterly.

You may also interested in

What is an investment loan?

Can this loan last a lifetime? Interest-only payments? Tax-deductible? Is it a private loan? Is the threshold high?

Why do you need segregated funds for retirement?

Segregated funds are a popular choice for group savings and retirement plans. They provide access to high-end and unique……

Invest with TFSA

A Tax-Free Savings Account (TFSA) provides you with a flexible way to save for a financial goal, while growing your money tax-free……

Invest in RRSP-Invest wisely, retire early

According to a recent survey by BMO, due to inflation and rising prices, Canadians now believe they need 1.7 million dollars in savings to retire……