How much do Canadians need to retire? Surveys show the...

Read More2024 US Stock Market Summary

Looking back at the beginning of the year, we made predictions about the outlook for the stock market at the end of the year, predicting that this year would reflect a clear rise Now that this year is coming to an end, we will use this topic to review the main events and stock market trends during the year

The content of this blog is divided into the following four parts

- Major Financial events in the United States in 2023

- Major Financial events in the Untied States in 2024

- US Macroeconomics

- US Stock market performance

- Investment strategies and suggestions

Now let’s start with the major financial events in the United States

Major Financial Events in the U.S. -

An Overview of 2023

Compared to 2023, the number of major financial events in 2024 significantly decreased, with the market exhibiting relative stability. Below is a review of the key events in 2023:

- Eurozone Expansion: On January 1, 2023, Croatia officially joined the Eurozone and adopted the euro.

- Tech Fines and Banking Crisis: The EU imposed hefty fines on Facebook and Instagram. Subsequently, several banks, including SilverGate, Silicon Valley Bank (SVB), and Signature Bank, collapsed, with First Republic Bank acquired by JPMorgan Chase. Additionally, UBS completed its acquisition of Credit Suisse.

- AI Boom: NVIDIA’s market capitalization surpassed $1 trillion, and Apple’s market cap broke through $3 trillion, capturing market attention.

- Decline of the Sharing Economy Model: New York banned Airbnb operations, WeWork filed for bankruptcy, signaling the decline of the sharing economy model.

- U.S. National Debt and Notable Figures: The U.S. national debt exceeded $33 trillion, and legendary investor Charlie Munger passed away.

Major Financial Events in 2024

Compared to the turbulence of 2023, 2024 appeared steadier but still featured significant developments worth noting:

- IPO Surge: Companies like Stripe, Arm Holdings, DataBricks, and Reddit went public, reflecting optimism in the high-tech sector about the future economy.

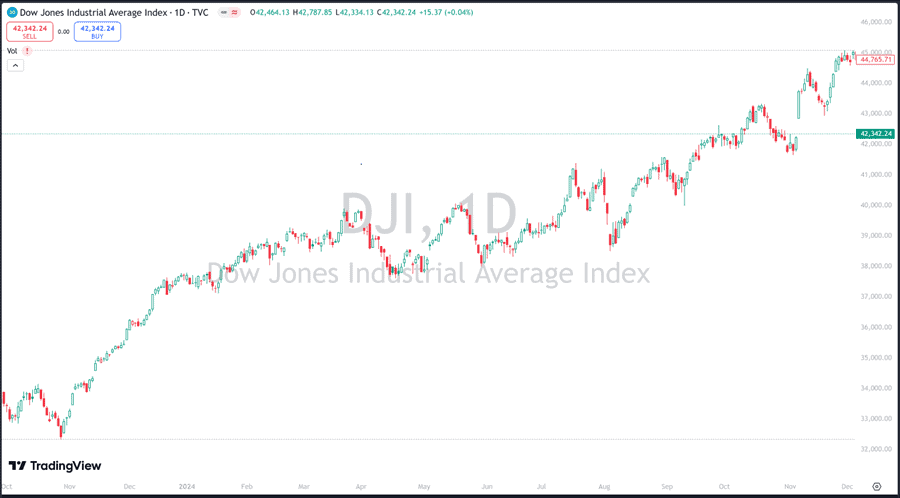

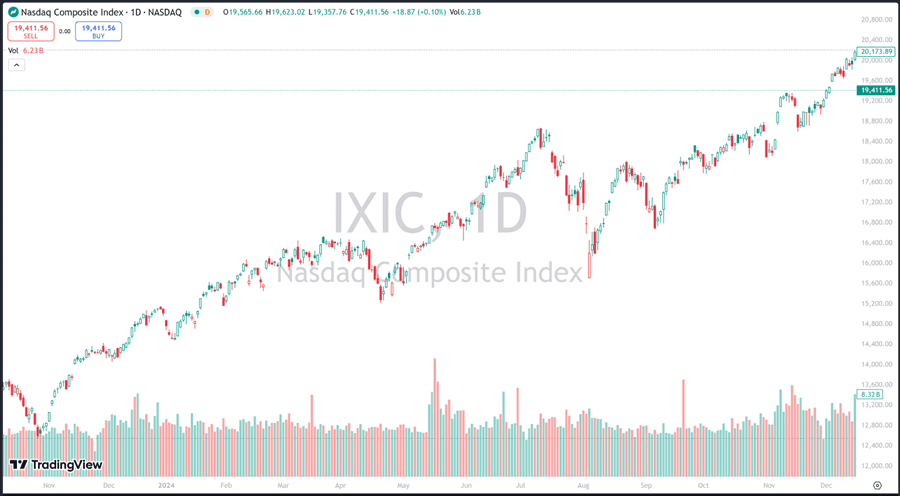

- Stock Market Performance: The Dow Jones Industrial Average surpassed 40,000 points in August, and the Nasdaq Index exceeded 20,000 points in December. Apple’s market cap climbed to $3.7 trillion.

- AI and Regulation: In August, the U.S. strengthened regulations on the application of AI in the financial sector. In October, Microsoft acquired OpenAI, intensifying its focus on artificial intelligence.

- Bitcoin and Cryptocurrency Regulation: Bitcoin’s price exceeded $100,000 in December, while the U.S. simultaneously tightened regulatory oversight of digital currencies.

In conclusion, while the number of major events in 2024 decreased, their impact was significant, highlighting the market’s robust recovery and the profound influence of technological advancements.

U.S. Macroeconomic Overview for 2024

To analyze the macroeconomic situation of the United States in 2024, we’ll delve into key indicators supported by data and charts:

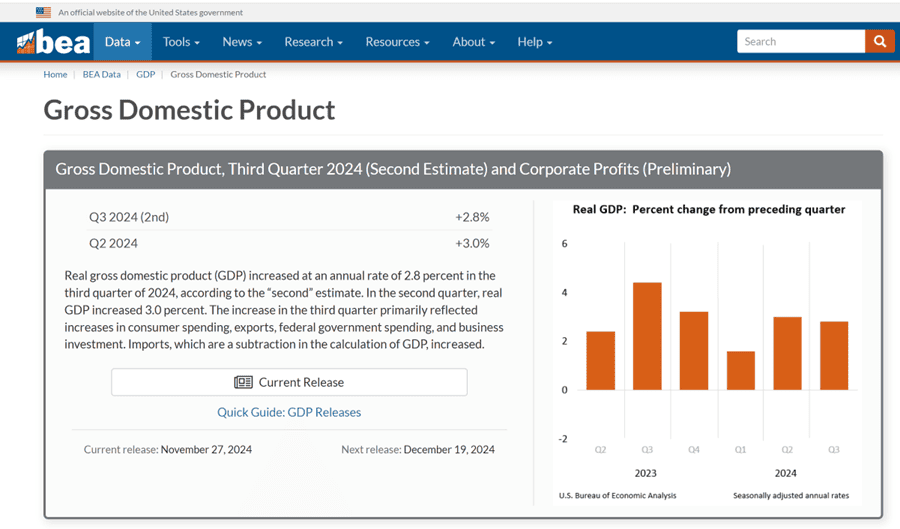

First, let’s take a look at a chart released by the US Government Census Bureau, showing GDP in 2023 and 2024. In 2023, after experiencing a strong recovery after the epidemic, the US economy showed strong growth. After entering 2024, the U.S. economy has entered a stage of sustained and stable development, and the impact of the epidemic can basically be said to have passed. Judging from the data, in the second quarter of 2024, U.S. GDP grew by 3%; in the third quarter, this growth rate was 2.8%.

What needs to be emphasized is that the U.S. economy is huge, and when it achieves a growth rate of 2%-3%, it is already developing at a high speed. This shows that the U.S. economy is strong and has continued development momentum. Solid economic growth also provides a solid foundation for the stock market to rise. When the economy is good, the stock market can rise. Therefore, there is no need to worry about whether the current market rise is a bubble. It can be seen from the GDP growth data that there is currently no risk of a bubble in the U.S. economy.

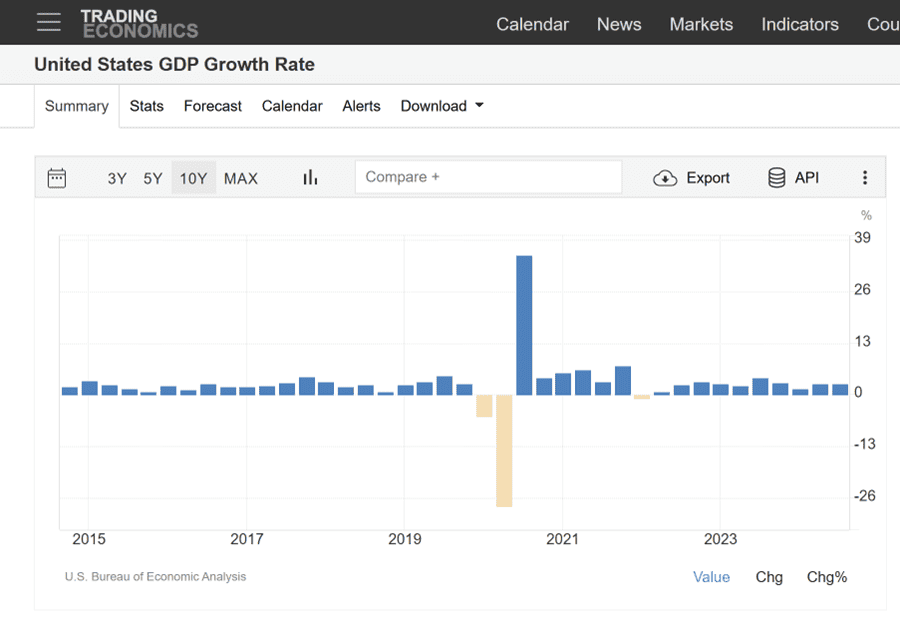

Regarding the sustainability of economic growth, we can also analyze it through longer-term GDP data. From 2015 to 2024, the GDP growth trend of the United States will be stable. The only exception is 2020, when GDP suffered a short-term decline due to the epidemic. However, just two quarters later, the US economy rebounded strongly and returned to the track of sustained and stable growth. This also shows that the supply chain disruption caused by the epidemic has been completely repaired, and the successful transfer of the US supply chain has promoted further development of the North American market.

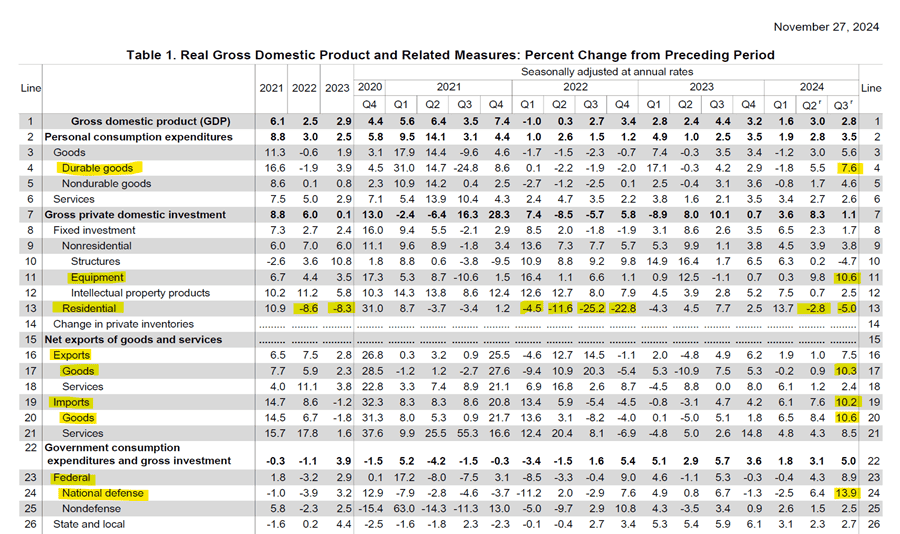

Next up, we will analyze the sources of GDP growth in detail. Judging from official US government data, personal consumption is one of the main driving forces of GDP growth. In particular, purchases of sustainable consumer goods increased by 7.6% in the third quarter of this year. Private investment focused on equipment purchases, with a growth rate of 10.6%. This verifies the trend of supply chain reshoring: setting up factories in the United States requires a lot of equipment, and the growth in equipment procurement is a direct reflection of supply chain reshoring.

However, residential investment continued to shrink, falling by 5.0% in the third quarter of 2024 and by 2.8% in the second quarter. Since 2022, residential investment has continued to decline with a decrease of 8.6% throughout the year, in 2023, the decrease will be 8.3%. This trend further validates the end of an era in the real estate market. We have observed through data that funds are flowing out of the real estate market and into areas with greater potential.

Export growth is also a bright spot in GDP, growing by 10.3% in the third quarter of this year. At the same time, imports increased by 10.6%. This surge in imports is mainly due to companies anticipating future adjustments to tariff policies. A large number of goods are entering the United States before tariffs are increased. This phenomenon may only be a short-term trend, and the data is expected to decline by the first quarter of 2025.

US defense spending also increased significantly, reaching 19.3%. The growth in defense spending reflects the strong strength of the US military. Coupled with the strength of the US dollar, the overall performance of the US economy will undoubtedly continue to improve.

Finally, from the perspective of personal income and expenditure, the income of the US residents has increased significantly, while the expenditure has declined. This suggests that inflationary pressures are easing and Americans’ real residual wealth is increasing. This will further stimulate consumption, promote the economic cycle, and drive the stock market to rise.

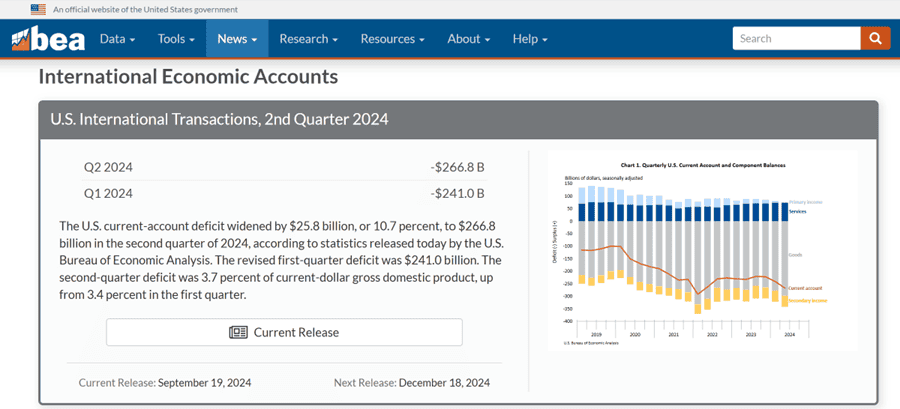

This chart illustrates the U.S. deficit. The increasing deficit essentially indicates that the U.S. is spending more money. In the previous chart, we saw where this money is being spent.

From the chart, it is evident that the U.S. is significantly increasing its defense spending, with the trend being very clear. This is the primary reason for the growing fiscal deficit.

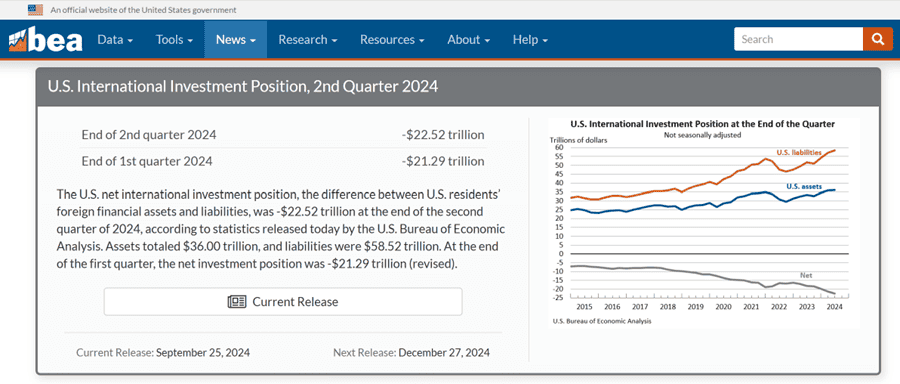

Next, let’s look at another chart, which shows the trends in U.S. international investments. These investments are decreasing.

This phenomenon indicates that U.S. businesses and individuals are repatriating overseas assets for domestic investments. This capital influx has significantly bolstered the U.S. domestic funding pool, showcasing the strong financial support for the country’s economic development.

It can be observed that funds are flowing from around the globe into the U.S., where they are extensively used for equipment procurement and defense investments. These funds provide companies with more production opportunities, boosting product manufacturing and export growth. Consequently, the increase in U.S. exports is one of the outcomes of this capital flow.

By connecting these data points, we can gain a more comprehensive understanding of the U.S. economic situation. This analysis is based on publicly available data from the U.S. government rather than simple speculative conclusions.

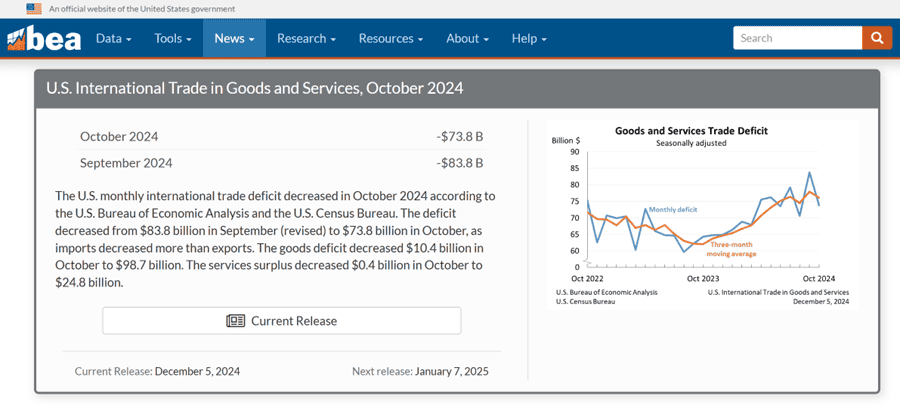

Additionally, another chart shows that the U.S. trade deficit is narrowing. In September, the U.S. trade deficit was -$83.8 billion; by October, it had decreased to -$73.8 billion. This trend indicates a reduction in the U.S.’s purchases of goods from other countries and an increase in its product exports.

A shrinking trade deficit means U.S. exports are increasing while imports are decreasing. When exports exceed imports, the U.S. spends less and earns more. This change reflects the gradual strengthening of the U.S. economy.

Finally, some may ask, what is a trade deficit? Simply put, a trade deficit occurs when a country exports less and imports more, resulting in a negative value. Conversely, when exports exceed imports, it is called a trade surplus. Thus, a negative trade deficit indicates that imports exceed exports, while a surplus reflects exports exceeding imports.

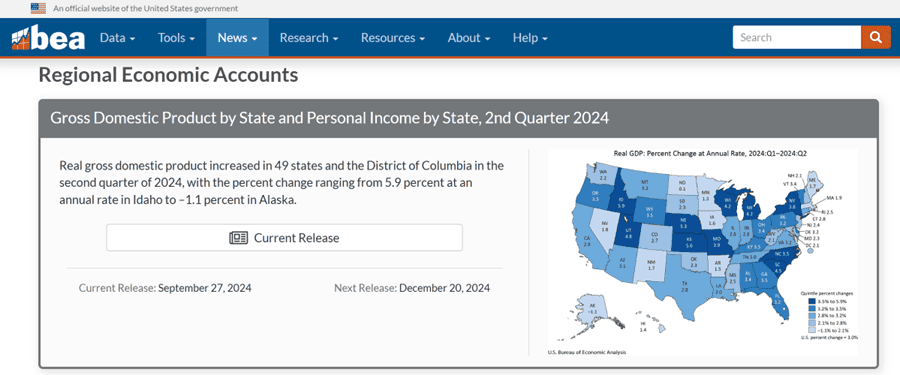

Next, let’s look at another set of data that shows GDP growth across U.S. states. The chart reveals that out of the 50 states, only one—Alaska—experienced negative GDP growth, with a growth rate of -1.1%, indicating slight negative growth. Apart from Alaska, the other 49 states all showed positive GDP growth.

This phenomenon highlights the highly balanced nature of U.S. economic development. Each state has its own independent growth drivers, enabling self-sustained development. This balance means that even if a state faces economic difficulties in the short term, its impact on the national economy is relatively limited. This stands in stark contrast to some countries that rely heavily on a few regions to support their entire economy, where any issues in these regions could severely affect the overall economy.

From this data, we can conclude that the U.S. economy is currently performing very strongly, with no signs of recession. This economic resilience provides a solid foundation for steady stock market growth. It also explains why we place such emphasis on analyzing the U.S. economy. If the U.S. economy continues to develop healthily, there is no need for concern about stock market performance.

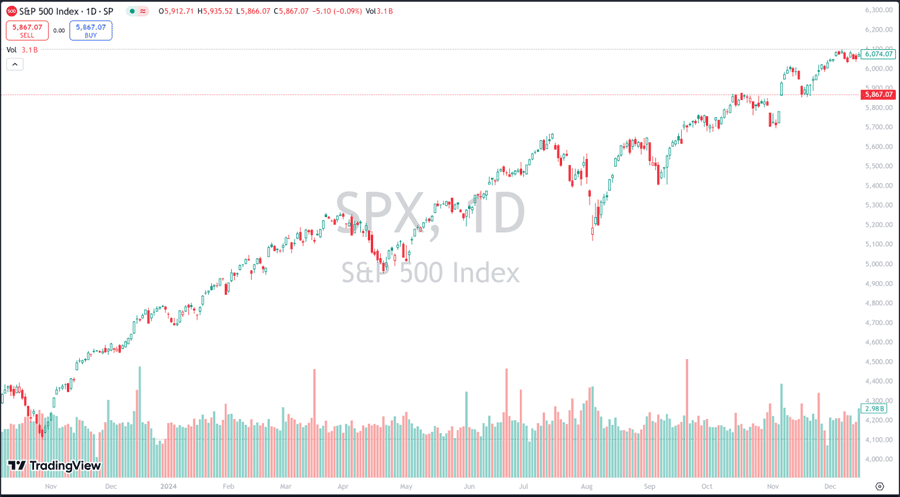

U.S. Stock Market Performance

Let’s take a look at the performance of the U.S. stock market in 2024.

The market performed exceptionally well. As we just mentioned, the Dow Jones Industrial Average reached 47 all-time highs, the S&P 500 hit 55 all-time highs, and the Nasdaq set 21 new records. All of this indicates that the stock market is performing robustly, with no signs of a bubble.

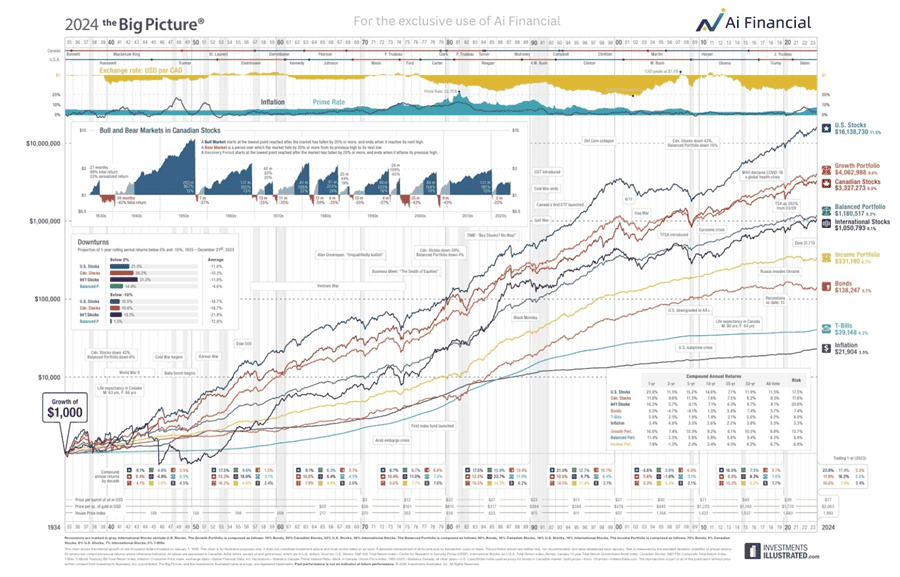

Additionally, data shows that from 1934 to 2024, if you had invested $1,000 in 1934, it would have grown to $16 million today. This means that over these 90 years, the stock market has seen a total increase of 16,000 times, equivalent to an annual growth of about 180 times! This is an astounding performance.

Therefore, we can foresee that the U.S. stock market will continue to perform strongly in the future and may even experience an unprecedented bull market. This bull market could potentially transform everyone’s wealth and lives. Of course, after this wealth growth, one might not need to do anything, but simply enjoy a leisurely life.

However, the stock market is not always on the rise. The market always goes through ups and downs, and the declines are necessary for a stronger rebound. Just like when we want to jump higher, we squat down first before jumping up. The greater the force, the higher we can jump. The stock market is the same—only after experiencing significant declines can future rebounds be stronger.

How Do We Invest?

Now that we understand these concepts, how should we proceed with investing?

First, we must acknowledge an important fact: without investing, you cannot accumulate wealth. In today’s context of rising prices and rapid global wealth expansion, if you don’t invest, you will gradually be replaced by poverty. This is an inevitable trend.

However, during the investment process, there are two key pitfalls to avoid: one is rushing into investments, and the other is making unprofessional investments. Attempting to quickly earn high returns often becomes fertile ground for scams. The more eager you are to make money, the more likely you are to fall into risks. Therefore, when investing, you need to calm down and leave professional matters to professionals.

Here, we recommend the professional team at Ai Financial. We have long adhered to the “Eight Don’ts” principle, which includes not investing in sunset industries. For example, the chip industry is a typical sunset industry. Although there have been impressive gains in the chip field in recent years, we have always emphasized that the essence of “old chips” cannot keep rising and must eventually undergo new breakthroughs.

Recently, Google launched quantum chips, which means that traditional semiconductor chips will be replaced. Although they are still nominally called chips, they are fundamentally different from traditional semiconductors. As we predicted, with the launch of quantum chips, stock prices of traditional semiconductor companies like NVIDIA will face pressure.

As a professional investment institution, we can help you identify which sectors are worth investing in and which ones to avoid. Our focus is always on safe, steady investments.

In the current wave of the Fourth Industrial Revolution, the market is about to experience explosive growth. However, individual investors are likely to miss this wave. Compared to speculating on individual stocks, investing in public funds with principal protection is clearly a safer choice. Principal-protected funds invest in a diversified manner, ensuring that some assets continue to grow, helping you steadily accumulate wealth.

Additionally, we can assist through investment loans, which are perfect for individuals in need of capital. Through Ai Financial’s professional services, you can invest in stable principal-protected funds to grow your wealth while ensuring safety.

In conclusion, when investing, you need to be cautious. Choosing the right tools and professional help is the key to success.

The Best Time to Start Is Now

Recent Posts

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More