ETF Analysis - Can You Always Make Money by Buying ETFs?

Since the advent of ETFs, they have quickly gained popularity among investors due to their strong liquidity and diverse options. Investors who prefer to manage their own portfolios view ETFs as an ideal choice that is both safe and profitable.

But is this really the case? Is an ETF truly a “low-risk, high-return” investment product? Can individuals really profit by buying ETFs on their own?

In this article, we will discuss ETFs, as many investors believe they can make money without a financial advisor by purchasing ETFs. We will analyze four key aspects: introducing ETFs and comparing them with mutual funds and stocks; exploring the potential risks of ETFs; and discussing how to choose and operate ETF investments.

What is ETF?

An ETF, or exchange-traded fund, is essentially an investment tool that can include a variety of assets rather than just a single asset. ETFs can track a range of financial products, including stocks, bonds, and GICs, which contributes to their diversity. Currently, there are 8,754 ETFs available in the market. However, not every ETF is profitable; in fact, the vast majority of ETFs experience losses. Therefore, selecting profitable products from over 8,000 ETFs requires substantial professional support.

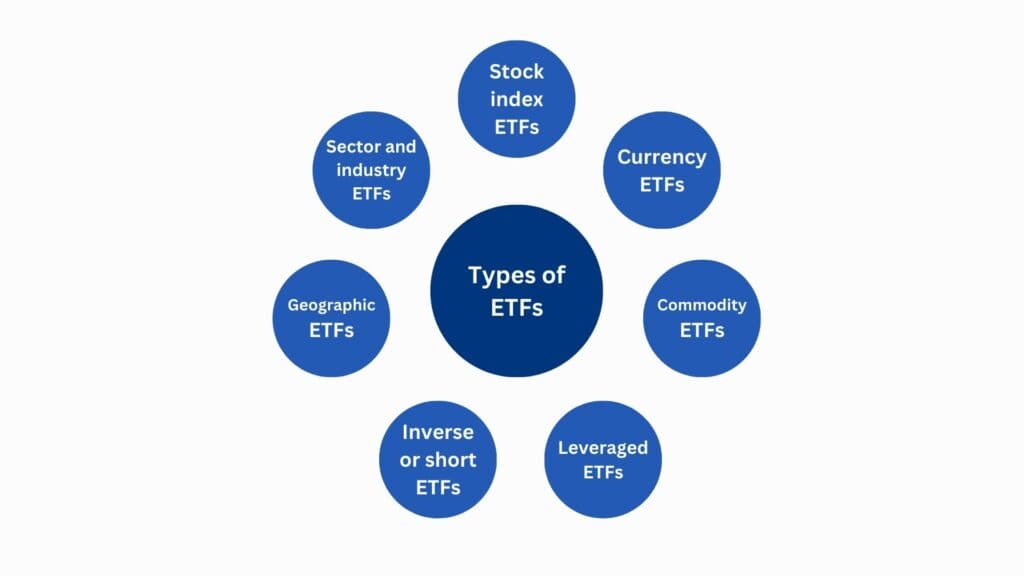

There are many types of ETFs, including common passive ETFs like the S&P 500 ETF, as well as actively managed, bond, stock, sector, and commodity ETFs. Different types of ETFs cater to various investment strategies, but identifying profitable ETFs is a significant challenge for ordinary investors.

Types of ETFs

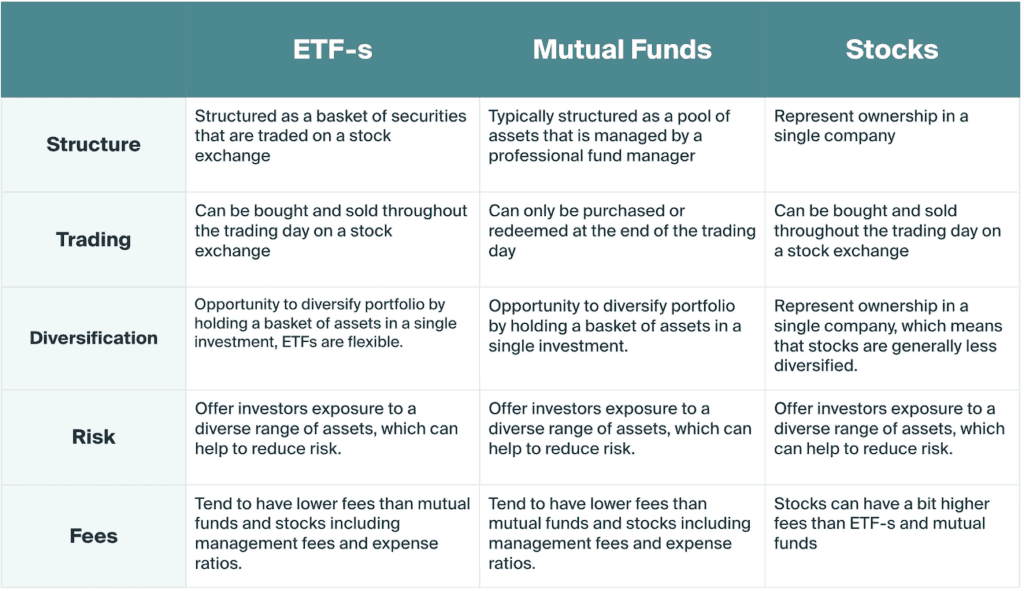

ETF vs Seg Fund vs Stock

Many see ETFs as low-cost investments that can be traded like stocks throughout the day. However, this flexibility carries significant risks due to price fluctuations that can lead to losses. While ETFs have lower costs than stocks, they are not necessarily the best option.

Advantages:

- It allows investment in a wide range of stocks across various sectors.

- Low fees, with some ETFs even having no brokerage commissions.

- Provides risk management through diversification.

- Investors can focus on ETFs that target specific industries.

Disadvantages:

- Some actively managed ETFs have relatively higher fees.

- ETFs focused on a single industry limit diversification.

- Due to the nature of ETFs, they may sometimes lack liquidity, hindering trading.

We will focus on the critical drawbacks of ETFs to help you decide if you should buy them yourself. Let’s take a look at these disadvantages.

Critical Drawbacks of ETFs

While ETFs are often seen as having tax advantages, they actually carry significant tax risks. ETFs use Authorized Participants (APs) for physical exchanges, which makes it seem like there are no immediate tax implications compared to traditional funds. However, stock trades still occur, and capital gains will eventually arise. Although initial tax burdens are borne by APs, when investors sell their ETFs, the accumulated capital gains can lead to a higher tax burden, potentially exceeding that of traditional funds.

ETFs allow for the same flexibility as stocks, but this can lead investors to shift from long-term strategies to frequent trading, turning into speculative behavior. Frequent buying and selling increase transaction costs and may result in missed market opportunities. Moreover, market fluctuations can cause ETF prices to fall below their actual net asset value. Selling when prices drop below true value can lead to significant losses. In extreme market conditions, ETF prices can become highly volatile and, without support, trigger trading halts, resulting in even greater losses.

While ETFs offer a diverse range of assets that can mitigate certain risks, they also increase overall investment complexity and uncertainty. Each added country or sector fund introduces additional political and liquidity risks. This is particularly true for leveraged ETFs, where market fluctuations can amplify losses, significantly raising portfolio risk.

Many investors mistakenly believe that purchasing ETFs like QQQ will yield returns in sync with the Nasdaq index. However, there is a risk of tracking error. The returns of an ETF may deviate from those of its underlying index, typically by a few percentage points. When multiple factors combine, this discrepancy can widen to several percentage points. As a result, the Nasdaq index might show positive returns while the ETF held by the investor could reflect negative returns, a risk that many overlook.

Not all ETFs have enough capital or high trading volumes, resulting in large bid-ask spreads. For instance, if you want to sell your ETF for $10 but the highest offer is only $5, you might be stuck unable to sell. When you need funds urgently, you may have to sell at a much lower price, leading to actual losses. This means paper profits may not become real gains, especially in illiquid markets where the selling price can be significantly lower than expected.

Many ETFs focus on specific industries or sectors, making them closely tied to industry performance. If the industry performs well, the ETF’s returns will rise; however, if it underperforms, investors face corresponding losses. Industry-specific ETFs lack diversification, leading to concentrated risks, especially in slower sectors like real estate, where downturns can result in significant losses.

When many investors opt for ETFs over individual stocks, the market’s price discovery mechanism can falter. In extreme cases, the reduced buying of underlying stocks can lead to ineffective pricing, causing market imbalances and potential crashes. As more funds flow into ETFs, trading volumes for individual stocks decline, increasing market volatility. For instance, recent fluctuations of hundreds or even thousands of points in the Dow Jones index have been linked to retail investors buying ETFs, prompting market makers to intensify their actions to push these investors out and stabilize the market.

In derivative ETFs such as futures and options, counterparty risk is a significant concern. If you hold a profitable derivative ETF, it implies that your counterparty may be incurring losses. Should they default due to these losses, you may be unable to realize your profits, and even your principal could be at risk. This risk is particularly prevalent in derivative ETFs, where the inability of the counterparty to fulfill their obligations could lead to a total loss of your investment.

When investing in dividend or bond ETFs, it’s essential to consider the risks associated with fluctuations in dividends and interest rates. For instance, bond ETFs typically decline in value when interest rates rise and vice versa. Similarly, if a company reduces or eliminates its dividend, the returns from a dividend ETF can significantly drop, exposing investors to potential losses. Therefore, adjustments in dividends and interest directly affect the returns of these ETFs.

Leveraged ETFs, such as TQQQ, can provide three times the returns of the underlying index but also amplify risks. If QQQ declines, TQQQ’s losses will exceed three times that amount, leading to substantial losses for investors. Similarly, inverse ETFs like SQQQ may generate triple returns when the underlying index drops, but losses can also increase dramatically during market rebounds. While these ETFs offer high return potential, their inherent risks make them more suitable for experienced investors.

Holding multiple ETFs in the same sector creates overlap risk. For example, owning several real estate ETFs can lead to significant losses if the sector declines. This lack of diversification increases risk during downturns. When choosing ETFs, ensure your portfolio is diversified to avoid amplifying risk from sector concentration.

The Bottom Line

While ETFs may appear to have many advantages, they come with significant risks. Issues such as tracking error, liquidity risk, concentration risk, price discovery risk, counterparty risk, and challenges related to leverage, dividends, and interest mean that profiting from ETFs is not as straightforward as it seems. For investors without specialized knowledge, choosing ETFs can often lead to losses. Therefore, these complex investment tools are best left to professionals. At Ai Financial (AIF), we prioritize prudent investment practices and explicitly exclude high-risk instruments like ETFs in our “Eight No’s Policy.” We strongly recommend against self-investing in ETFs.

Eight No’s Policy

- No short selling

- No penny stocks

- No derivatives

- No Chinese concept stocks

- No sunset industries

- No commodities

- No newly listed stocks

- No unfamiliar stocks

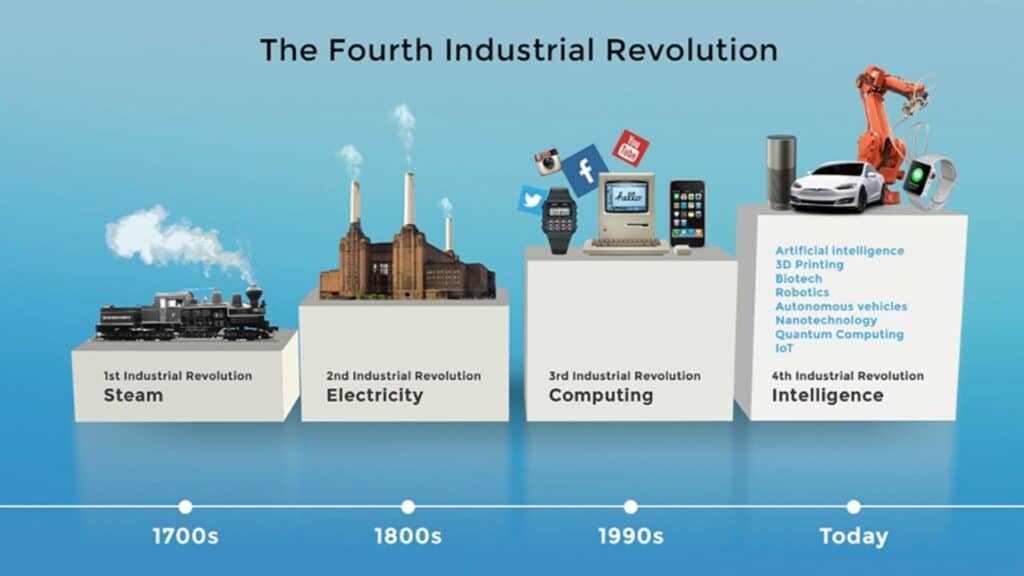

We are currently riding the wave of the Fourth Industrial Revolution, presenting significant growth opportunities in the market. Without a professional investment team, investors may not only miss out on profit opportunities but also risk losing their principal. Investing in individual stocks can be akin to gambling, often resulting in losses over the long term.

For those seeking truly stable investments, principal-protected mutual funds are the best choice. These funds not only ensure the safety of your principal but also provide steady returns. Additionally, principal-protected funds can be combined with investment loans, leveraging other people’s capital to enhance returns. This is a highly advantageous investment strategy that investors should take full advantage of.

You may also interested in

What is an investment loan?

Can this loan last a lifetime? Interest-only payments? Tax-deductible? Is it a private loan? Is the threshold high?

Why do you need segregated funds for retirement?

Segregated funds are a popular choice for group savings and retirement plans. They provide access to high-end and unique……

Invest with TFSA

A Tax-Free Savings Account (TFSA) provides you with a flexible way to save for a financial goal, while growing your money tax-free……

Invest in RRSP-Invest wisely, retire early

According to a recent survey by BMO, due to inflation and rising prices, Canadians now believe they need 1.7 million dollars in savings to retire……