Passive Income Ideas 2024: Make Money Without Working

In today’s fast-paced world, where high prices and economic uncertainty can weigh heavily on consumers, the pursuit of passive income has become increasingly relevant. Whether you’re managing a side hustle or simply looking to bolster your financial security, passive income can help you generate extra cash flow. It offers a safety net during challenging times, whether you face sudden unemployment, take a voluntary break from work, or navigate inflation that diminishes your purchasing power. Most importantly, financial investment stands out as one of the best methods for achieving this goal.

What is Passive Income?

Passive income is money you can earn with little effort and without working a traditional job. You can earn passive income by renting out property, through dividend stocks or a high-yield savings account.

This is the opposite of active or earned income, which is generally defined as income received from working at a job or as a contractor. That’s not to say passive income is easy money — in fact, the opposite can be true. Most ways to generate passive income require an upfront investment of either money, time or both; the income part comes later (in some cases, much later). But once you’ve made that initial investment, passive income can pay off for years to come.

What are the benefits of compound interest?

In general, if you choose to purchase an investment that offers an interest rate compounded over time, the longer the term of the investment, and the more frequent the compound calculation occurs, the higher your return could be. And the earlier you start investing, the sooner interest can begin to compound.

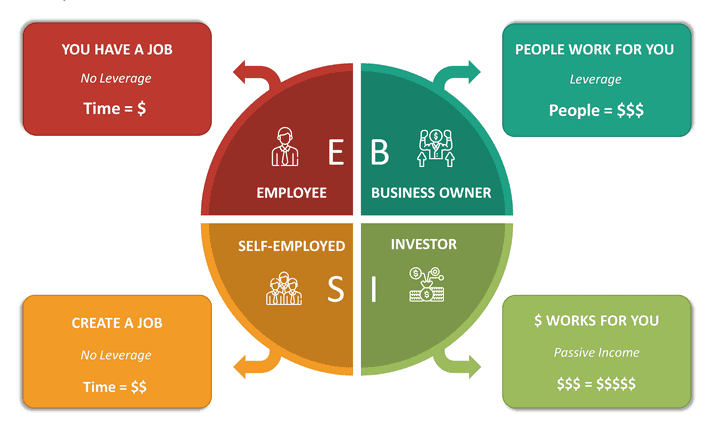

Exploring the ESBI Model

Before diving deeper, let’s explore the ESBI model, which categorizes different income-generating strategies:

E (Employee):

- Working for someone else to earn a salary or wages.

S (Self-Employed):

- Advertise on your car

- Rent out useful household items

- Sell designs online

B (Business Owner):

- Create a course

- Write an e-book

- Affiliate marketing

- Flip retail products

- Sell photography online

- Create an app

- Sponsored posts on social media

- Create a blog or YouTube channel

- Buy a local business

- Buy a blog

I (Investor):

- Rental income (includes renting out property or a parking space)

- Crowdfunded real estate and REITs (both are real estate investment methods)

- Peer-to-peer lending, bonds (includes bond ladder, municipal bond closed-end fund, and annuities as fixed-income investments)

- Dividend-paying and preferred stocks

- High-yield CD or savings account (low-risk, interest-generating investments)

The Appeal of Financial Investment

“Many people think passive income is about getting something for nothing,” says financial coach and retired hedge fund manager Todd Tresidder. “It has a ‘get-rich-quick’ appeal… but in reality, it often requires upfront work. You just do the work first and reap the rewards later.”

In practice, passive income can involve some effort, like developing a product or maintaining rental properties to keep the cash flow coming. However, there’s an even better option if you’d prefer to skip all that hassle—letting professionals handle it for you.

That’s where we come in. At our investment firm, we take care of the fund selection, purchasing, and account management for you. No need to worry about getting your hands dirty with market research or spending years learning the ins and outs of investing. As seasoned experts, we’ve already done the homework, and we know how to maximize your returns.

This is not only a smart move for you, but also for us—because the more you earn, the better we do. It’s a win-win situation: you save time, energy, and avoid costly mistakes, while we make sure your money works harder for you. After all, leaving the heavy lifting to the professionals ensures everyone comes out ahead.

Investing is a particularly effective way to generate passive income. With services like segregated funds and investment loans, individuals can build wealth while minimizing their involvement in day-to-day financial management. In the I (Investor) quadrant of the ESBI model, our company helps clients navigate the investment landscape, providing opportunities for capital-protected growth through segregated funds. These funds offer security and potential for appreciation, allowing you to benefit from your investment without the constant stress of market fluctuations.

In contrast, real estate investments, while popular, come with their own set of challenges. Rental properties require ongoing management, maintenance, and tenant relations, which can be time-consuming and stressful. Even with a well-maintained property, market conditions can affect rental income, leading to variability in cash flow. By choosing funds instead, investors can enjoy the benefits of diversification and professional management without the headaches associated with real estate.

Why Investing is the Best Option for Passive Income

Investing in segregated funds or similar financial products provides a streamlined approach to building wealth. Unlike rental properties, where you must actively manage tenants and maintain the property, investment funds allow you to sit back and let your money work for you. With the right strategy, you can create a sustainable stream of income, giving you more freedom to focus on your primary career or personal interests.

Moreover, financial investments can yield better returns over time, especially in a volatile economic climate. By leveraging investment loans, clients can amplify their returns, further enhancing their passive income potential. This not only builds a robust portfolio but also contributes to long-term financial stability.

The Bottom Line

In summary, passive income is a powerful tool for enhancing financial security, especially in challenging economic times. While many avenues exist to achieve passive income, financial investment stands out as the most effective option. By investing in segregated funds and utilizing investment loans, you can enjoy the benefits of passive income without the burdens often associated with real estate. This strategic approach not only helps build wealth but also allows you to focus on your passions and enjoy life without the constant worry of financial strain. Investing is more than just a means to earn; it’s a pathway to greater freedom and security in your financial future.

You may also interested in

What is an investment loan?

Can this loan last a lifetime? Interest-only payments? Tax-deductible? Is it a private loan? Is the threshold high?

Why do you need segregated funds for retirement?

Segregated funds are a popular choice for group savings and retirement plans. They provide access to high-end and unique……

Invest with TFSA

A Tax-Free Savings Account (TFSA) provides you with a flexible way to save for a financial goal, while growing your money tax-free……

Invest in RRSP-Invest wisely, retire early

According to a recent survey by BMO, due to inflation and rising prices, Canadians now believe they need 1.7 million dollars in savings to retire……