The Future is Here - Electric Air Taxis eVTOL

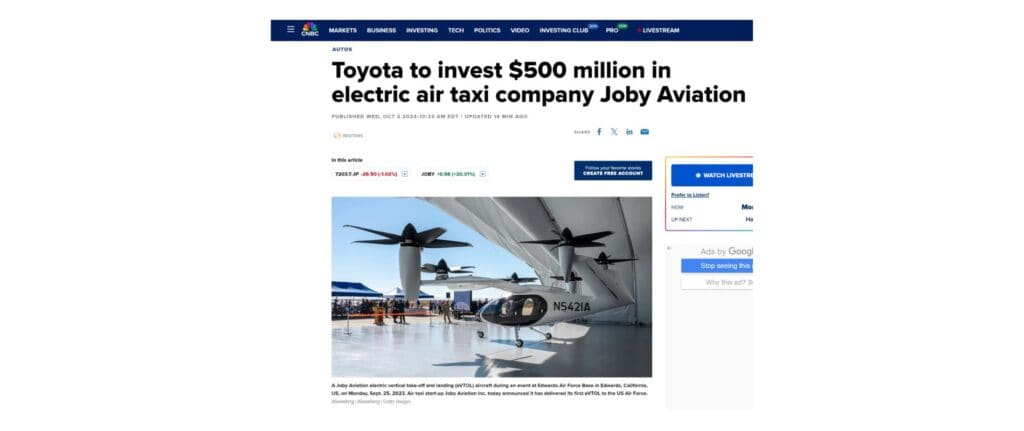

On October 2, 2024, a headline appeared on CNBC announcing that Toyota has invested $500 million into an electric vertical takeoff and landing (eVTOL) company. If eVTOL air taxis can integrate into our daily lives, they will fundamentally transform our mode of transportation.

The news regarding eVTOL air taxis once again brings the Fourth Industrial Revolution into focus. Let’s delve into eVTOL air taxis and envision the future of urban air mobility.

What’s in this article?

- Introduction to Air Taxis

- Prospects for Air Taxis

- Should We Pursue Investments?

- How Can We Invest?

Introduction to Air Taxis

As one of the latest innovations in transportation technology, eVTOL aircraft represent a type of electric vehicle capable of vertical takeoff and landing. eVTOL, which stands for electric vertical takeoff and landing, is sometimes referred to as air taxis or flying taxis. Powered by batteries, eVTOLs can hover and fly like helicopters and are typically designed to carry 2 to 6 passengers, including a pilot (helicopters are classified as VTOL).

Farhan Gandhi, Director of the Mobility Innovation Center (MOVE) and Aerospace Program Director at Rensselaer Polytechnic Institute, states that, apart from testing, eVTOLs have not yet been flight-tested in the United States. While Gandhi believes that eVTOL aircraft will soon be ready for operations beyond testing, obtaining certification from the Federal Aviation Administration (FAA) will still take time. What advantages does this new mode of public transportation offer?

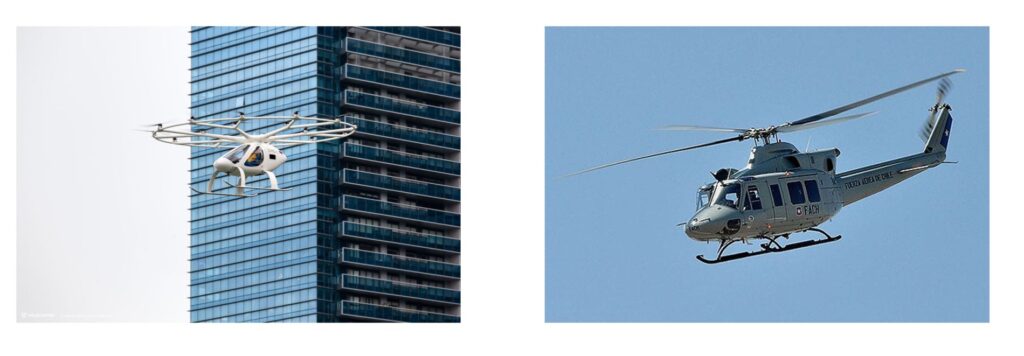

Gandhi notes that eVTOLs are quieter because much of their forward flight relies on wing lift. Once the aircraft reaches a certain speed, this lift propels it forward. Additionally, eVTOLs have lower rotor speeds compared to helicopters, which also contributes to reduced noise levels.

According to Gandhi, the rotor design of eVTOLs is very safe, as they typically have multiple rotors. If one rotor fails, numerous other rotors can provide support. Gandhi also points out that eVTOLs do not rely on a single battery pack; even if a battery pack fails, onboard power remains available.

For Plaut, one of the main advantages of eVTOLs is their ease of use, thanks to computerized flight control systems that allow the aircraft to operate more like drones or fly-by-wire systems, translating the controller’s actions into commands for the aircraft’s components. “You don’t actually control the motion; you control what you want to happen,” Plaut explains. “Then the aircraft decides what to do.” According to Plaut, 60% of the pre-order customers for his company’s AIR ONE eVTOL are not trained pilots.

As eVTOLs are electric, they have low emissions, potentially achieving zero carbon dioxide output.

Another significant reason for introducing eVTOLs is to substantially reduce traffic congestion. In Canada, major thoroughfares like Highways 401, 407, and 404 are perpetually congested. According to current population growth forecasts, the existing highway system will be inadequate to meet demand by 2035, leading to severe societal issues related to traffic congestion. The deployment of electric air taxis will effectively relieve pressure on ground transportation and serve as one of the solutions.

Limitations of eVTOLs:

Compared to helicopters and traditional aircraft, eVTOLs have insufficient battery range for long-distance flights or search and rescue missions.

Due to their smaller size, eVTOLs have lower passenger and cargo capacities, making them unsuitable for large-scale transport.

As an emerging technology, eVTOLs require time and real-world case studies to validate their reliability and identify potential issues.

Currently, these are some known limitations of electric air taxis.

Does the Air Taxi Have a Pilot? Is a Pilot's License Required?

Currently, eVTOL air taxis are still operated by professional pilots. However, the industry is actively pushing for advancements in autonomous flying technology, with the goal of ultimately achieving pilotless operation, similar to self-driving technology in cars. In the future, passengers will only need to input their destination into an AI system, and the aircraft will automatically fly there without pilot intervention.

That said, this technology still requires time to perfect. Similar to today’s self-driving cars, which have been in testing for years but are not yet widely deployed, fully autonomous eVTOLs will also take time to develop.

Regarding pilot licenses, the Federal Aviation Administration (FAA) in the United States has not yet issued any licenses related to eVTOLs, as they have not been formally approved for operation. Once autonomous technology matures, pilot licenses may no longer be necessary.

Are Air Taxis Safer than Helicopters?

Safety is one of our top concerns. Compared to traditional helicopters, electric air taxis have certain design advantages in terms of safety. Helicopters rely on a large rotor; if it fails, the consequences can be severe. In contrast, electric air taxis are equipped with multiple smaller rotors, so even if one or two fail, the remaining rotors can continue to operate, reducing risk.

Moreover, electric air taxis utilize multiple battery packs; if one pack encounters a problem, others can still maintain flight. From a design perspective, electric air taxis are expected to have superior safety compared to traditional helicopters.

What is the Speed of Air Taxis?

Electric air taxis can reach a maximum speed of up to 360 kilometers per hour. In comparison to cars, which travel at speeds of 100 to 120 kilometers per hour, air taxis are three times faster. While this speed may not match that of traditional aircraft, it is more than sufficient for daily commutes or short-distance travel, significantly saving time.

Is Riding in an Air Taxi Expensive? How Much Does an Air Taxi Cost?

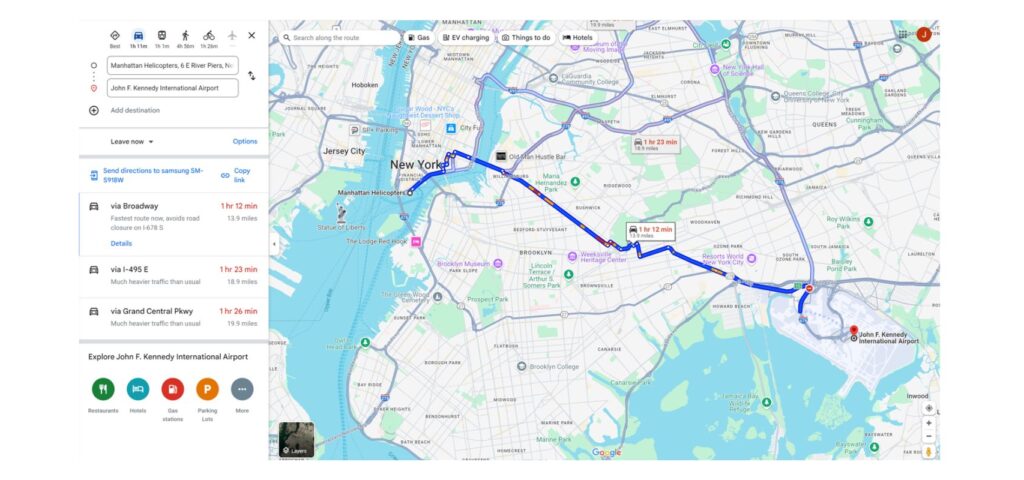

The cost of riding in an air taxi is approximately $200 per person. For example, the distance from Manhattan in New York to JFK Airport is about 22 kilometers. Driving takes around 1 hour and 12 minutes, but an air taxi can make the trip in just 7 minutes, saving over an hour. For some people, spending $200 to save an hour may be worth it.

If you’re interested in purchasing an air taxi, prices start at around $190,000 to $200,000, depending on the configuration. Considering the convenience it offers, this price is relatively reasonable, and in the future, more people may be able to afford it.

Prospects for Air Taxis

What does the market outlook for eVTOLs look like? Is there significant development potential? For instance, the appeal of a 7-minute flight costing $200 and saving over an hour of time is enticing; however, not everyone is willing to pay $200 for it. For some individuals, saving an hour may not justify the expense. Therefore, while this technology is futuristic, widespread adoption may still take time.

However, the technology behind electric air taxis is already quite mature, with some models undergoing flight and ground tests. Thus, while mainstream adoption may require time, the technological advancements are gradually maturing, indicating that the future is on the horizon.

Market Participants

From a market perspective, numerous players are involved in the eVTOL sector. Traditional manufacturers such as Airbus, Boeing, Embraer, Honda, Hyundai, and Toyota are all developing related technologies. Additionally, many startups are actively participating, including Archer Aviation, EHang, Joby Aviation, Overair, and Volocopter. These companies focus not only on hardware manufacturing but also on building the ecosystem, including autonomous flight technologies and operational systems, similar to the developments in the self-driving car sector.

The active investment from these market participants indicates substantial growth potential in this market.

Market Applications

The primary applications of electric air taxis are diverse, starting with passenger services, which represent the most direct use case. Companies like Joby and Wisk are already seeking relevant licenses to promote civilian usage.

Secondly, there is the package delivery sector. Google’s subsidiary, Wing, has been providing drone delivery services since 2020, and Amazon is also using drones for package deliveries. UPS and several German companies are actively adopting this technology. Additionally, air freight is a significant application for eVTOLs, as they can carry heavier cargo; for instance, aircraft developed by Sabrewing can transport up to 5,400 pounds.

Other applications include agricultural environmental monitoring, emergency medical services, recreational flying, and military uses. In agriculture, eVTOL technology can be employed for seeding, fertilization, environmental monitoring, and organ transport. In the military sector, it can be utilized for rapid assaults and infiltration behind enemy lines.

With technological advancements, more potential applications will likely be developed in the future.

Market Size and Outlook

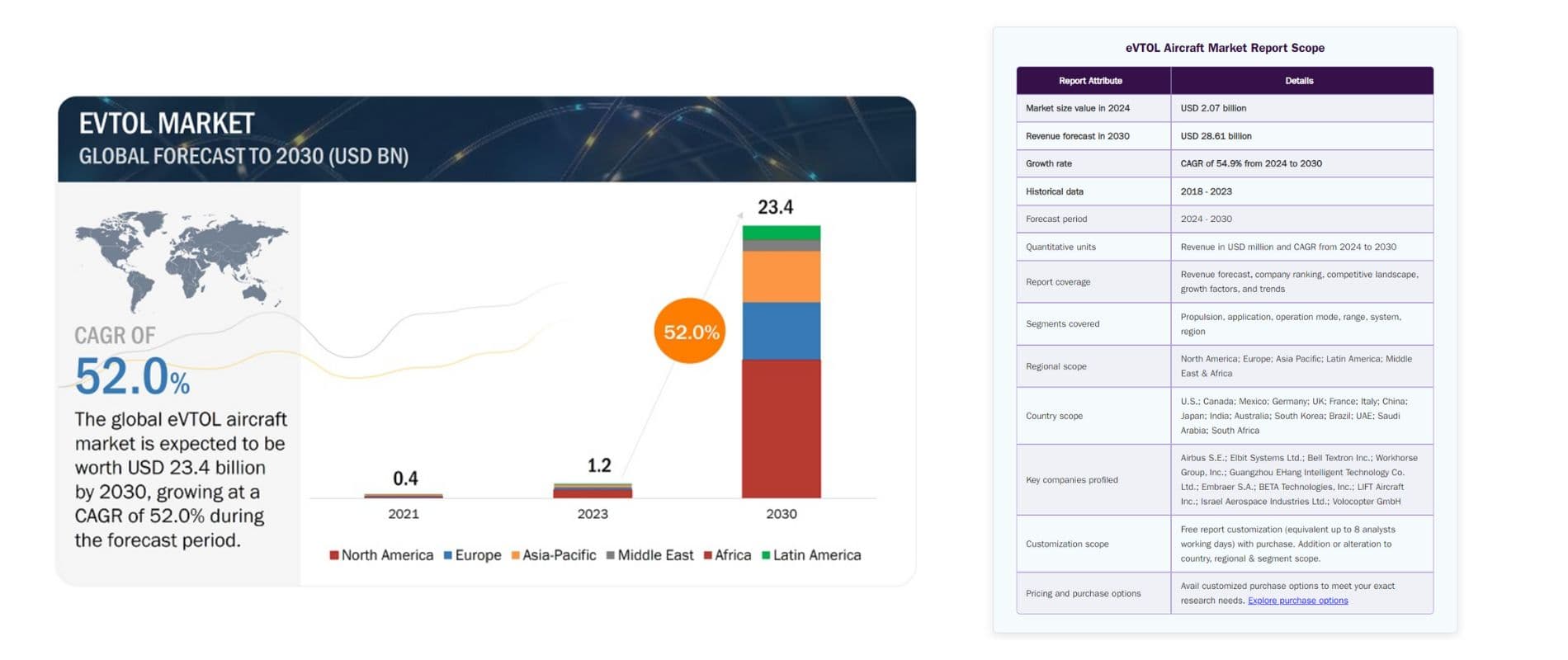

Given the broad range of applications, the overall market size for eVTOLs is highly promising. Data indicates that the market was valued at only $400 million in 2021, a relatively small figure; however, by 2023, it has grown to $1.2 billion, achieving a threefold increase within two years. From 2023 to 2030, the market is expected to rapidly expand to $23.4 billion, showing significant growth.

During this seven-year period, the average annual compound growth rate (CAGR) for the eVTOL market is projected to reach 52%. This growth rate is akin to the concept of “compounding” in investments; a 52% annual growth rate implies that the market could double in two years. This explains why the market size could grow nearly 20 times within seven years.

Looking ahead, the North American market, particularly the United States, is expected to hold a major share, with 42% of the global eVTOL market concentrated in North America, including the U.S. and Canada, by 2030. Thus, electric air taxis may gradually integrate into our daily lives in the near future.

With the FAA’s approval, eVTOLs will soon enter the market promotion phase, indicating a bright market outlook that warrants close attention.

Should We Follow Up on Investments?

In the previous introduction, we explored many advantages and prospects of the market. Given the vast market potential, our main concern is whether we should follow up on investments and share in this opportunity. So, how should we assess this?

Who Has Invested?

Many primary market investors have already engaged in this field. For instance, Toyota has significantly increased its investment, accumulating $500 million. Numerous well-known companies have also entered this arena, with initial funding coming from company founder JB, who raised capital by selling his previous company and later secured $100 million in funding in 2018, with Intel participating as well. This is because Intel’s technology in chips and AI is closely related to eVTOLs; autonomous aircraft require robust chip support, and Intel’s investment clearly reflects this insight. Other participants include Toyota, American Airlines, and the investment firm behind SpaceX.

Declining Stock Prices and Poor Secondary Market Performance

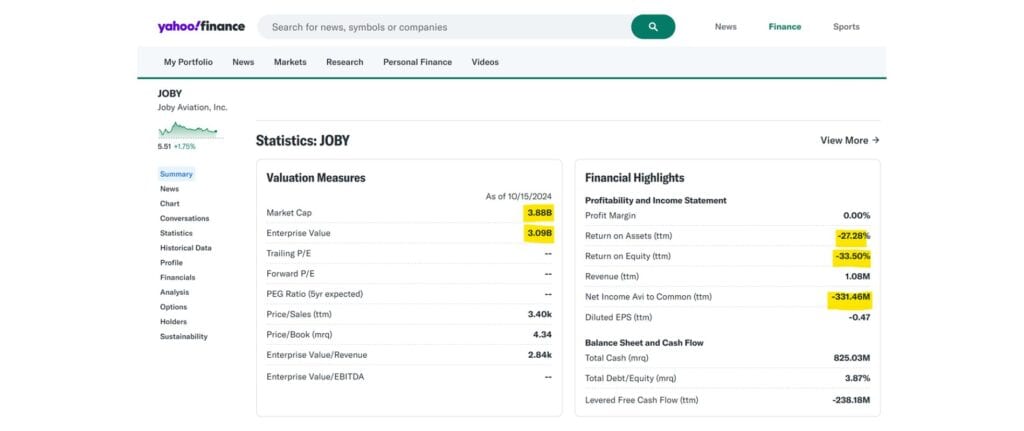

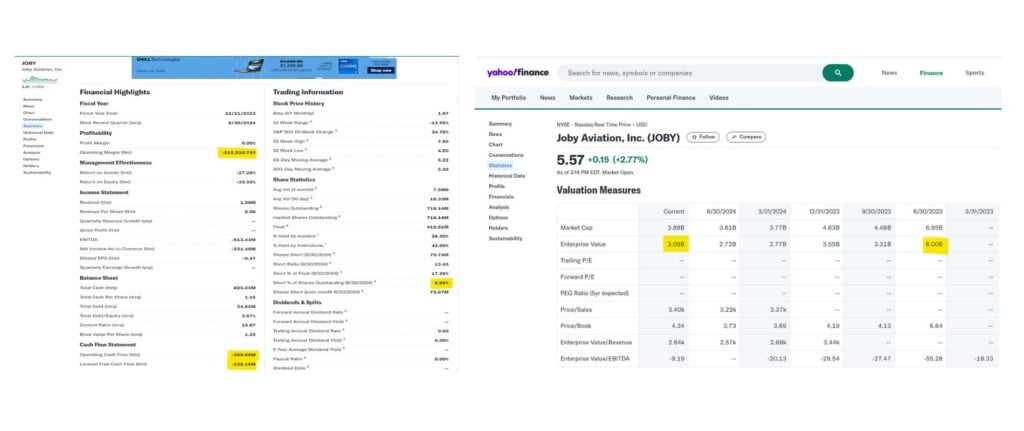

Despite the large number of primary market investors and the promising outlook, the secondary market performance has been dismal. The company went public in 2021, reaching a peak stock price of $17, but it is currently around $5, representing a two-thirds decline. The reasons for the stock price drop can be gleaned from the financial statements.

Bleak Financial Statements

The company’s current market value is approximately $388 million, while its intrinsic value stands at only $309 million, indicating that even at the current stock price, it remains above its intrinsic value. Further examination of the return on assets (ROA) and return on equity (ROE) reveals figures of -27.28% and -33.5%, respectively, demonstrating severe losses. A deeper analysis of cash flow shows an astonishing operating margin of -510,000%, with continuous negative cash flow and depleted working capital, resulting in a cash flow crisis for the company.

Valuation Halved

The company’s financial troubles have led to a substantial decline in valuation. As of June 2023, the company’s valuation was $600 million, but it has now plummeted to $300 million, effectively halving its worth.

Conclusion: Should We Follow Up on Investments?

Given the company’s current financial situation and secondary market performance, this stock is not suitable for investment at this time. However, the market outlook remains worthy of attention, and if the company improves its financial condition in the future, it may present new investment opportunities.

How Should We Invest?

First and foremost, we always emphasize that investing is a crucial way to escape poverty. Importantly, we must avoid rushing into investments, as the desire for quick riches often leads to scams and can easily result in falling prey to fraud. The current market is flooded with various schemes, so we must remain vigilant and act cautiously. Understanding investment knowledge and finding the right professionals are essential.

We discussed the promising market of electric air taxis, but in the secondary market, we currently do not plan to invest. Despite the optimistic market outlook, the current state of the secondary market is not favorable. Only those with professional knowledge can make wise investment decisions. Without the help of professionals, impulsively investing could lead to financial losses.

At Ai Financial, we have established a “Do Not List,” meaning we only choose investment projects that we are familiar with. If we are not familiar with an area, we would rather not participate. Over time, the rise of electric air taxis signals the advent of the Fourth Industrial Revolution, and we must keep pace with the times to seize this great bull market. The next decade will be a critical period for wealth differentiation; if you seize this opportunity, you may become wealthy. On the contrary, hesitation and waiting may lead to missed opportunities.

Therefore, finding professionals is crucial to ensuring that your investments yield returns. If you are not well-versed in investing, blindly purchasing individual stocks is highly risky, as it is essentially speculation, and the probability of success is low. A better strategy is to invest in public funds, especially capital-protected funds. These funds are managed by professionals and provide you with a safer investment plan.

Moreover, for those who do not have enough capital, you can invest in capital-protected funds through investment loans. You can leverage financial tools to invest, which is like borrowing your neighbor’s hen to lay eggs—the profits you gain are yours. This is an effective investment strategy suitable for everyone.

So, make full use of these investment tools and take advantage of loans to invest. Only by doing so can you seize the opportunities of this era and achieve wealth growth.

You may also interested in

What is an investment loan?

Can this loan last a lifetime? Interest-only payments? Tax-deductible? Is it a private loan? Is the threshold high?

Why do you need segregated funds for retirement?

Segregated funds are a popular choice for group savings and retirement plans. They provide access to high-end and unique……

Invest with TFSA

A Tax-Free Savings Account (TFSA) provides you with a flexible way to save for a financial goal, while growing your money tax-free……

Invest in RRSP-Invest wisely, retire early

According to a recent survey by BMO, due to inflation and rising prices, Canadians now believe they need 1.7 million dollars in savings to retire……