Trump's Mission: Impossible – What Investors Need to Know

The U.S presidential election has concluded, and Trump has officially been elected as the 47th President of the United States. While the process may appear straightforward, it was fraught with challenges and hardships beyond what most people could imagine, including tests of life and death. How exactly did Trump overcome these “Mission Impossible” moments?

This article covers four key topics: Trump’s completed and current “impossible missions,” the potential impact of his election on the stock market, and strategies for investors to make informed decisions.

Through these four sections, we will delve into how Trump overcame numerous challenges and predict the potential impact he may have on the economy and markets in the future.

Trump’s 'Mission Impossible' Achievements

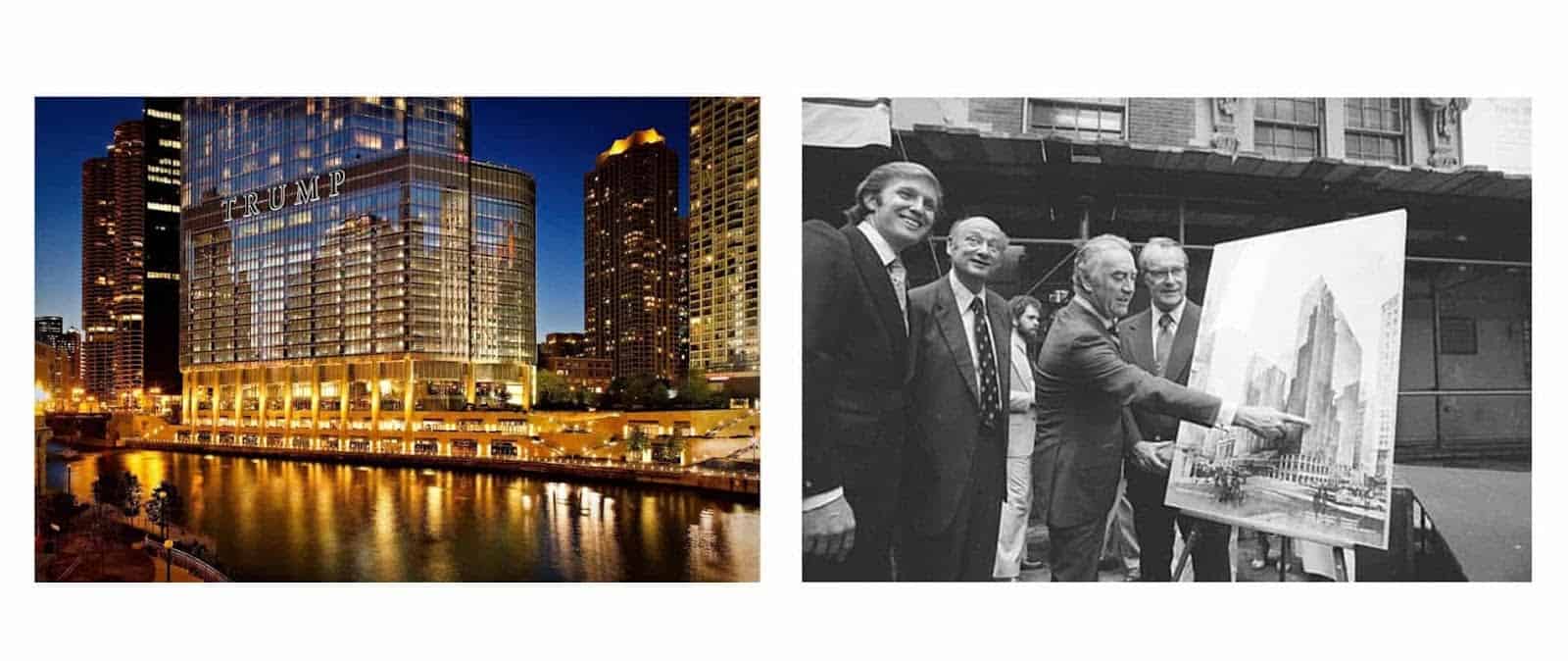

Let’s start with Trump’s early years to explore how he accomplished many seemingly impossible tasks. In 1968, at the age of 27, Trump entered Manhattan’s real estate market with $200,000. Although he was a wealthy heir with a father who was a real estate developer, Trump’s position wasn’t particularly notable at the time. Even for his father, developing real estate in New York was no easy feat. However, Trump saw opportunities where others saw impossibilities, viewing them as a chance to prove himself.

In 1971, Trump identified an opportunity: developing a convention center in New York City. What seemed like an unattainable goal was ultimately achieved through his meticulous planning and relentless efforts. His strategy included navigating complex negotiations, integrating himself into high society, identifying business opportunities, and connecting with key individuals.

Operating out of a small Manhattan apartment that doubled as his office, Trump actively engaged with influential figures, such as the owners of exclusive social clubs. By gaining their trust, he accessed critical real estate insights that would prove invaluable.

Trump then set his sights on a derelict parking lot owned by a railroad company. When the land became available for sale, he negotiated with the key decision-makers, successfully purchased the property, and redeveloped it into New York City’s convention center. Step by step, Trump executed his plan and turned an impossible challenge into a remarkable success.

Another classic “Mission Impossible” event was Trump’s reconstruction of the Wollman Rink in New York City. The rink had been closed since 1980, and by 1986, the city government still hadn’t completed the rebuild, claiming it would take at least two more years. At this point, Trump offered to fund the project himself, promising to finish it within six months, despite the city’s declaration that it was impossible to complete the work in such a short time. Through media attention, Trump garnered public support, and eventually, under the scrutiny of both the press and the public, the city handed the project over to him. Trump not only completed the rink ahead of schedule but also delivered a high-quality result, showcasing his determination and problem-solving ability.

Trump’s success in completing these “Mission Impossible” tasks can be attributed to his strong values. He prioritized social responsibility and duty over personal gain, using his intelligence, leadership, and relentless effort to overcome challenges others deemed impossible. His journey teaches us that with the right mindset and the courage to challenge the odds, even the most impossible tasks can be achieved.

Some might think building a house, a convention center, or a small ice rink doesn’t qualify as a “Mission Impossible.” But let’s examine whether what Trump accomplished was really that simple.

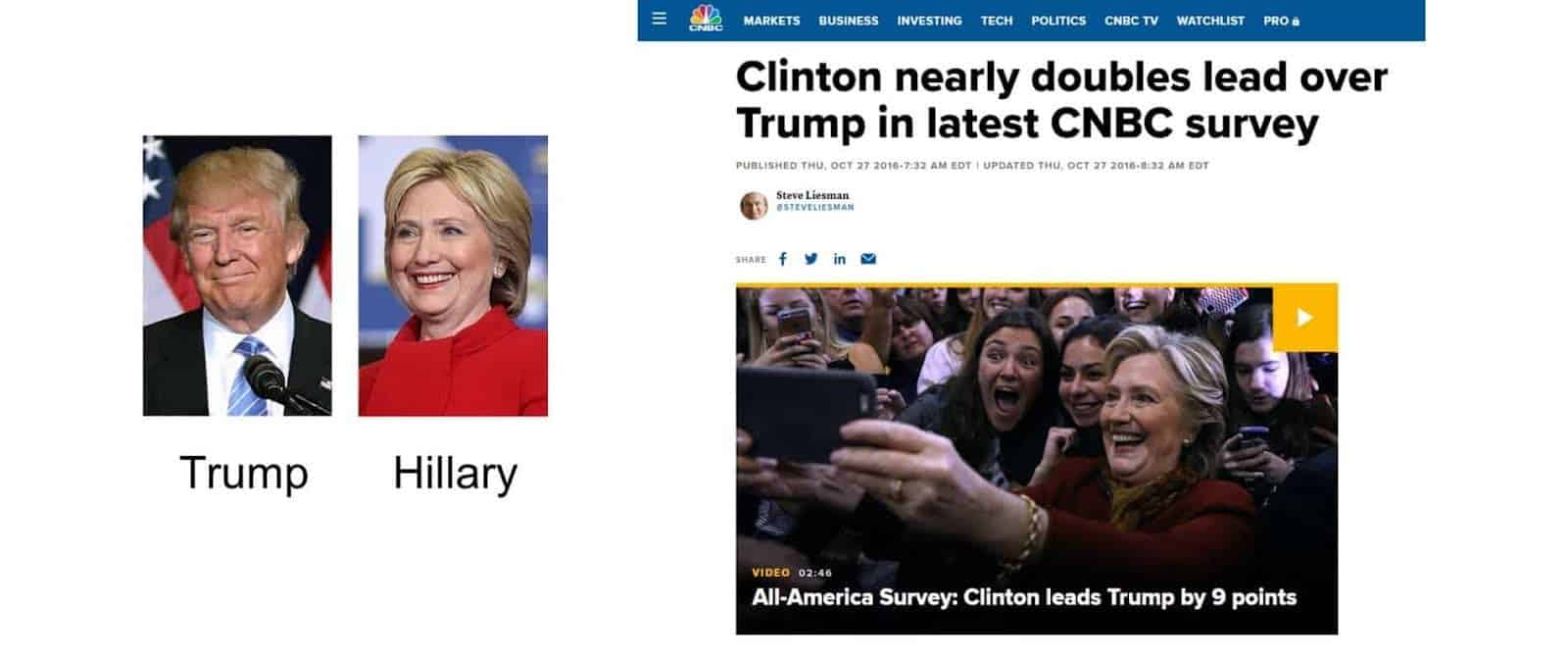

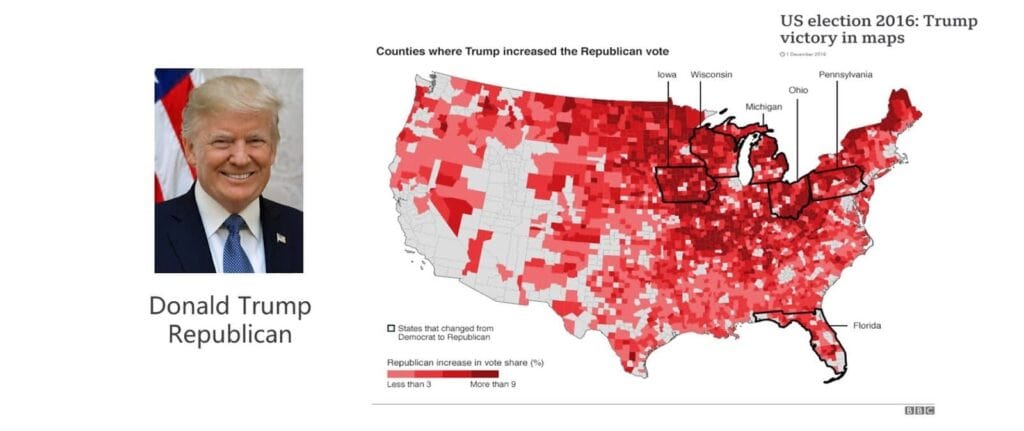

In 2016, Trump, a businessman with no political experience, entered the U.S. presidential race against a highly seasoned politician—Hillary Clinton. Hillary was not only a former First Lady but also had served as Secretary of State. Her campaign platform resonated deeply with voters, and her many advantages led many to believe that Trump had no chance of success, with polls showing him far behind. At the time, Trump was viewed by many as a political outsider, even ridiculed for making empty promises and being all talk with no action.

However, he faced the challenges head-on and successfully became the 45th President of the United States. This journey was undoubtedly a “Mission Impossible” for him, but through his relentless determination and resilience, he overcame countless obstacles and triumphed in what seemed like an impossible challenge.

Upon taking office, Trump continued to face numerous challenges, particularly the “Russia scandal.” Many believed his election was due to Russian interference, claiming he won the presidency with the help of Russia. As a result, he immediately faced an investigation into his alleged ties with Russia. This controversy not only made his political career tumultuous but also led to two impeachments during his term. The first impeachment occurred in December 2019, accusing him of seeking foreign interference during his campaign. The second impeachment took place in 2021, accusing him of inciting the Capitol riot on January 6th.

Despite facing two impeachments, Trump remained focused on his objectives. Through his determination and leadership, he steered the U.S. economy to unprecedented levels of prosperity during his term.

Next, let’s take a look at the extent of the persecution Trump faced from the deep state and the “Mission Impossible” tasks he completed despite these challenges.

In the fall of 2020, the New York State Attorney General filed a civil lawsuit against Trump, accusing him of inflating real estate values to evade taxes and secure better loan terms, thereby exaggerating his net worth. Ultimately, Trump was found guilty of fraud and fined $355 million, plus interest. Although this was a civil lawsuit, the penalty was severe, affecting both Trump’s personal credit and reputation. It also had the potential to impact his business operations, with the possibility of a three-year ban on running his company.

In addition, the sexual assault and defamation cases in Manhattan had a significant impact on Trump. Although he denied the sexual assault allegations from 1990, the case ultimately ruled that Trump defamed the plaintiff, and he was ordered to pay $5 million in damages. In a second case, Trump was ordered to pay $83.3 million, bringing the total damages close to $90 million. These lawsuits severely damaged his reputation. While these were civil cases, the large fines and the harm to his personal image could not be overlooked.

Additionally, there was the hush money case in Manhattan, where Trump was accused of paying a woman to keep quiet about an alleged affair. While the truth of these accusations remains uncertain, they had a major impact on Trump, with many questioning his character. These cases and fines posed significant challenges to his public image.

Trump’s Legal Challenges

What’s even more serious are the criminal charges brought against Trump by the Department of Justice, particularly those related to his taking classified documents after leaving office. Trump was charged with 37 felony counts, accused of not only taking documents unlawfully but also storing them improperly, refusing to return them, and attempting to conceal them. These charges shifted Trump from civil to criminal cases, with much more severe legal consequences.

In addition, prosecutors in Georgia have accused Trump of attempting to overturn the results of the 2020 election, alleging that he conspired with 18 individuals in a cross-state plot to steal the election. If convicted in this case, Trump could be barred from running for president again, representing a life-or-death challenge for his political career.

Despite facing such numerous lawsuits and criminal charges, Trump did not back down. In the face of massive fines, legal battles, and damage to his public image, he remained resolute in his path. Ultimately, Trump secured the 2024 presidential nomination.

But the challenges didn’t end there. During his campaign, Trump also survived two assassination attempts. Despite a bullet coming dangerously close to hitting him, Trump pressed on, undeterred, and continued to fight for his election goals. In the end, Trump triumphed in the intense competition and was re-elected as President of the United States.

One man, One Mission: Trump's Victory

During Trump’s campaign, Trump also survived two assassination attempts. Despite a bullet coming dangerously close to hitting him, Trump pressed on, undeterred, and continued to fight for his election goals. In the end, Trump triumphed in the intense competition and was re-elected as President of the United States.

Trump’s successful re-election and his ability to accomplish so many “Mission Impossible” tasks can be attributed to the fact that many Americans had grown weary of the left’s elitist self-interest and lack of common sense. Trump’s election represented a desire among the American people for a return to traditional values and practical thinking. His success once again proved that, no matter how many difficulties and challenges one faces, steadfast belief and courage will ultimately lead to victory.

Trump's Future Challenges

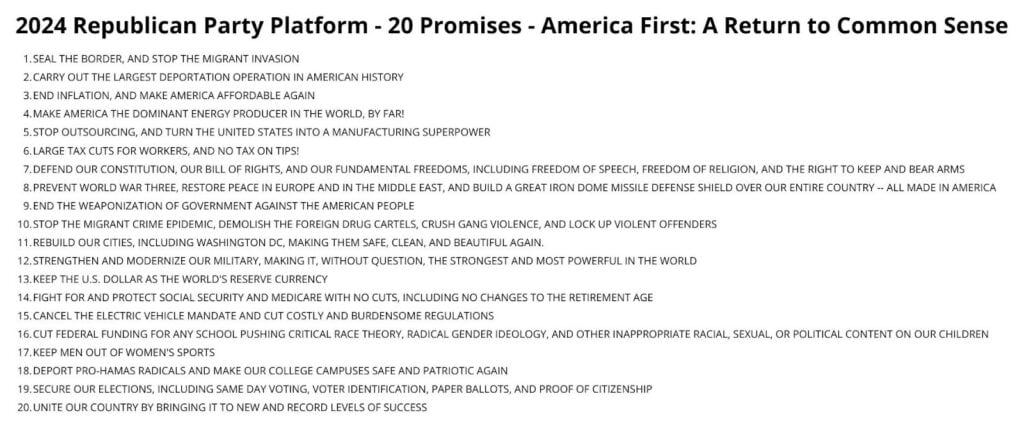

Trump’s challenges were not limited to winning the U.S. presidency; they were just the beginning. His 20 campaign promises each had the potential to directly impact the U.S. economy, and in turn, the economies of Canada and the world. For investors, understanding these dynamics is crucial, as politics and economics are deeply interconnected, and their trajectories will directly determine the success or failure of investments.

Core Task: Team Building

The key to fulfilling campaign promises lies in building a cohesive team with aligned values. Without the right people in place, policies are hard to implement, and economic recovery becomes impossible. In such a scenario, the global investment environment would become even more uncertain. As a result, Trump’s personnel decisions have drawn significant attention, divided into two categories: those that do not require Senate approval and those that do.

Key Appointments Not Requiring Senate Approval

- Vice President: JD Vance

With a background in Silicon Valley investment, Vance has limited political experience but strong capital support. - White House Chief of Staff: Susie Wiles

The first female Chief of Staff in history, Wiles will oversee all personnel appointments. - “Border Czar”: Thomas Homan

Homan will be responsible for overseeing the construction of the Mexican border wall. - National Security Advisor: Michael Waltz

An Afghanistan war veteran, Waltz has been a vocal critic of Biden’s military withdrawal from Afghanistan. - White House Legal Counsel & Efficiency Team

This team includes Elon Musk and Indian-American experts to help improve government efficiency.

- Secretary of State: Marco Rubio

A strong advocate for a hardline stance on China, Rubio is expected to be more assertive than his predecessor. - Attorney General: Matt Gaetz

A staunch ally of Trump, Gaetz has previously resisted accusations against him, aligning with Trump’s political vision. - Secretary of Defense: Peter Thiel

Former Fox News host Thiel lacks government experience but may bring a fresh, non-traditional approach to the role. - CIA Director & Other Cabinet Members

The team includes veterans and loyal Trump supporters, offering a non-traditional perspective on national security and governance.

Trump not only needs to fulfill the appointments mentioned above but also faces numerous “Mission Impossible” tasks:

- Combating Corruption

- Strengthening the U.S. Military and Dollar Hegemony

- Increasing Tariffs and Promoting Supply Chain Repatriation

- Creating Jobs and Enacting Significant Tax Cuts

- Reforming Education and Healthcare

- Tackling Illegal Immigration, Crime, and Drugs

- Protecting Religious Freedom and Global Peace

These tasks will determine whether the U.S. economy can continue its recovery and will influence the global investment landscape. Whether Trump can achieve these goals will be closely watched by the world.

Trump's Impact on the Stock Market

Trump’s policies and leadership style have had a significant impact on the stock market. On the day he was elected president, the Dow Jones surged by 1,500 points, setting a new record. This strong reaction reflected the optimism on Wall Street and within the investment community, with many believing that his presidency would bring positive developments for the market.

Reviewing Trump’s Impact on the Stock Market During His First Term

- 2017: In Trump’s first year in office, the U.S. stock market performed exceptionally well, seeing significant gains. This was largely driven by market expectations of his tax cuts, deregulation, and policies aimed at stimulating economic growth.

- 2018: The stock market declined, primarily due to the onset of the U.S.-China trade war. The trade tensions created uncertainty, disrupting supply chains and impacting corporate profits, which led to a downturn in market sentiment. However, Trump remained committed to the trade war in order to protect U.S. interests.

- 2019: After the adjustments in 2018, the stock market strongly rebounded. Confidence in trade negotiations and economic growth prospects was restored, helping the market recover.

- 2020: The outbreak of the COVID-19 pandemic severely impacted the global economy, and U.S. stock markets experienced multiple circuit breakers. However, the Trump administration implemented a range of economic stimulus measures, including relief funding and interest rate cuts, which helped stabilize the market. Despite the challenges, the stock market ended the year with positive growth.

Summary:

During Trump’s four-year term, the U.S. stock market rose by 54%. This performance was largely driven by his policies, including tax cuts, deregulation, and a tough stance on trade. However, these policies also came with high risks and controversy, such as the short-term economic impact of the trade war and the timeliness and effectiveness of policies during the pandemic.

For investors, understanding the specific impacts of Trump’s policies on the stock market is crucial. This not only helped identify investment opportunities during past market fluctuations but also provides valuable insights for future decision-making.

How to Invest Correctly

Investing is a crucial path to financial independence, but the pursuit of quick wealth often leads to scams. Therefore, professional investment management should be entrusted to experts. As a specialized financial investment company, Ai Financial understands how to allocate client funds, avoid unnecessary risks, and seize genuine investment opportunities.

Investment Principle: Avoid Speculation

Investing is not gambling. For instance, when an individual buys stocks, they are essentially betting on probabilities, which can lead to losses due to market fluctuations. The correct approach is to use professional tools that reduce risk and increase the sustainability of returns. Ai Financial adheres to the “Eight Don’ts Principle,” which clearly defines which investments to avoid and which ones are worth focusing on.

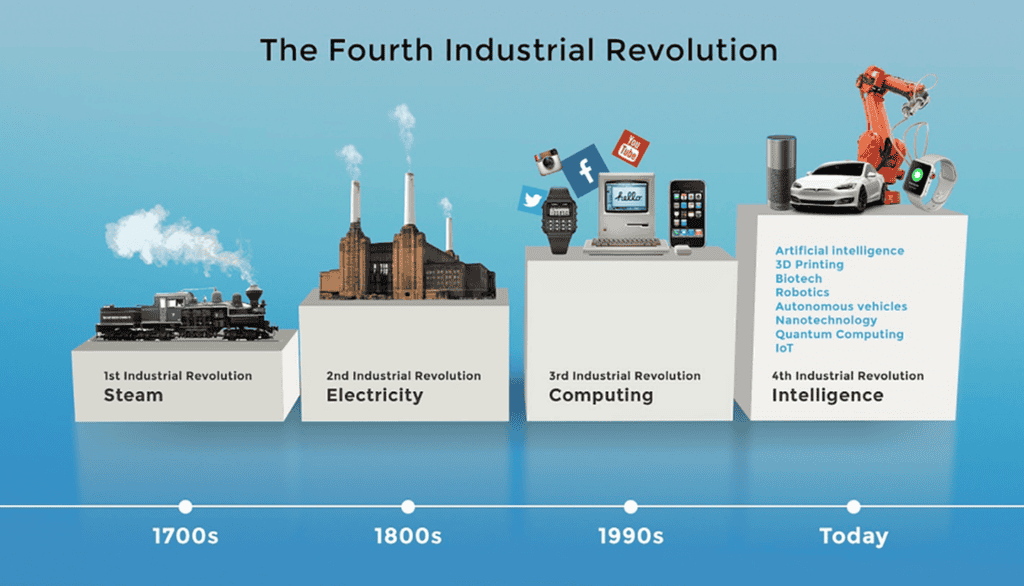

Seizing Opportunities in the Fourth Industrial Revolution

As the Fourth Industrial Revolution progresses, future wealth growth will increasingly be concentrated in emerging technologies. Individual investors may find it challenging to accurately capture these opportunities, but by using professional investment tools, such as public Segregated funds, they can steadily share in these gains.

Advantages of Segregated Funds

- Diversified Risk: The fund hedges risk by holding a basket of stocks. Even if some stocks perform poorly, other stocks provide returns, helping to manage overall risk.

- Stable Returns: Designed to preserve principal, Segregated funds also offer good growth potential, providing a balance of security and reward.

- Investment Loans: Ai Financial offers a unique investment loan feature that allows clients to leverage smaller amounts of capital for larger investment returns. This is an advantage that traditional banks or standard mutual funds cannot provide.

Investment requires long-term planning and professional support. By choosing an experienced institution like Ai Financial, investors can seize the wealth opportunities brought by the Fourth Industrial Revolution through Segregated funds and investment loans, making their investments more stable and efficient.

You may also interested in

What is an investment loan?

Can this loan last a lifetime? Interest-only payments? Tax-deductible? Is it a private loan? Is the threshold high?

Why do you need segregated funds for retirement?

Segregated funds are a popular choice for group savings and retirement plans. They provide access to high-end and unique……

Invest with TFSA

A Tax-Free Savings Account (TFSA) provides you with a flexible way to save for a financial goal, while growing your money tax-free……

Invest in RRSP-Invest wisely, retire early

According to a recent survey by BMO, due to inflation and rising prices, Canadians now believe they need 1.7 million dollars in savings to retire……