Navigating the Christmas Rally: Insights into December’s Stock Market Performance and Long-Term Investing Strategies

As we approach the end of another year, investors often look forward to the “Christmas rally,” a term coined in 1972, which refers to the historical trend of the stock market rising in the final week of December and into early January. This festive period typically sees increased consumer spending and an optimistic outlook, which can positively influence the market. However, as with all trends, not every year follows this pattern. To gain a better understanding of what to expect this December, let’s explore both the market’s performance in past Decembers and the strategies for long-term growth.

Christmas is right around the corner – Don’t forget to check out AIFinancial’s Christmas deals on leveraging investment funds to further achieve your dreams

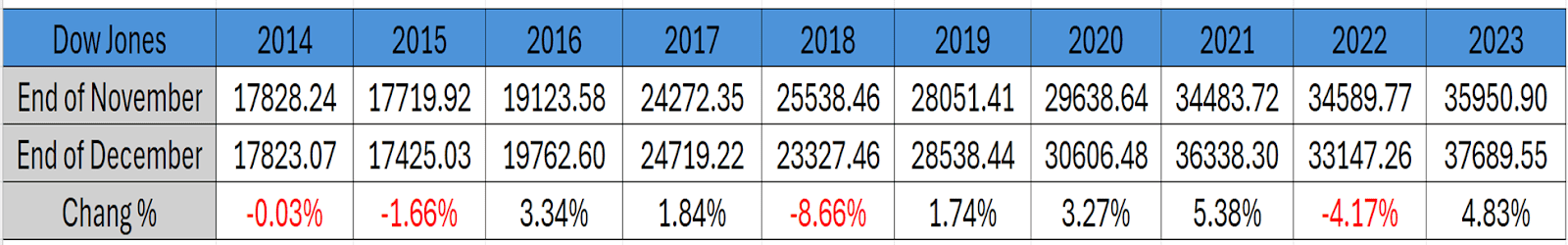

The Christmas Rally: A Historical Overview

The Christmas rally is often characterized by positive movements in the stock market as investors enjoy the festive season. Yet, not every December experiences this upward momentum. In December 2018, for example, the market saw a sharp decline of 8.66%, its worst drop in a decade, despite a positive economic outlook. This dip was primarily driven by uncertainty from the ongoing China-U.S. trade war. In stark contrast, December 2019 witnessed a more positive performance, with the S&P 500 rising by 1.74%, fueled by optimism surrounding the trade war and favorable economic indicators.

Looking back at the past decade, we see a variety of December performances. Some years brought significant rallies, while others reflected broader economic or political uncertainties.

December 2014: Mixed Signals

The market ended December 2014 nearly flat, down by just 0.03%. While the U.S. dollar was flowing back into stocks after years of quantitative easing, the anticipation of Federal Reserve interest rate hikes created market turbulence.

December 2015: Impact of Financial Regulation

In 2015, the market dropped by 1.66%, largely due to increased financial regulation and the Federal Reserve’s decision to raise interest rates for the first time since 2006, unsettling investors.

December 2016: Post-Election Rally

The unexpected election of Donald Trump in 2016 sparked a rally, with the market rising by 3.34%. Optimism around anticipated tax reforms and deregulation, coupled with strong employment figures, fueled this surge.

December 2017: Sustained Optimism

The market continued its upward trajectory in 2017, rising by 1.84%. Economic reforms, including tax cuts, and the continuation of deregulation efforts helped maintain market confidence.

December 2020: Pandemic Response

Despite the ongoing COVID-19 pandemic, December 2020 saw a remarkable 3.27% rise. This growth was largely attributed to massive government stimulus programs and historic low interest rates that helped support the economy.

December 2021: Post-Pandemic Boom

December 2021 saw a huge 5.38% increase, fueled by strong economic recovery post-pandemic and a drop in unemployment, with consumer confidence at its highest in years.

December 2022: Setback Amid Fed Tightening

In December 2022, the market dropped by 4.17% as the Federal Reserve’s aggressive interest rate hikes to combat inflation led to market turbulence.

December 2023: Rebound from Inflation

By December 2023, the market rebounded with a 4.83% increase. This recovery was driven by a decrease in inflation, which had peaked in 2022, and signs of economic stabilization.

The historical data reveals that December often plays a pivotal role in setting the tone for investor sentiment heading into the new year. While the so-called “Christmas rally” is not guaranteed, it has been a recurring phenomenon, supported by bullish sentiment in years of economic recovery or political stability. The steep losses in 2018 and 2022 serve as reminders that macroeconomic uncertainties, such as trade wars or central bank policies, can disrupt this seasonal trend.

This year-end trend highlights how external factors—policy decisions, inflation trends, and geopolitical dynamics—can strongly influence market outcomes, creating both opportunities and risks for investors.

What Can We Expect for December 2024?

Given the volatility and varied performances of past Decembers, investors wonder what this year holds. While the current economic climate presents both opportunities and challenges, understanding the broader trends is crucial. After a period of inflationary concerns and rising interest rates, the market appears to be stabilizing, with inflation decreasing and consumer confidence returning.

However, it’s important to note that market conditions are always subject to change, and while predictions may offer some insight, they should not dictate investment strategies. Recognizing long-term growth trends and avoiding short-term speculation remains key.

The Importance of Long-Term Investing

In today’s fast-paced world, investing is more important than ever. With inflation constantly eroding purchasing power, it’s essential to invest to grow wealth over time. However, it’s equally important to adopt the right mindset when investing. Many people fall for “get-rich-quick” schemes, but these often lead to financial losses.

Investing isn’t about quick profits; it’s about steady, long-term growth. At AI Financial, we focus on calculated, sustainable investments that yield long-term returns. Over the last decade, our approach has generated a 21.6% return on investments, a testament to the value of professional guidance and careful decision-making.

Avoiding Quick Rich Schemes and Focusing on Long-Term Growth

Quick-fix schemes and speculative investments may promise high returns, but they often lead to significant financial losses. The key to success lies in avoiding these temptations and adopting a strategy that prioritizes security and steady growth. One effective investment strategy is to focus on segregated funds that guarantee principal protection. These segregated funds are invested in a diversified basket of stocks, which reduces risk and provides stability.

Moreover, large-scale investments, such as those managed by AI Financial, offer additional advantages. By leveraging borrowing, these investments can access opportunities that smaller investors may not, enhancing returns while maintaining safety.

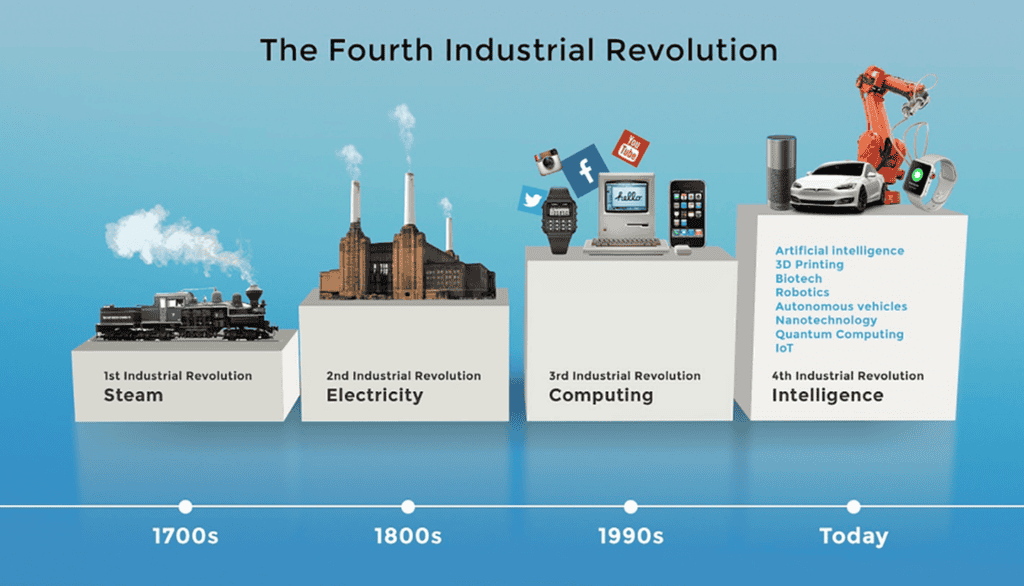

The Fourth Industrial Revolution: A Time for Wealth Creation

The Fourth Industrial Revolution, driven by artificial intelligence, big data, and technological advancements, is reshaping industries and creating unprecedented wealth. As these changes unfold, the stock market will reflect the wealth being generated. This is why long-term investment in sectors that stand to benefit from technological innovation is crucial.

While some sectors, like semiconductors, may still offer short-term opportunities, we believe that investing in emerging technologies that support the Fourth Industrial Revolution will provide more reliable, long-term growth.

Seizing Opportunities in the Fourth Industrial Revolution

As the Fourth Industrial Revolution progresses, future wealth growth will increasingly be concentrated in emerging technologies. Individual investors may find it challenging to accurately capture these opportunities, but by using professional investment tools, such as public Segregated funds, they can steadily share in these gains.

Advantages of Segregated Funds

- Diversified Risk: The fund hedges risk by holding a basket of stocks. Even if some stocks perform poorly, other stocks provide returns, helping to manage overall risk.

- Stable Returns: Designed to preserve principal, Segregated funds also offer good growth potential, providing a balance of security and reward.

- Investment Loans: Ai Financial offers a unique investment loan feature that allows clients to leverage smaller amounts of capital for larger investment returns. This is an advantage that traditional banks or standard mutual funds cannot provide.

Investment requires long-term planning and professional support. By choosing an experienced institution like Ai Financial, investors can seize the wealth opportunities brought by the Fourth Industrial Revolution through Segregated funds and investment loans, making their investments more stable and efficient.

You may also interested in

What is an investment loan?

Can this loan last a lifetime? Interest-only payments? Tax-deductible? Is it a private loan? Is the threshold high?

Why do you need segregated funds for retirement?

Segregated funds are a popular choice for group savings and retirement plans. They provide access to high-end and unique……

Invest with TFSA

A Tax-Free Savings Account (TFSA) provides you with a flexible way to save for a financial goal, while growing your money tax-free……

Invest in RRSP-Invest wisely, retire early

According to a recent survey by BMO, due to inflation and rising prices, Canadians now believe they need 1.7 million dollars in savings to retire……