Turning Loans into Wealth: A Game-Changer for Canadian investors

Wealth isn’t just about having money in your bank account; It’s about building assets that work for you, even when you’re asleep. True wealth means having investments that keep growing and making money for you, giving you freedom to enjoy life.

Wealth is what buys freedom. Imagine not having to wake up to an alarm clock, commute in traffic, or spend your days in a job that doesn’t inspire you. Wealth gives you choices—whether it’s to work on your passion projects, spend more time with your loved ones, or simply live life on your own terms.

Why Investment Loans Can Help You Build True Wealth

True wealth doesn’t come from renting out your time—it comes from building assets that work for you, even when you’re not working. The problem with relying solely on work for income is that it’s linear. The more time you put in, the more you earn. But the moment you stop working—whether it’s while you sleep, on vacation, or when you retire—your earnings stop.

To build true wealth, you need to own equity. You need to create something that generates income without needing constant attention. That’s where Ai Financial comes in.

How Investment Loans Build Non-Linear Wealth

The biggest wealth creators—whether they’re entrepreneurs, investors, or successful professionals—understand that wealth comes from ownership, not just earning. They’ve invested in assets, businesses, or intellectual property that compound over time, creating income streams that continue to grow.

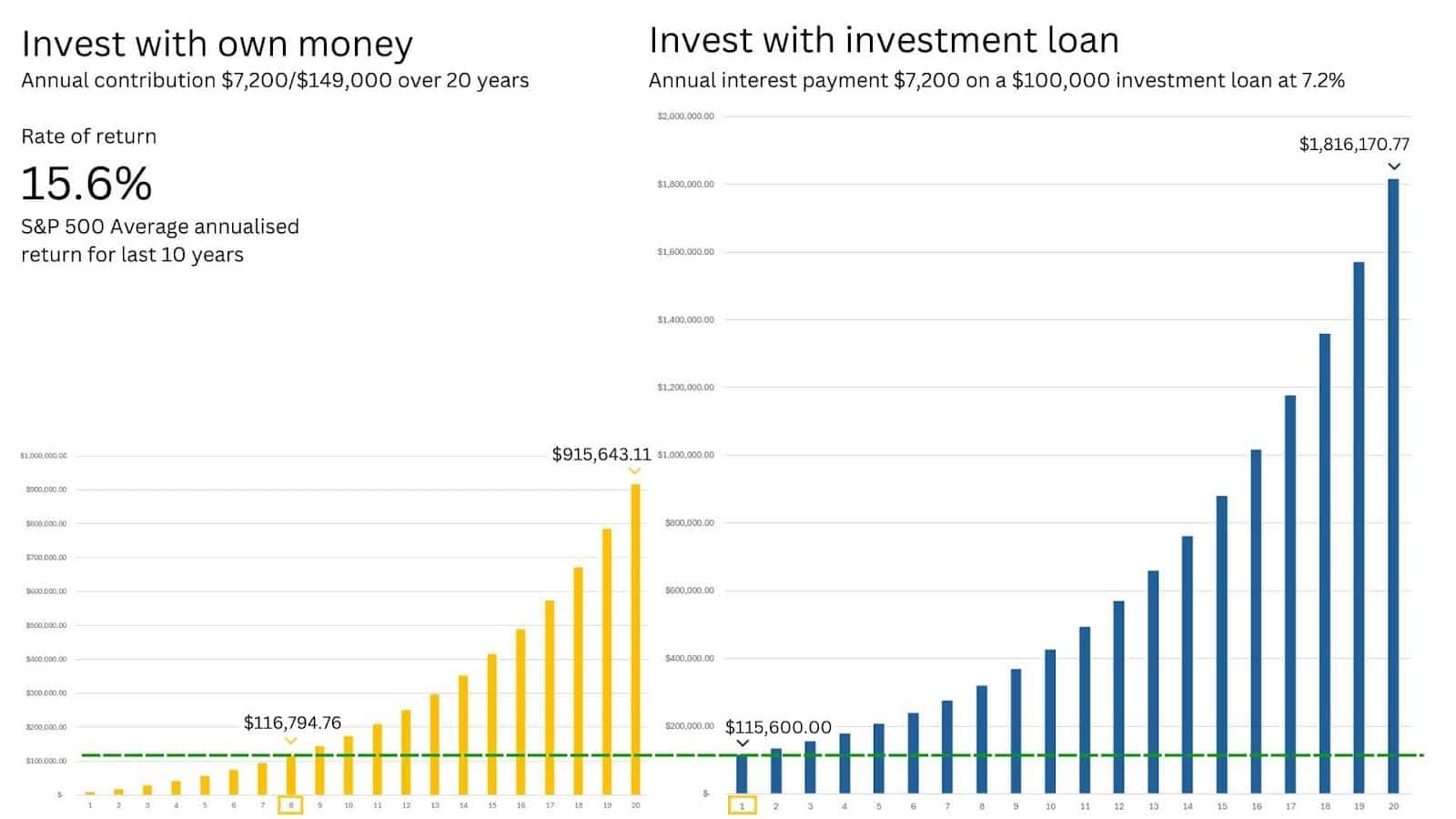

Fast Forwarding Your Savings – With a traditional savings plan, only the investment you make in the first year will have the full 20 years to grow. Each subsequent year, the amount you contribute will have less time to grow. This means that the amount you contribute in year 2 will only grow for 19 years, in year 3 for 18 years, and so forth, resulting in a lost opportunity for compound returns compared to a larger lump sum investment.

Let’s say you have $7,200 to invest each year for 20 years. With a traditional savings plan at a 15.6% rate of return, it would take 7-8 years to grow your savings to $100,000. After 20 years, your investment would be worth $915,643.11.

However, if you made an interest-only annual payment of $7,200 toward a $100,000 investment loan, the entire loan amount could benefit for the full 20 years, with your investment worth $1,716,170.77 (after repaying the $100,000 loan), which is $900,527.66 more than the traditional savings plan. This is how an investment loan could accelerate your savings.

Why should I consider getting an investment loan?

- Leverage Your Opportunities

Investment loans allow you to use borrowed money to invest in high-growth opportunities, such as segregated funds. By leveraging debt, you can multiply the potential return on your investment. Instead of waiting to save up the full amount, you can start building wealth now and have the opportunity for faster growth. - Diversification of Investments

By borrowing to invest, you can diversify your portfolio more effectively. A well-diversified investment strategy spreads your risk and increases the chance of generating stable, long-term returns. With an investment loan, you can access a wider range of assets, giving you more opportunities to grow your wealth. - Tax Benefits

In some cases, the interest on an investment loan can be tax-deductible, depending on the type of loan and where the funds are invested. This can help you reduce your overall tax burden, increasing your net returns over time. - Build Wealth Over Time

Investment loans help you take advantage of the compounding power of long-term investments. The earlier you invest, the more time your money has to grow. By using an investment loan, you can start building wealth today, instead of waiting until you have enough saved up to invest.

Professional Guidance and Strategy

At Ai Financial, we work closely with you to ensure your investment loan is part of a strategic, well-thought-out plan. We help you understand the risks and rewards, and guide you to make informed decisions that align with your financial goals.

“Give me a lever long enough, and a place to stand, and I will move the earth.”

- Archimedes

At Ai Financial, we help you use investment loans to create wealth through smart, strategic investments. Instead of waiting years to save up enough to invest, you can use borrowed funds to start building your future now. And as your investments grow, they generate more returns than what you initially invested—creating a cycle of increasing wealth.

The beauty of using borrowed money for investment is that it allows you to grow your portfolio faster. By investing in segregated funds, you’re giving your money the opportunity to compound, while also keeping the flexibility of managing your financial future. Your wealth isn’t tied to your time or salary—it’s tied to your ability to make smart investments that pay off over time.

Why Ai Financial?

We act as your financial partner, helping you transform investment loans into wealth-building opportunities. Here’s how we do it:

- Tailored Loan Structuring: We work with trusted financial institutions to secure loans tailored to your needs.

- Strategic Investments: We specialize in segregated funds, which provide long-term growth with built-in protections.

- Expert Management: Our team oversees your investments, ensuring they align with your financial goals.

- Clear Path to Freedom: We help you turn borrowed capital into assets that work for you, creating a system that supports your financial independence.

Ai Financial has an astonishing 20%+ average annual investment return over the past decade.

Real-Life Investment Journeys

Alex: $140,000 Profit in 2.5 Years with 400% Real ROI

Alex took a $200,000 investment loan with us in 2022 to invest in our recommended segregated funds. This year, his account profit has reached $140,000.

Sophia: 5 Years, double wealth, make $100,000 into $250,000

Sophia’s investment return has already reached nearly 30% this year! In 2018, she took a $100,000 loan to invest. By last year, her assets had already doubled, with a profit of $150,000!

Take the First Step Toward Your Financial Freedom

At Ai Financial, we’re not just helping you take out a loan—we’re helping you build a future. If you’re ready to transform borrowed funds into growing assets, let’s start your journey toward wealth today. Together, we’ll create a system that works for you, so you can focus on what truly matters.

As the Fourth Industrial Revolution progresses, future wealth growth will increasingly be concentrated in emerging technologies. Individual investors may find it challenging to accurately capture these opportunities, but by using professional investment tools, such as public Segregated funds, they can steadily share in these gains.

You may also interested in

What is an investment loan?

Can this loan last a lifetime? Interest-only payments? Tax-deductible? Is it a private loan? Is the threshold high?

Why do you need segregated funds for retirement?

Segregated funds are a popular choice for group savings and retirement plans. They provide access to high-end and unique……

Invest with TFSA

A Tax-Free Savings Account (TFSA) provides you with a flexible way to save for a financial goal, while growing your money tax-free……

Invest in RRSP-Invest wisely, retire early

According to a recent survey by BMO, due to inflation and rising prices, Canadians now believe they need 1.7 million dollars in savings to retire……