Analysis of the Toronto Condo Market Crash. With the GTA...

Read MoreDow Tumbles for Ninth Day as Markets Await Fed’s Final Decision

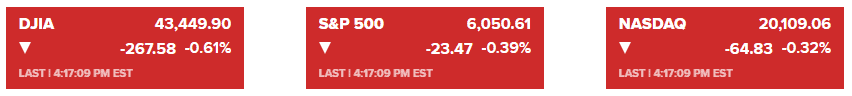

Market Overview:

On Tuesday, the Dow Jones Industrial Average recorded its longest losing streak since 1978, declining for the ninth consecutive session. The index fell 267.58 points (0.61%) to 43,449.90. The S&P 500 lost 0.39%, closing at 6,050.61, while the Nasdaq Composite slid 0.32% to 20,109.06.

Despite the Dow’s downturn, the broader market showed resilience. The S&P 500 remains less than 1% away from its recent high, and the Nasdaq reached a record on Monday. Driving the Dow’s losses is a rotation away from traditional economy stocks toward technology stocks, which have dominated recent market gains.

Investors are bracing for the Federal Reserve’s interest rate decision due Wednesday, with a 95% probability of a quarter-point rate cut. However, concerns persist about the Fed’s future moves, inflationary risks, and potential market bubbles. November retail sales data surpassed expectations, underscoring consumer resilience but adding to concerns that rate cuts may be unnecessary.

In global markets, Canada’s inflation dropped below the Bank of Canada’s 2% target, providing reassurance about the impact of rapid rate cuts. However, political discord weakened the Canadian dollar, hitting Covid-era lows. Brazil’s currency, the real, also faced pressure, prompting multiple central bank interventions to stabilize it.

Oil prices declined for a second day amid concerns over weakening Chinese demand and sliding equity markets.

Corporate News:

- Nvidia: Despite recent gains in the tech sector, Nvidia, a new member of the Dow, struggled and entered correction territory, reflecting broader market dynamics.

- Tesla: Shares of Tesla rose again on Tuesday, maintaining its upward momentum.

- Broadcom: Broadcom’s stock fell 3.9%, contributing to the Dow’s losses.

- Bank of America: CEO Brian Moynihan projected that the Federal Reserve could lower rates to 3.75% in 2024, citing economic resilience but potential external risks.

Currencies and Commodities

- The Canadian dollar weakened amid political discord, while inflation data reassured the Bank of Canada about its rate policy.

- Brazil’s real hit an all-time low due to fiscal concerns, prompting repeated central bank interventions.

- Asian currencies declined to a two-year low, driven by pessimism over China’s economic outlook.

- The yen ended its six-day losing streak, with strategists cautioning against further declines that could trigger intervention.

- Oil prices dropped for a second day, reflecting concerns over Chinese demand and broader market weakness.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

Recent Posts

You may also interested in

Nightmare in Vaughan: Pre-con Buyer Loses Life Savings | AIF Insight on Real Estate | AiF News Bites

A Vaughan man lost his deposit and faces legal action...

Read MoreExperts Warn: Canada’s Economic Growth Slows as Recession Risks Rise | AiF News Bites

Economists and rating agencies warn of structural slowing in Canada's...

Read MoreGold and Silver Market Crash: Historical Precious Metals Price Volatility Amid Shifting US Dollar Strength Expectations | AiF News Bites

Analyze the epic gold and silver market crash triggered by...

Read More