How much do Canadians need to retire? Surveys show the...

Read MoreFHSA 2025 - An Ai Financial Guide

Canada’s housing affordability crisis has been driven not just by supply shortages but by a societal view of homes as financial assets. Home prices have tripled since 2005, propelled by investor demand and rising speculation. While first-time buyers struggle to enter the market, long-term homeowners benefit from soaring property values, creating a system that prioritizes profit over affordability. Experts argue for structural changes, including tax reforms, but political will to reduce housing prices remains limited.

This complex reality has led Canadians to explore alternative ways to build wealth for real estate—one of which is the First Home Savings Account (FHSA).

FHSA: Your path to homeownership

The Tax-Free First Home Savings Account (FHSA) was introduced in Canada on April 1, 2023, as a new registered plan following the Tax-Free Savings Account (TFSA). Designed to assist first-time homebuyers, FHSA combines the tax benefits of TFSA and RRSP.

Contributions, investment income, and growth in FHSA are all tax-free, and withdrawals for a first home purchase are also tax-exempt, offering convenient and favorable financial support for homeownership dreams

How does FHSA Work?

The First Home Savings Account (FHSA) is a smart and efficient way to save for your first home while taking advantage of significant tax benefits. Unlike a traditional savings account, your investment earnings within an FHSA aren’t taxed, allowing your money to grow faster over time.

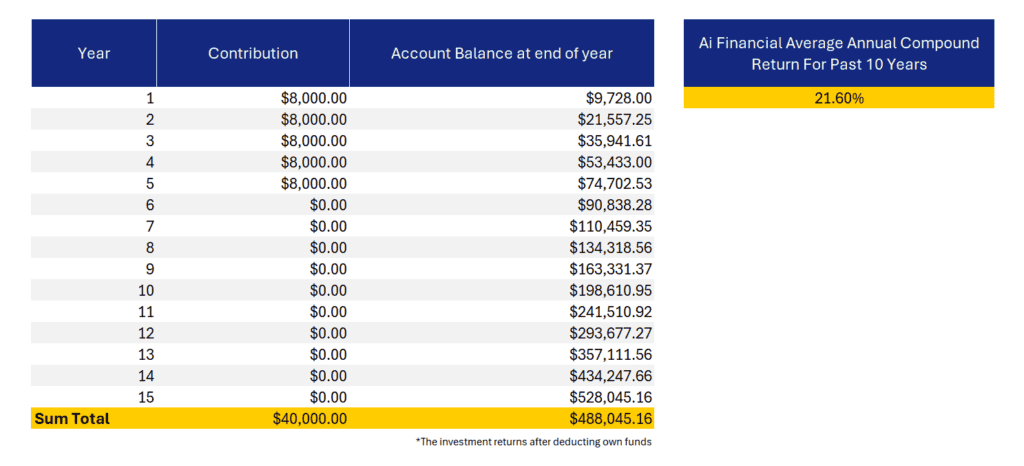

You can contribute up to $8,000 annually, with a lifetime maximum of $40,000, and any unused contribution room can be carried forward to the next year, up to the $8,000 yearly limit. This flexibility ensures you can maximize your savings at a pace that works for you.

One of the standout benefits of the FHSA is that you can make tax-free withdrawals at any time to purchase a qualifying home.

Additionally, you can combine the FHSA with the Home Buyers’ Plan (HBP) for even greater purchasing power. While the HBP requires you to repay the withdrawn funds over time, FHSA withdrawals are completely repayment-free—making it a stress-free, tax-efficient way to fund your dream home.

With its tax advantages and growth potential, the FHSA is a valuable tool to help you achieve homeownership faster and with greater financial confidence.

Who can open a FHSA?

To open a First Home Savings Account (FHSA), you must meet the following criteria:

- Age Requirement: You must be at least 18 years old (or the age of majority in your province/territory) and less than 71 years old by December 31 of the current year.

- Residency: You must be a resident of Canada.

- First-Time Home Buyer: In the current year and the past four years:

- Neither you nor your spouse can have owned a property in Canada.

- Neither of you can have designated any property as your principal residence.

The FHSA account has a maximum lifespan of 15 years. This gives you plenty of time to save and invest for your first home purchase.

You can open an FHSA through various financial institutions that also offer TFSA and RRSP services. These include:

- Banks

- Credit unions

- Life insurance companies

- Canadian trust companies

- Ai Financial

What types of products can be held in a FHSA?

Despite its name, FHSA is not a typical savings account – it’s a place where you can put investments like segregated funds. Segregated fund policies give you the freedom to invest while offering insurance protection to preserve your savings. With our choice of guarantees, you can expand your wealth and secure it at the same time.

You can purchase Segregated Funds using various accounts, including but not limited to TFSA, RRSP, RESP, Non-Reg, etc.

By leveraging the tax-free growth advantage of an FHSA, you have up to 15 years to invest and benefit from compound growth.

Returns will vary depending on the financial market and the investment vehicles you choose. But generally speaking, the sooner you start contributing, the higher your FHSA returns will be.

Grow your FHSA with Ai Financial

The FHSA allows you to hold funds in the account for up to 15 years, during which time your initial contributions can grow into a substantial amount for purchasing a home.

At Ai Financial, our historical investment returns have successfully doubled our clients’ assets within five years.

Let’s simulate how much financial support your could potentially receive within 15 years based on our historical investment returns:

If you max out your TFSA contribution limit every year, you have the opportunity to achieve tax-free investment gains of $480,000 after 15 years based on Ai Financials’ historical average annual return of 21.6% (excluding the initial $40,000 principal). This would provide substantial support for a down payment on a new home.

Maybe you’re concerned about our return rate accuracy, using the historical average annual return of the SPY 500 (approximately 15%), you could still achieve investment gains of $210,000 after 15 years. If you have a spouse, doubling your contribution room and returns can effectively help alleviate the pressure of buying a home.

The Best Time to Start Is Now

Recent Posts

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More

What is an investment loan?

Can this loan last a lifetime? Interest-only payments? Tax-deductible? Is it a private loan? Is the threshold high?

Why do you need segregated funds for retirement?

Segregated funds are a popular choice for group savings and retirement plans. They provide access to high-end and unique……

Invest with TFSA

A Tax-Free Savings Account (TFSA) provides you with a flexible way to save for a financial goal, while growing your money tax-free……

Invest in RRSP-Invest wisely, retire early

According to a recent survey by BMO, due to inflation and rising prices, Canadians now believe they need 1.7 million dollars in savings to retire……