Analysis of the Toronto Condo Market Crash. With the GTA...

Read MoreMarkets Wrap: Dow Drops 400 Points as Wall Street Ends Year in Decline

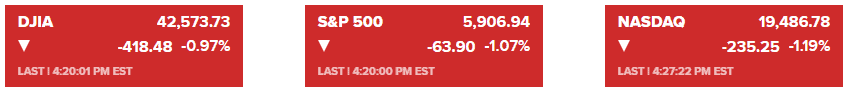

Market Overview:

U.S. stocks declined on Monday in one of the final trading sessions of 2024, as a banner year for investors appears to be ending on a sour note. The Dow Jones Industrial Average lost 418.48 points (-0.97%) to close at 42,573.73, while the S&P 500 fell 1.07% to 5,906.94, and the Nasdaq Composite dropped 1.19% to 19,486.78.

Trading was volatile throughout the day, with the Dow dropping more than 700 points at session lows. No apparent catalyst drove the decline, although light trading volumes typical of the holiday season likely contributed.

For 2024, the major averages remain on track for a strong year, with the S&P 500 up about 24%, the Dow up 13%, and the Nasdaq gaining nearly 30%, its best performance since 2021. However, recent sessions have seen losses, driven by year-end profit-taking and concerns over market momentum.

In the bond market, 10-year Treasury yields retreated to 4.54% after peaking above 4.6% last week. Meanwhile, the Chicago Purchasing Managers Index (PMI) came in at 36.9, below expectations of 42.2, indicating weaker economic activity. Pending U.S. home sales rose for a fourth consecutive month in November, reaching their highest level since early 2023.

Globally, Europe’s Stoxx 600 Index declined, and Asian equities snapped a five-day rally. Commodities saw mixed performance, with oil edging higher amid 2025 risk considerations, while gold is set to end the year with significant gains.

Looking ahead, traders anticipate key economic data and the potential for a “Santa Claus rally,” a phenomenon where markets often rise during the final five trading days of December and the first two in January.

Corporate News:

- Technology Stocks: Large-cap technology stocks extended their decline, with Tesla falling 3.3% and Meta Platforms dropping 1.4%. Nvidia, however, rose 0.4%, helping to offset broader losses in the tech sector.

- Magnificent Seven: The group of leading U.S. tech giants has driven a 25% advance in the S&P 500 this year, though concerns remain about the concentration of gains.

- CME Group Operations: CME Group announced adjusted trading schedules in observance of a national day of mourning for former U.S. President Jimmy Carter, who passed away on Sunday. U.S. equities markets, including NYSE and Nasdaq, will close on January 9, while bond markets will close early at 2 p.m.

- German DAX Performance: Germany’s DAX Index ended 2024 with a 19% annual gain, highlighting a strong year for European equities.

Key Events This Week

- Tuesday: China manufacturing PMI, non-manufacturing PMI

- Wednesday: New Year’s Day holiday (markets closed)

- Thursday: U.S. construction spending, jobless claims, manufacturing PMI

- Friday: U.S. ISM manufacturing, light vehicle sales

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

Recent Posts

You may also interested in

Nightmare in Vaughan: Pre-con Buyer Loses Life Savings | AIF Insight on Real Estate | AiF News Bites

A Vaughan man lost his deposit and faces legal action...

Read MoreExperts Warn: Canada’s Economic Growth Slows as Recession Risks Rise | AiF News Bites

Economists and rating agencies warn of structural slowing in Canada's...

Read MoreGold and Silver Market Crash: Historical Precious Metals Price Volatility Amid Shifting US Dollar Strength Expectations | AiF News Bites

Analyze the epic gold and silver market crash triggered by...

Read More