Analysis of the Toronto Condo Market Crash. With the GTA...

Read More2024 US Stock Market Summary Part 2

Disclaimer:

This blog is for educational purposes only and does not constitute any investment advice. Investors should not make decisions based solely on this information. While we strive for the accuracy and reliability of the information, we make no guarantees regarding the completeness and accuracy of this information and data, and we do not assume any responsibility for losses incurred due to the use of this information. The market carries risks, and investment should be approached with caution.

The content of this blog is divided into the following four parts

- Review of the 2024 Investment returns.

- Industry analysis for 2024 to see which sectors and segments delivered high returns.

- A market outlook for 2025, including where to invest and which sectors to focus on.

- AIF’s investment strategies for 2025.

Let’s jump into the first part, reviewing 2024’s investment returns.

2024 Investment Report

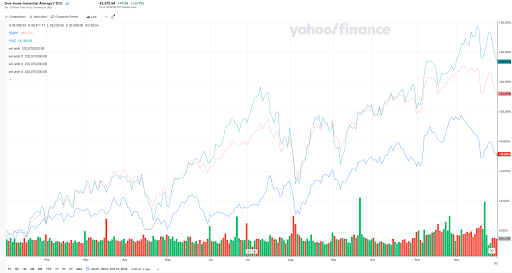

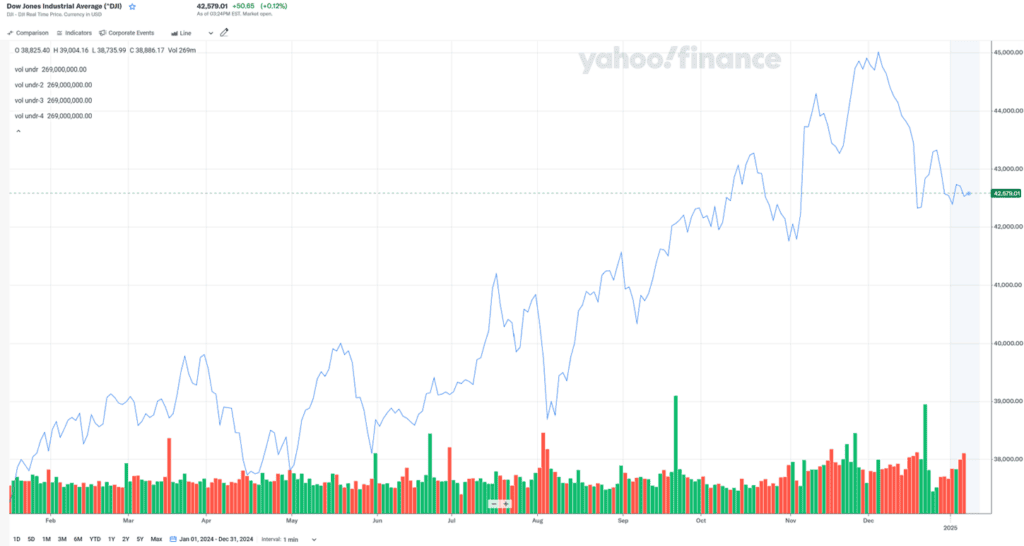

All three major indexes surged across the board.

In 2024, the U.S. stock market saw all three major nidexes surge across the board, with extraordinary gains.

Of the three major indexes, the one with the smallest gain is represented by the dark blue line – this is the Dow Jones Industrial Average, which grew by 12.88%.

Don’t underestimate this 12..88% – this was an exceptional year for the Dow Jones

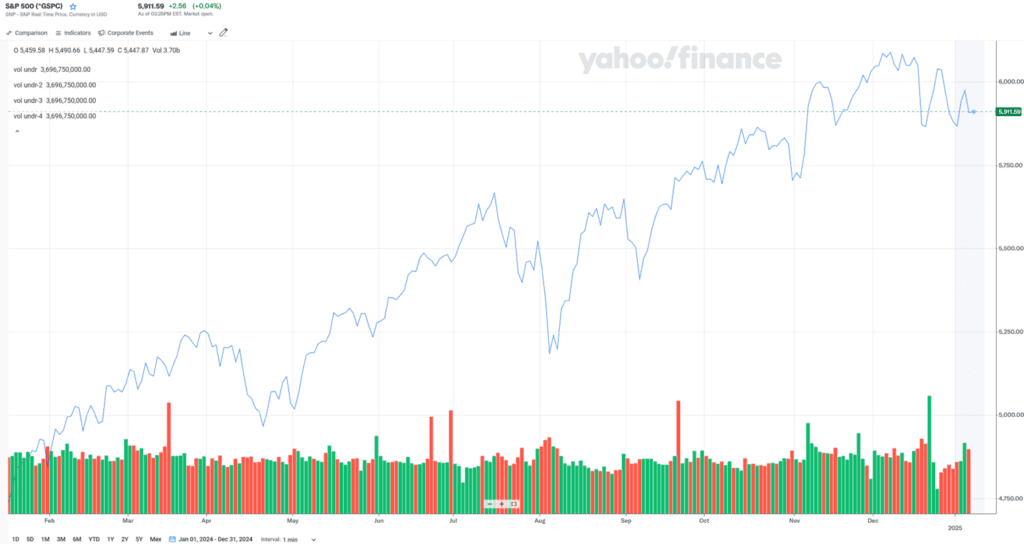

The middle red line represents the S&P, which rose by 23.03%

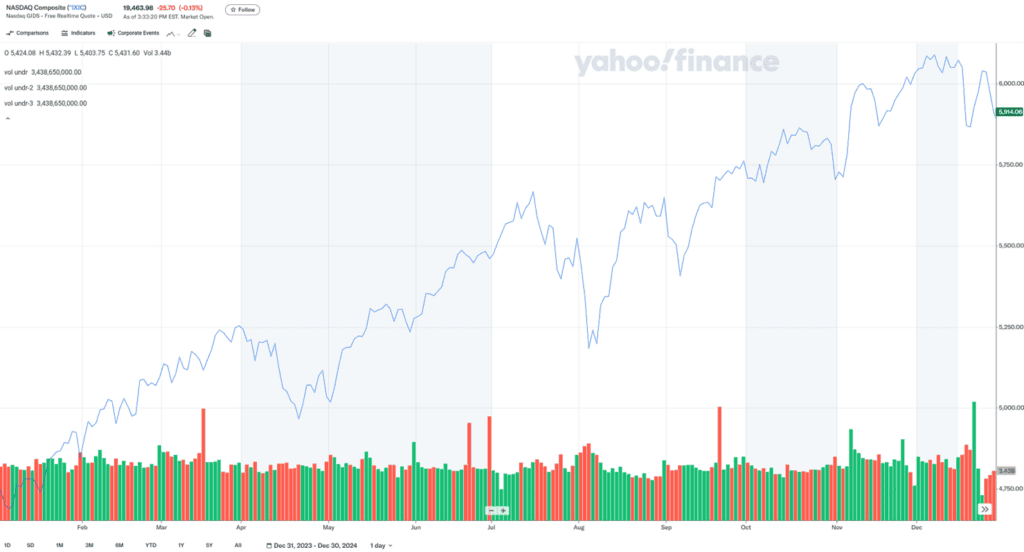

The highest gains came from Nasdaq, represented by the green line at the top, which soared by 28.44%.

So, in 2024, the three major indexes experienced explosive growth.

Although the Dow Jones only rose by 12.88% it set 47 new historical highs last year, which is a new record.

The S&P 500 index set an even more impressive 55 historical highs.

and the Nasdaq followed with 21 historical highs.

This was a historical year, where almost everyone who participated in the market enjoyed significant returns.

However, despite the excellent market performance, many people missed out entirely on the growth last year.

Thanks to the market reaching record highs, AIF’s 2024 investment returns also hit record levels.

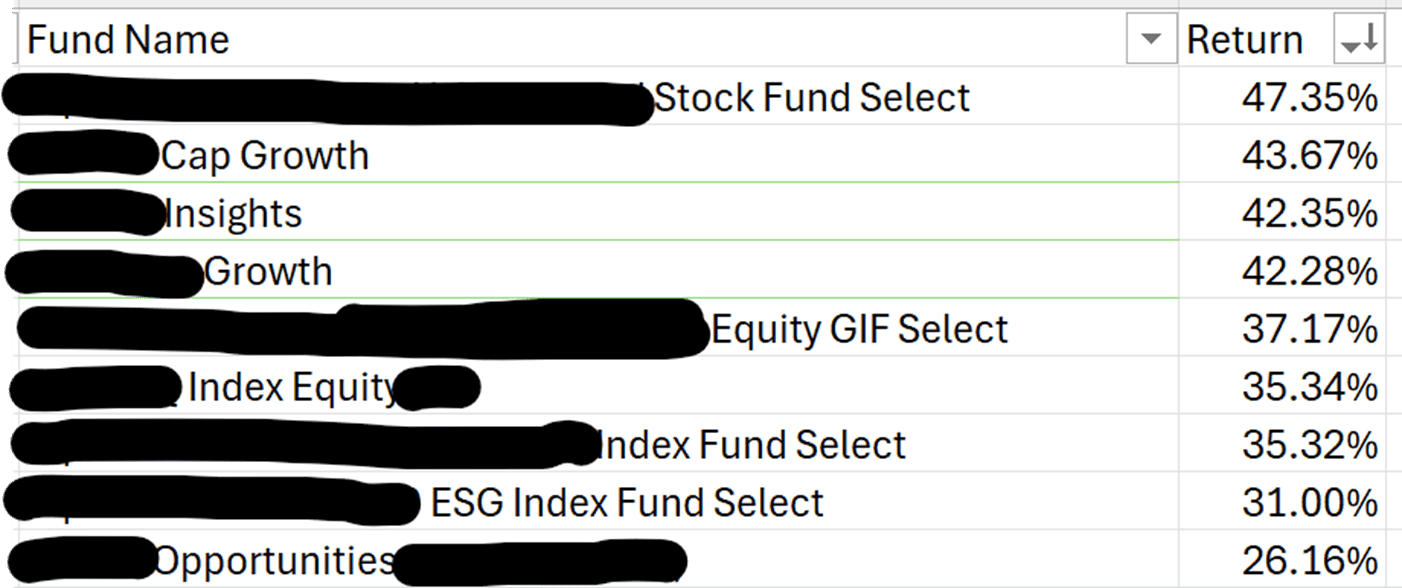

Here some data from AIF’s statistics database

In the SACFON capital-protected funds we selected for our clients, even the lowest-performing fund delivered a return of 26.16%, while the highest-performing fund achieved a return of 47.35%.

All the funds generated returns above 20%, allowing us to truly create wealth for our clients.

We feel very proud and grateful for our clients’ trust, which gave us the opportunity to help them invest and earn profits.

Part 2 Industry analysis of 2024 to see which sector delivered high returns

Before diving into industry analysis, let’s revisit AIF’s investment philosophy – our “locomotive theory”

AIF’s Locomotive Theory

Think of a train: its forward motion is powered by the locomotive, specifically the engine within it.

Even without the carriages, the locomotive can move forward on its own. But without the locomotive, the carriages can’t move at all.

In investments, the locomotive engine represents the core value and the source of wealth creation.

Our goal is to invest in the “locomotive engine”—the part that generates the most value.

The seven most prominent stocks that performed exceptionally well in recent years are:

- NVIDIA

- Meta (Facebook)

- Tesla

- Amazon

- Microsoft

- Apple

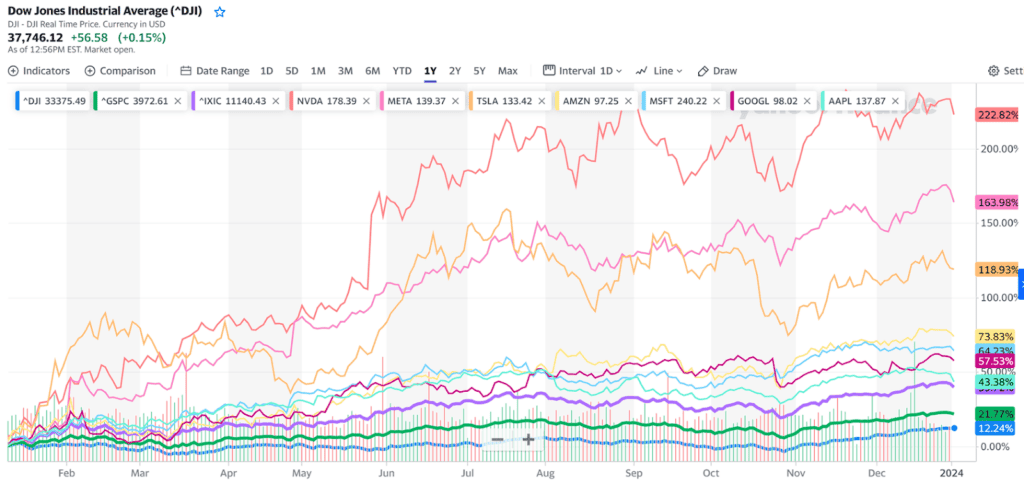

In 2023, these stocks delivered staggering returns:

- NVIDIA: 222.82%

- Meta: 163.98%

- Tesla: 118.93%

- Amazon: 73.83%

- Microsoft: 64.23%

- Google: 57.53%

- Apple: 43.38%

Locomotive Theory in 2024

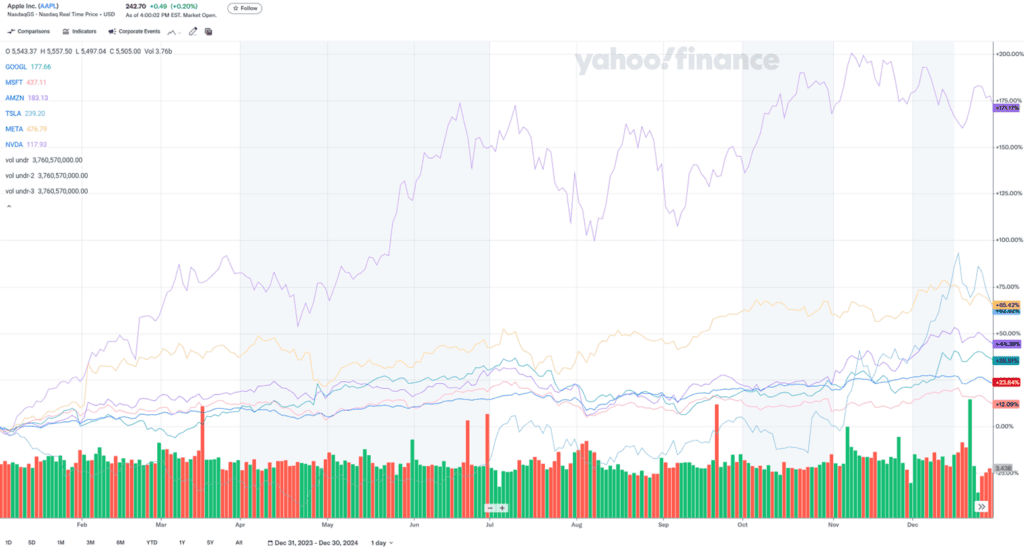

Did the seven giants maintain their strong growth in 2024? The answer is yes.

Although their rankings shifted slightly, these stocks continued to dominate:

- NVIDIA: 171.17%

- Meta: 65.42%

- Tesla: 62.53%

- Amazon: 44.39%

- Google: 35.51%

- Apple: 23.84%

- Microsoft: 12.09%

Once again, the seven giants led the way, confirming the validity of AIF’s locomotive theory as a sustainable investment strategy.

However, many people think that two years of data alone seems insufficient to prove that AIF’s “locomotive theory” is executable. It feels like the timeframe is too short.

Actually, I want to tell everyone: if you really look at historical data charts, you’ll find that the seven major giants we just mentioned have actually been leading the market for 20 years.

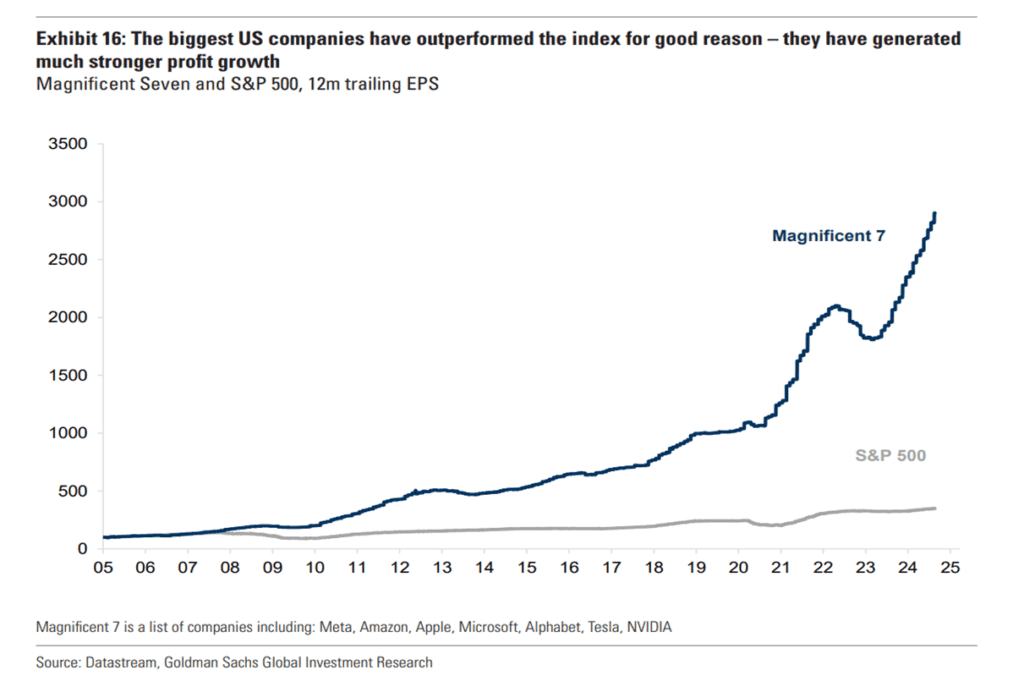

Please take a look at the chart. This chart, provided by Goldman Sachs, shows data from 2005 to 2024.

Over this 20-year period, you can see the growth of these seven giants. Other than the 2007-2008 period where this might not have been evident, starting from 2009, hasn’t there been a clear divergence? Up until 2024, haven’t these seven giants only grown stronger and higher?

Doesn’t this prove that AIF’s locomotive theory has been a viable investment strategy over the past 20 years?

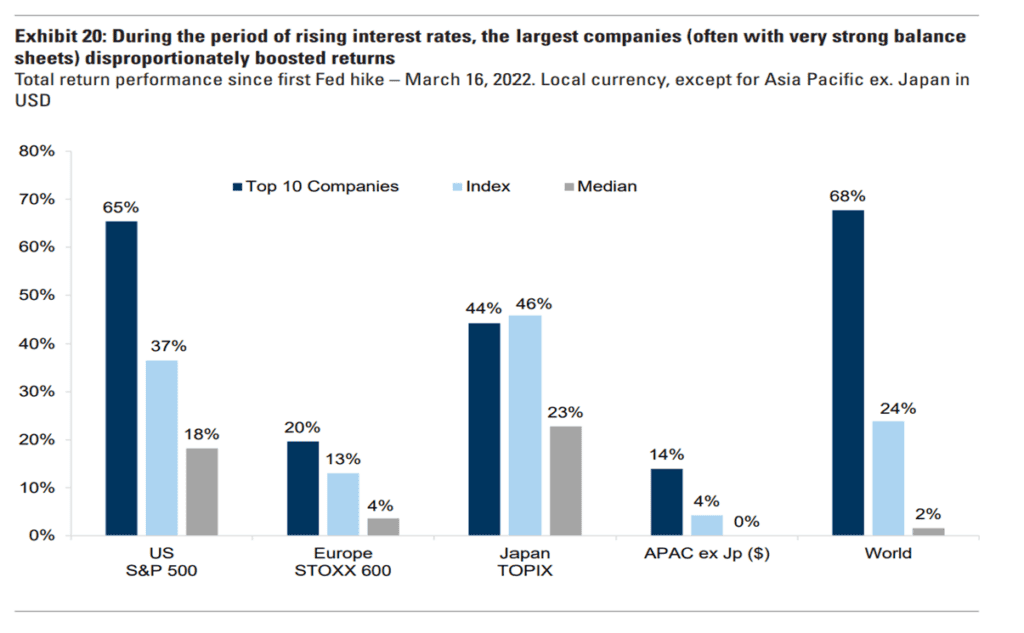

In addition to this chart, there’s another one that supports this. The growth of top-performing stocks, such as the top 10 in the U.S. S&P 500, has far outperformed the index and ETFs.

Let’s take a look. The first line here represents the S&P 500. The light blue line in the middle is the index. From 2022 to now—less than three years—the S&P 500 index has increased by 37%. If you had invested in the index or ETFs tracking it, your return would have been 37% in under three years. Is that good? Of course, it’s very good—an excellent return. Congratulations if you achieved this by investing in index ETFs on your own.

However, if you had invested in the top 10 S&P 500 stocks during this same period, your growth would have been 65%. What’s the difference? A 28% gap, right? That’s a significant difference. In fact, that 28% is 80% more than the 37% return you would have gotten with ETFs.

Many people like to invest in indexes or index ETFs, don’t they? But as you can see, while the market has been favorable in recent years, allowing you to make money, if you work with professionals like us at AIF who implement the locomotive theory, you could have earned at least 80% more during these years.

This highlights the importance of professional expertise. If you want high returns, you must rely on professionals to help you invest. If you invest on your own and happen to do so during good market conditions, you might not lose money and even make some profit. However, during poor market conditions, you risk losing money quickly, potentially wiping out all previous profits.

Here at AIF, we emphasize the importance of professional guidance, genuinely prioritizing the safety of your investments.

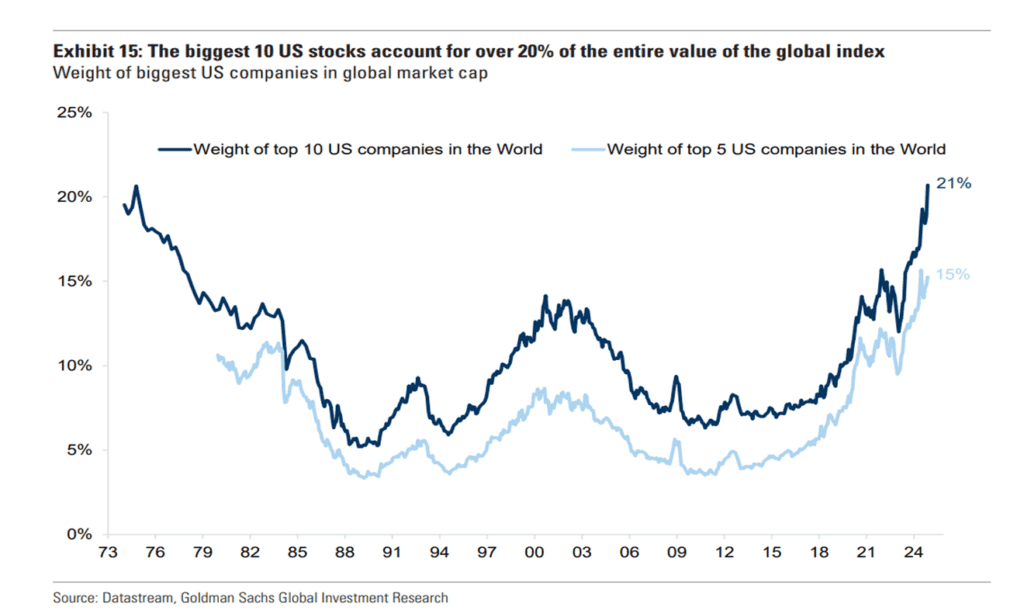

Let’s look at another chart, again from a report by Goldman Sachs. It shows that over the past 50 years, the top 10 stocks contributed 20% of the total market growth.

Take a look: starting in 1973 and going up to 2024—a 50-year span—the top 10 stocks have continuously changed over time. Don’t assume the top stocks are permanent. They evolve, but consistently selecting the top stocks to invest in has been enough to contribute 20% of the market’s overall growth.

From this, we can see that AIF’s locomotive theory has been thoroughly validated by the market and proven effective. It is a solid strategy and method for investment.

Here’s a simple analogy: Newton’s first law of motion, formulated 400 years ago, describes inertia. When inertia drives an object forward, such as a locomotive, never try to stop it or predict when it will halt or reverse. It has inertia and will keep moving forward.

This is crucial because inertia represents trends. In investing, we often emphasize following the trend. This trend is inertia, which is human nature. Inertia doesn’t change, trends don’t change, and human nature doesn’t change. These three principles are vital for understanding investment.

Since human nature is constant, and inertia exists, we shouldn’t try to predict when it will end. Attempting to forecast the market is a flawed mindset. We must follow the trend.

AIF’s locomotive theory has been proven correct over the past 20 years, and we believe it will remain applicable for the next 20 years. However, acknowledging the validity of the theory doesn’t mean the market will remain static.

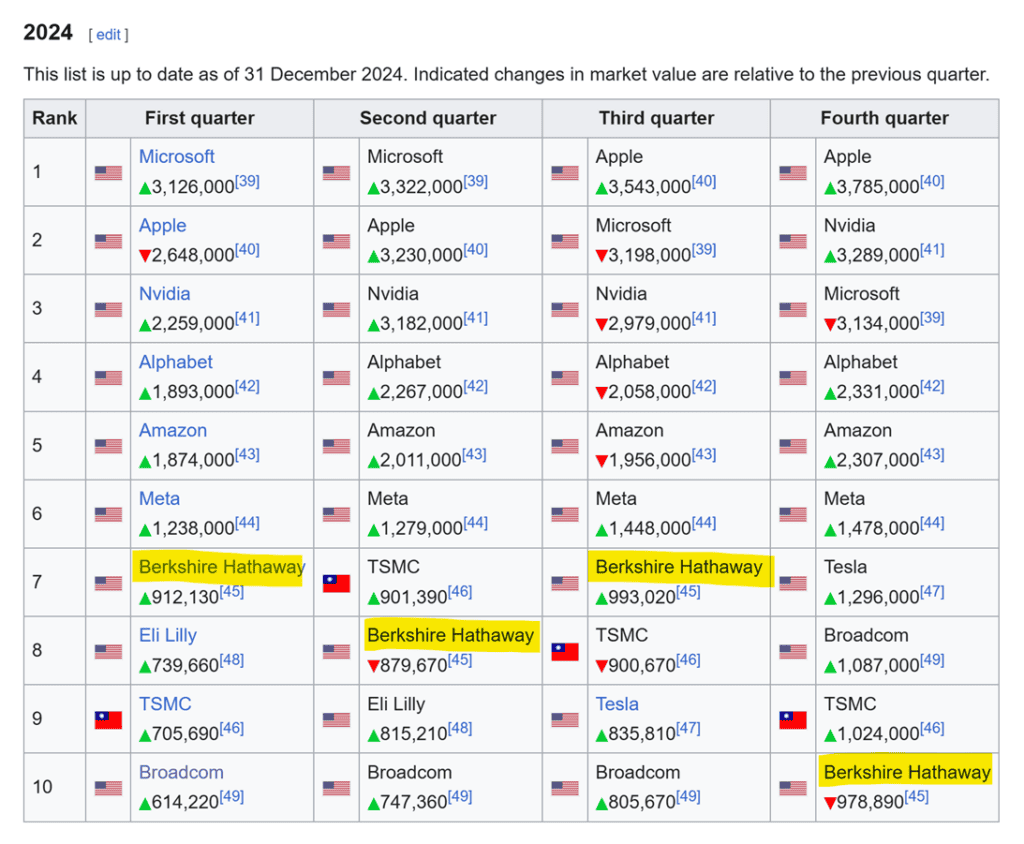

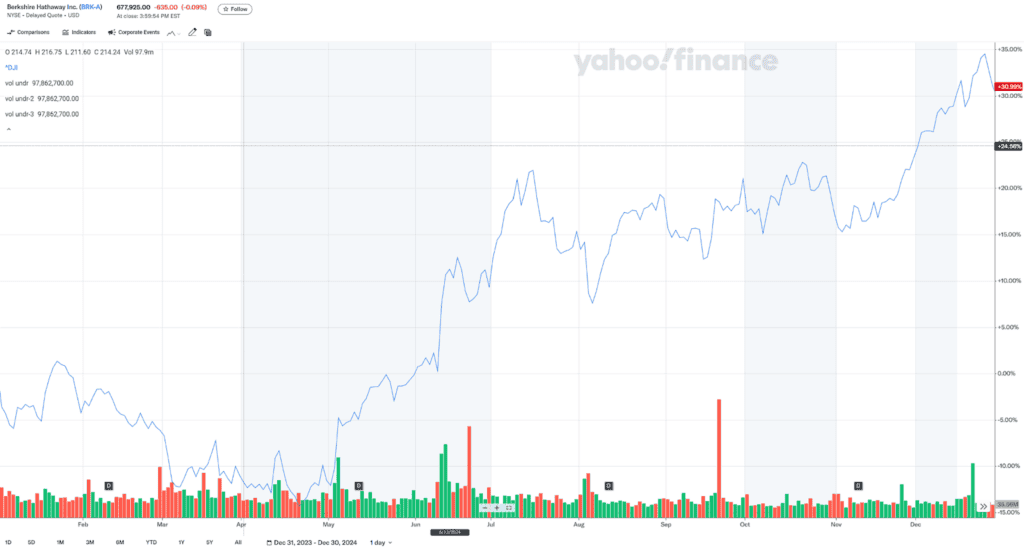

Markets do change. When they do, we adjust the stocks and funds we choose. For example, in recent years, we’ve observed the emergence of exceptional companies. Among them, Berkshire Hathaway, Warren Buffett’s company, stands out.

In 2024, Berkshire Hathaway entered the top 10 U.S. companies by market capitalization, maintaining this rank throughout the year. Over decades, Buffett’s company has demonstrated sustained and stable profitability.

In 2024 alone, Berkshire Hathaway grew by 30.99%. Some might say this isn’t high, especially compared to some of AIF’s chosen funds, which saw returns as high as 47% last year. Does that make AIF better than Berkshire Hathaway? Absolutely not.

Although our returns were high last year, can we maintain long-term stable profitability like Buffett’s company? I don’t think we have that capability.

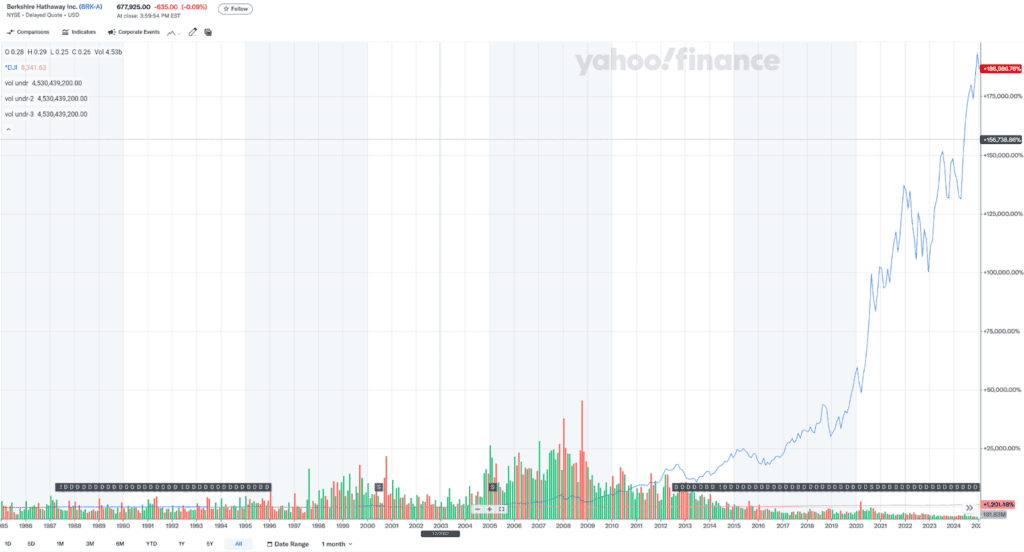

Let’s look at Berkshire Hathaway’s stock performance. From 1985 to 2024, its stock has grown by 186,986.76%. What does this mean? It means that over the past 40 years, Berkshire Hathaway’s stock has increased 45-fold every year, consistently.

This highlights the importance of sustained, stable profitability in investing. Buffett is known as the “stock god” because his company, though seemingly slow-growing, has achieved extraordinary results over time.

This is the power of compounding—what Buffett often refers to as a “snowball.” As time goes on, the snowball grows larger and larger. Over time, other companies currently ranked ahead of Berkshire will likely fall behind.

From Buffett’s company, we can see that investing in companies is the next big trend following artificial intelligence (AI).

Everyone knows the saying by Lei Jun: “If you stand in the wind, even pigs can fly.” So, what are the hottest sectors right now? Artificial intelligence (AI) and finance.

AI + Finance represents the hottest opportunities to build wealth and change lives.

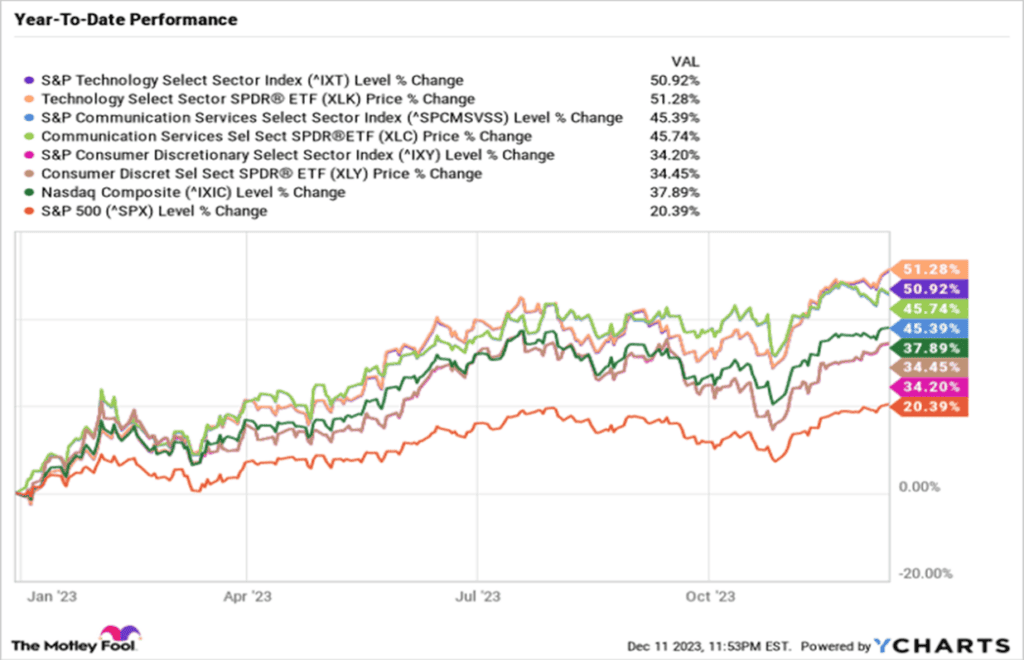

Looking back at 2023, the leading sectors were AI/high-tech, telecommunications (including semiconductors and chips), and consumer goods.

Moving into 2024, these sectors have shifted slightly. AI/high-tech remains at the top, but healthcare has replaced telecommunications as the second leading sector, and finance has overtaken consumer goods to become the third.

This shift underscores why following AI and finance, guided by AIF’s locomotive theory, is the path to maximizing profits.

Part 3 - A market outlook for 2025 - Including where to invest

The evolving industries and their influence on the economy are driving changes. While the “Magnificent 7” still leads, other emerging companies offer potentially better returns.

Investing strategies must adapt to market changes. As we look ahead to 2025, Morgan Stanley predicts robust global economic growth, ushering in a “big bang” year for the economy.

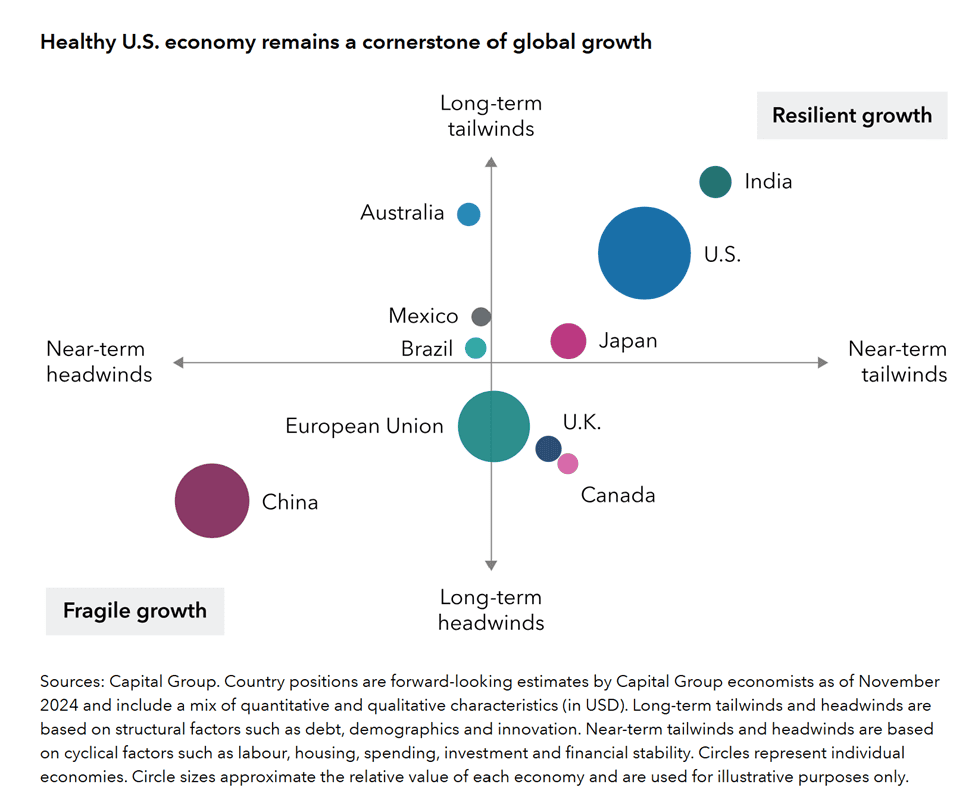

The primary economic drivers will be the U.S., Japan, and India. India, in particular, is expected to benefit significantly from global supply chain shifts due to its population and infrastructure.

Canada, on the other hand, faces challenges. Short-term prospects are acceptable, but long-term growth is hindered by left-leaning policies and structural inefficiencies.

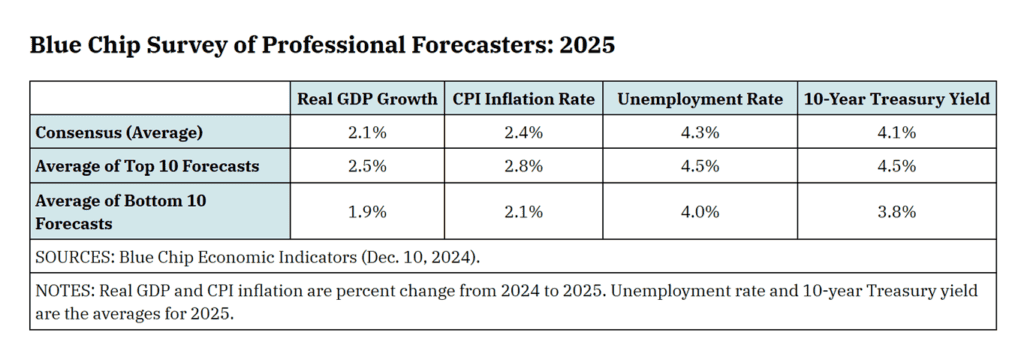

Turning back to the U.S., the GDP growth forecast for 2025 is 2.1%. While this may seem modest, it represents substantial growth for the world’s largest economy.

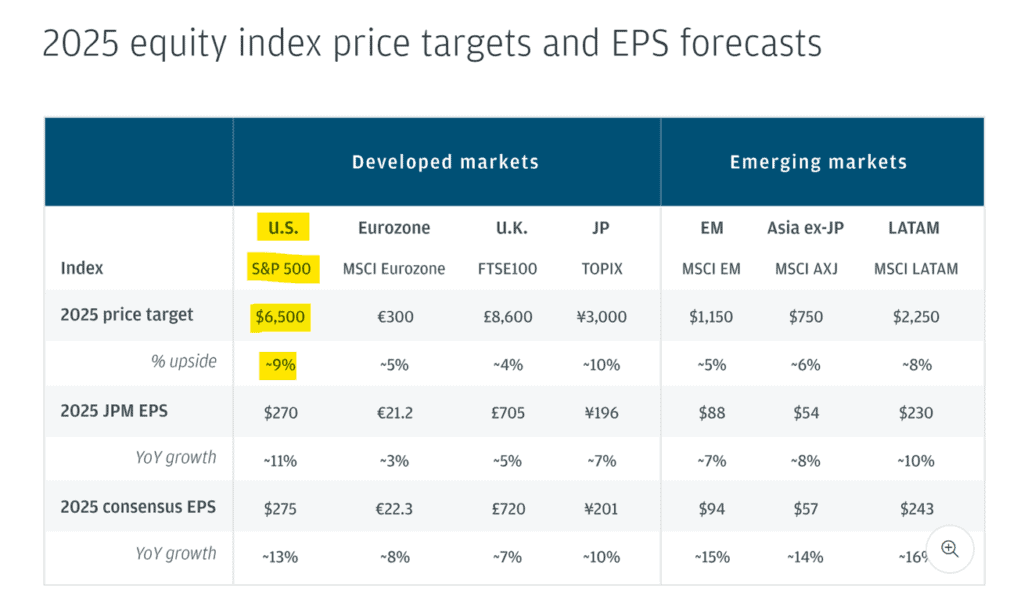

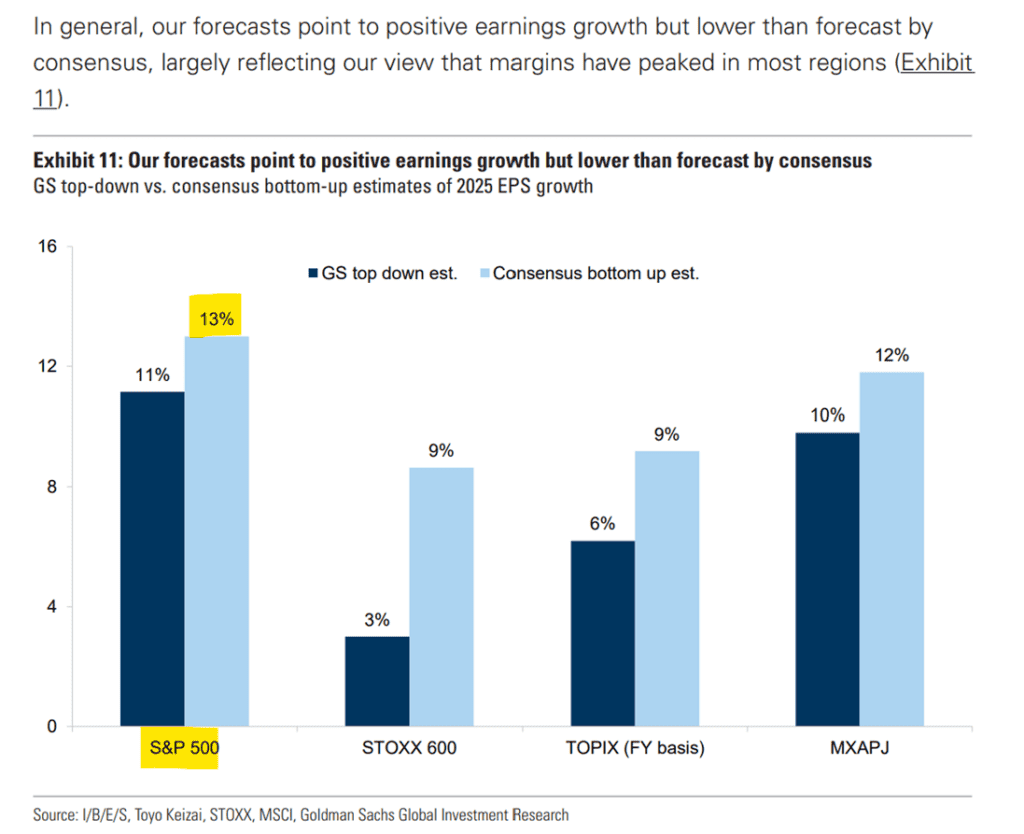

Stock market analysts are optimistic, predicting the S&P 500 to reach 6,500 points in 2025, with potential returns ranging from 9% to 13%.

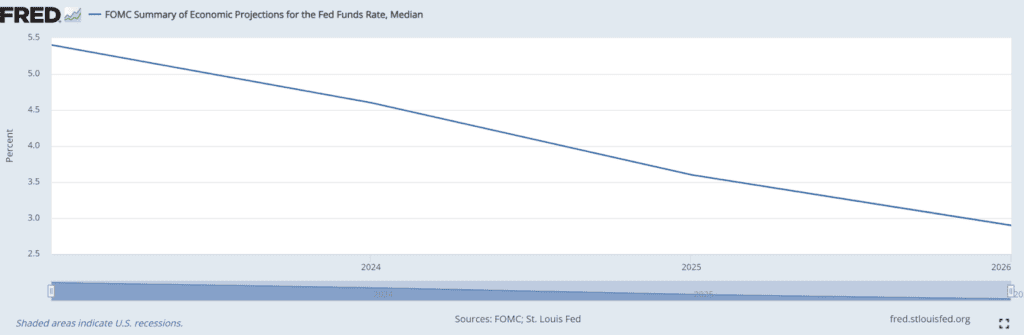

With declining interest rates, the low-rate era is over, and we’re entering a mid-range rate environment, likely stabilizing between 3% and 3.5%.

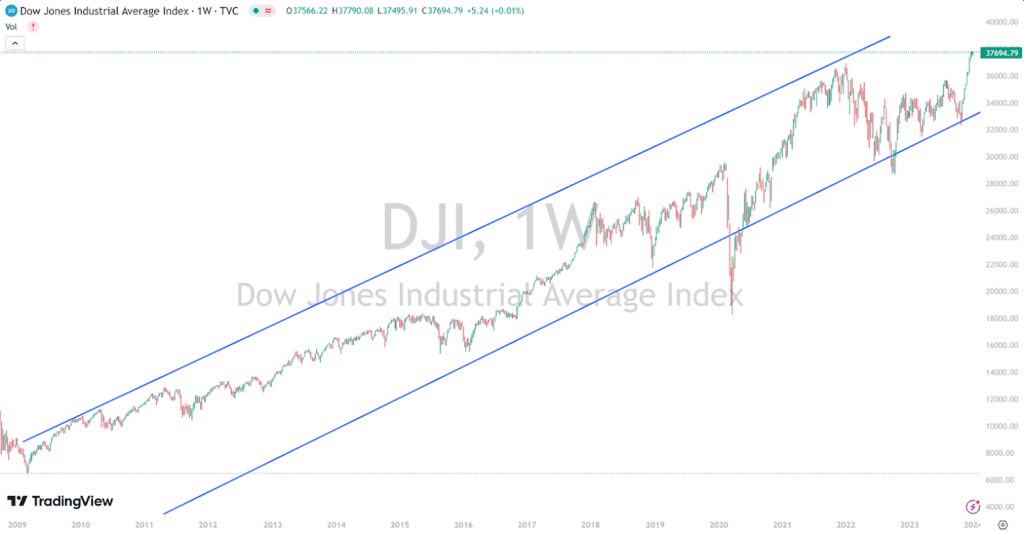

Reflecting on the past 15 years, the market has seen a clear upward trend, despite occasional fluctuations like the 2020 pandemic crash and the 2022 correction.

The inertia of this trend indicates continued growth. With these trends in mind, 2025 is poised to be an exceptional year for investors.

You want to make money, but you must never let your desire for wealth lead you into being scammed, resulting in all your accumulated wealth being wiped out.

Scams these days are almost impossible to guard against, so everyone must be cautious. We keep reminding everyone to prevent scams. While making money is important, you must also be vigilant.

When it comes to investing, leave professional matters to professionals. If you’re not a professional, don’t try to do it yourself. However, finding a truly professional advisor is also a test of your own wisdom and ability. This is crucial because if you choose the wrong one, you could end up losing your lifetime savings to scammers. Once that happens, it will be nearly impossible to recover in the future.

So, you must ensure you find the right professionals to assist you with your investments. At AIF, we rely on our years of experience, reputation, and our “locomotive theory.” Every year, we validate that we help our clients make money through investments. We know what to do and what not to do, and we follow strict discipline.

For example, AIF has a “Do-Not-Do List” of products we will not touch. This is very important because if you don’t know what to invest in and what to avoid, you’ll ultimately make the wrong choices. You’ll choose the wrong advisor and end up with investment losses. So, you must work with professionals.

AIF’s investment strategies for 2025

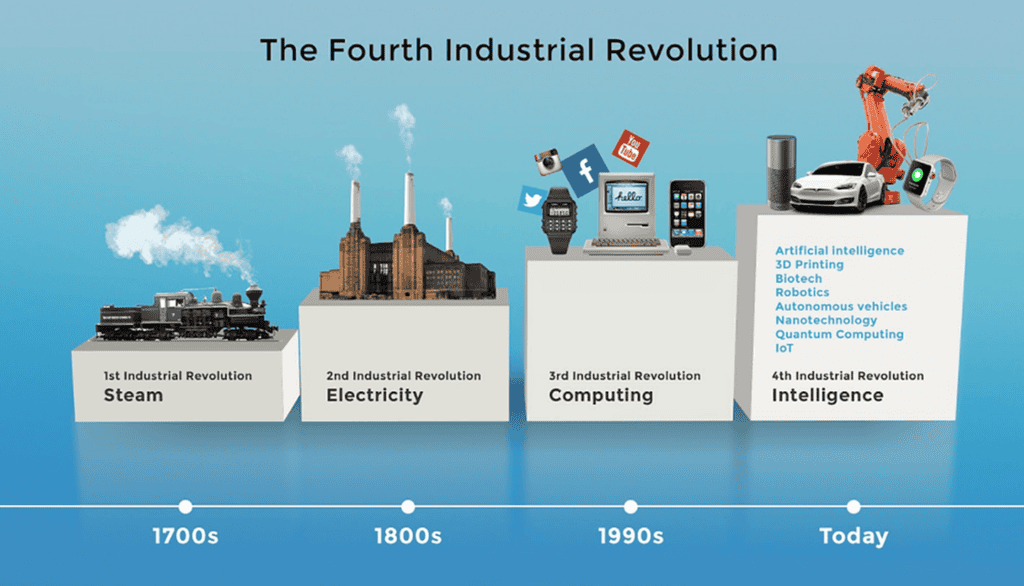

We’ve been saying this repeatedly: with the advent of artificial intelligence, the widespread use of big data, the Internet of Things, and cloud computing, the Fourth Industrial Revolution is upon us. Therefore, you should invest your money in the right sectors—those industries and fields related to the Fourth Industrial Revolution.

But do you know how to pick the right sectors? Even within artificial intelligence, there are many specific stocks to choose from. Have you made the right choices? If you choose incorrectly, you’ll still incur losses. You must invest in the Fourth Industrial Revolution and find professionals to help you make the right investments to profit.

If you buy stocks on your own, especially individual stocks, you’re essentially betting on probabilities. We’ve repeatedly told everyone that buying individual stocks is about gambling on probabilities, not investing. Speculation might yield gains, but it can also result in total losses. You must invest, not speculate. If you don’t want to speculate, don’t bet on probabilities.

Avoiding probabilities means you shouldn’t buy individual stocks. Then what should you buy? The correct approach is to invest in public capital-preservation funds. That’s the way to go because these funds invest in a basket of stocks. If one stock doesn’t perform well, another stock in the portfolio will, ensuring overall growth and profits.

By investing in capital-preservation funds, you both diversify your risk and ensure you capture profits. That’s why we keep emphasizing that buying public capital-preservation funds is the best approach. Don’t trade individual stocks thinking you’re smart enough to beat the market. And don’t invest in indices, index funds, or ETFs.

Our earlier data from Google and Goldman Sachs shows that during the past few years, when the market performed well, index funds and ETFs also gained. However, their growth rate and magnitude were lower compared to the capital-preservation funds we invested in. The facts speak for themselves.

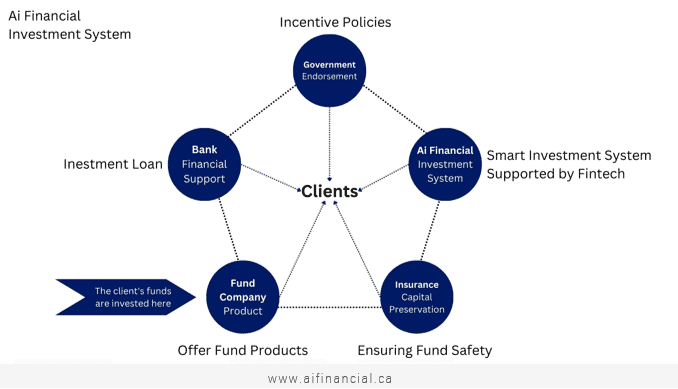

Work with professionals to invest in public capital-preservation funds. Especially with our capital-preservation funds, you can even borrow money to invest. This allows you to “borrow chickens to lay eggs.” Banks can’t offer this feature. If you go to a bank, you won’t be able to get an investment loan to buy capital-preservation funds.

If you want to borrow money to invest—using an investment loan—you’ll need to work with licensed and certified professionals like us at AIF. Only we can help you borrow money for investment purposes; banks cannot. Don’t believe us? Feel free to ask any bank if they can provide an investment loan for buying capital-preservation funds.

Only we can do it. So, it’s critical that you understand this and find professionals to help you invest. This approach will truly save you effort while maximizing your profits.

The Best Time to Start Is Now

Recent Posts

You may also interested in

Nightmare in Vaughan: Pre-con Buyer Loses Life Savings | AIF Insight on Real Estate | AiF News Bites

A Vaughan man lost his deposit and faces legal action...

Read MoreExperts Warn: Canada’s Economic Growth Slows as Recession Risks Rise | AiF News Bites

Economists and rating agencies warn of structural slowing in Canada's...

Read MoreGold and Silver Market Crash: Historical Precious Metals Price Volatility Amid Shifting US Dollar Strength Expectations | AiF News Bites

Analyze the epic gold and silver market crash triggered by...

Read More