In-depth analysis of five decades of Dow Jones Industrial Average...

Read MoreA 60s Physiotherapist Earns Nearly CAD 100,000 in Just Over a Year: The Power of Smart Choices

Effortless Gains of Nearly CAD 100,000 in a Year

For W, a physiotherapist born in the 1960s, the post-pandemic era brought concerns about rising costs and high inflation, particularly its impact on her retirement plans. With retirement on the horizon, she wanted to ensure her financial security. In 2023, W attended AiF’s in-person investment seminar in Vancouver and had a one-on-one session with a financial advisor to develop a tailored plan.

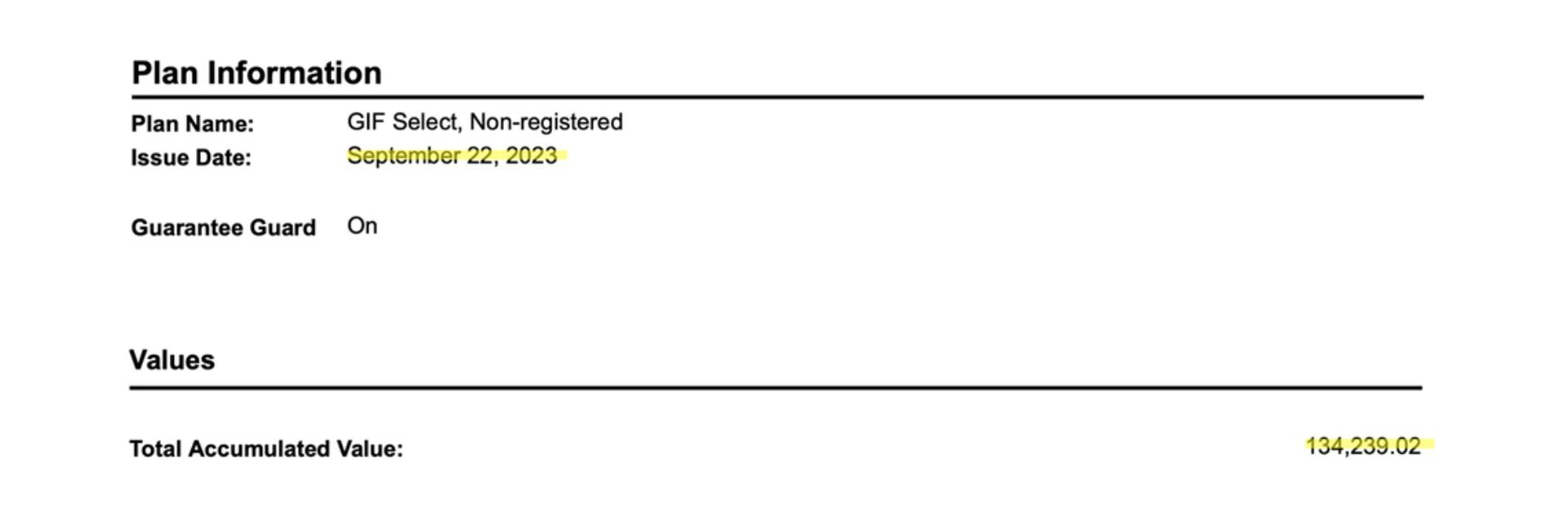

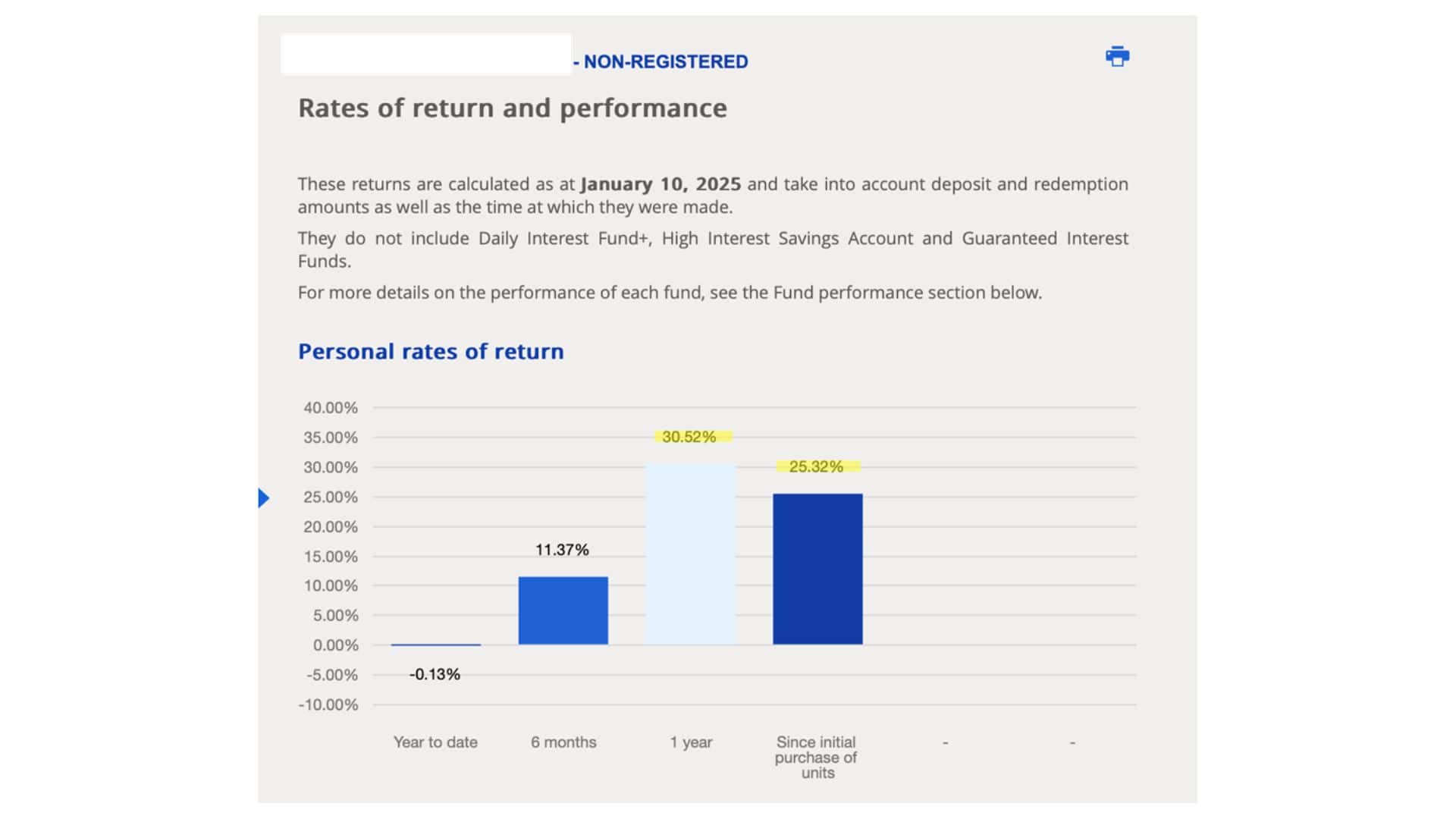

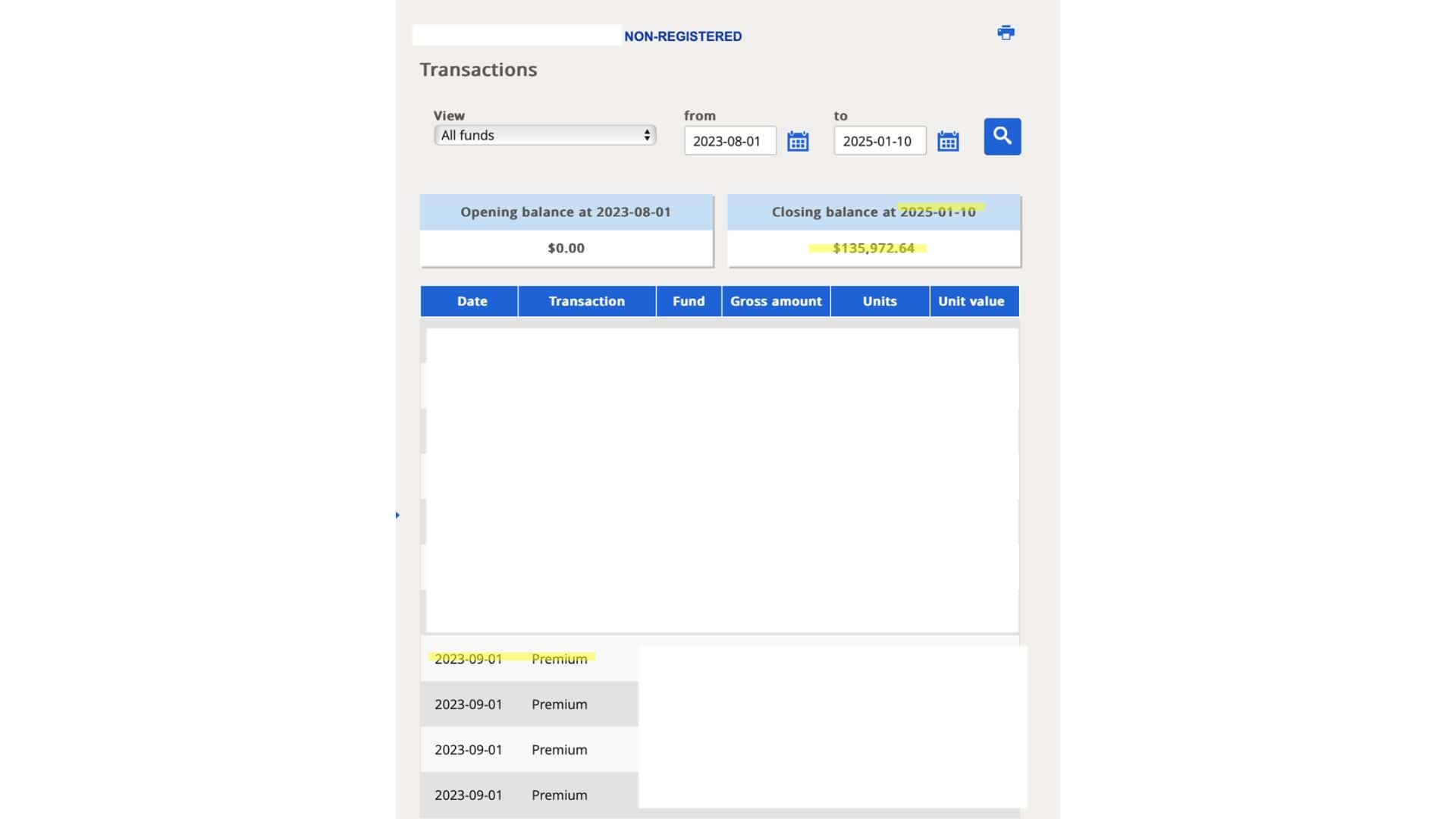

In September 2023, she placed her trust in AiF. With AiF’s guidance, she secured a CAD 200,000 investment loan through B2B Bank and Manulife Bank, channeling the funds into Canada’s Segregated Fund (capital-protected public fund). This investment was strategically dedicated to securing her retirement.

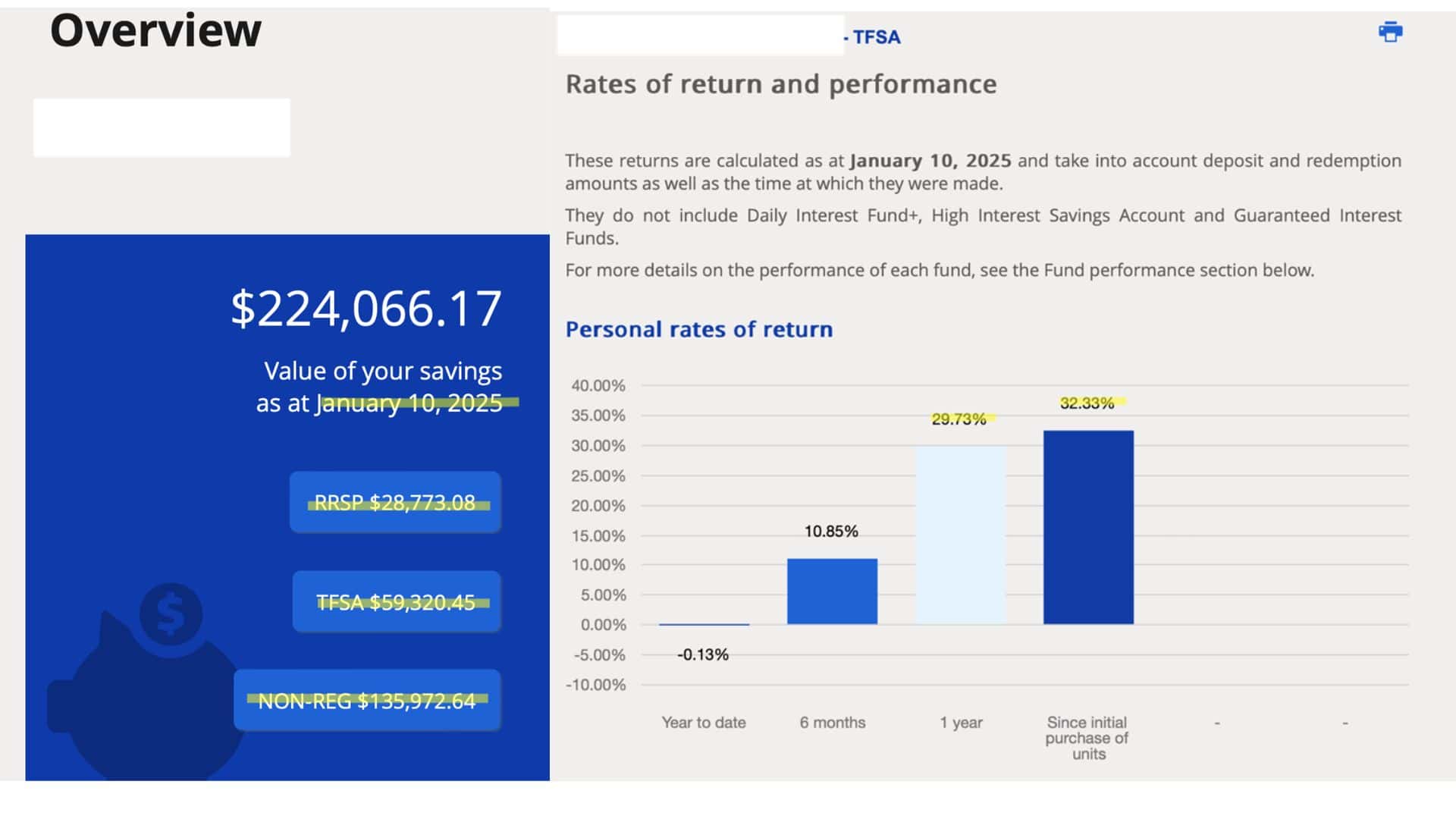

W further diversified her portfolio by opening RRSP and TFSA accounts with AiF, investing an additional CAD 88,000. In July 2024, she extended the same opportunity to her daughter, helping her secure a CAD 100,000 investment loan. As of now, her daughter has already earned CAD 13,000 in investment gains.

Investment Performance Summary

- Loan Investment Gains: From September 2023 to December 2024 (15 months), W earned CAD 70,000 on her CAD 200,000 loan investment, achieving a 35% return. After deducting CAD 19,400 in loan interest, her net return reached an impressive 36.3%.

- Registered Account Gains: During the same period, her RRSP and TFSA investments of CAD 88,000 yielded CAD 26,400 in profits, reflecting a 30% return.

By the end of 2024, W’s total investment portfolio reached CAD 358,000. Combined, her investments have generated nearly CAD 100,000 in profits, significantly boosting her financial security and ensuring a more comfortable retirement.

The Power of Smart Choices

W and her daughter’s story highlights a vital truth: making the right choices is more important than mere effort. Opting to invest retirement savings in financial markets instead of real estate marked a strategic pivot. Backed by 25 years of North American financial expertise, AiF specializes in long-term investment strategies, turning wealth generation into a consistent and reliable process rather than a gamble.

What Makes AiF Different?

Effortless Loan Approval

AiF partners with leading institutions like B2B Bank, Manulife Bank, and iA Trust to provide fast-tracked investment loans. With programs like Quick Loan, clients can secure loans without income or asset proof, empowering those with limited capital to start their wealth-building journey.

Professional Investment Management

Collaborating with Canada Life, iA, and Manulife, AiF focuses on Segregated Fund investments. By leveraging compound interest and financial leverage, AiF helps clients achieve consistent and sustainable returns.

Strategic and Stable Growth

AiF emphasizes long-term investing, capitalizing on the power of compounding over time to grow wealth. This approach avoids the uncertainties of short-term speculation and ensures steady progress toward financial goals.

Choose AiF for Smarter Investments

Leveraging loans for investment requires expertise. With decades of experience, AiF has successfully helped clients grow their wealth. The wrong direction can render even the greatest efforts fruitless, but with AiF, you gain a trusted partner to build a secure and prosperous future.

Let AiF brighten your retirement journey!

You may also interested in

How to Make $100 Billion in a Day: What We Can Learn from Oracle’s Larry Ellison | AiF insight

New PWL Capital data shows renters in most Canadian cities...

Read MoreRenters Now Beating Homeowners in Canada: How Investing Outpaces Property Ownership | AiF insight

New PWL Capital data shows renters in most Canadian cities...

Read MoreWhy the Rich Focus and the Poor Get Distracted: The Hidden Law of Wealth | AiF insight

Wealth doesn’t come from chasing every trend. Ai Financial explains...

Read More2025 Canada National Risk Assessment on Money Laundering and Terrorist Financing| AiF Insights

The Government of Canada recently released the 2025 National Risk...

Read More