Discover how a Canadian family achieved 239% returns using strategic...

Read MoreTurning the Tide: How a 60s Couple Recovered from Real Estate Losses and Made $148K in 16 Months with Investment Loans

In 2019, Jack and Linda moved to Canada, settling in Vancouver with hopes of continuing their entrepreneurial success from experience. Even in their 60s, they were eager to build something new. But just as they were making plans, the COVID-19 pandemic threw everything off course.

After exploring different opportunities, they decided to invest in Vancouver real estate, putting their life savings into the market. In 2021, they purchased two properties worth $2 million, expecting steady rental income and long-term appreciation to secure their retirement.

However, things didn’t go as planned. As the Bank of Canada hiked interest rates, their rental income was no longer enough to cover skyrocketing mortgage payments. Every year, they had to shell out an extra $30,000 just to keep up with the loans. Over three years, they racked up $120,000 in losses.

What they thought was a safe investment quickly became a financial drain. Just when Jack was feeling stuck, an unexpected solution came his way. In the summer of 2023, a relative introduced him to Ai Financial’s investment loan program. After learning more, the couple decided to take action, securing a $400,000 investment loan through B2B Bank and Manulife Bank.

They put the funds into Canadian segregated funds, spreading their investments across Canada Life, Manulife, and iA to build a more secure future.

Fast forward to January 31, 2025—just 16 months later—their investment account has grown by $148,000 in net profit, delivering an impressive 390% return.

From struggling with real estate losses to thriving in financial investments, Jack didn’t dwell on setbacks. Instead, he pivoted, made a bold move, and turned things around. His story is proof that with the right strategy, it’s never too late to rebuild and grow wealth.

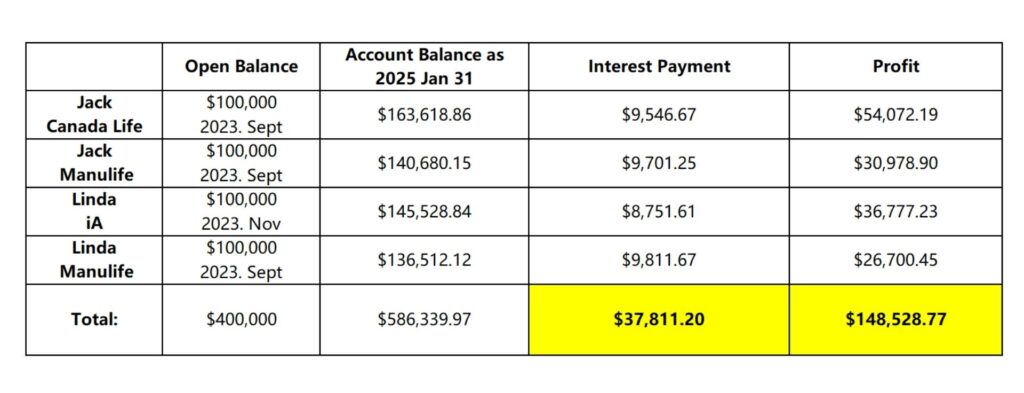

Investment summary:

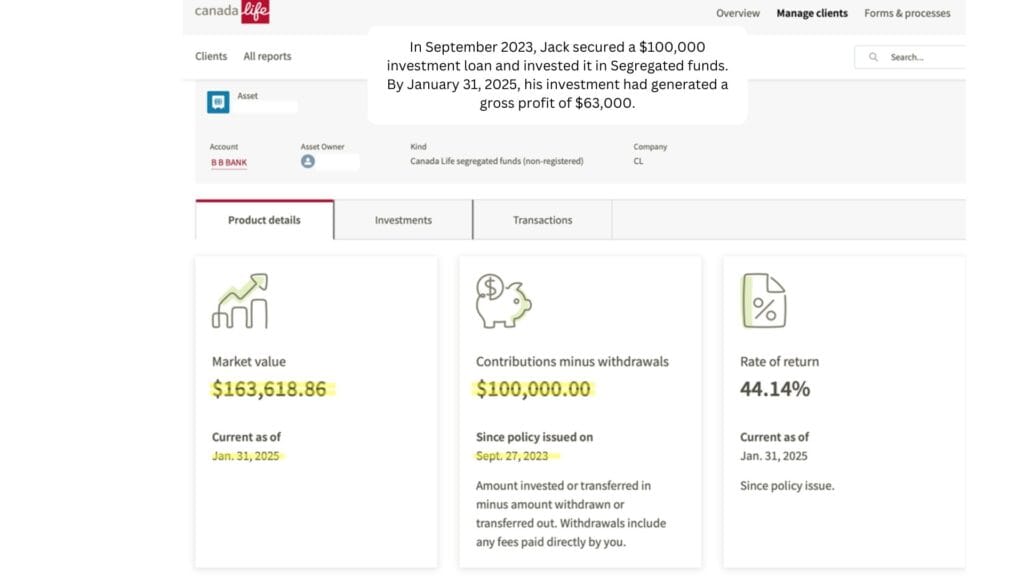

Jack’s Canada Life Investment Returns:

In September 2023, Jack secured a $100,000 investment loan and invested it in a principal-protected fund. By January 31, 2025, his investment had generated a gross profit of $63,000.

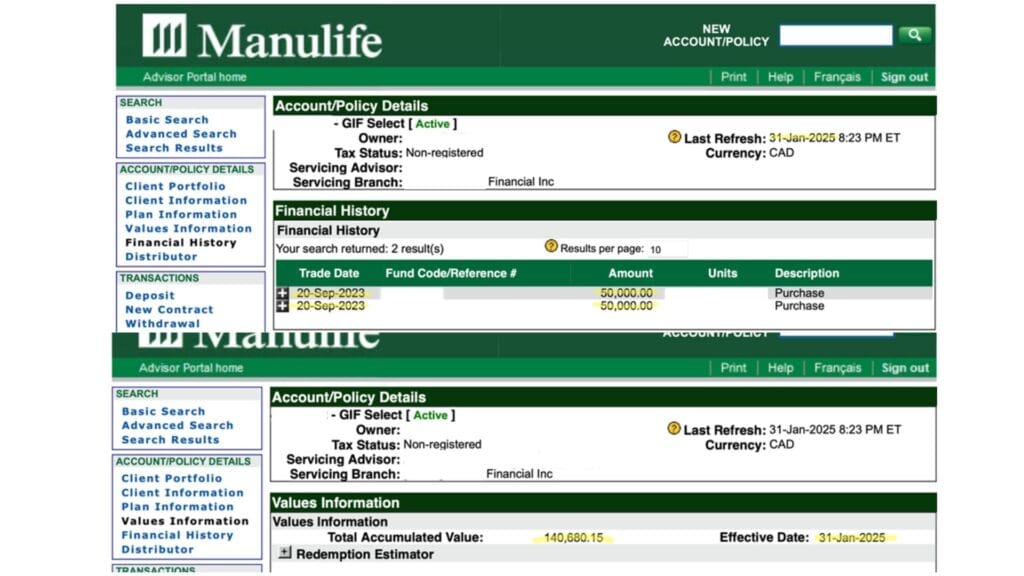

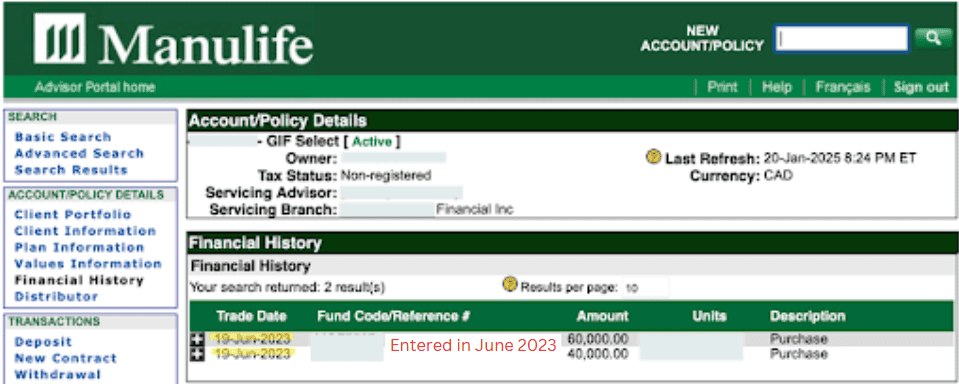

Jack’s Manulife Investment Returns:

In September 2023, Jack secured a $100,000 loan from Manulife. By January 31, 2025, his investment had generated a gross profit of $40,000.

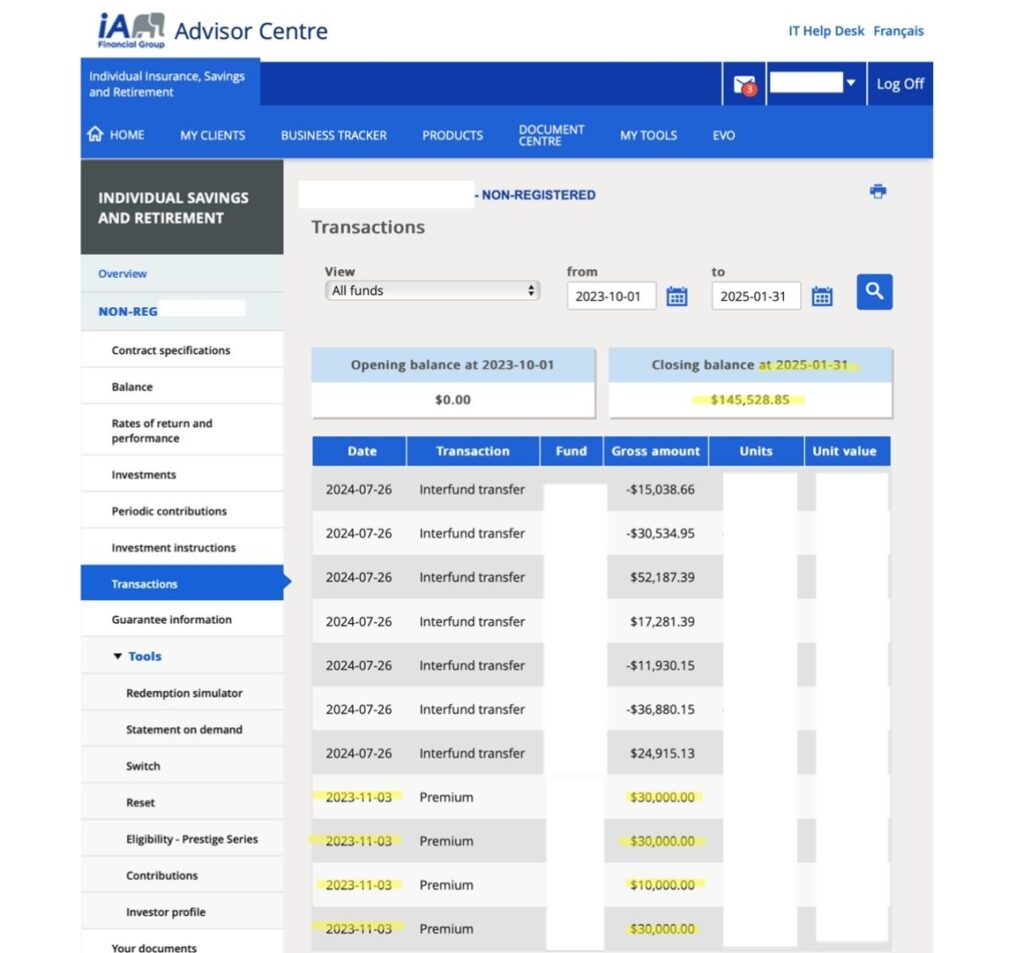

Linda’s iA Investment Returns:

In November 2023, Linda secured a $100,000 loan. By January 31, 2025, her investment had generated a gross profit of $45,000.

Linda’s Manulife Investment Returns:

In September 2023, Linda secured a $100,000 loan. By January 31, 2025, her investment had generated a gross profit of $36,000.

We believe that every family or individual, whether relying on personal funds or investment loans, can gradually build wealth and secure their retirement through smart, strategic investing. In this increasingly challenging era, especially amidst global transformations, the choices you make today will determine the quality of your life in the future.

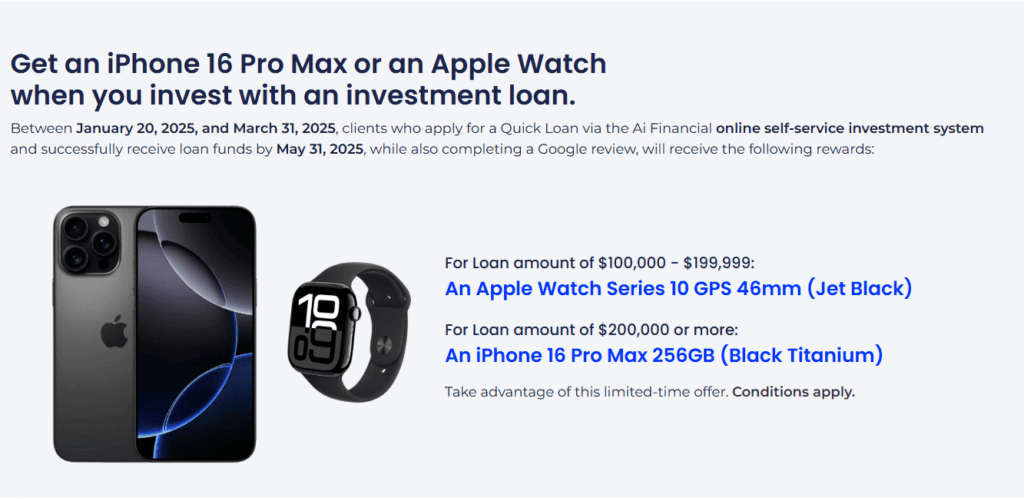

The 2025 Winter Promotion is in full swing! Successfully apply to get approved for a $200,000 investment loan to receive an IPhone 16 Pro Max! More offers are available for a limited time—learn more now!

Exclusive Advantages of Ai Financial

- Convenient Loan Application

- Ai Financial collaborates with multiple financial institutions such as B2B Bank, Manulife Bank, and iA Trust to provide clients with fast loan approval services. Especially with Quick Loan, there is no need for income or asset proof, offering rapid approval and valuable support for investors lacking principal.

- Professional Investment Management

- Partnering with insurance companies like Canada Life, iA, and Manulife, Ai Financial specializes in Segregated Fund investments. By leveraging the power of compounding with leverage, Ai Financial helps clients achieve consistent and stable returns.

- Stable Investment Strategy

- Ai Financial sees through market fundamentals and advocates for long-term investment. Through compounding and time, Ai Financial helps accumulate wealth while avoiding risks associated with speculation.

Choose Ai Financial, Make Investing Easier

Leverage-based investments require professional expertise, and with Ai Financials’ extensive experience and industry resources, countless clients have achieved significant wealth growth. Without the right direction, efforts can be futile. By choosing Ai Financial, you’re building your future on a foundation of professionalism and trust, ensuring a solid base for long-term financial success.”

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More