Discover how a Canadian family achieved 239% returns using strategic...

Read MoreJuggling Three Jobs? Break the Cycle with Smart Investing!

Jenny, a post-60s immigrant to Canada for over 27 years, is a mother of three children. Facing high living costs, she has had to juggle three jobs, just to provide a better life for her family. However, the high inflation after the pandemic has made her feel immense pressure. As she gets older, she increasingly desires to find an investment method that is both stable and can accelerate wealth growth.

The Turning Point

A turning point appeared at an offline Ai Financial investment seminar in February 2024. Jenny learned about an exciting opportunity: eligible applicants could obtain a government-approved “investment loan” in Canada, requiring no collateral, no down payment, only interest payments, and no need to repay the principal. The minimum loan amount is $200,000 CAD, and what excites her even more is that the principal-protected fund managed by AI Financial has achieved an average annual return of 21.6% over the past decade. Moreover, many investors have already gained considerable returns through this strategy.

Jenny realized that this might be the opportunity she had been looking for—leveraging a government-backed credit loan to amplify investment capital, then using AI Financials’ professional management, compounding interest, and time to achieve wealth growth!

This fund is used to invest in Canada’s public segregated funds (principal-protected/segregated funds). Ai Financial allocates the $100,000 investment loan to a Canada Life principal-protected fund, ensuring that the funds are dedicated solely to securing her future retirement life.

After thorough research, she discovered that by using a government credit loan to increase investment capital and leveraging AI Financials’ artificial intelligence and big data for asset investment management, she could achieve an investment model of “using borrowed money to generate returns and leveraging time compounding.” However, at the time, the loan interest rate was relatively high, which made her hesitate. But under the guidance of AI Financials’ professional team, she decided to first apply for a $100,000 investment loan. To her surprise, the loan was successfully approved within just a few days.

A Journey to Passive Investing

Jenny officially embarked on her passive investment journey!

How were Jenny’s investment results after one year?

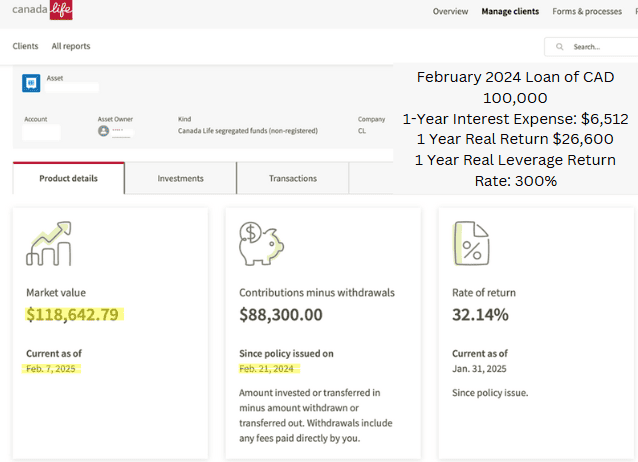

✅ February 2024: Jenny used an investment loan and borrowed $100,000 CAD from B2B Bank to start investing in a principal-protected fund.

✅ By the end of 2024: She had paid a total of $6,512 in loan interest, but her investment returns reached $26,600, achieving a real return of 300%.

✅ January 2025: She withdrew $11,700 to supplement her household expenses, enjoying investment returns while allowing her principal to continue compounding and growing.

The Fruits of Labor (Without the Labor)

In just one year, Jenny successfully completed the full process of borrowing money → investing → earning money → withdrawing money, personally verifying the feasibility and efficiency of this investment strategy.

Now, Jenny has gained immense confidence and has made an even bolder and forward-thinking decision—she plans to sell her house early this year and fully invest in principal-protected funds, ensuring that her capital operates efficiently and achieves a truly “passive income lifestyle.”

In the past, she relied on three jobs to barely make ends meet. Now, through a stable investment strategy, she has not only achieved considerable returns but also accelerated her capital accumulation using leverage. Jenny’s success story has made her even more convinced:

“Choosing the right path is more important than working hard. Once you find the correct investment direction, wealth growth becomes inevitable.”

Is this Realistic? Can I also Achieve This?

All the above information comes from Jenny herself and is her real investment experience and success story. At Ai Financial, we hope that every family or individual, whether using their own funds or investment loans, can accumulate at least $1 million in starting wealth through investment. With the power of compounding, we can solve our future retirement and pension needs.

While Jenny’s success story is inspiring, it’s important to note that investment outcomes depend on market conditions, risk tolerance, and timing. Government-backed loans can provide accessible leverage, and AI-driven strategies may optimize returns, but they do not eliminate risk.

Key considerations:

Risk vs. Reward: Leverage amplifies gains and losses. A 32.14% return is strong but requires favorable market conditions.

Sustainability: Such high returns may not be repeatable long-term. Markets fluctuate, and past performance ≠ future results.

Due Diligence: Always verify claims, review fees, and consult a licensed financial advisor to align strategies with your goals.

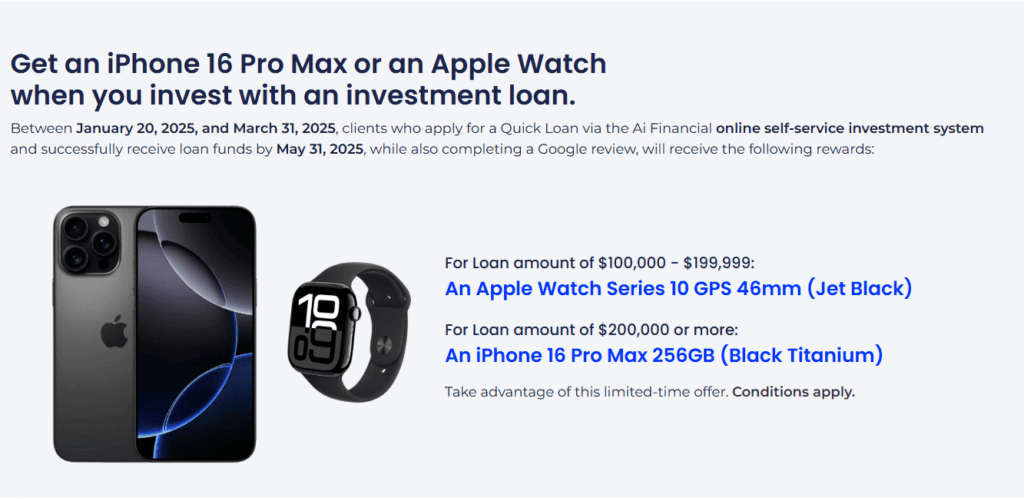

The 2025 Winter Promotion is in full swing! Successfully apply to get approved for a $200,000 investment loan to receive an IPhone 16 Pro Max! More offers are available for a limited time—learn more now!

Exclusive Advantages of Ai Financial

- Convenient Loan Application

- Ai Financial collaborates with multiple financial institutions such as B2B Bank, Manulife Bank, and iA Trust to provide clients with fast loan approval services. Especially with Quick Loan, there is no need for income or asset proof, offering rapid approval and valuable support for investors lacking principal.

- Professional Investment Management

- Partnering with insurance companies like Canada Life, iA, and Manulife, Ai Financial specializes in Segregated Fund investments. By leveraging the power of compounding with leverage, Ai Financial helps clients achieve consistent and stable returns.

- Stable Investment Strategy

- Ai Financial sees through market fundamentals and advocates for long-term investment. Through compounding and time, Ai Financial helps accumulate wealth while avoiding risks associated with speculation.

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More