Analysis of the Toronto Condo Market Crash. With the GTA...

Read MoreShould I buy Segregated Funds in My RRSP?

RRSP stands for Registered Retirement Savings Plan, a government-registered retirement savings program designed by the Canadian government. Introduced in 1957, this plan encourages Canadians to save during their working years to ensure they have sufficient income for a stable retirement.

This article covers:

- Individual RRSP

- Group RRSP

- Spousal RRSP

- RRSP tax refund calculation

- How to purchase RRSP with limited cash

- How RRSP can be used for investment

What is RRSP?

According to the official definition from the Canadian government:

- An RRSP requires an account to be opened.

- Contributions can be made by the individual, their spouse, or a common-law partner.

- Contributions to an RRSP reduce taxable income, lowering the tax bracket and providing tax deferral benefits.

- However, withdrawals from an RRSP may be subject to taxation.

The primary goals of purchasing an RRSP are both short-term and long-term. In the short term, contributing to an RRSP helps reduce taxable income, resulting in a tax refund that is deposited into the contributor’s bank account. In the long term, the RRSP serves as a tax-efficient investment tool, allowing earnings within the account to grow tax-free until withdrawal. Given Canada’s high-tax environment, RRSPs provide a valuable opportunity for tax planning and retirement savings.

There are three common types of RRSPs: Individual RRSP, Spousal RRSP, and Group RRSP. Their key features are as follows:

1. Individual RRSP

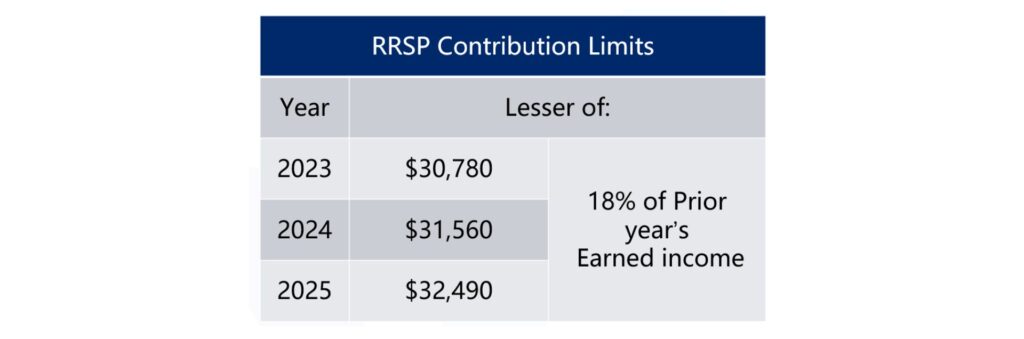

An Individual RRSP is opened in the contributor’s name and is the most common type. Since RRSPs are registered accounts with the Canada Revenue Agency (CRA), they have annual contribution limits. Exceeding these limits results in a 1% monthly penalty on the excess amount.

The RRSP contribution limit is calculated as follows:

Annual RRSP contribution room = Earned income from the previous year × 18%

For example:

If your earned income in 2022 was $100,000, then your RRSP contribution room for 2023 would be:

$100,000 × 18% = $18,000

However, there is also an annual maximum contribution limit set by the government. For 2025, this limit is $32,490. Even if your income allows for a higher contribution based on the 18% formula, you cannot contribute more than this cap.

RRSP contribution room can be carried forward if unused in previous years. Contributions can be made monthly, annually, or at any time, as long as there is available room.

To check your RRSP contribution limit, you can:

- Log into your CRA My Account online.

- Review your Notice of Assessment (NOA), which details your RRSP contribution room.

- Call the CRA at 1-800-959-8281 (have your previous tax return details ready).

- Consult your accountant if you use one for tax filing.

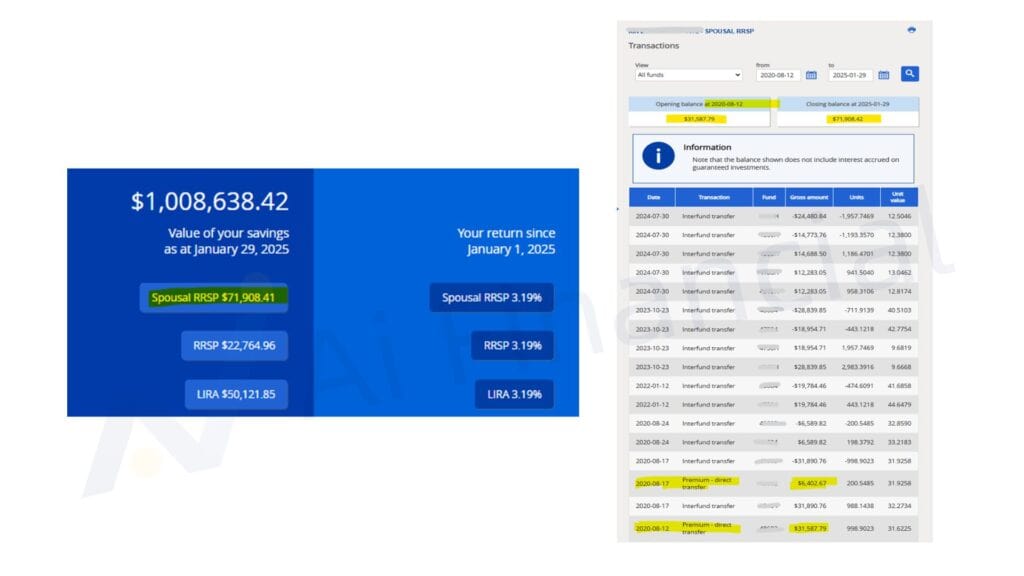

2. Spousal RRSP

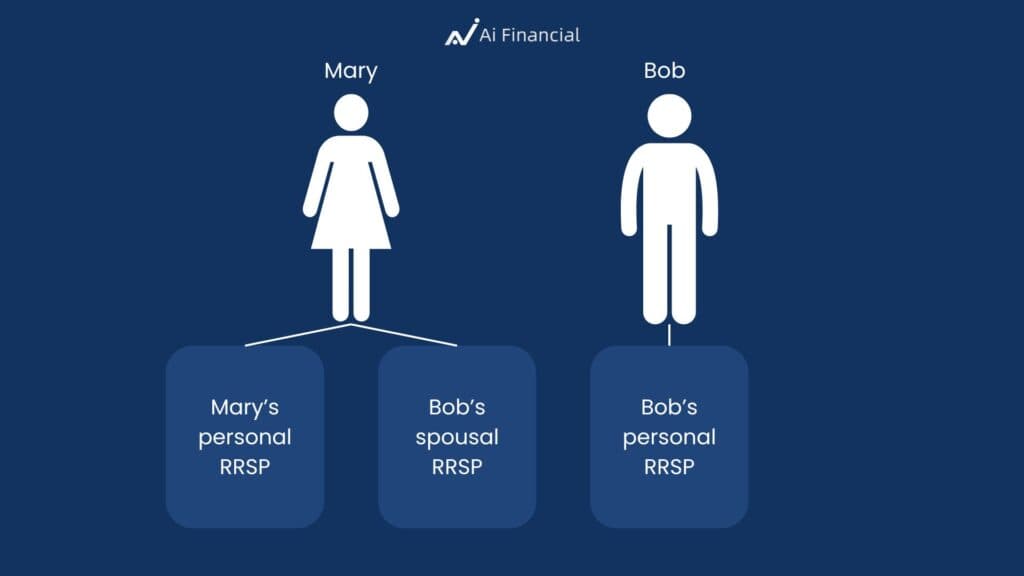

A Spousal RRSP is ideal for couples with significant income differences, as it helps reduce the overall tax burden for the household.

For example, if the husband earns $150,000 while the wife earns $40,000, the husband can use his RRSP contribution room to purchase an RRSP for his spouse. This account is called a Spousal RRSP.

There is a restriction on Spousal RRSPs: withdrawals cannot be made within three years. If funds are withdrawn within this period, the amount will be taxed as the contributor’s (husband’s) income. After three years, withdrawals will be taxed as the recipient’s (wife’s) income.

Many people get confused about the roles in a Spousal RRSP. Here’s a breakdown:

Contributor: The person providing the RRSP contribution room (e.g., Bob, the higher-earning husband).

Owner: The account holder (e.g., Mary, the wife).

Since the Spousal RRSP is under the wife’s name, the husband has no control over the account and cannot manage its investments.

3. Group RRSP

A Group RRSP is an employer-sponsored retirement savings plan. In Canada, many large organizations, such as government agencies, healthcare institutions, teachers’ unions, and some major banks, offer this benefit to employees.

Advantages:

Employer Matching: If you contribute to a Group RRSP, your employer may match a portion of your contribution. However, this still counts toward your personal RRSP contribution limit.

Contribution Matching Ratios: Employers set a matching limit. Some offer a 1:1 ratio, meaning if you contribute 4%, the company contributes 4%. Others may offer a 1:0.5 ratio, where a 4% employee contribution results in a 2% employer match. The exact amount depends on company policy. Regardless of the ratio, this is a valuable employee benefit.

Disadvantages:

Limited Investment Options: Employees typically have little control over their investments. They complete a risk tolerance questionnaire (e.g., conservative or aggressive investor), and the plan administrator selects the investments based on the responses.

Locked-in Feature: While employed, you cannot transfer funds out of a Group RRSP. This is known as a Locked-in RRSP (LIRA). If you leave the company, the Group RRSP can be transferred, but only to a Locked-in RRSP account—not a regular RRSP.

Contribution Limits:

Regardless of whether you contribute to an Individual RRSP, Spousal RRSP, or Group RRSP, all contributions count toward your personal RRSP limit. If you exceed your annual limit, you will incur a 1% penalty per month on the excess amount.

How to Calculate RRSP Tax Refunds

During tax season, many people wonder how much RRSP they should contribute to reduce their tax burden and how much they can get back in refunds. Here’s a simple method to estimate whether contributing to an RRSP is worthwhile.

Suppose it’s 2025, and you plan to contribute $18,000 to your RRSP. You first need to check your Marginal Tax Rate (MTR), which determines the tax bracket your income falls into. Federal and provincial tax rates in Canada vary, so refer to the latest tax rate table. For example, if your marginal tax rate is 38%, your estimated tax refund from an $18,000 RRSP contribution would be around $6,800.

The formula is:

RRSP Contribution × Marginal Tax Rate = Estimated Tax Refund

However, actual tax savings may vary based on your income structure. For precise tax planning, consult a professional accountant or tax advisor.

How to Buy RRSP Without Sufficient Cash

If you don’t have enough cash on hand but still want to reduce your tax burden through RRSP contributions, you can consider an RRSP loan. Several Canadian banks and insurance companies, such as Manulife Bank and B2B Bank, offer RRSP loans.

Manulife’s RRSP loan application is simple—no income proof or debt assessment is required, as long as you have a good credit score. If you’re interested in an RRSP loan, feel free to contact us for assistance. Additionally, the loan can be invested in Manulife’s segregated funds, ensuring secure capital growth.

How to Use RRSP for Investment

Aside from Canada’s Big Five banks (RBC, TD, BMO, CIBC, and Scotiabank), many other financial institutions—including insurance companies, mutual fund companies, and trust companies like Ai Financial—offer RRSP accounts. As long as your total contributions do not exceed the CRA’s annual limit, you can open an RRSP account with any of these providers.

Once you’ve set up your RRSP and made contributions, the more important question is how to manage it. Generally, there are three main approaches:

- Savings Accounts

Many people choose to keep their RRSP funds in savings accounts to earn some interest. A slightly better option is to invest in GICs (Guaranteed Investment Certificates) or HISA (High-Interest Savings Accounts) to ensure capital preservation.

However, while these options appear to generate interest, they are essentially “guaranteed losses” in real terms. The reason is that interest rates often fail to keep up with inflation. While the account balance may grow, the actual purchasing power of the funds decreases over time.

For example, suppose you deposit $100,000 in a savings account and withdraw it 10 or 20 years later upon retirement. Even with an interest rate of 2-3%, the growth would barely offset inflation, which has averaged 2.5% in Canada over the past decade. This means that in real terms, your savings do not increase in value and may even lose purchasing power. Over the long term, savings accounts cannot outpace inflation, making them an unsuitable choice for long-term retirement planning.

- Stock Market

If savings accounts aren’t ideal, where should RRSP funds be invested?

Many people turn to stocks. However, unless you are a professional investor, this approach carries significant risks. If you invest in a few individual stocks and they decline sharply, your entire RRSP portfolio could suffer severe losses.

Although buying and selling stocks within an RRSP account does not trigger immediate tax implications, concentrated investments increase the risk of losing retirement savings. A better approach is to diversify RRSP investments into funds or professionally managed investment products that balance risk and return.

- Funds

The most effective strategy is to invest RRSP funds in mutual funds through banks or segregated funds through insurance companies.

The reason is simple: long-term market trends favor disciplined investors.

Historical data shows that if someone invested $1,000 in the U.S. stock market in 1934, their investment would have grown to $14,861,397 by 2021—a 14,861x return. In the Canadian market, the same investment would have reached $3,162,135, or 3,162x.

Following this trend, if RRSP funds are invested properly and held long-term, the potential for substantial growth is clear. RRSP is specifically designed for retirement, meaning that those who invested their RRSP 20 years ago have already seen impressive returns today.

However, achieving this success requires discipline and professional management. Managing investments independently can be challenging, so the best approach is to follow key investment principles:

- Invest in funds rather than individual stocks.

- Commit to long-term investing.

- Choose protected, well-managed funds to ensure stability and growth.

By applying these principles, RRSP investments can grow steadily over time, ensuring financial security in retirement.

Introduction to Segregated Funds

When discussing investment options for RRSPs, Ai Financial primarily focuses on segregated funds. Issued by insurance companies, segregated funds are similar to mutual funds sold by banks but are classified as investment products rather than insurance. In recent years, companies like Canada Life and Manulife have actively promoted segregated funds, yet many investors remain unfamiliar with them. Given the growing number of inquiries about their functionality, we will provide a brief overview today.

Three Key Advantages of Segregated Funds

- Principal Protection

Segregated funds offer both maturity guarantees and death benefit guarantees. For example, if an investor passes away unexpectedly, the beneficiary will receive at least 75% or 100% of the invested principal, even in the event of a major market downturn. Similarly, upon maturity, investors can also benefit from this capital protection.

- Protection from Creditors

Funds held within a segregated fund are legally separate from personal or business liabilities. This means that even in cases of bankruptcy or debt claims, creditors cannot seize these assets. This feature makes segregated funds an excellent asset protection tool, especially for business owners and high-net-worth individuals.

- Beneficiary Designation & Probate Avoidance

Unlike other investment products, segregated funds allow investors to directly designate beneficiaries. Upon the investor’s passing, the funds are transferred directly to the named beneficiary, bypassing the lengthy probate process and avoiding additional legal fees.

In cases where estate disputes arise, probate can take months or even years. By using segregated funds, investors can ensure a smooth and timely transfer of wealth to their heirs, even without a will or additional insurance coverage.

Investment Benefits & Returns

At Ai Financial, we have been specializing in segregated fund investments not only because of their unique advantages but also due to their strong performance and safety. These funds are publicly regulated and can be combined with investment loans to enhance returns through leverage.

Our current investment strategy focuses on using Investment Loans to invest in segregated funds, allowing investors to maximize returns while managing risk.

Over the past 10 years (as of the end of 2023), our investment portfolio has achieved an average annual return of 21.6%. In 2024, returns have been even higher, ranging between 30% and 40%. For example, a Canada Life segregated fund achieved an impressive 40% return from January to December 2024.

Our investment portfolios have consistently outperformed Canada’s major stock indices, thanks to our strict fund selection criteria. Moving forward, we will remain committed to segregated fund investments and proven investment strategies to help our clients achieve stable and superior returns.

Steps to get Started

- Speak with an advisor who can help you navigate mutual funds and segregated funds.

- Look into how these funds can fit into your estate planning.

- Conduct your own research to understand which investment option is right for you.

- Contact us anytime! Visit Aifinancial.ca to learn more about our products and services.

The Best Time to Start Is Now

Recent Posts

You may also interested in

Nightmare in Vaughan: Pre-con Buyer Loses Life Savings | AIF Insight on Real Estate | AiF News Bites

A Vaughan man lost his deposit and faces legal action...

Read MoreExperts Warn: Canada’s Economic Growth Slows as Recession Risks Rise | AiF News Bites

Economists and rating agencies warn of structural slowing in Canada's...

Read MoreGold and Silver Market Crash: Historical Precious Metals Price Volatility Amid Shifting US Dollar Strength Expectations | AiF News Bites

Analyze the epic gold and silver market crash triggered by...

Read More