Analysis of the Toronto Condo Market Crash. With the GTA...

Read MoreAcquiring Statements or T Slips: Essential Tax Documents for Your Filing

2024 Tax documents

RRSP receipts from 2024 will be available in early February. RRSP receipts for contributions from Jan. 1, 2025 to Feb. 28, 2025 will be available in early April. Tax slips will be available mid-March.

For tax filing purposes, you may need to obtain your investment statements or T Slips, which include details of your investment income and transactions. Different financial institutions have different retrieval methods. Please follow the instructions below to access your documents:

Mailed Statements:

Some institutions will send the statements directly to you by mail.

- B2B Bank – Mailed directly to clients

- iA Trust Statement – Mailed directly to clients

- Manulife Bank – Mailed directly to clients

Request by Phone:

- National Bank – Clients must call the bank to request their statement.

https://www.nbc.ca/contact-us.html

Download Online:

For other institutions, please log in to their official websites to download the statements:

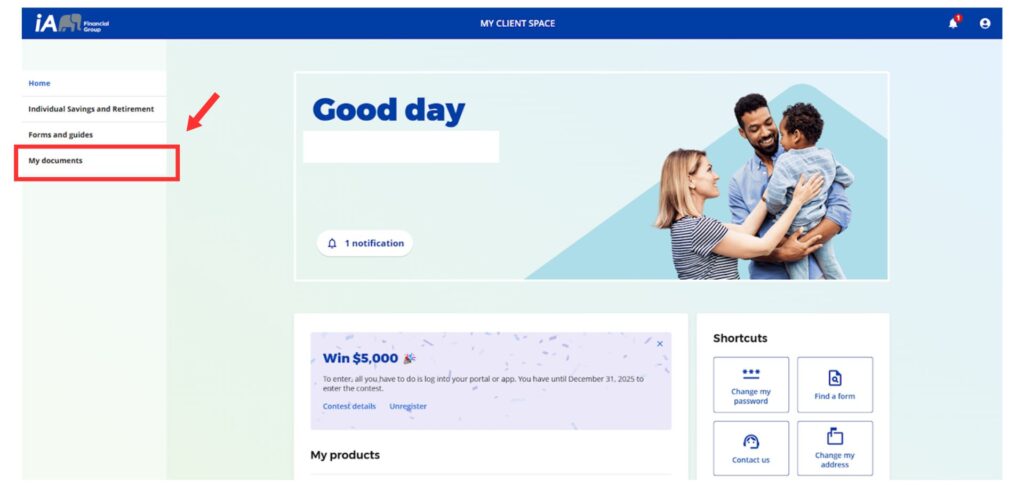

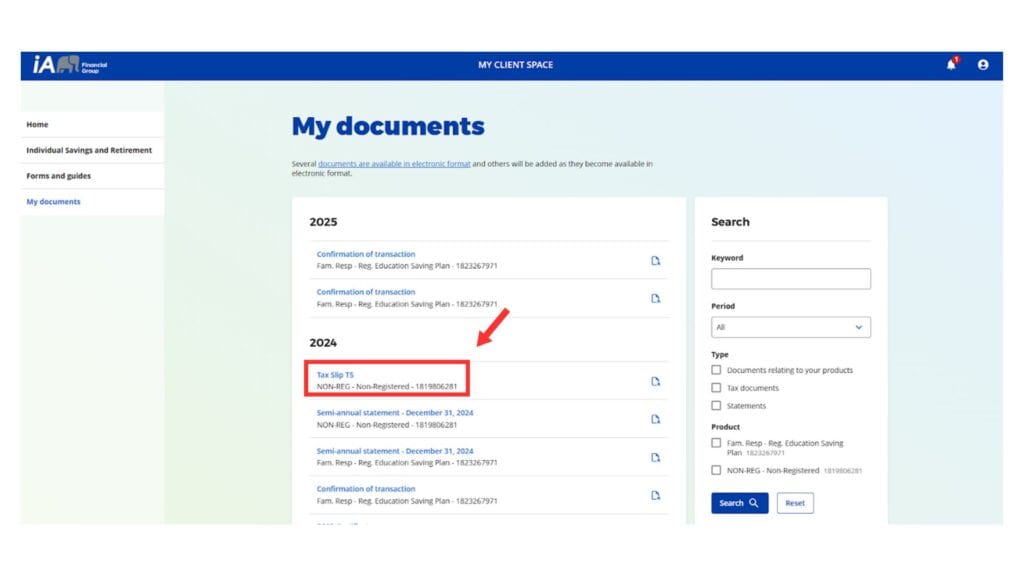

iA Investment Tax Slip

Mail or download it online by choice.

- Sign into ‘MY CLIENT SPACE’ https://iac.secureweb.inalco.com/

- Click the ‘My documents’ on the left.

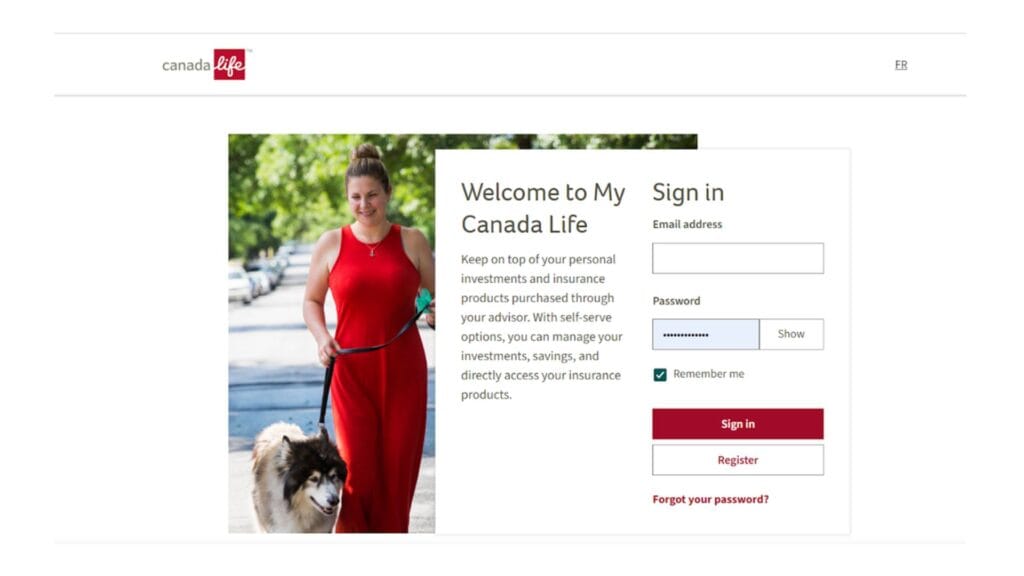

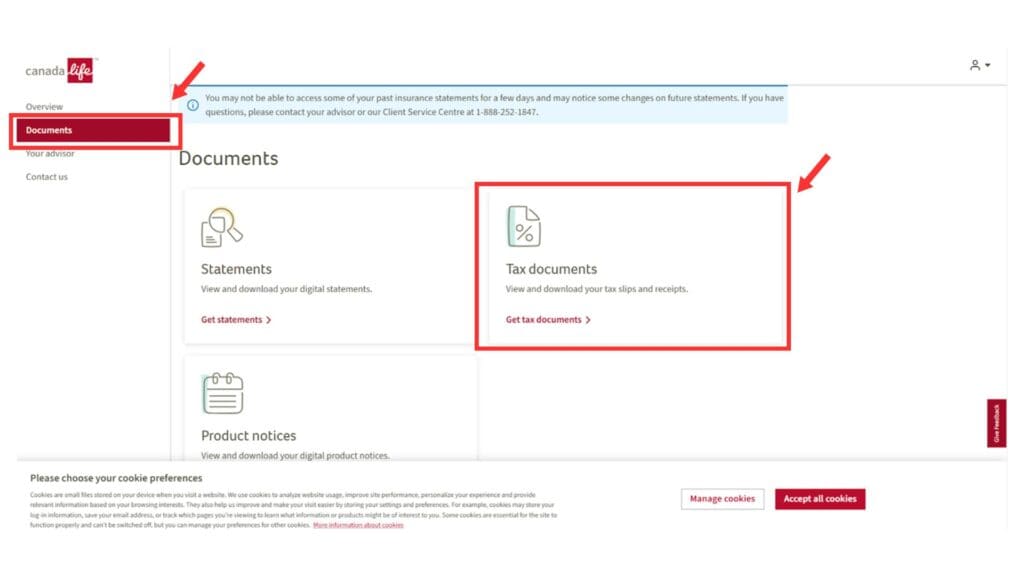

Canada Life Investment Tax Slip

- Sign in to the CANADA LIFE CLIENT https://my.canadalife.com/mcl/sign-in

2. Click on the ‘Documents’ on the left

3. Click on the tax documents

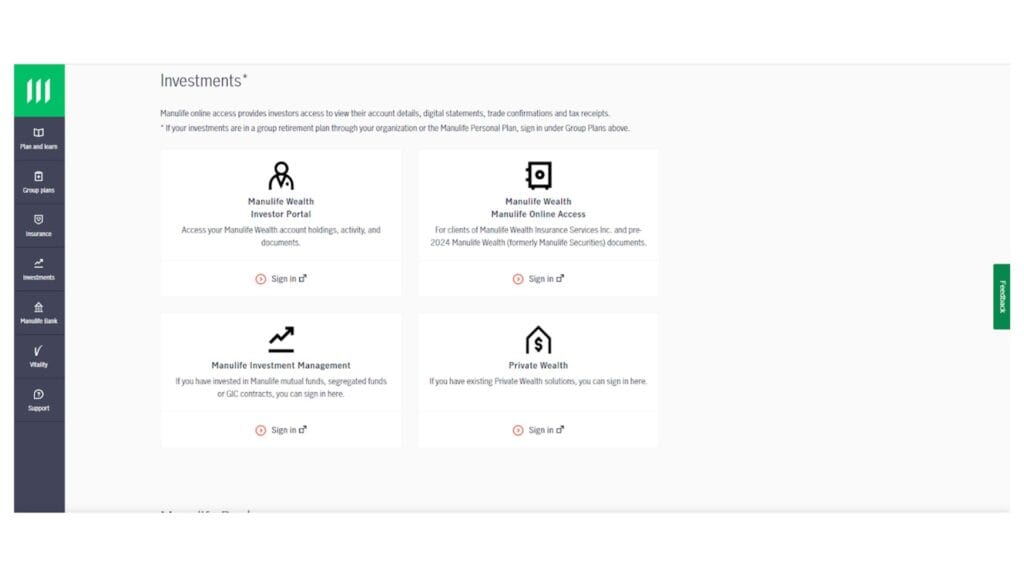

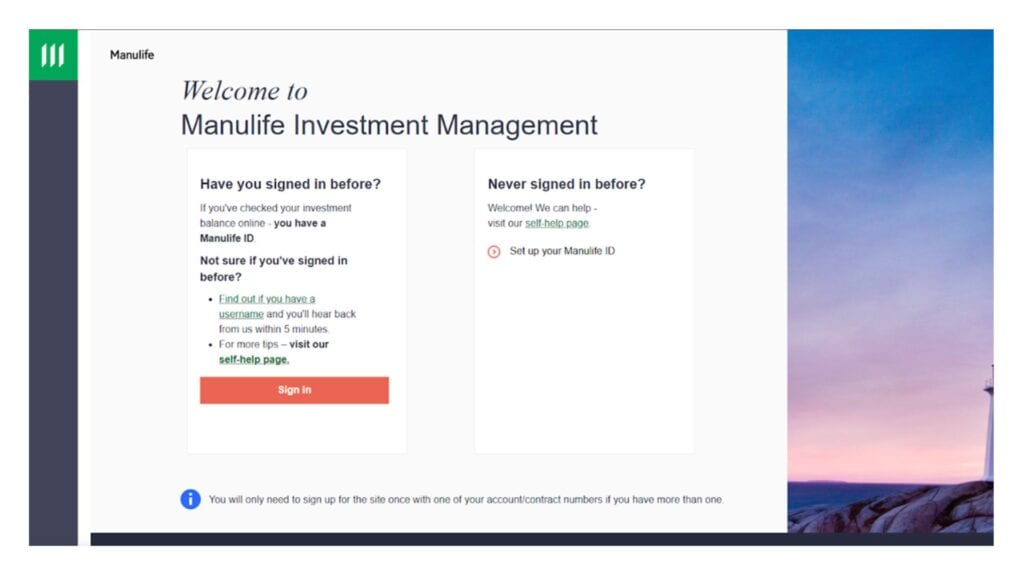

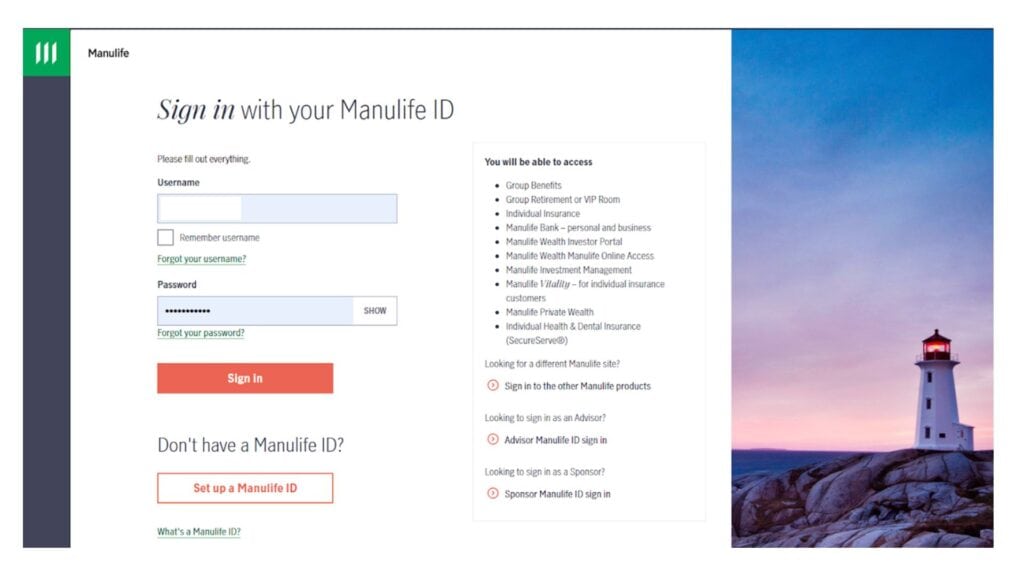

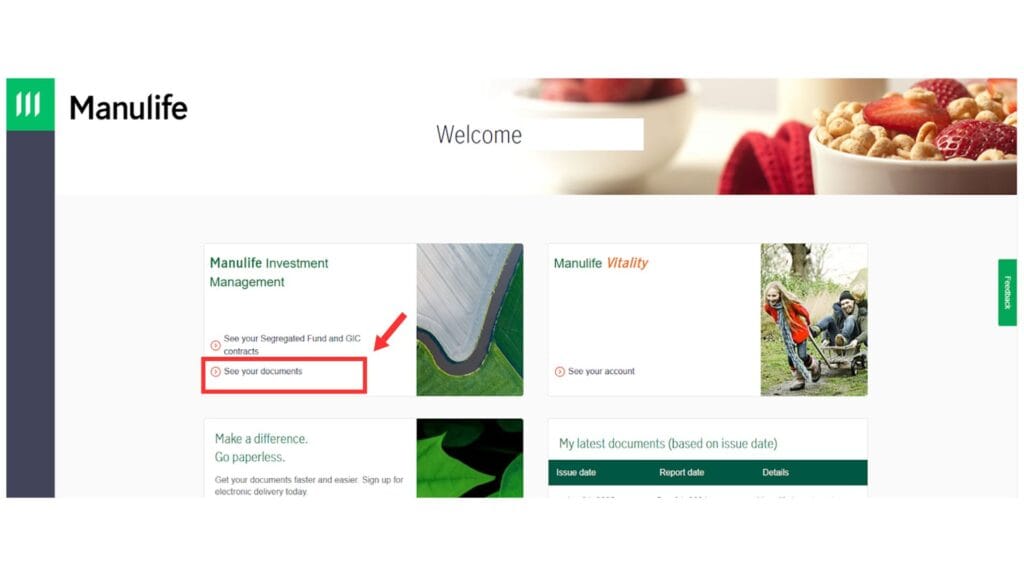

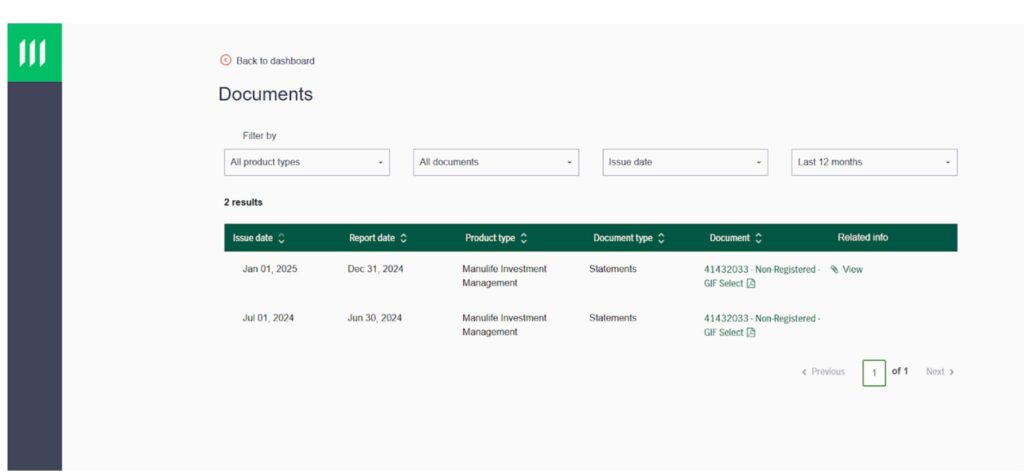

Manulife Investment Tax Slip

Mail or download it online by choice.

- sign in to Manulife https://www.manulife.ca/personal/sign-in.html

2. Click on ‘See your documents’

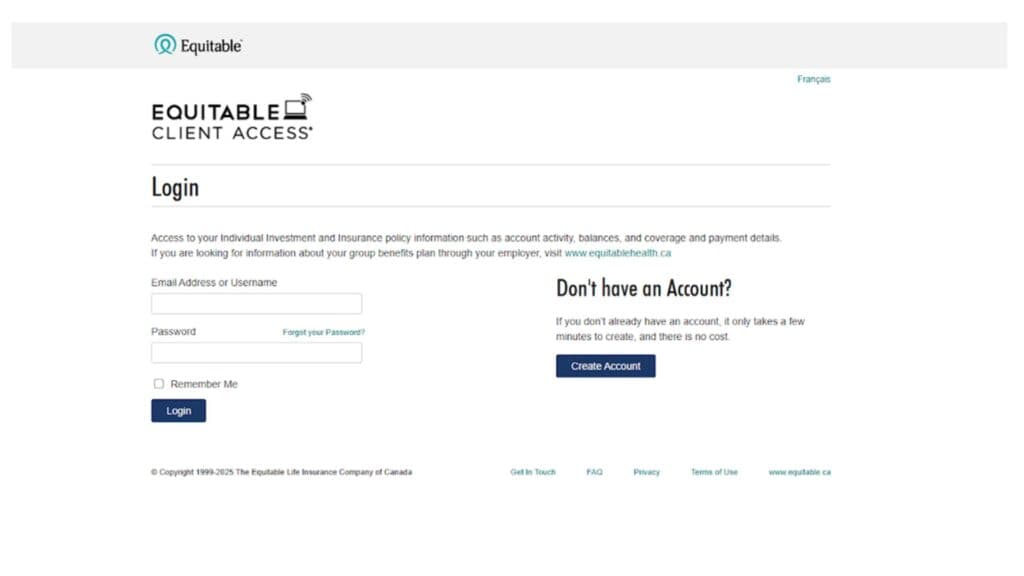

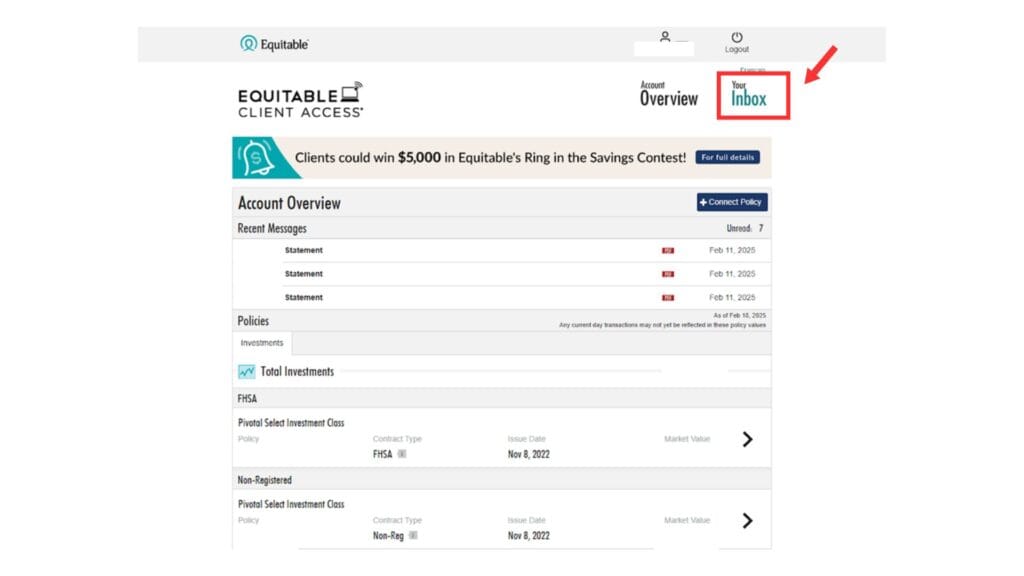

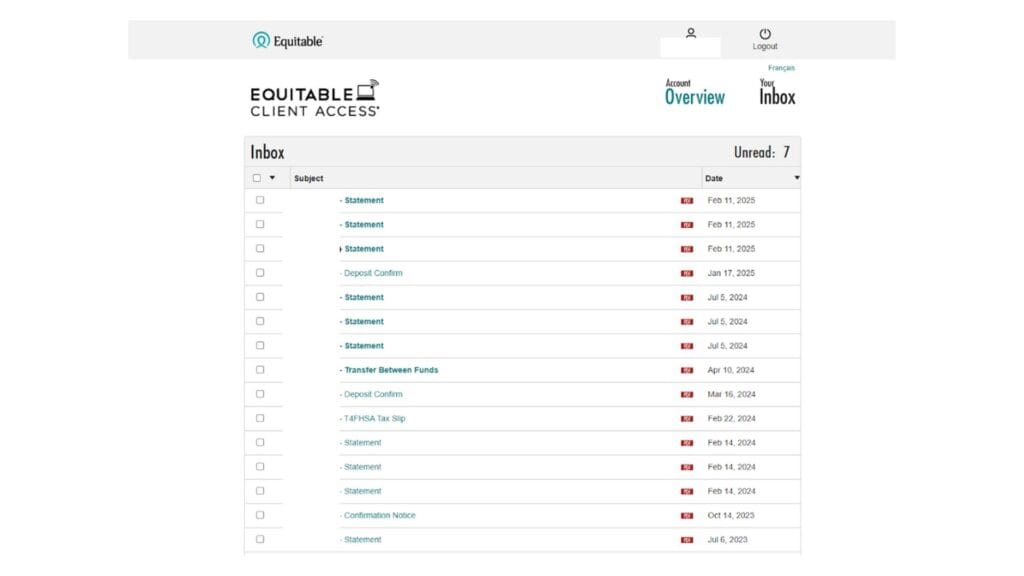

Equitable Life Tax Slip

- Sign in to Equitable Life: https://client.equitable.ca/client/en/Account/LogOn

2. Click on ‘my inbox’

The Best Time to Start Is Now

Recent Posts

You may also interested in

Nightmare in Vaughan: Pre-con Buyer Loses Life Savings | AIF Insight on Real Estate | AiF News Bites

A Vaughan man lost his deposit and faces legal action...

Read MoreExperts Warn: Canada’s Economic Growth Slows as Recession Risks Rise | AiF News Bites

Economists and rating agencies warn of structural slowing in Canada's...

Read MoreGold and Silver Market Crash: Historical Precious Metals Price Volatility Amid Shifting US Dollar Strength Expectations | AiF News Bites

Analyze the epic gold and silver market crash triggered by...

Read More