Discover how a Canadian family achieved 239% returns using strategic...

Read MoreSegregated Funds vs. Mutual Funds: the Estate Planning Benefits of Segregated Funds

If you’re thinking about building wealth for your family, you may be considering mutual funds. However, segregated funds are another avenue worth considering. While both offer potential for growth, segregated funds provide unique estate planning advantages that mutual funds simply can’t match, be it avoiding probate fees, minimizing taxes, or simply the efficiency of passing on your inheritance. Additionally, traditional methods of passing on wealth—like through a will—can sometimes be a slow, costly process due to probate and the associated taxes and fees.

In this article, we’ll explore how segregated funds can help you avoid these issues by bypassing probate, minimizing taxes, and ensuring that your beneficiaries receive their inheritance faster and more efficiently than with other investment options, such as mutual funds.

How Segregated Funds Bypass Probate (And Why That Matters)

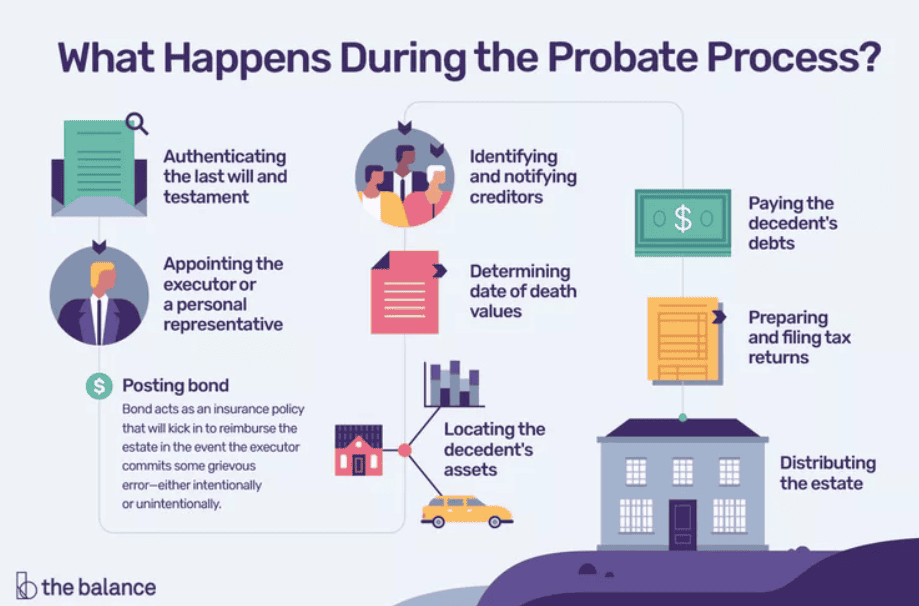

One of the standout features of segregated funds is that they bypass the probate process altogether. But what does that mean, and why is it such a big deal in estate planning?

What is Probate?

Probate is the legal process that occurs after someone passes away. It involves validating the deceased person’s will, paying off any outstanding debts, and distributing the assets according to the will or the laws of the jurisdiction if there’s no will. This process, although necessary, can be time-consuming and costly, often taking several months and incurring legal and administrative fees that can eat into the estate’s value. In some provinces, probate fees can be as high as 5% of the estate’s value!

Benefit of segregated funds

Here’s where segregated funds shine: If you’ve named a beneficiary on your segregated fund, the fund is paid directly to that beneficiary upon your death, outside of probate. This means your heirs can receive their inheritance quickly, without having to wait for the probate process to unfold.

For example, let’s say you have a segregated fund worth $500,000 and you’ve designated your daughter as the beneficiary. When you pass away, the $500,000 will go straight to her, bypassing probate altogether, and avoiding any associated fees or delays.

Segregated funds therefore allow you to control who gets the money and when, with no need for court intervention.

The Process for Mutual Funds: More Steps, More Fees

Now, let’s talk about mutual funds. While they can be a solid investment, the transfer of mutual fund assets upon your death is a different, more complicated process.

When someone passes away and owns mutual funds, the process typically works like this:

- The Mutual Fund Becomes Part of the Estate:

Unlike segregated funds, mutual funds are usually not directly transferred to beneficiaries unless a transfer-on-death (TOD) designation has been made (which isn’t available for all mutual funds). Instead, the mutual fund becomes part of the deceased’s estate. - Probate Proceedings Begin:

The mutual fund holdings are now part of the probate process. The executor of your estate will need to go through the formalities of probating the will, which, as mentioned, can take time and involve various legal fees. In addition to court and administrative costs, the estate might also have to pay taxes, which can further reduce the overall value of the inheritance.

3. Disbursement to Beneficiaries:

After the probate process is completed, the mutual fund assets will be liquidated or transferred to the beneficiaries as per the will. This can take several months, and any capital gains taxes on the mutual fund’s appreciation may be due at the time of transfer.

The Efficiency of Wealth Transfer with Segregated Funds

One of the key advantages of segregated funds is the efficiency with which wealth is transferred to your beneficiaries.

Because segregated funds avoid probate, your heirs don’t need to go through the lengthy and expensive process of validating the estate through court. This direct transfer not only saves time but also minimizes costs, which can sometimes erode the value of an inheritance.

In practical terms, this means that upon your death, your beneficiaries will have access to the funds faster, without the delays associated with the probate process. In the case of larger estates, this can be especially beneficial, as it ensures that your heirs are financially supported without the need for immediate liquidation of other assets or waiting for the probate court to approve the transfer of funds.

Less Family Disputes

Additionally, the clarity and control that comes with naming a beneficiary on your segregated fund ensures that there is no ambiguity over who gets what. This can help to avoid family disputes and make the entire wealth transfer process more straightforward and transparent.

Side Note: Security

It’s also worth noting that the guarantee features of segregated funds provide added peace of mind. Many segregated funds offer a death benefit guarantee, which means your beneficiaries will receive a guaranteed minimum amount—often the principal invested—regardless of market performance. This assurance of financial security can be especially helpful in ensuring your legacy is protected, particularly if you are concerned about market fluctuations in the years to come.

What This Means for Your Estate Plan

For anyone concerned about minimizing probate costs, maintaining privacy, and ensuring a swift transfer of assets, segregated funds offer a significant advantage over mutual funds. By keeping your investments outside of the probate process, you not only preserve more of your wealth but also ensure that your beneficiaries don’t have to deal with lengthy delays in receiving their inheritance.

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More