Discover how a Canadian family achieved 239% returns using strategic...

Read MoreWealth Comes Faster with an

Investment Loan

What is an investment loan?

An ideal option to boost the create wealth faster than a traditional investment strategy.

An investment loan is an ideal option to boost the potential growth of your investments. By leveraging borrowed money, you can significantly increase your investment capacity, thereby maximizing your potential returns while maintaining liquidity for other projects. This type of loan can be part of a tax-advantaged financial strategy since the loan interest is often tax-deductible.

Video Source: B2B Bank – Understanding Investment Loans

How do investment loans work?

Leveraged investing via investment loans is quite a simple concept:

- You borrow money

- You invest the money

- You only pay interest on the loan

- When you sell the investment, you repay the loan and keep any investment growth

An investment loan has the potential to generate greater returns for you than a traditional investment strategy. Here’s why:

- Accelerates savings through a larger initial upfront investment and compound returns.

- Compound returns on an investment means that returns are calculated not only on the initial investment, but also on the accumulated growth from year-to-year.

- Investment loan interest has the potential to be tax-deductible, but not in all circumstances; when it is deductible, it can effectively reduce the overall cost of an investment lending strategy.

Benefits of an investment loan

Investment loans are particularly suitable for investors who prefer not to use their own money and may lack substantial liquid funds for investment, provided they have some level of risk tolerance.

- Interest-Only Payments: Pay only interest, keeping cash flow flexible.

- Maximize Investment Potential: Grow your investments while keeping liquidity.

- Immediate Compounding: Lump sum investments start compounding right away.

- Tax Deductions: Potential to reduce overall costs through tax benefits.

- Segregated Fund Access: Benefit from principal protection and growth opportunities.

It’s especially beneficial for long-term investors (minimum 10 years) with non-registered assets, offering the advantage of reducing taxable income through tax-deductible loan interest.

How to Accelerate Your Savings

With a traditional savings plan, only the first year’s contribution enjoys the full 20 years of compound growth. Each subsequent contribution compounds for one year less — the second year for 19 years, the third for 18 years, and so on — which limits your total compound return.

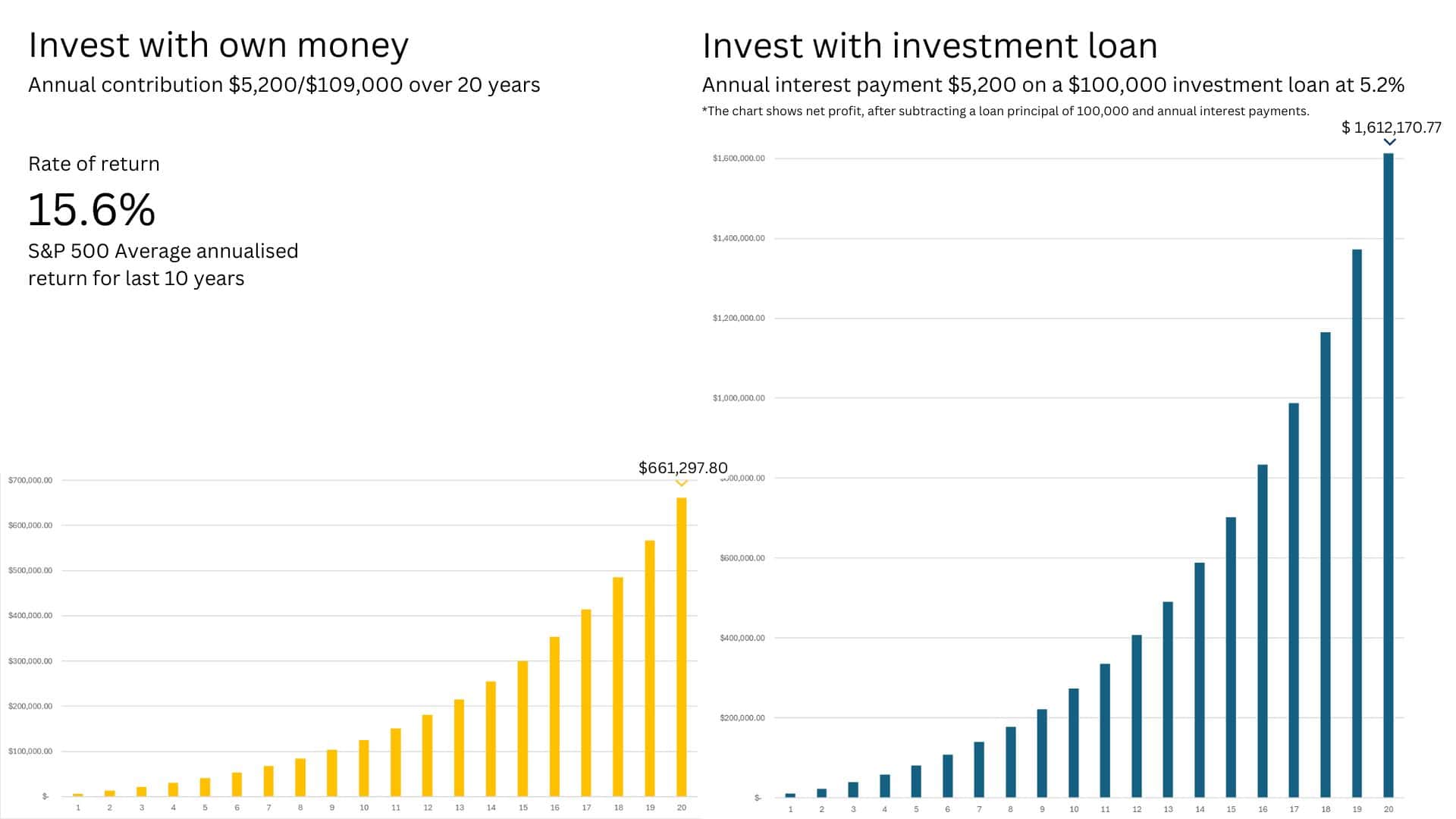

If you have $5,200 to invest each year and continue for 20 years, at an annual return rate of 15.6% (assuming contributions are made at the beginning of each year), your total investment will grow to:

Total value of savings plan: $661,297.80

However, if you use that same $5,200 each year to cover the annual interest on an investment loan — borrowing $100,000 upfront to invest — that full amount can participate in compound growth for the entire 20 years. After 20 years:

Total investment value: $1,816,170.77

After deducting the $100,000 principal and $104,000 in total interest paid:

Net gain from investment loan: $1,612,170.77

Compared with the traditional savings approach, the investment-loan strategy earns an additional:

Extra gain: $950,872.97

This example illustrates how an investment loan can magnify your wealth-growth potential.

To tailor an investment strategy for your own situation, contact the Ai Financial advisory team.

We can design a personalized leveraged-investing plan — combining investment loans with segregated funds — to help protect your capital and accelerate long-term growth.

*For illustrative purposes only. Actual rates and amounts may differ. The illustration is a hypothetical example and is not intended to project or predict actual results.

Investment loan interest rates

The rates shown are determined based on the Royal Bank of Canada’s prime rate (PR).

The interest rate is: PR+0.75%

*5.2% as of October 31 , 2025

Interest rates are provided for information purposes only and are subject to change at any time without notice.

Ai Financial services on investment loan

If you lack sufficient funds, we can help you secure investment loans.

While people often think of debt as something to be avoided, an investment loan is a strategic form of debt designed to improve your financial position, providing money when you need it, for as long as you need it.

- We Provide Loans from Canadian Tier 1 or Tier 2 banks or Credit Unions (e.g., B2B Bank, Manulife Bank, iA Trust, National Bank, DUCA).

- Loans must be invested in Segregated Funds with Canadian Insurance Companies (e.g., Manulife, Canada Life, iA, Sun Life, Equitable Life).

- Investment loans have a 20-year term but can be canceled anytime.

Only pay Interest-only payments at Prime rate + 0.75% (e.g., $433/month for $100K).

Client may qualified to withdraw 10% of Total Market Value to cover the interest.

- With an Average Annual Return of 21.6% with AI Financial, borrowing to invest can be highly profitable.

Our Loan providers

Get Started Today

Applying for an Investment Loan

Only licensed advisors like AiF can help you apply for an investment loan.

Eligibility Assessment

AiF will assess your eligibility and, if qualified, apply for the loan on your behalf. Upon approval, we will assist you with your investments.

Leverage with Caution

Investment loans are a leveraging tool and may not be suitable for everyone. Qualification is determined by the banks, and AiF can often assist clients who were previously denied elsewhere.

A few criteria are taken into account to verify eligibility for an investment loan.

Minimum criteria for investment loans typically included:

- A credit score of 720.

- At least 2 years as a Canadian resident.

- Income and tax returns for the past 2 years. (Don’t need to provide proved documents for quick investment loan)

Our Successful Client Cases

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read More