The Power of Compound Interest: Life-Changing Magic

Albert Einstein once said compound interest is the “eighth wonder of the world.” And when one of the smartest people who ever lived puts something in the same category as the Great Pyramid of Giza, you better pay attention!

Let’s start with a definition: Compound interest is calculated on both the principal and the interest already earned or payable. The frequency of compounding, such as monthly or yearly, and the length of the term can affect the total interest. The longer and more frequent the compounding, the higher the return.

How does compound interest work?

To illustrate how compound interest works, let’s consider the snowball effect.

Let’s say you’re standing at the top of a snowy hill holding a snowball. You let go of the snowball, sending it rolling down the hill. As the snowball rolls, more snow packs on to it, making it grow a bit bigger. Then more snow packs on to that, making it grow even more.

Compound interest grows almost the same way as what happens to the snowball rolling down the hill – interest is calculated on both principal and interest.

Let’s say you have $1,000 in your saving account that earns 15% in annual interest. With simple interest, in year one, you’d earn $150, and this would continue each year, resulting in a total balance of $5,500 after 30 years. However, with compound interest, in year one, you’d earn $150, giving you a new balance of $1,150. In year two, you’d earn 15% on the larger balance of $1,150, which is $172.50—giving you a new balance of $1,322.50. If you left $1,000 in this hypothetical account for 30 years, earning 15% annual interest, you’d end up with a balance of $66,211.77.

Thanks to compound interest, the growth of your balance accelerates over time, far outpacing simple interest.

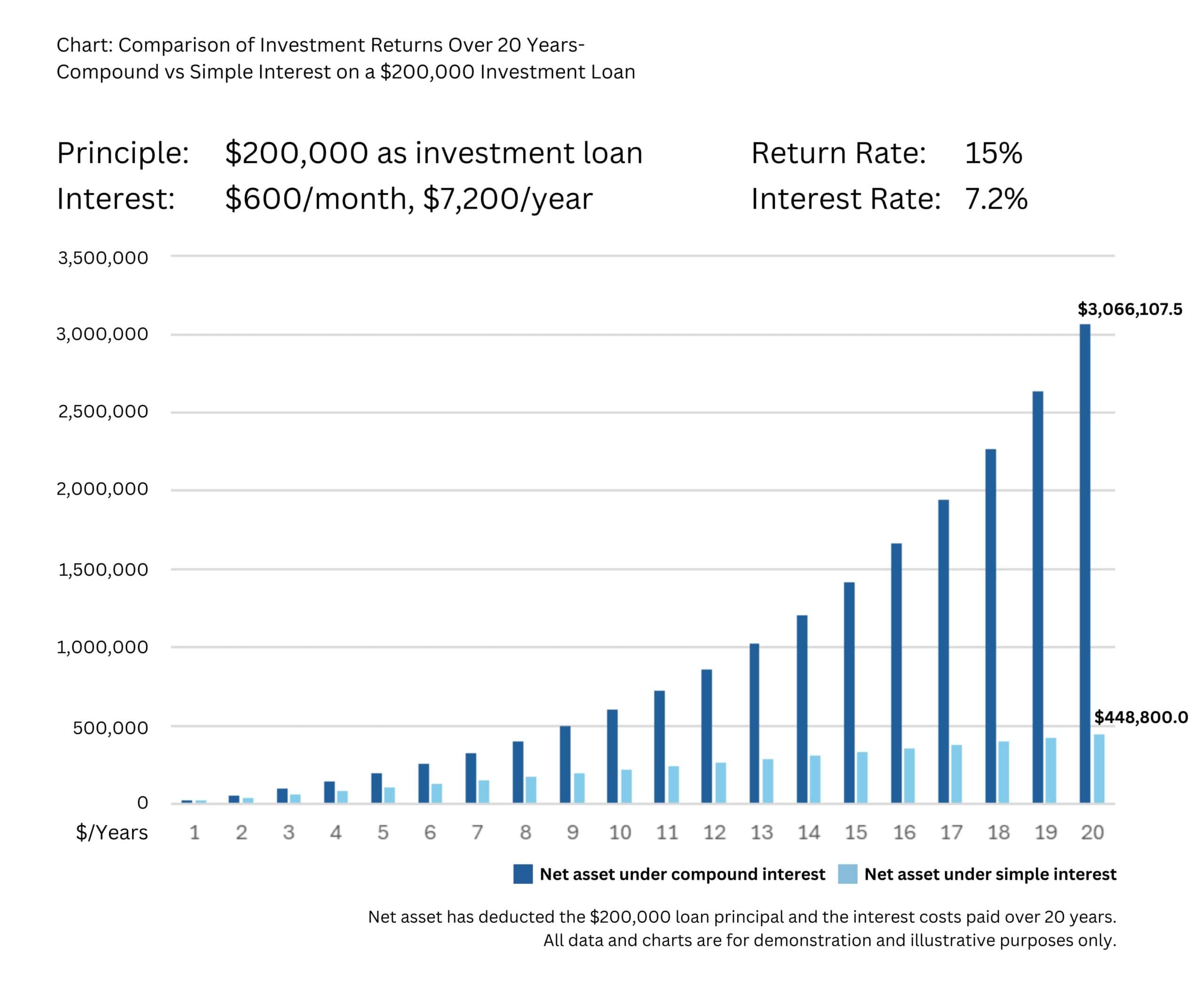

The following table demonstrates the difference between compound and simple interest calculations on a $200,000 investment loan, with a loan interest rate of 7.2% and an annual return rate of 15%, showing the results after 20 years.

Under the same investment amount, the compound interest effect can create a $2.6 million difference.

Of course, the duration of the investment and the initial amount also have a significant impact.

(We use the long-term growth rate of the S&P 500—a common measuring stick for how the stock market is performing—the current historically average annual rate of return is around 15%.)

What are the benefits of compound interest?

In general, if you choose to purchase an investment that offers an interest rate compounded over time, the longer the term of the investment, and the more frequent the compound calculation occurs, the higher your return could be. And the earlier you start investing, the sooner interest can begin to compound.

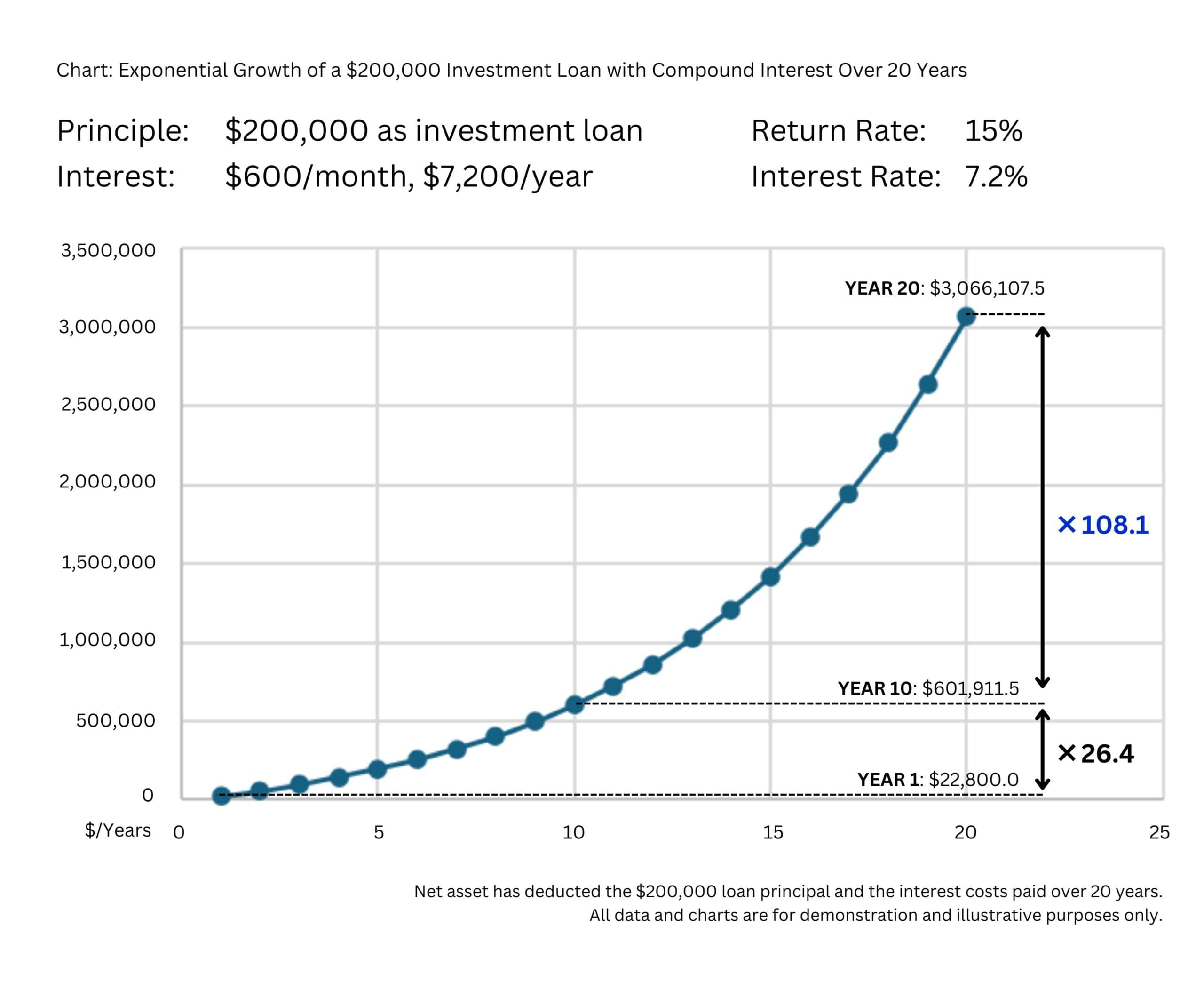

How Compound Interest Grows Over Time

Compound interest can significantly boost investment returns over the long term.

The longer the investment period, the more powerful the effect of compound interest. In the first 10 years, the return increased by 26.4 times, while in the second 10 years, it grew by 108.1 times. This exponential growth occurs because compound interest earns returns not only on the initial principal but also on accumulated interest, causing gains to accelerate significantly over time.

Compound Interest: Start Saving Early

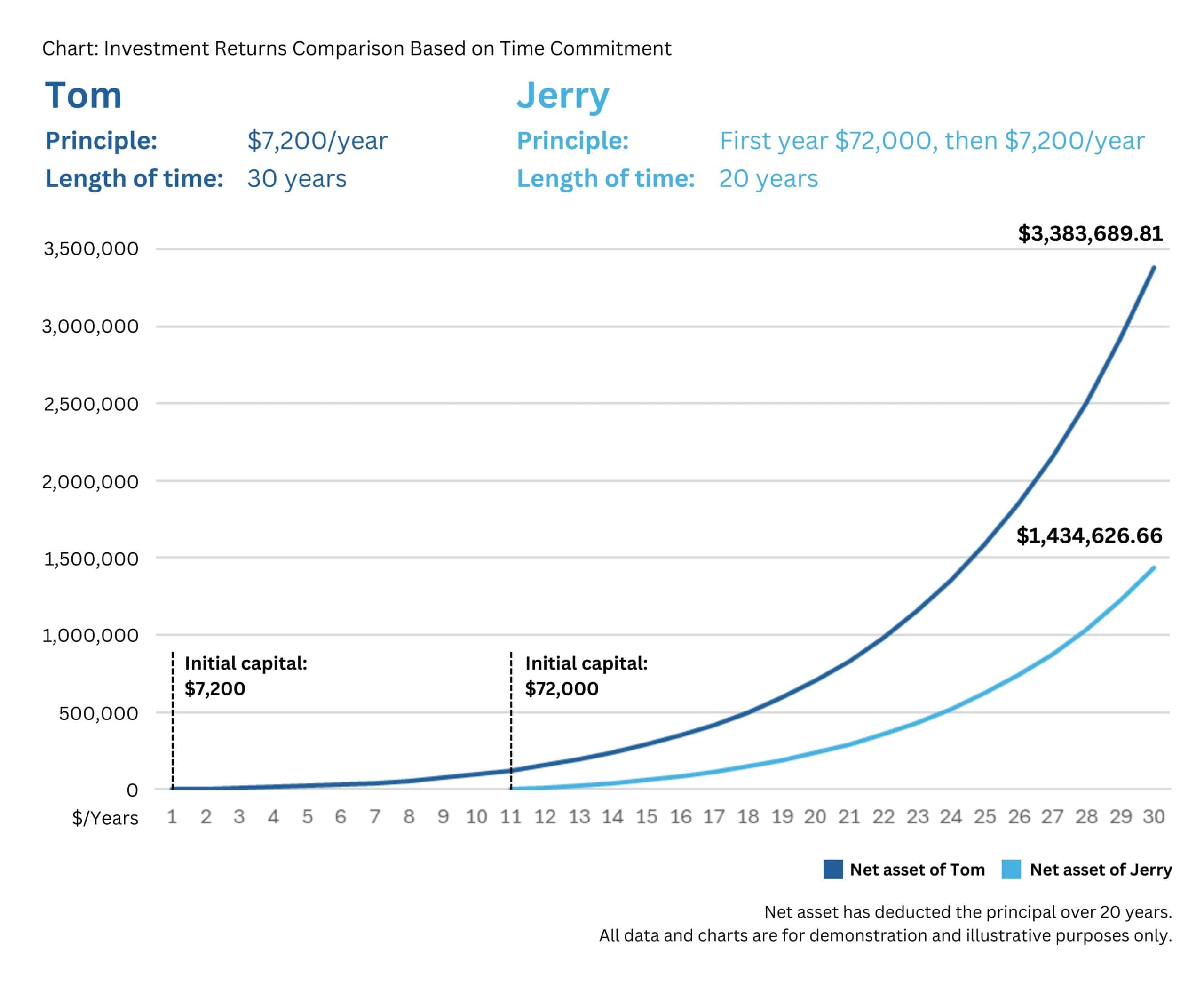

Young people often neglect to save for retirement. They may have other expenses they feel more urgent with more time to save. Yet the earlier you start saving, the more compounding interest can work in your favor, even with relatively small amounts. Saving small amounts can pay off massively down the road—far more than saving higher amounts later in life. Here’s one example of its effect.

Let’s say Tom start saving $7,200 every year at age 30. He earns an average compounded return of 15% annually across 30 years. He could earn $3,383,689.81 by age 60. His principal investment was just $216,000.

His sibling Jerry doesn’t begin investing until age 40. He invests $72,000 initially, then $7,200 annually for 20 years, also averaging an annually compounded 15% return. By age 60, Jerry could only earn $1,434,626.66, with a same principal investment of $216,000.

Even Jerry invests twice than Tom, when they both reach their 60, Tom’s investing will still be $1 million more than Jerry.

Pros and Cons Compound Interest

Pros

Compounding works to your advantage when it comes to your investments and savings, as your returns earn returns.

Compounding interest’s exponential growth is also important in mitigating wealth-eroding factors, such as increases in the cost of living, or inflation that reduces purchasing power.

Cons

If you only pay the minimum, your balance could continue growing exponentially as a result of compounding interest. This is how people get trapped in a “debt cycle.”

The Bottom Line

The long-term effect of compound interest on savings and investments is indeed powerful. Because it grows your money much faster than simple interest, compound interest is a central factor in increasing wealth. It also mitigates a rising cost of living caused by inflation. For young people, compound interest offers a chance to take advantage of the time value of money.

You may also interested in

What is an investment loan?

Can this loan last a lifetime? Interest-only payments? Tax-deductible? Is it a private loan? Is the threshold high?

Why do you need segregated funds for retirement?

Segregated funds are a popular choice for group savings and retirement plans. They provide access to high-end and unique……

Invest with TFSA

A Tax-Free Savings Account (TFSA) provides you with a flexible way to save for a financial goal, while growing your money tax-free……

Invest in RRSP-Invest wisely, retire early

According to a recent survey by BMO, due to inflation and rising prices, Canadians now believe they need 1.7 million dollars in savings to retire……