Discover how a Canadian family achieved 239% returns using strategic...

Read MoreGlobal & Canada 2025 Investment Outlook: Navigating Uncertainty in a Shifting Economy

Global markets have entered a phase of heightened volatility. Using the Dow Jones Industrial Average as an example, we can trace the year-to-date trajectory to better understand market sentiment and trends. Starting at 42,660 on January 2, 2025, the Dow peaked at 45,054 by January 31 before falling sharply to 36,611 on April 7 — an 18.73% correction within just three months, signaling the market’s depth and speed of adjustment.

This rapid decline triggered concern among investors, some fearing the onset of a prolonged bear market. However, Ai Financial maintained a firm view that this correction was structural and part of a normal technical consolidation. We advised clients to stay the course and avoid emotionally driven decisions.

By mid-year, markets have largely rebounded, with the Dow approaching its previous high. Yet this recovery has sparked fresh anxieties: Are we at a temporary peak? Is another correction imminent? With inflation trends unclear, Fed rate policies undecided, and geopolitical tensions rising, market outlooks remain highly divided.

To address these challenges, this session provides a comprehensive breakdown of macroeconomic trends, policy developments, and actionable investment strategies. We aim to equip investors with clarity and confidence as they navigate an uncertain environment.

Global Economic Landscape: Complex and Divergent

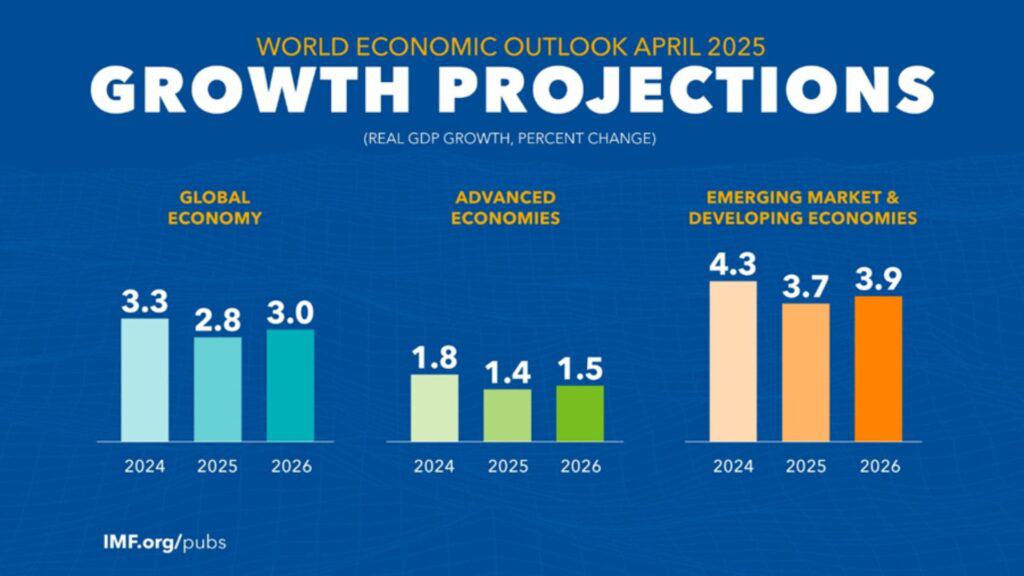

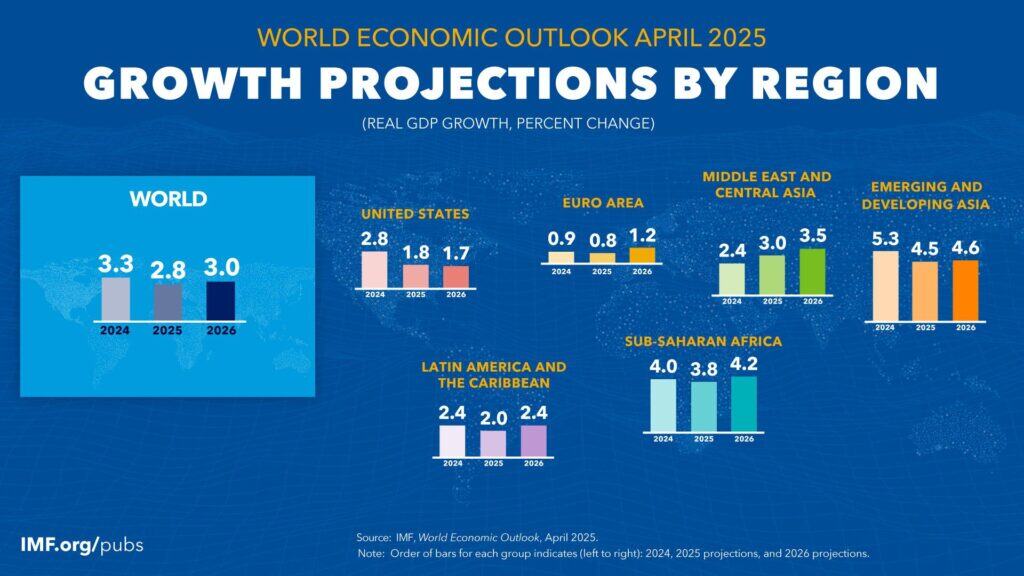

As we enter the second half of 2025, global economic performance is marked by complexity and divergence. Leading forecasts, including those from the United Nations, suggest a period of moderate, uneven growth.

Global Trade: Slowing Momentum

- Global trade growth is projected to decelerate from 3.3% in 2024 to 2.8% in 2025.

- Key contributing factors:

- Rising U.S. tariffs increasing global trade uncertainty;

- Higher trade costs suppressing corporate investment appetite;

- Ongoing geopolitical tensions and supply chain disruptions.

Inflation: Decelerating, but Stubborn

- While global inflation is trending downward, the pace of improvement is slowing.

- Forecasts estimate 2025 year-end inflation at 3.6%, higher than initial projections.

- Risks include volatile energy prices, disrupted supply chains, and evolving trade policies.

U.S. Outlook: Slowing Growth Amid Policy Shifts

The U.S. economy began 2025 on solid footing but is now decelerating amid:

- Expanding tariffs,

- Fiscal tightening,

- Weakened consumer sentiment.

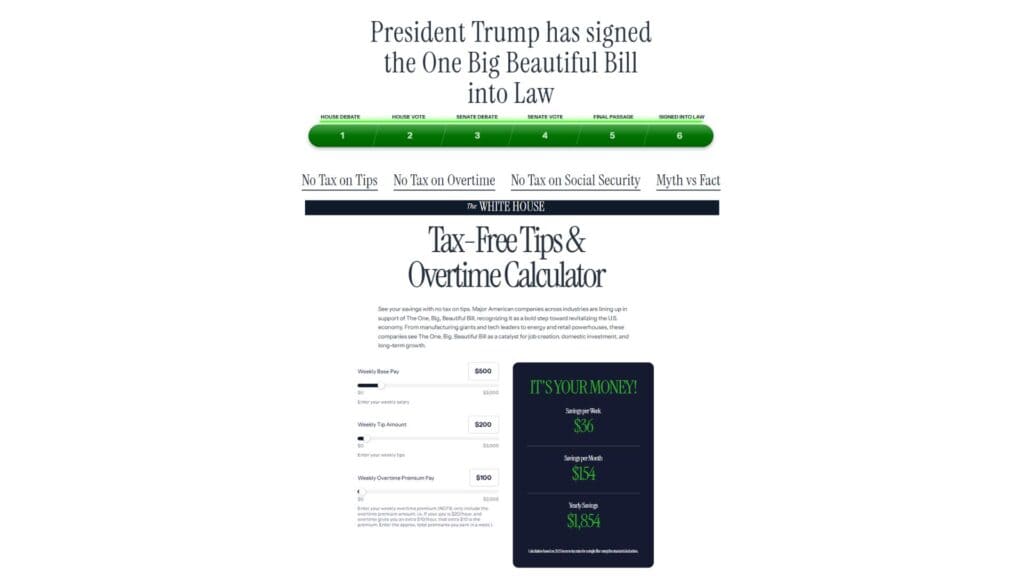

While rate cuts by the Federal Reserve remain a possibility, their effectiveness remains uncertain. The passage of the “One Big Beautiful Bill Act” on July 4, 2025, stands as the most consequential policy development, with long-term implications for the U.S. and global economies.

The One Big Beautiful Bill Act: Rebuilding Growth Through Fiscal Reallocation

This sweeping policy package balances spending cuts with targeted tax reductions and capital market incentives. Core measures include:

- Federal Budget Cuts

- EPA staff reductions of up to 60%, with other agencies also facing deep cuts.

- Reallocation toward defense spending: expansion of Iron Dome and Golden Dawn systems.

- Tripling of ICE personnel to strengthen border control.

- Corporate Tax Reform

- Extension and permanent implementation of Trump-era cuts (21% corporate rate).

- QBI deductions raised from 20% to 23%.

- Objective: free up capital for hiring, expansion, and capex.

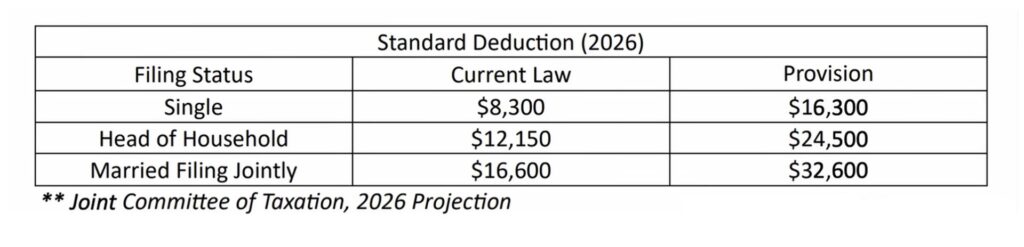

- Middle-Class Tax Relief

- Elimination of taxes on tips, overtime wages, and Social Security benefits (for 88% of recipients).

- Doubling of standard deductions:

- Single: $8,300 → $16,300

- Family: $12,150 → $24,500

- Married: $16,600 → $32,600

- State/local tax deduction cap raised from $10,000 → $40,000.

- Child tax credit increased to $2,500.

- Seniors (65+) get an additional $4,000 tax deduction.

- Investment Incentives

- Health Savings Account (HSA) limits doubled:

- Single: $4,300 → $8,600

- Family: $8,550 → $17,100

- New Investment Accumulation Account (IAA) introduced: $5,000 annual cap.

- Strong incentives for long-term investing and retirement planning, especially for working families.

- Estate Tax Relief

- Exemption raised from $13.6M to $15M per individual.

- Prior sunset clauses made permanent; 40% tax only applies to amounts exceeding the threshold.

Additional Fiscal Shifts: Reducing Welfare, Boosting Security and Innovation

Despite being a welfare-heavy nation, the U.S. is cutting back significantly:

Welfare Reductions

- $1 trillion in healthcare subsidies slashed over 10 years (approx. 30% reduction).

- Work requirements (80 hours/month) added for those without dependents or disabilities.

- Expected: 11.8 million to lose healthcare coverage; 3 million may lose food stamps.

- Green energy subsidies, including EV credits, will end by September 30, 2025.

- Tesla expected to lose $1.2B/year in incentives.

Defense & Border Security

- $150B to upgrade military infrastructure and missile defense.

- $25B for Iron Dome; $10B to enhance border deployments.

- $350B allocated to border security, including tripling ICE manpower.

Tech & Manufacturing Support

- R&D tax credits made permanent; 100% depreciation in year one.

- Semiconductor tax relief increased to 25%.

- Infrastructure projects (including AI data centers and power plants) starting before 2026 are eligible for large-scale deductions.

Space Program Investments

- Funding allocated for lunar and Mars missions, space station replacement, and satellite system expansion to secure space leadership.

Implications for Canada: A Stark Contrast

While the U.S. accelerates economic momentum through aggressive reform, Canada’s economic outlook remains sluggish.

- GDP Forecast Downgraded

- The Bank of Canada revised its 2025 growth forecast down to 1.8%, signaling weak expansion.

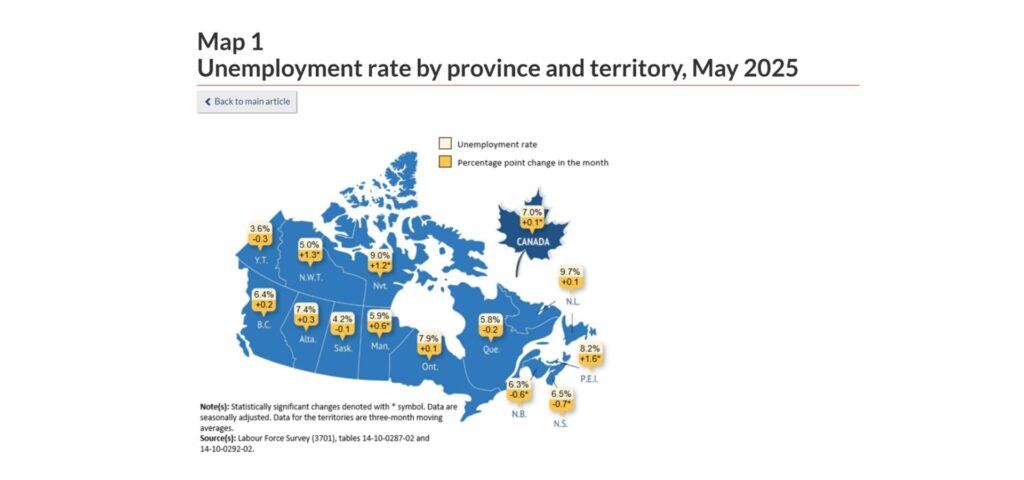

- Labor Market Deterioration

- National unemployment hit 7.0% in May 2025, up from a healthy range of 4–5%.

- Ontario: 7.9%

- British Columbia: 6.4%

- Quebec: 5.8%

- Rising unemployment weakens consumer demand and business confidence, reinforcing economic drag.

- Interest Rate Stagnation

- BoC reduced rates to 2.75% in March but has since held them steady, showing a cautious approach amid inflation concerns.

Conclusion: Uncertainty Persists, Policy Response Lags

In summary, Canada faces:

- Tepid economic growth,

- A weakening labor market,

- A central bank in wait-and-see mode.

Without bold policy actions similar to the U.S., Canada risks falling behind in the global recovery. In this environment, investors must be especially strategic in asset allocation and sector positioning.

Investment Challenges in the Second Half of 2025: Rising Risks & Structural Shifts

Following the macroeconomic outlook, we now examine the key challenges facing investors in the second half of 2025. From political realignment to sectoral shifts and structural changes in financial markets, this period demands a disciplined response to uncertainty and volatility.

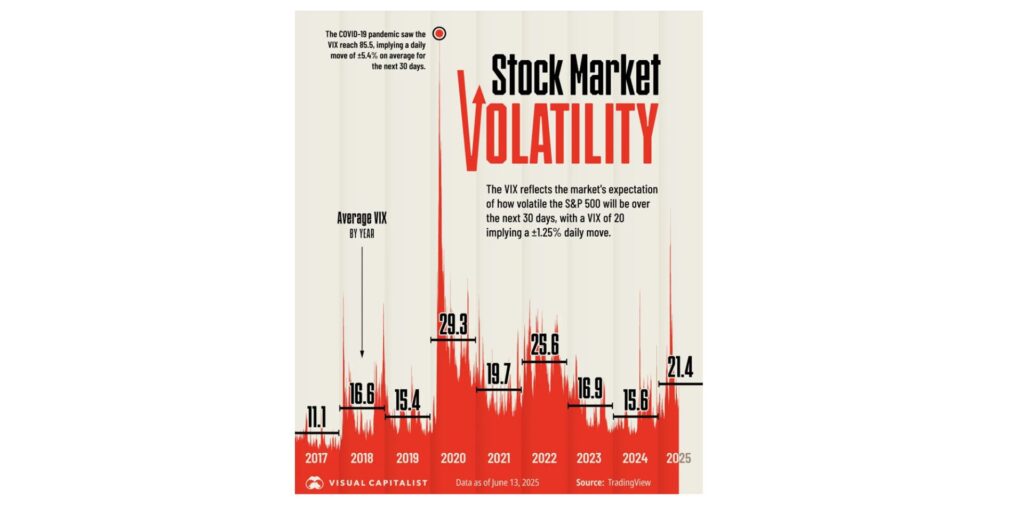

Volatility Is the New Norm

The political landscape has shifted significantly, especially with Trump’s return to office, marking a broader societal pivot from left to right. This ideological realignment has intensified short-term uncertainty and introduced new variables into the investment environment.

As a result, market volatility has surged. We’ve moved from intra-day swings of 200–300 points to a new reality where daily fluctuations of 1,000–3,000 points may become routine. This heightened volatility demands stronger risk management and more resilient portfolios.

The Era of Low Interest Rates Is Over

For decades, low interest rates fueled housing and equity market growth. That era has ended. Today:

- Central banks are maintaining relatively high rates;

- The U.S. Federal Reserve shows no clear signs of cutting rates;

High interest rates will continue to pressure asset classes, especially real estate.

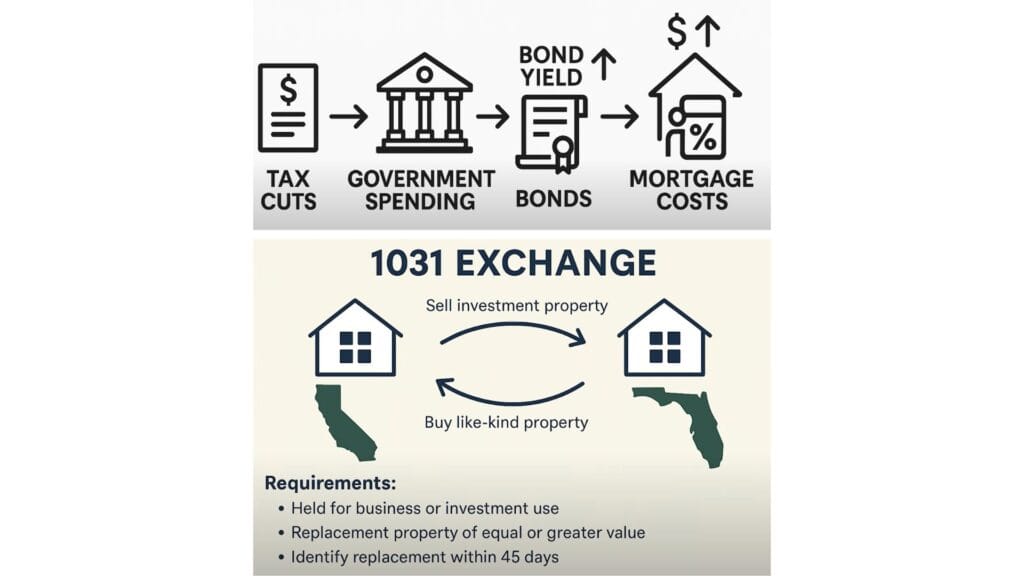

3. Tax Reform’s Ripple Effect on Real Estate

The U.S. “One Big Beautiful Bill Act” introduced massive tax cuts, injecting liquidity—but with consequences:

- Lower tax revenue;

- Increased short-term government spending;

- Widened fiscal deficit;

- Surge in government bond issuance;

- Higher bond yields → rising loan and mortgage rates;

- Stricter lending standards → higher down payments;

- Reduced housing affordability → weakened demand → downward pressure on prices.

This chain reaction illustrates how fiscal policy indirectly but materially impacts real estate markets. As access to credit tightens, speculative demand recedes, leading to deflation of housing bubbles.

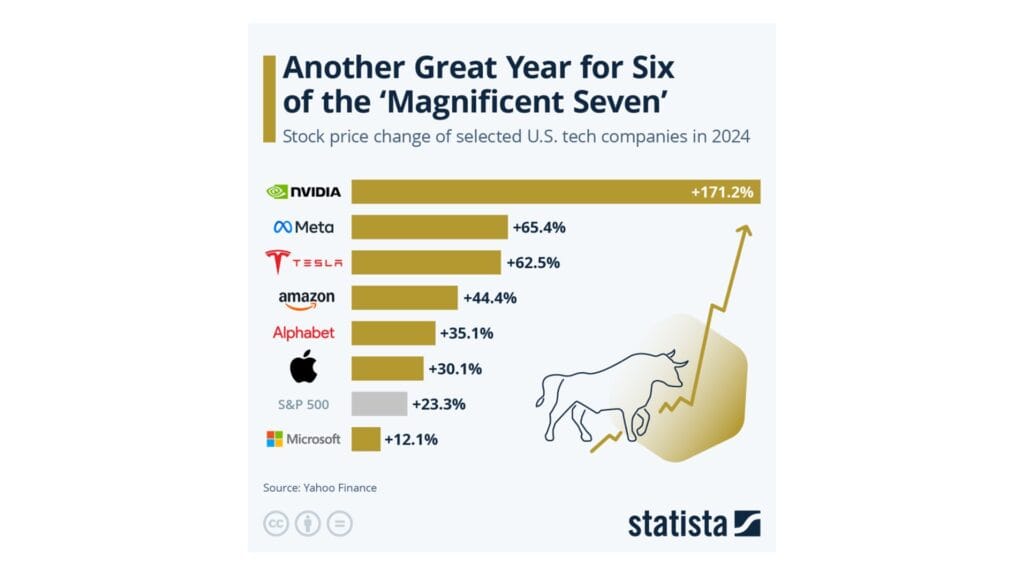

- Sector Divergence: Tech Titans Decouple

The once-unified rise of the “Magnificent 7” tech stocks is fracturing:

- NVIDIA has continued surging, now valued above $4 trillion;

- Tesla has dropped over 35% from its peak.

This divergence signals higher risks in concentrated bets. Investors must now prioritize sector rotation and dynamic asset allocation.

5. Geopolitical Risks Remain Elevated

Beyond economics and policy, geopolitical instability remains a serious concern:

- Middle East: The Iran nuclear threat recently stoked fears of nuclear conflict;

- Russia-Ukraine: No signs of de-escalation, with significant uncertainty ahead.

While immediate Middle East tensions have eased, any escalation in global conflicts could trigger sharp market reactions and flight-to-safety behavior.

Summary

Key challenges in the second half of 2025 include:

- Greater systemic volatility and frequent short-term shocks;

- Prolonged high interest rates, suppressing leveraged assets;

- Sector-specific divergences, requiring adaptive strategies;

- Persistent geopolitical instability, warranting diversified and defensive positions.

In this environment, investors must prioritize capital preservation, maintain liquidity, and consider working with professionals to implement resilient, long-term investment strategies.

How Ai Financial Responds to Market Uncertainty

Investment Is the Only Way to Outpace Uncertainty

In today’s environment, not investing is a risk in itself. With inflation and elevated rates eroding cash value, pure savings leads to long-term loss. While many seek quick wins, they often fall prey to scams or poor decisions.

At Ai Financial, we advocate for long-term strategies rooted in discipline and risk control. With over 25 years of real-world experience, our professional team helps clients grow wealth steadily and avoid speculative traps. Investing is not just important — it must be done professionally.

Target Structural Growth, Not Hype

The fourth industrial revolution is accelerating, driven by AI, cloud computing, big data, semiconductors, and clean energy. Instead of chasing volatile individual stocks, we recommend diversified exposure via segregated funds — professionally managed, capital-protected investment vehicles.

These funds offer:

- Downside protection at maturity,

- Legal advantages (e.g., creditor protection, probate bypass),

- Broad access to high-growth industries.

With disciplined allocation, we help clients capture upside while managing downside — building portfolios that can withstand market cycles.

Smart Leverage: Accelerate Growth Safely

For clients with stable cash flow, investment loans can be a powerful growth tool. For example, by paying under $1,000/month in interest, one can control a $200,000 portfolio — keeping all investment returns.

Combined with tax-advantaged accounts like TFSA or RRSP, this strategy can meaningfully boost long-term compounding. At Ai Financial, we tailor leverage strategies to each client’s capacity and goals, ensuring tools are used strategically — not speculatively.

Online Q&A

Q1: Can Canada adopt a tax cut policy like the U.S. to stimulate growth?

A1: We hope so. The U.S. approach of tax cuts + government streamlining empowers businesses and households, fuels consumption, and reduces inefficiencies. Canada, by contrast, faces heavy government spending and high taxes. A more competitive tax structure could energize our economy — if the political will exists.

Q2: Is it true that “America prints money and the world pays”?

A2: Not quite. While the U.S. did expand its balance sheet during crises (e.g., QE), the Fed also withdrew liquidity afterward to control inflation. In reality, America’s institutional credibility and monetary stability support global markets — not burden them. Canada, on the other hand, must address internal inefficiencies like inter-provincial trade barriers and excessive bureaucracy.

Q3: What’s your view on Tesla and Apple?

A3: We don’t recommend Tesla due to its volatility and weak fundamentals. As for Apple, we still see value, but recognize its growth is plateauing. iPhone sales have matured, and while Apple is exploring new areas like autonomous driving, clear breakthroughs haven’t emerged yet. The stock warrants caution and ongoing monitoring.

Q4: With high interest rates, is an investment loan still worth it?

A4: Yes — if the net return is positive.

For example:

- Loan rate = 5%

- Portfolio return = 15%

- Net gain = 10%

Many Ai Financial clients have earned double-digit returns even in high-rate environments. The key metric is return minus borrowing cost — not the rate alone. For investors with stable cash flow, an investment loan can be a smart way to accelerate long-term wealth growth.

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More