Discover how a Canadian family achieved 239% returns using strategic...

Read MoreFrom Testing to Doubling Down: His Trust in AiF Speaks Through Action

Mr. W is an employee at a large publicly listed gaming company in Canada. With an MBA and a strong passion for business trends and financial investments, he has been actively involved in various markets for years — including stocks, funds, and cryptocurrencies. His flexible strategies and sharp decision-making make him a typical active investor.

Even in April 2025, when global markets were once again thrown into turmoil — with bulls and bears clashing and the Dow Jones plunging 2,200 points in a single day — Mr. W chose to stand firmly with Ai Financial.

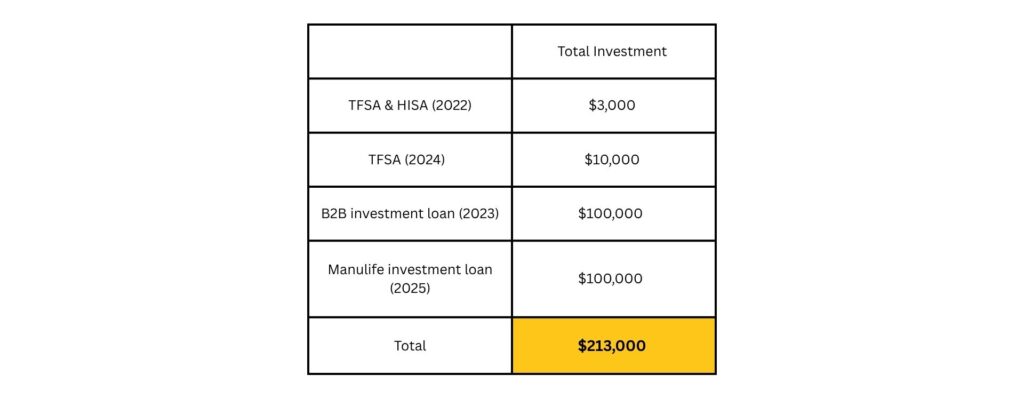

📊 Mr. W's Investment Overview

🔹 2022|First Encounter with AiF — A Trial Run

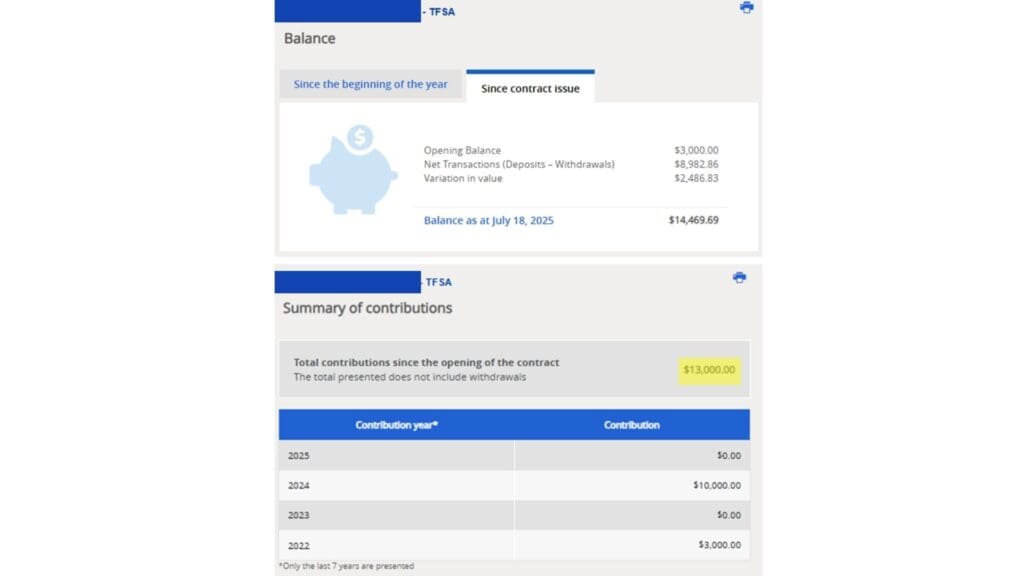

Mr. W first opened a TFSA account with Ai Financial in 2022, depositing $3,000. He allocated $1,000 to a High-Interest Savings Account (HISA) to maintain liquidity, while the remaining $2,000 was invested in a segregated fund. Later, due to family expenses, he flexibly withdrew the funds from the HISA.

This initial experience gave him an understanding of AiF’s operational logic and liquidity structure, laying the foundation for future investment scaling. In August 2024, Mr. W invested another $10,000 of his own capital into his TFSA account.

🔹 2023|Seeing Returns, He Actively Increases His Position

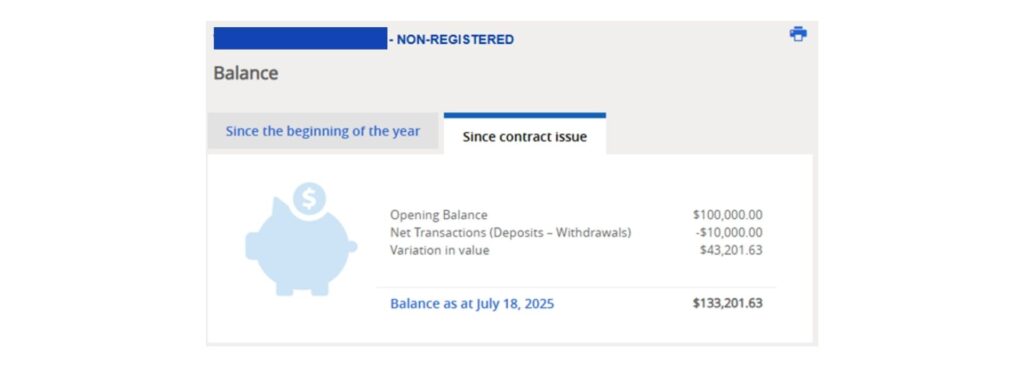

As the account continued to perform steadily and deliver positive returns, Mr. W reassessed the strategic value of the AiF team. On top of his profitable TFSA, he decided to take his first step into leveraged investing.

With AiF’s support, he successfully secured a $100,000 investment loan from B2B Bank, allocating it to a diversified segregated fund portfolio under iA. This marked a significant step toward structured leverage investing. During this period, he also flexibly withdrew $10,000 for short-term needs — demonstrating both the liquidity and resilience of the portfolio.

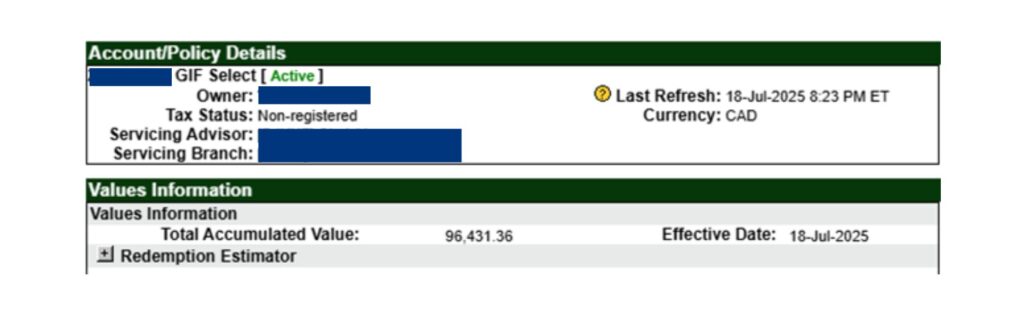

🔹 March 2025|Catching the Opportunity — Another Strategic Move with Leverage

During a promotional campaign by AiF, Mr. W noticed that he could receive a phone or smartwatch as a bonus for investing. But for him, what truly mattered was the disciplined investment strategy behind Ai Financial.

Once again with AiF’s assistance, he successfully obtained a $100,000 investment loan from Manulife Bank, which he deployed into Manulife segregated funds. Even amid a sharp short-term correction in U.S. markets due to tariff-related volatility, he did not hesitate — sticking firmly to his plan.

⭐️ Mr. W’s journey is proof: when you choose the right direction and trust the right team, every additional investment is a more confident step toward your long-term future.

📩 If you’re like Mr. W and you:

✔️ Want to leverage financing tools to amplify your capital

✔️ Hope to build a portfolio that balances liquidity and steady growth

✔️ Aim to stay clear-headed and stable through market swings

✔️ Value professional support to review, rebalance, and go the distance

AiF is here to help you plan the next 3, 5, or even 7+ years of your long-term asset growth journey.

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More