Discover how a Canadian family achieved 239% returns using strategic...

Read MoreSuburban Condo Prices Crash Over 50% — Worse Than Downtown Toronto

Massive Losses in GTA Suburbs

Canada’s condominium market is facing a sharp correction — and suburban areas are bearing the brunt of the downturn.

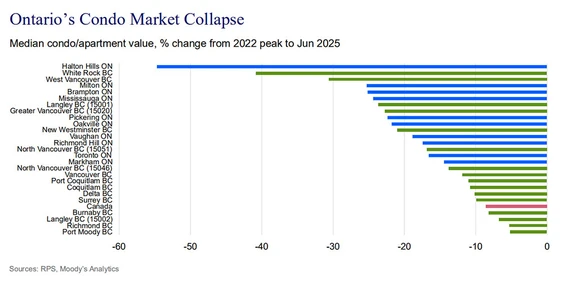

According to a new report from Moody’s Analytics, condo prices in communities surrounding Toronto, including Halton Hills, Ontario, have plummeted by more than 50% from their pandemic-era peaks. Nearby cities like Brampton, Mississauga, and Oakville have also recorded much steeper declines than the City of Toronto itself.

In British Columbia, the pattern is similar: White Rock and West Vancouver saw peak-to-trough price drops of between 30% and 40%, far above the national average condo price decline of just 8%.

“Given the booming supply, proximity is commanding a premium, and periphery markets are giving back their pandemic gains,” said Brendan LaCerda, Director of Economic Research at Moody’s.

From Pandemic Boom to Post-Pandemic Bust

During the COVID-19 lockdowns, the rise of remote work pushed many buyers toward the suburbs, sparking a surge in demand — and developers followed with rapid construction. However, this surge in new builds eventually erased the suburban price advantage.

Since Canada’s housing market peaked in mid-2022, condos have significantly underperformed compared to single-family homes. Both segments declined as interest rates climbed, but detached home prices have since rebounded, while condo values have continued to slide.

According to Canada Mortgage and Housing Corporation (CMHC), condo sales in the Greater Toronto Area were down 75% in Q1 2025 compared to the mid-2022 high. Meanwhile, pre-construction condo inventory reached a new record — 14 times higher than in 2022.

Ongoing Risks: Inventory and Interest Rates

Moody’s cautions that the short-term trajectory for condo prices depends heavily on how well the market can absorb the existing oversupply. Many pre-sale condo agreements were signed under low-rate conditions, but today’s higher interest rates may force some buyers into distress sales.

“With a wave of new supply poised to hit the market and interest rates remaining elevated, the downward trend in condo prices is likely to endure,” LaCerda added.

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More