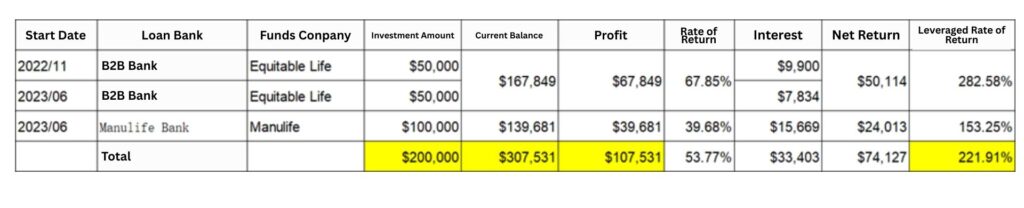

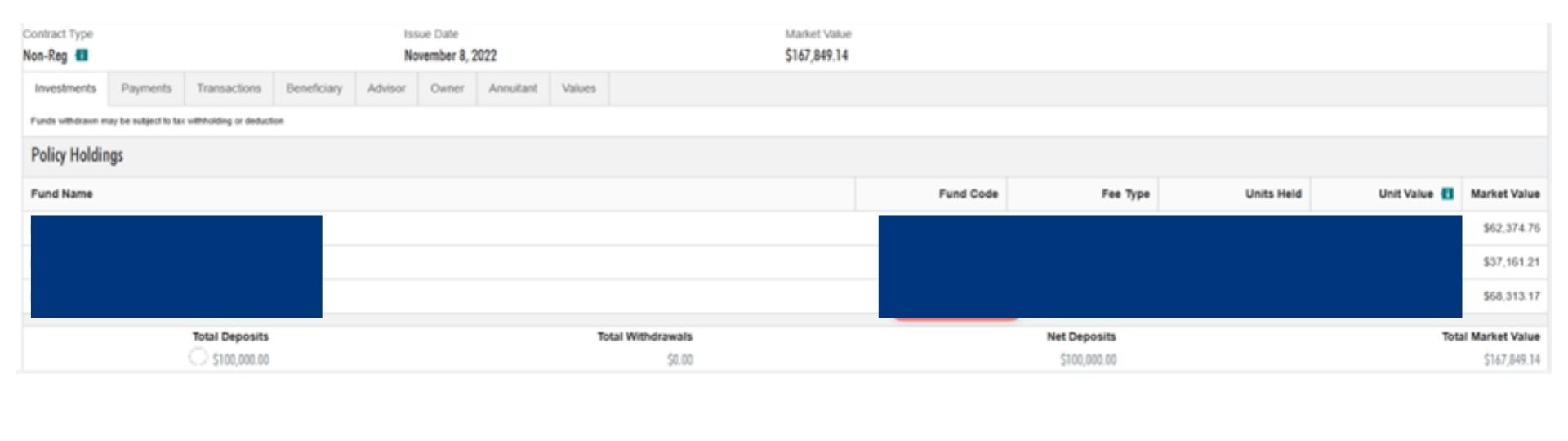

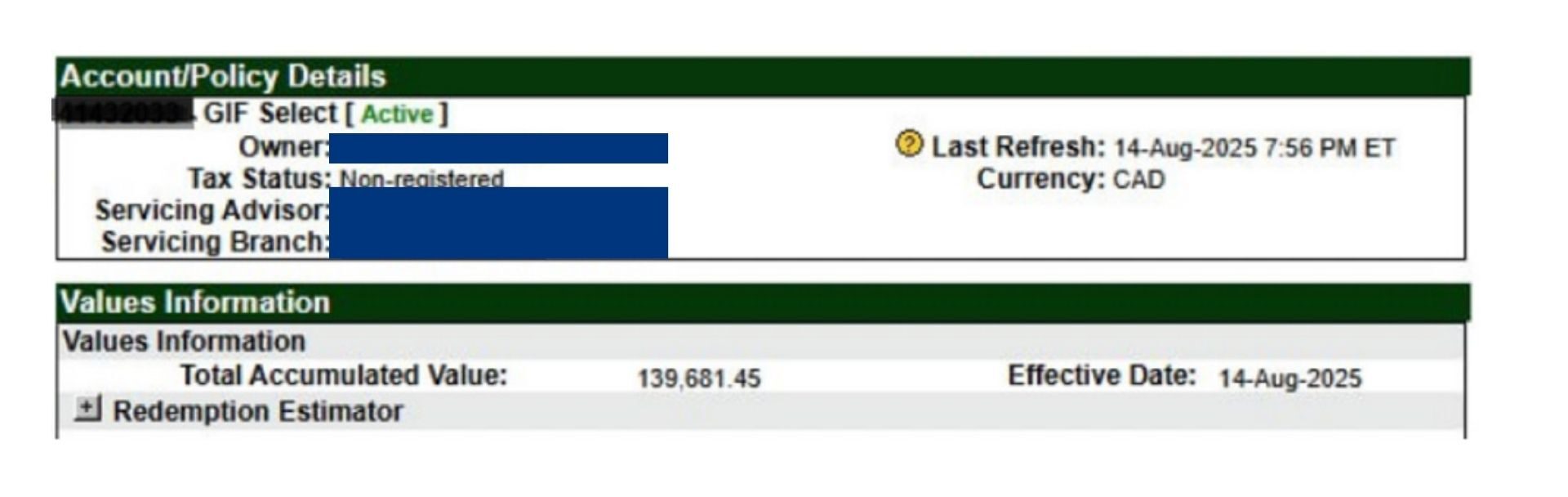

As of August 2025, her loan-funded investments grew to $307,531, generating:

✅ Profit: $107,531

✅ Return: 53.7%

✅ Leverage ROI: 222%

Family Planning: From Herself to Her Next Generation

Today, Cindy not only has a strong financial cushion for her family, she’s also started a RESP account for her future child’s education. No matter where the economy heads, her long-term lifestyle, retirement, and child’s tuition are all secured.

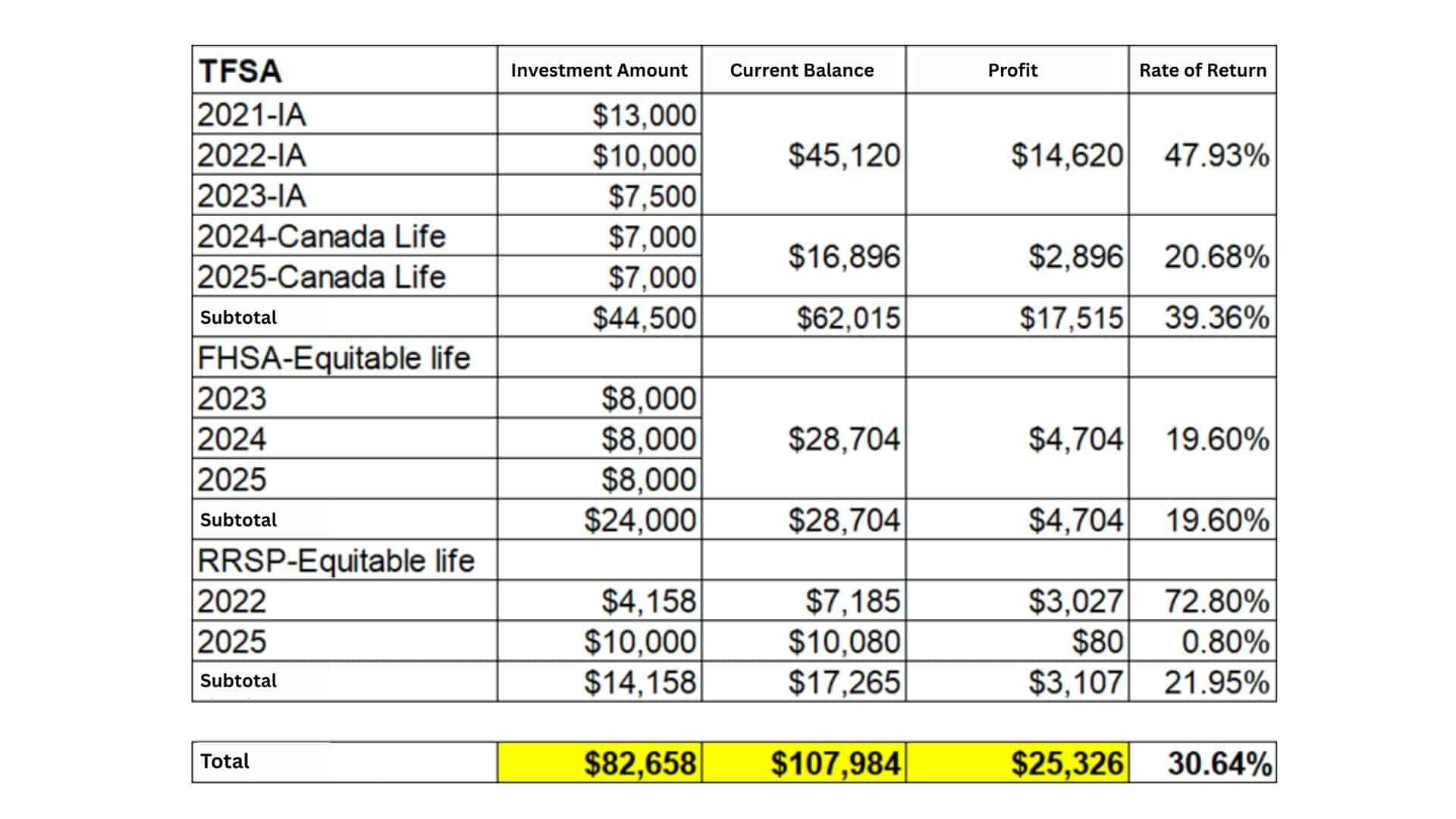

Overall Portfolio (2021–2025)

✅ Total Investment: $282,658

✅ Current Value: $415,515

✅ Net Profit: $132,857

✅ Total ROI: 47%

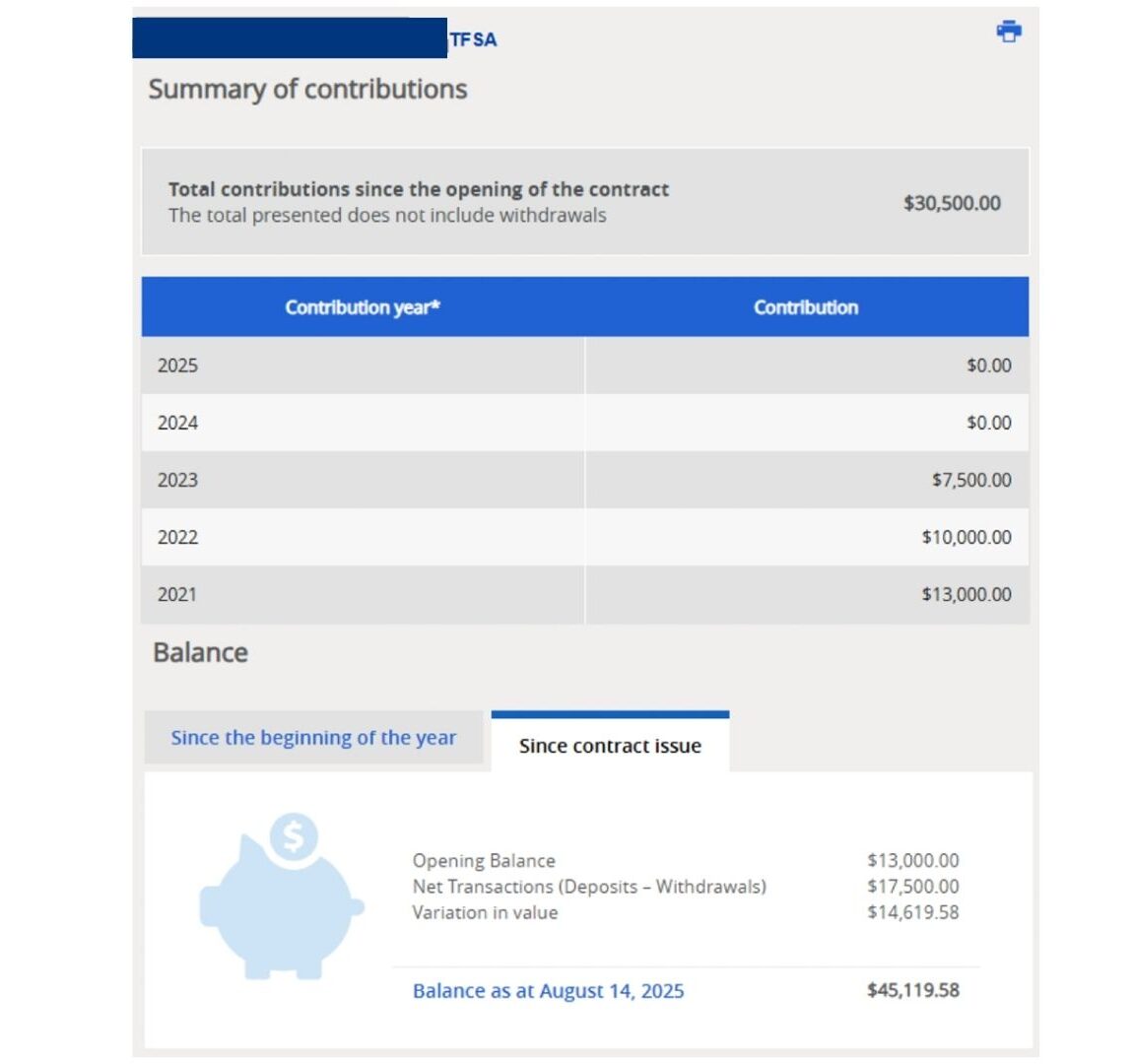

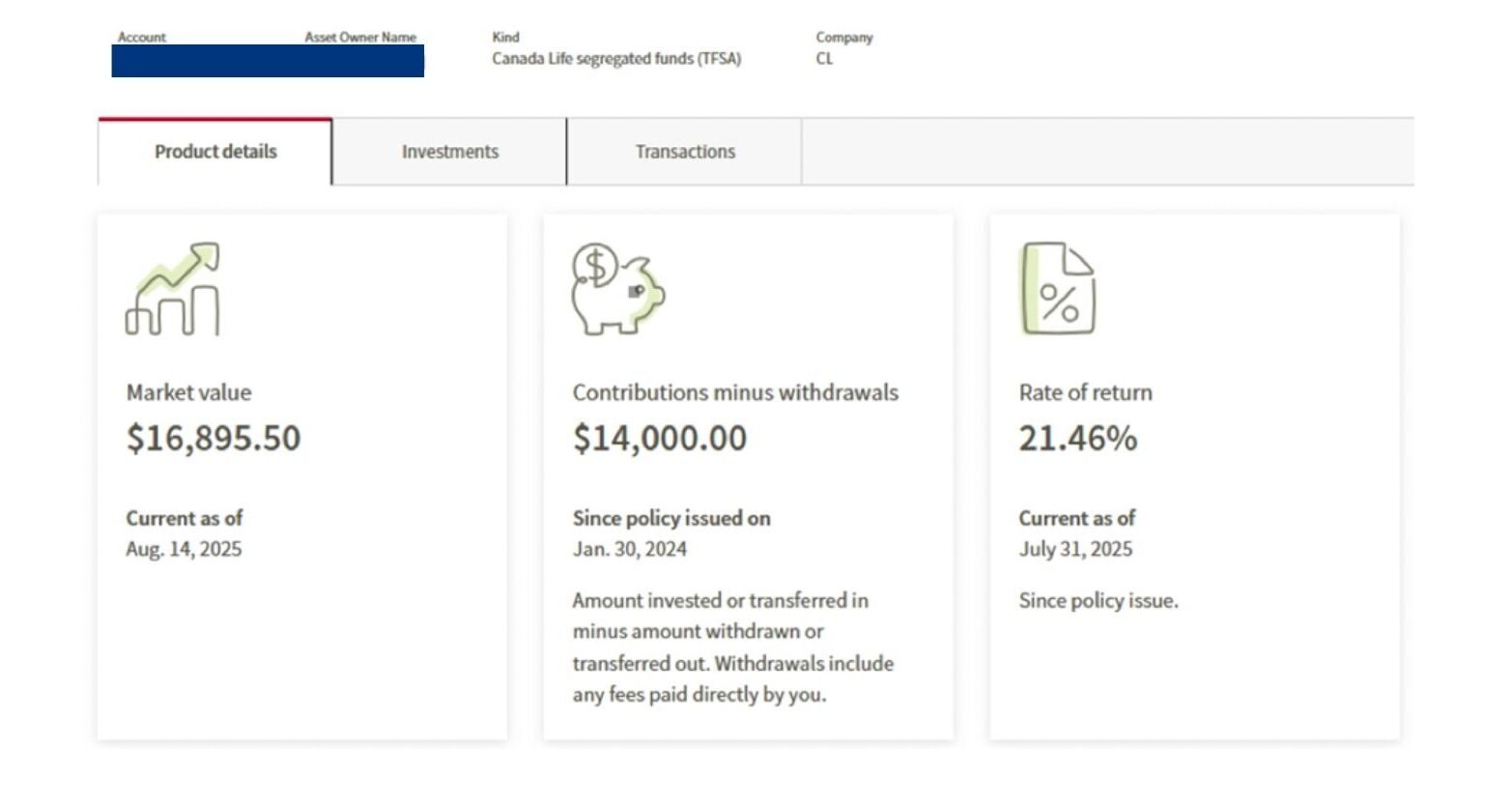

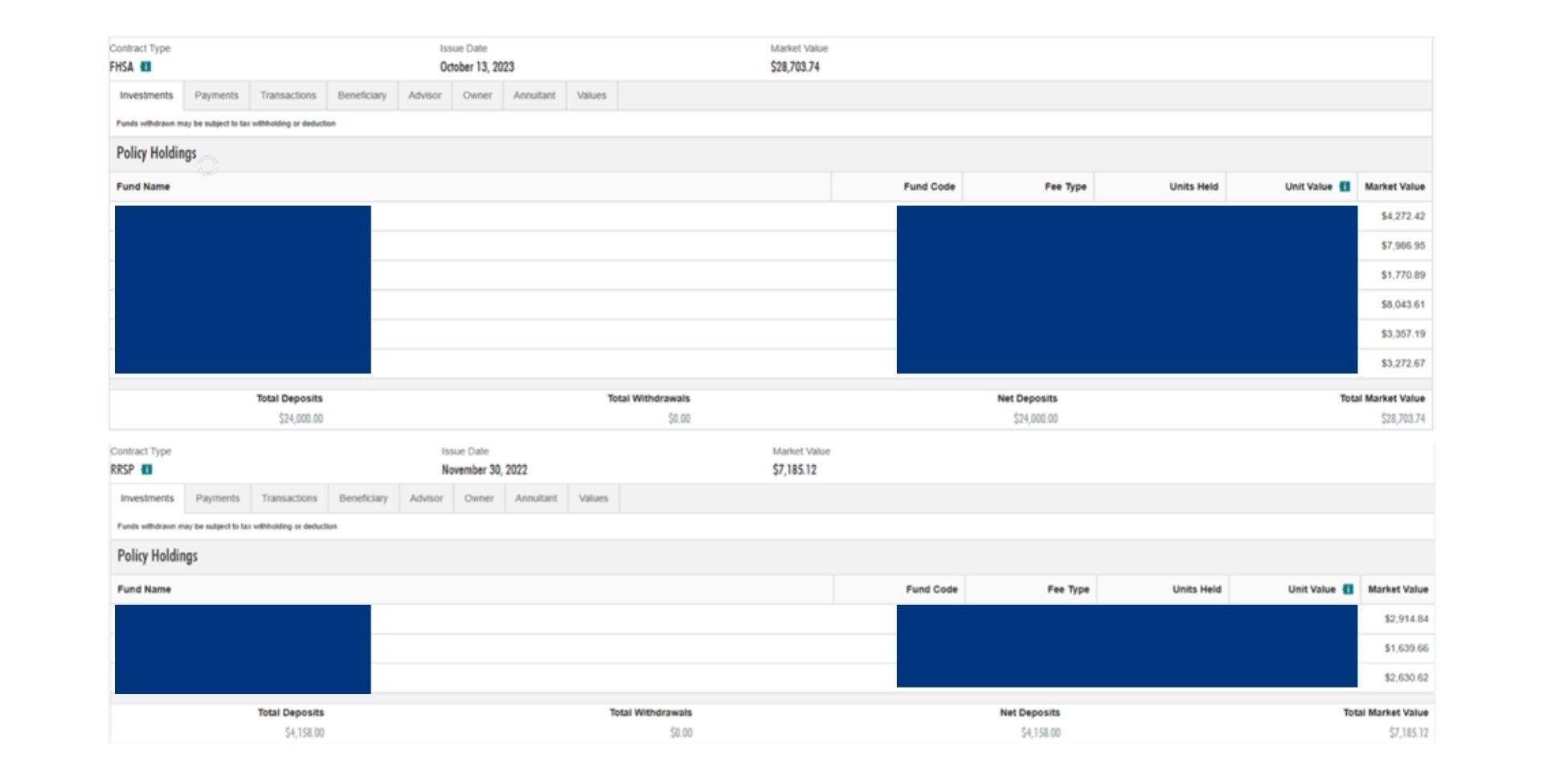

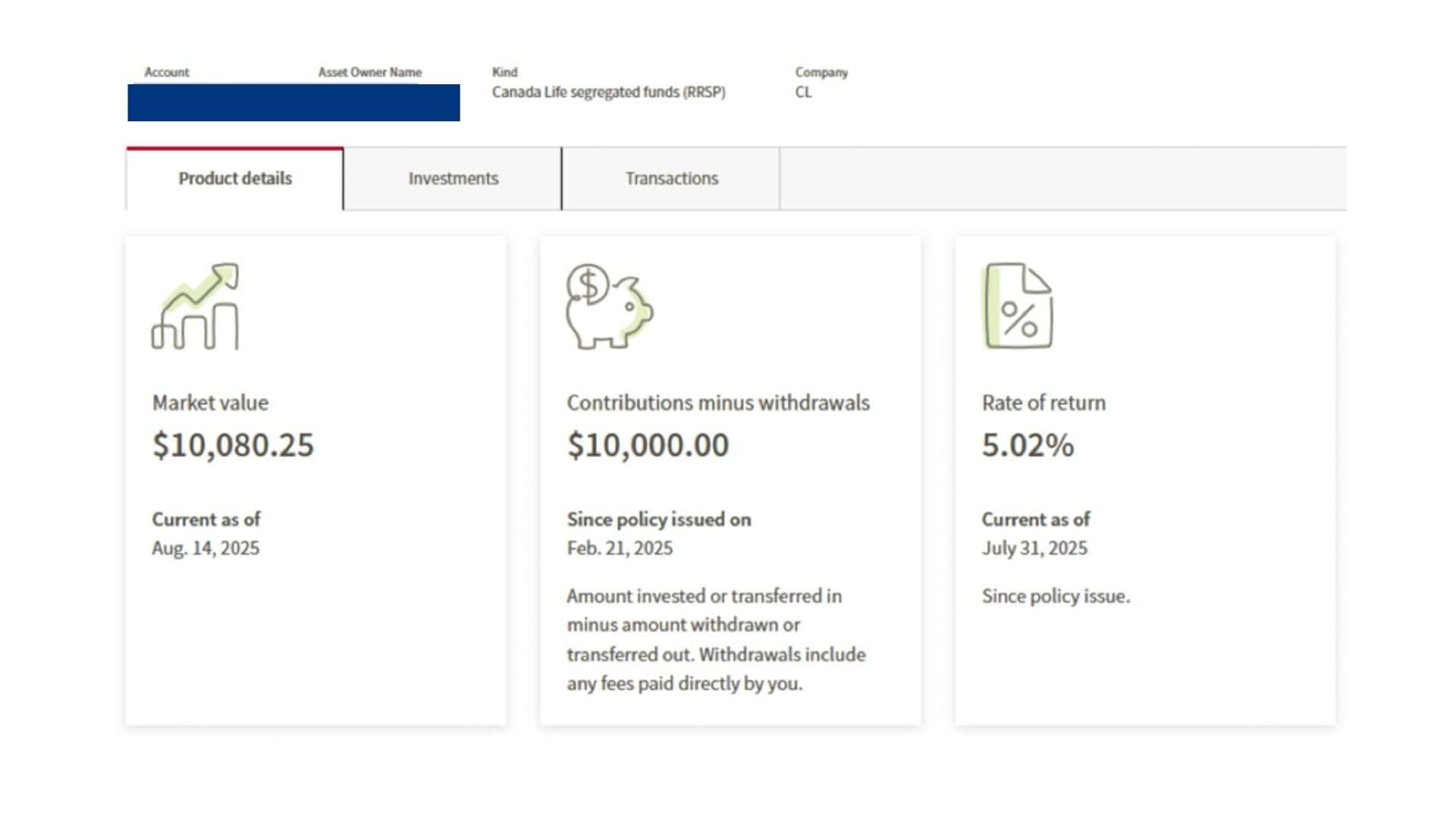

One Platform, Full Visibility

Cindy holds segregated fund accounts across four different insurance companies. In the past, checking balances meant logging into each provider separately — time-consuming and tedious.

With AiFundTech, she now only needs one login to view all her accounts: fund performance, TFSA, RRSP, FHSA, RESP — all in one place.

This has empowered her to see the big picture and make decisions quickly and confidently.

Why Cindy Succeeded

✅ All-in-One Wealth Planning with AiF

TFSA, FHSA, RRSP, RESP, Non-Reg, and investment loans all managed under one roof.

✅ Safety + Growth

Segregated funds for stability, loans for acceleration — balancing security with performance.

✅ Time is the Most Powerful Multiplier

Planning early means compounding works in your favor for decades.

What About You?

If you’re still unsure where to start —

📌 Test with a small amount

📌 Build a personal strategy

📌 Let a professional team guide you

📩 Contact AiF today to unlock your own long-term wealth journey — just like Cindy did.