Discover how a Canadian family achieved 239% returns using strategic...

Read MoreJanuary 2024: Added another $100,000 CAD into a Manulife segregated funds

In the world of financial investing, some stories speak louder than numbers. Today, we share the turning point in Zara’s investment journey—a story that may resonate with many mid-life families facing similar challenges.

Zara works a full-time job, takes on part-time gigs, and cares for three children. Her busy life leaves her with barely any time to herself.

Like many, she tried various investment and savings options. However, due to a lack of experience, she fell into poor investment traps and lost her hard-earned savings. As she reached mid-life, the looming costs of her children’s future education and her own retirement weighed heavily on her.

She often lay awake at night, haunted by a single thought:

“If I don’t change now, what will happen ten years from today?”

At the end of 2023, a friend shared their own investment results. Through Ai Financial’s one-stop asset management solution—investment loans combined with segregated funds—her friend had not only secured their capital but also enjoyed steady returns.

The data was compelling: safe, reliable, and consistently growing. For the first time in years, Zara felt hope. She gathered her courage and walked into Ai Financial’s office.

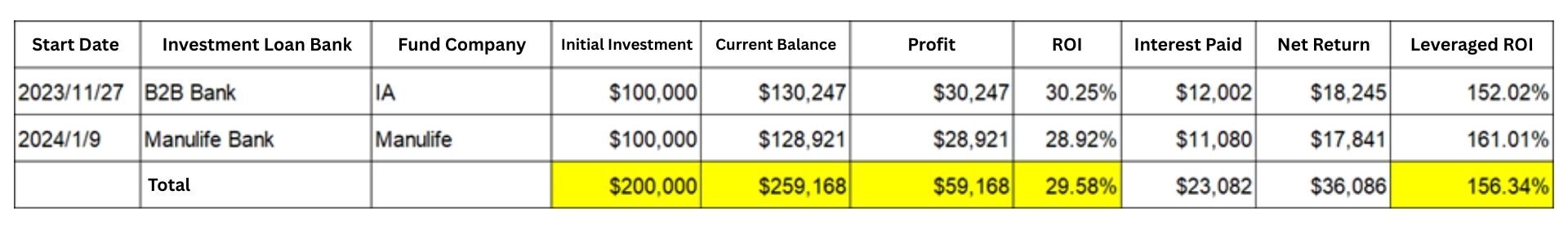

With the help of Ai Financial’s professional advisors, Zara successfully applied for a $200,000 CAD investment loan.

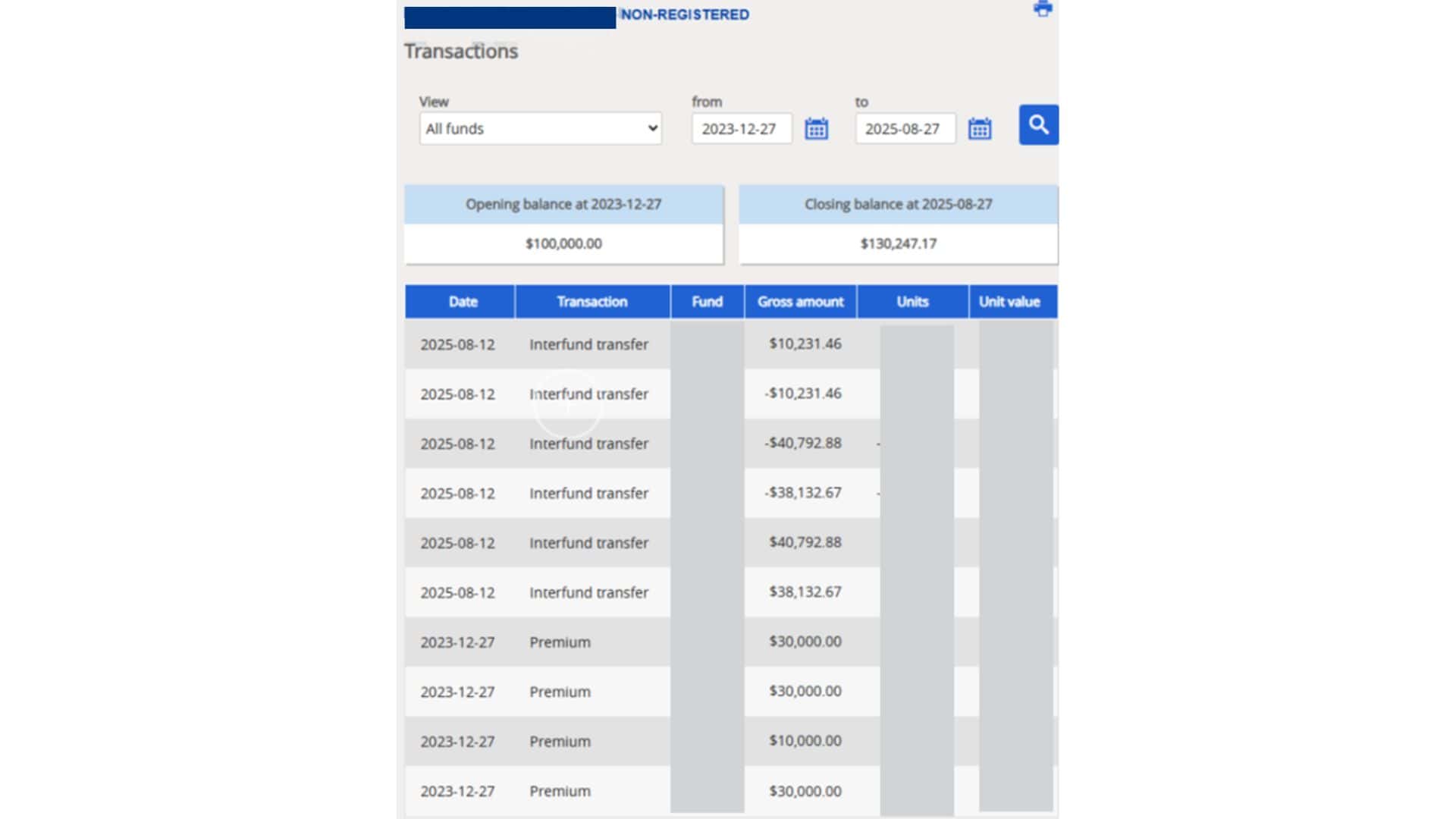

December 2023: Invested $100,000 CAD into an iA segregated funds

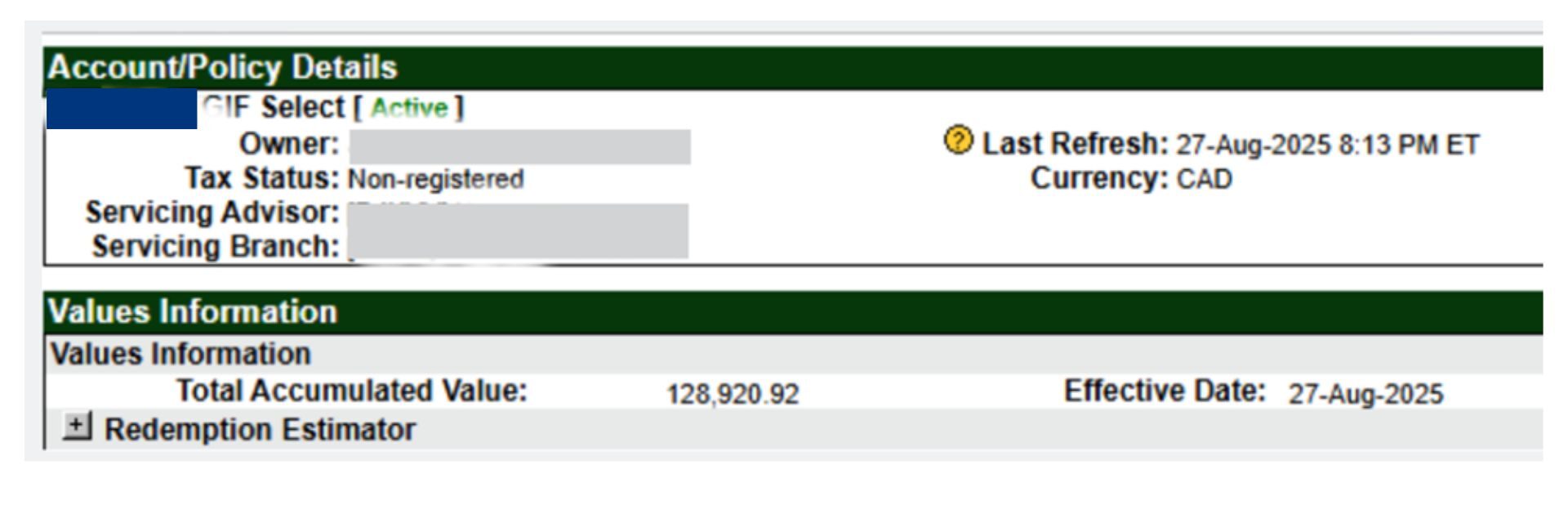

January 2024: Added another $100,000 CAD into a Manulife segregated funds

By August 2025, in less than two years, her non-registered account had grown to $259,168 CAD:

✅ Total Invested: $200,000 CAD

✅ Current Value: $259,168 CAD

✅ Profit: $59,168 CAD

✅ Return on Investment: 30%

✅ Leveraged ROI: 156%

From her initial hesitation to witnessing her portfolio grow, Zara felt for the first time that wealth could have direction. She also finally understood the power of compounding and professional support.

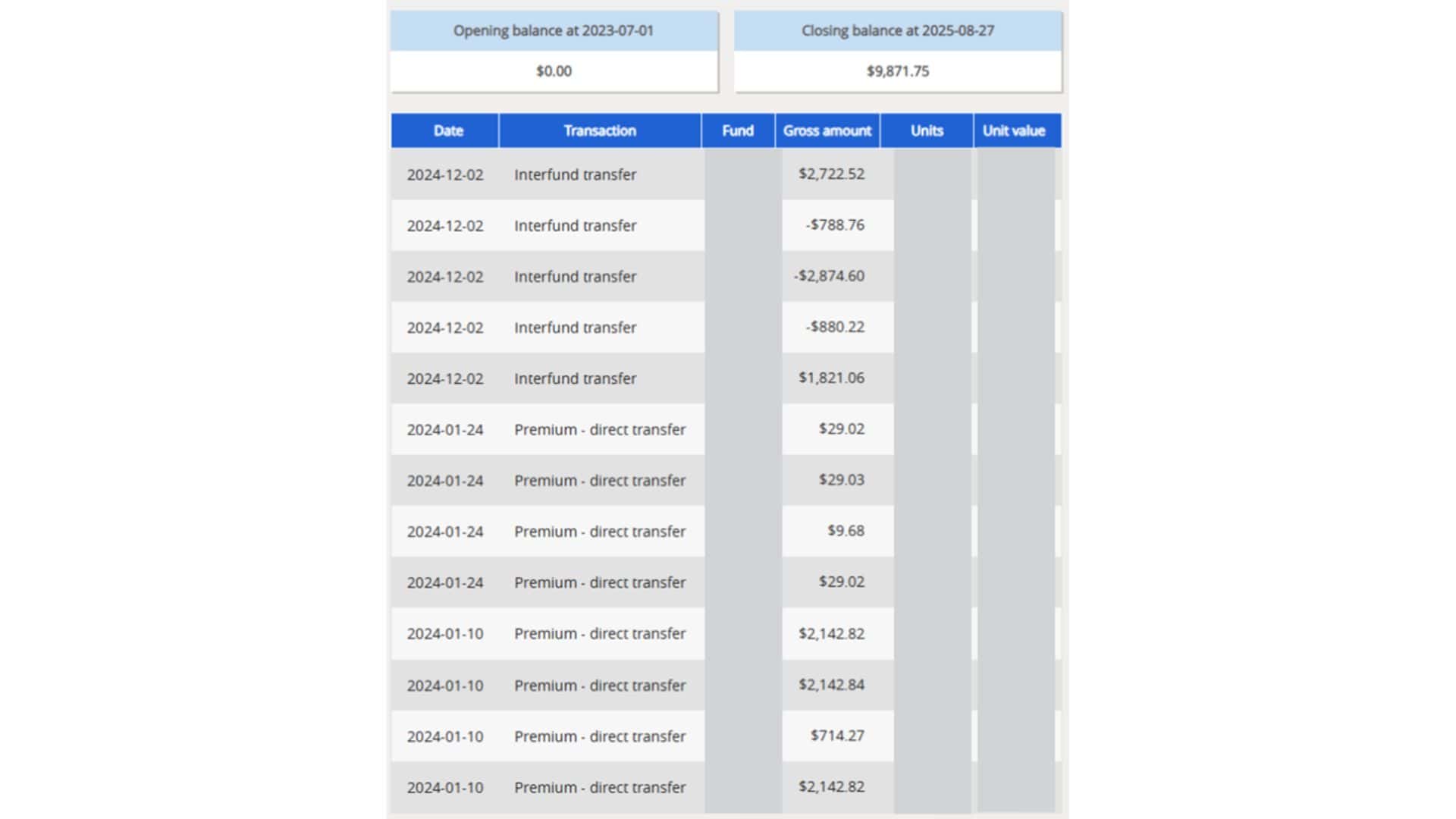

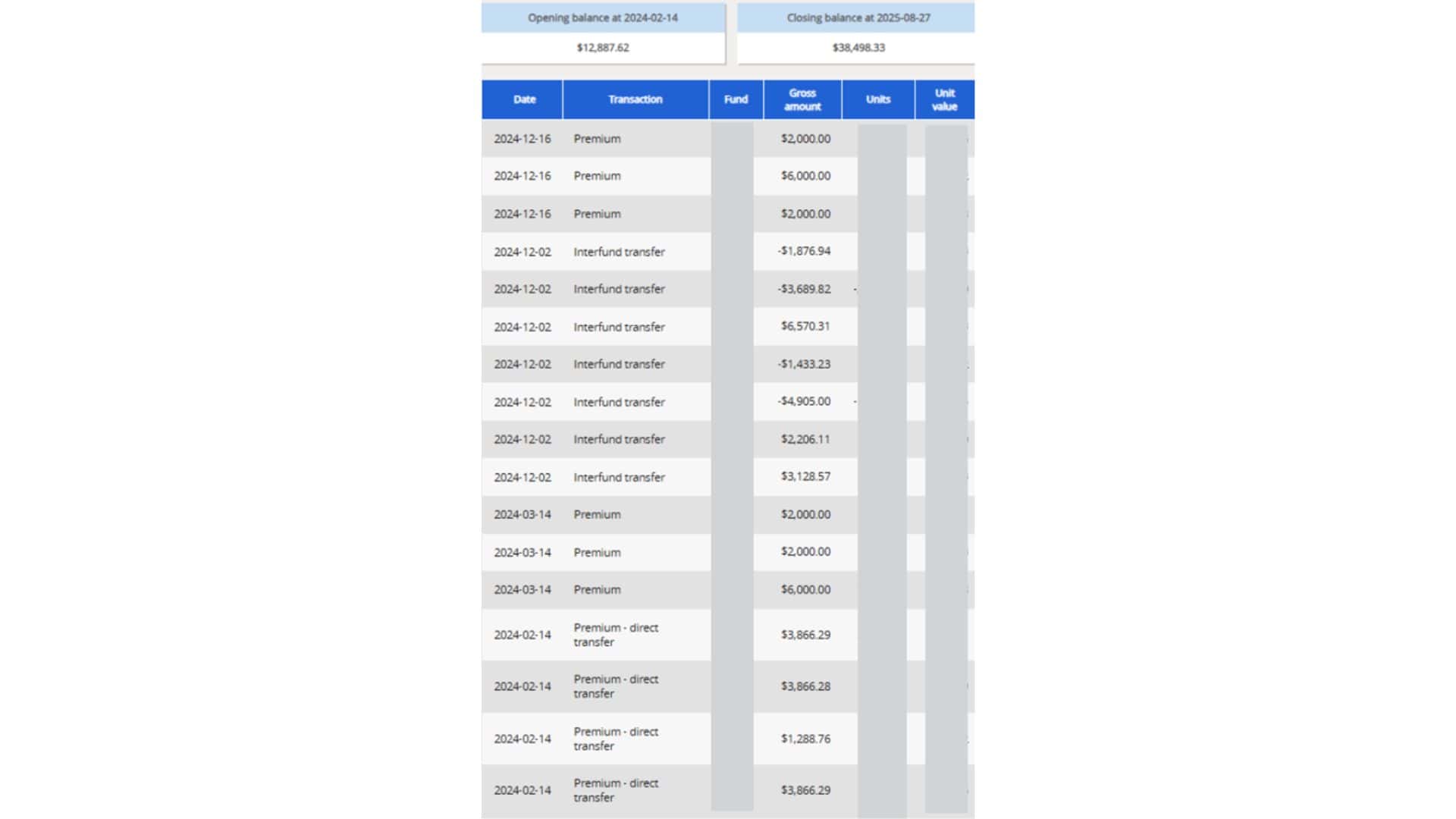

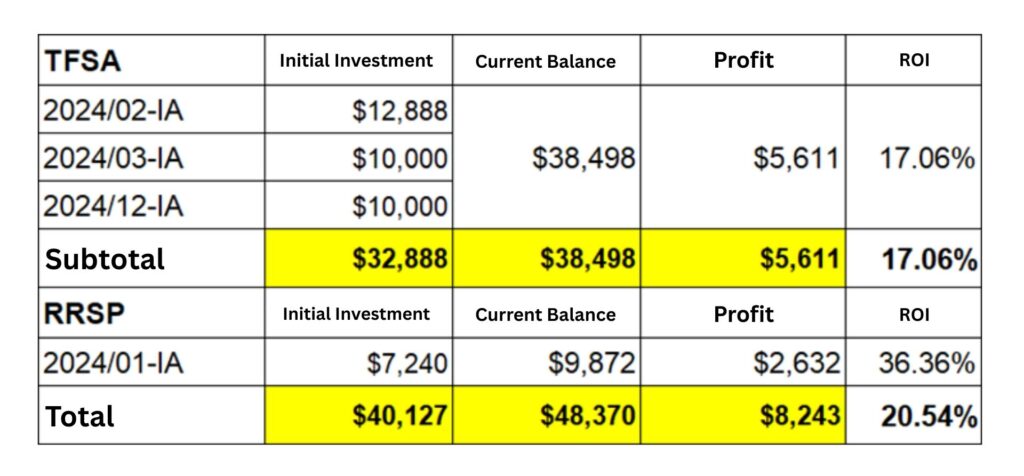

Encouraged by her early success, Zara decided not to let her other funds sit idle. She entrusted her registered accounts to Ai Financial as well:

January 2024: Transferred $7,240 CAD into RRSP

February–April 2024: Gradually transferred $32,888 CAD into TFSA

By August 2025:

✅ Total Invested (Registered): $40,127 CAD

✅ Current Value: $48,370 CAD

✅ Profit: $8,243 CAD

✅ Return: 21%

Moreover, starting August 2025, Zara committed to investing $500 CAD monthly into her TFSA, regardless of tight cash flow—because investment had become a part of her life.

Looking back over the past two years, Zara shared emotionally:

“I used to think investing was gambling—and it only made me more anxious.

Now, with a professional team guiding me, I see my money steadily growing. The future no longer feels dark.”

She finally understood the difference between speculation and strategic investment.

She once worried endlessly about her kids’ education and her own retirement.

Now, her wealth growth curve is rising alongside her children’s growth curve.

✅ Security: Principal-protected funds eliminate capital risk, giving clients the confidence to invest

✅ Simplicity: Investment loans + fund allocation = seamless one-stop asset management

✅ Efficiency: With leverage and compounding, she achieved a 156% ROI in just 20 months

✅ Support: From loan application to portfolio management, Ai Financial’s team was with her every step

To Zara, Ai Financial isn’t just a financial institution—it’s a wealth partner she met at a crucial turning point in her life.

Zara’s story is far from unique. It reflects the journey of many middle-aged families:

Busy, stressed, yet unwilling to accept financial stagnation

Wanting change, but afraid of falling into the wrong path again

Ai Financial’s one-stop asset management solution—investment loans + principal-protected funds—offers a safe, replicable, and proven path to long-term growth.

👉 In just 20 months, she went from anxiety to empowerment, from $0 profit to over $67,000 in gains.

That was Zara’s answer.

It might be yours, too.

Ai Financial – Let Your Wealth Begin Today.

If you’re ready to be like Zara and…

✔ Use small capital to unlock bigger growth potential

✔ Balance short-term and long-term returns across multiple accounts

✔ Avoid pitfalls and seize opportunities

✔ Have a dedicated professional team to review and optimize your strategy

Contact AiF and start building your long-term wealth plan today.

Discover how a Canadian family achieved 239% returns using strategic...

Read MoreZack, a Canadian soldier in his 40s, turned limited savings...

Read MoreDiscover how a millennial actuary couple used investment loans and...

Read MoreHazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreZara, a working mom of three, turned $200K into $259K...

Read More