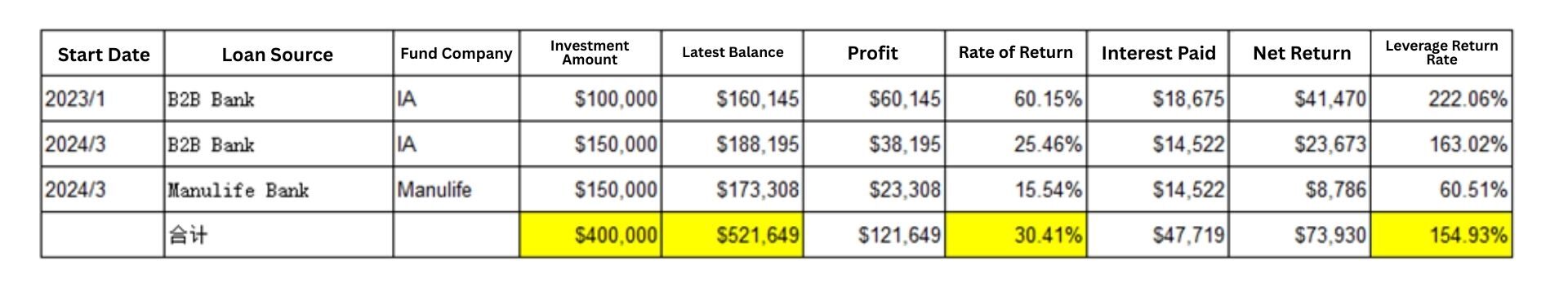

⏱ Investment period: ~2 years

💰 Total principal (loaned): $400,000

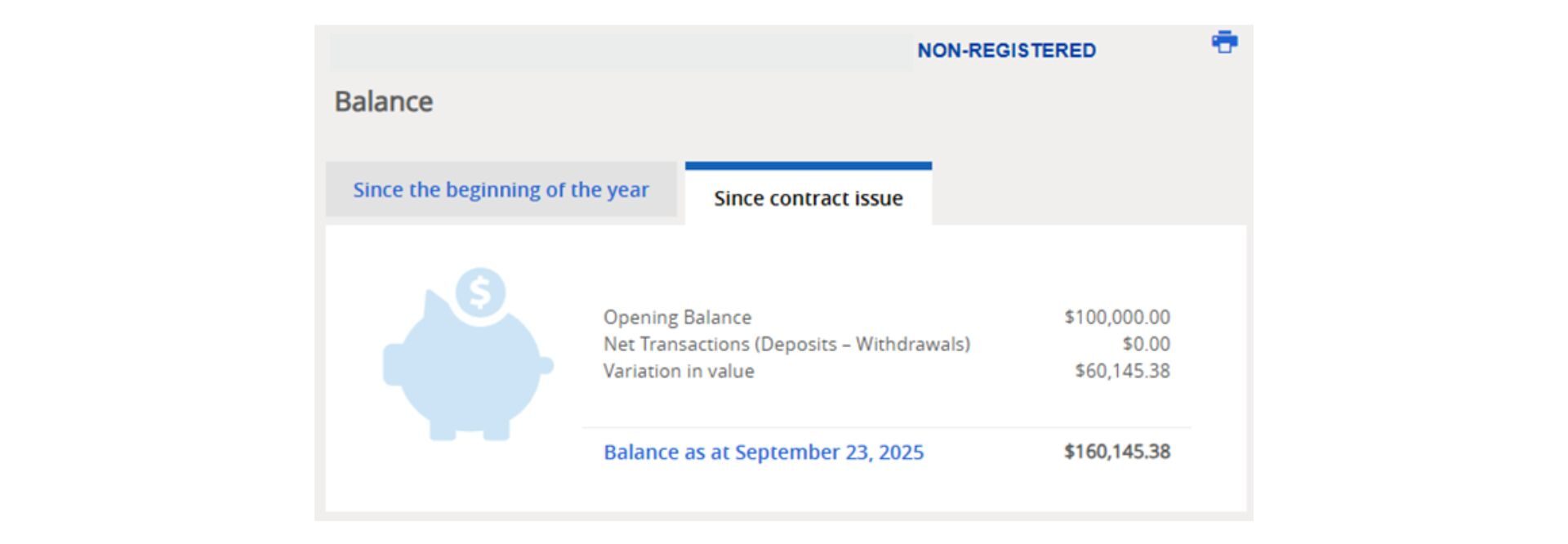

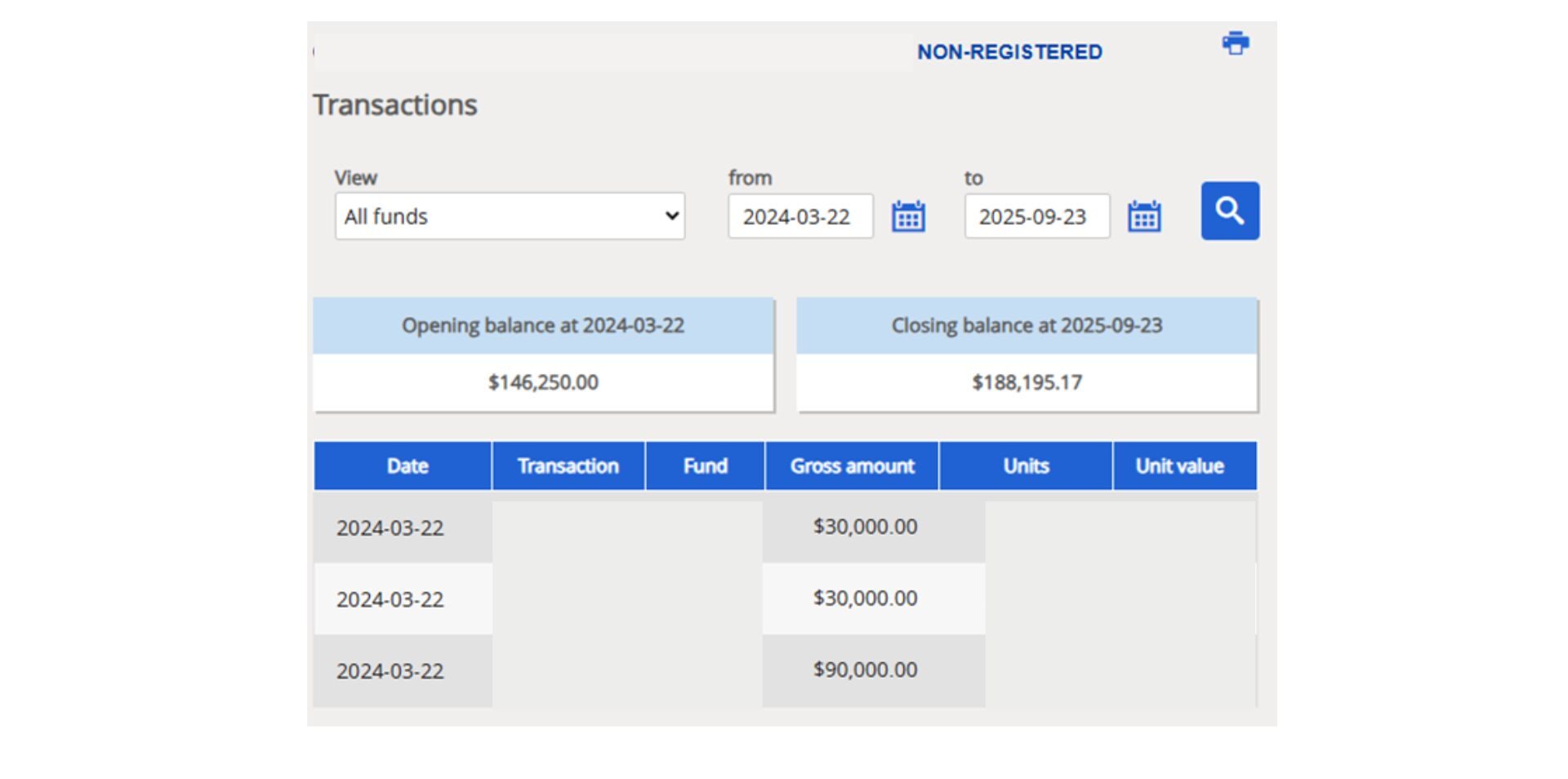

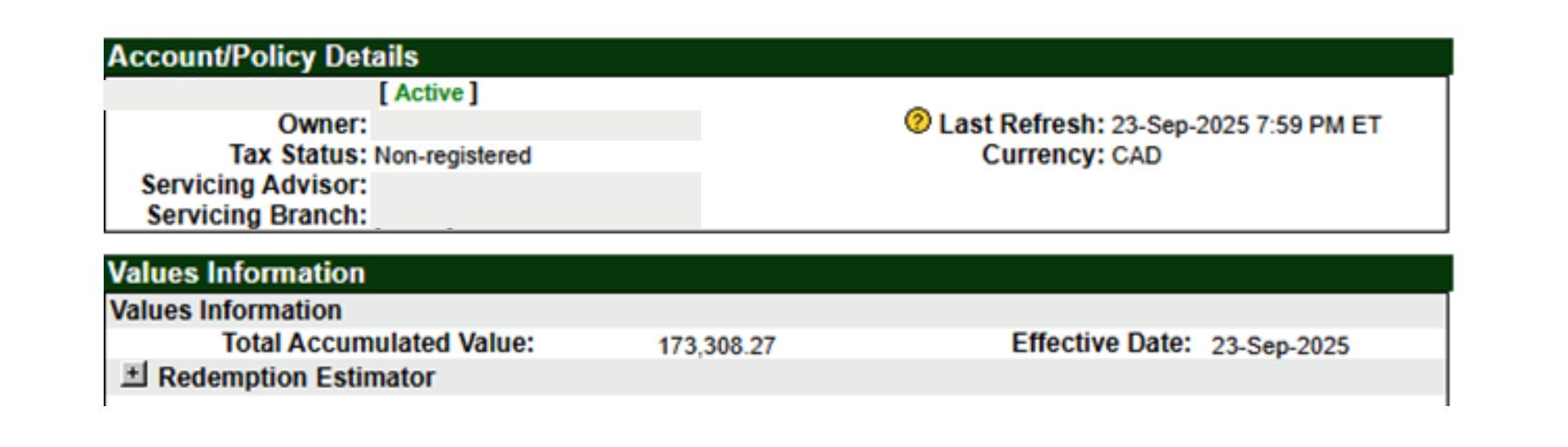

📈 Latest account balance: $521,649

💵 Profit: $121,649

✨ Total return: 30.4%

🚀 Leveraged return: 154.9%

Compared with what they could have earned using only their own savings, the growth was nothing short of a breakthrough.

Chris reflected with a smile:

“Without AiF, we would probably still be worrying about building a few hundred thousand in capital. Now, not only did we earn our first big win, but we also used leverage to accelerate our wealth accumulation.”

Strategic Adjustments Along the Way

During the two years working with AiF, the investment team made two key fund reallocations, based on market trends and future outlooks. These adjustments helped them avoid sector-wide downturns, lock in profits, and demonstrated AiF’s professionalism and forward-looking strategies.

Although they are financial professionals themselves, Chris and Cici acknowledged that AiF’s expertise and focus in asset management provided the edge they needed.

Next Step: Tapping Into the AI Era

Now, the couple is evaluating a 3:1 investment loan structure to further amplify their leverage and position themselves for the wealth opportunities of the AI-driven era.

Their journey is not just about financial growth — it’s also about a mindset shift:

This is what Ai Financial’s investment loan + segregated fund strategy makes possible:

👉 Using limited capital to unlock unlimited potential.

👉 Leveraging professional products and services so every hardworking young Canadian can benefit from today’s opportunities.

Ready to Write Your Own Story?

If you, like Chris and Cici, want to:

✔ Use smaller capital to access bigger growth opportunities

✔ Balance short-term and long-term returns with diversified accounts

✔ Avoid common pitfalls and seize timely opportunities

✔ Have a professional team to review and rebalance your portfolio

✔ Capture the wealth dividends of the future financial markets

Then connect with Ai Financial today — and start building your path to long-term wealth growth.