Discover how a Canadian family achieved 239% returns using strategic...

Read MoreCanada Faces Largest Retirement Wave: 2.7 Million Boomers to Exit Workforce — Can Economy Cope?

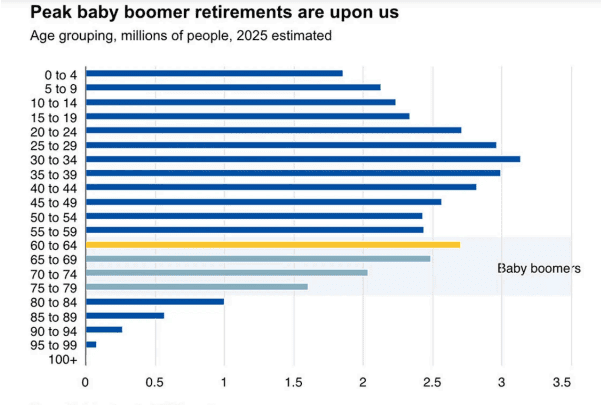

Recent reporting, notably from Global News and RBC’s thought leadership, highlights a looming demographic shift in Canada: over the next five years, the final, and largest, wave of baby boomers will be turning 65 and exiting the labour force. RBC estimates that some 2.7 million individuals currently aged 60–64 may retire in the coming years.

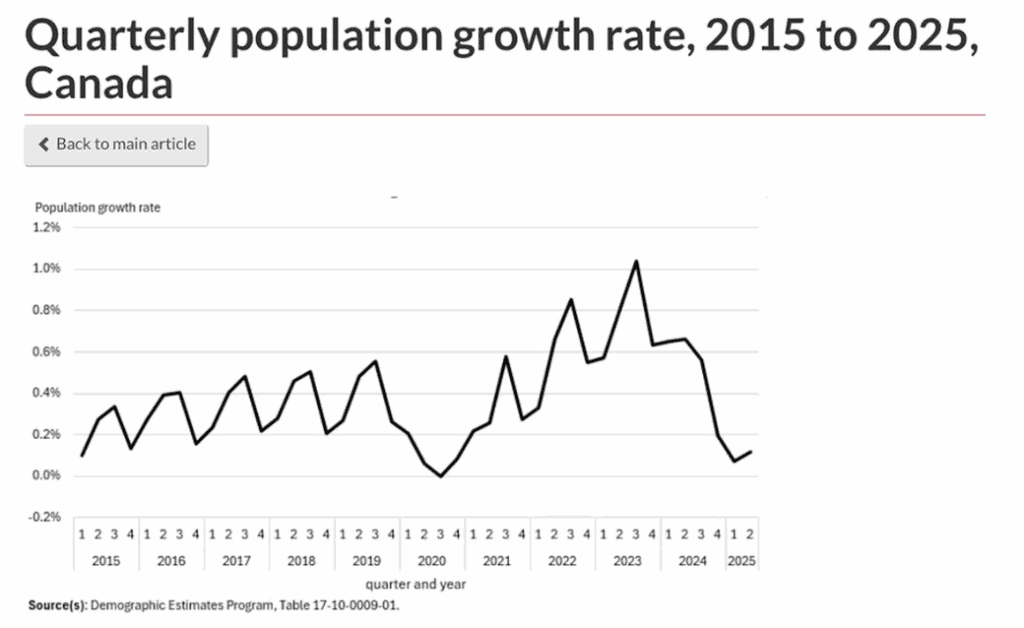

So far, about 5.2 million boomers have already retired over the past decade, contributing to structural tightening in Canada’s labour market. RBC warns that even as unemployment hovers, the real pressure lies ahead: a wave of retirees combined with slowing immigration will squeeze labour supply further.

Supporting Data & Trends

Statistics Canada reports that as of July 1, 2023, approximately 7.6 million Canadians (18.9% of population) were aged 65 or older. That share is projected to rise to between 21.4% and 23.4% by 2030.

In a demographic projection, regardless of immigration levels, Canada’s labour force participation rate is expected to decline until the 2030s, potentially stabilizing around 65%.

The Labour Market Information Council (LMIC) notes that since 2000, the share of workers aged 55+ has surged — from 1 in 9.5 to 1 in 4.6 in 2023 — intensifying retirement risk across sectors.

Fraser Institute research indicates that a 10% increase in the share of population aged 65+ is associated with a 0.23 percentage point drop in growth rate of real GDP per capita. Under aggressive aging scenarios, Canada’s per-capita GDP in 2043 could be ~13% lower than in a no-aging scenario.

On health expenditures, the Fraser Institute also projects that aging will force large increases in healthcare spending: per-capita costs for seniors are several times higher than for younger age groups, and between 2019 to 2040, health care for 65+ categories could grow by ~88%.

TD Economics likewise warns that aging will stretch firms’ ability to maintain workforce levels, and even robust immigration and participation efforts may not fully offset the trend.

RBC contends that the labour force participation rate has already declined by 1.6 percentage points between 2010 and 2024, despite rising participation among prime-age workers. They project another 2-point drop by 2030 under moderate immigration scenarios.

Risks & Challenges

Labor Supply Crunch & Mismatches

Many sectors have disproportionately older staff; when they retire en masse, key roles may face shortages. RBC notes business, support services, non-durable goods manufacturing, and agriculture are among those doubling in annual retirement churn.Escalating Health & Pension Burden

As older cohorts rise, public health costs and pension liabilities will surge. Canada’s health system is projected to incur significant strain from age-related demand.Slower Economic Growth

With fewer workers, GDP growth per capita may be suppressed. Aging population’s drag on labour inputs and increasing health burden have empirical negative correlation with growth.Regional & Sectoral Vulnerabilities

Regions aging faster (Atlantic provinces, Quebec, BC) and sectors with high older employee concentrations will feel the impact earliest. The mismatch between skills and demand may deepen.

Strategic Responses & Policy Recommendations

Boost Productivity & Capital Investment

In tightening labour conditions, output growth must rely more on efficiency gains. Automation, AI, digital transformation are essential.Extend Working Lives & Flexibility

Introduce incentives, flexible hours, phased retirements to keep capable seniors in the workforce. Government programs are increasingly supporting this.Targeted Immigration & Skills Matching

Rather than simply increasing numbers, Canada needs strategic selection and integration of immigrants aligned with sectoral skill gaps.Promote Mobility & Reallocation

Encourage interprovincial migration, retraining, and cross-sector shifts to balance local deficits.Strengthen Long-Term Care & Health Infrastructure

Expand capacity for elder care, home care, caregiver support, telemedicine — to absorb rising demand without collapsing systems.Invest in Future Workforce

Early investments in education, lifelong learning, STEM / green skills will help refill gaps left by retirees over time.

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More