Discover how a Canadian family achieved 239% returns using strategic...

Read MoreHow to Make $100 Billion in a Day: What We Can Learn from Oracle’s Larry Ellison

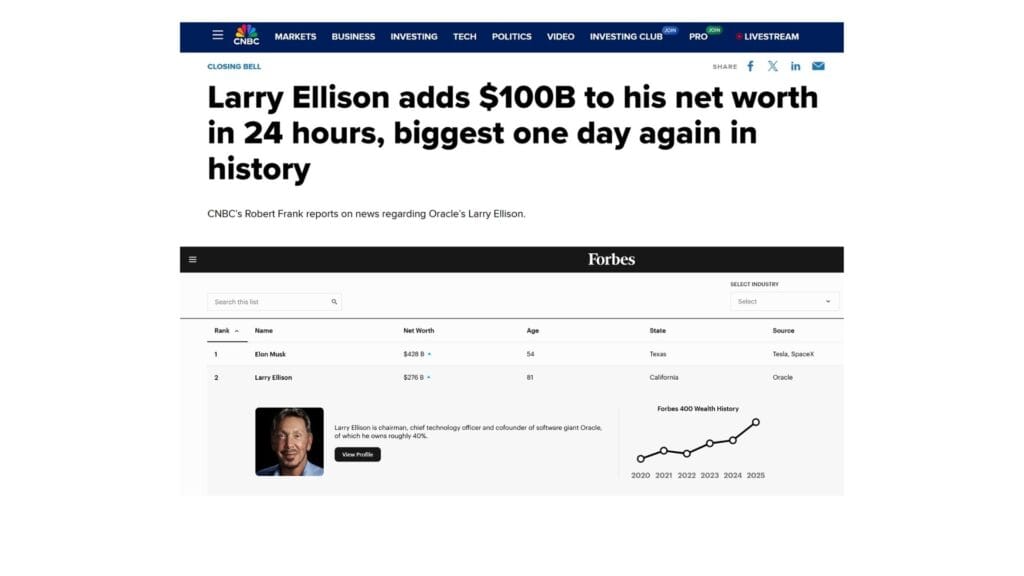

On September 10, 2025, Oracle founder Larry Ellison saw his net worth soar by an astonishing $100 billion in just one day. It wasn’t an exaggeration—it was a record-breaking reality. In only 24 hours, his total wealth jumped to $365 billion, surpassing Jeff Bezos and Mark Zuckerberg, and securing the No. 2 spot on the Forbes Billionaires List—second only to Elon Musk.

The idea of “making $100 billion in one day” sounds almost impossible. Naturally, people began to speculate: did he make a lucky bet on crypto? Sell off a chunk of his stock? Win the world’s biggest lottery? The answer to all three is no. Ellison’s massive wealth surge had nothing to do with luck—or speculation. Instead, it came from a powerful and disciplined system: a long-term wealth structure built on the idea of “using the money of the future to invest in the future.”

The Secret: He Doesn’t Sell — He Borrows

Ellison’s fortune is the product of an unconventional choice: he doesn’t sell his stock; he borrows against it. For nearly five decades, he has maintained firm control over Oracle, holding the company’s core shares without cashing out. While other founders sold equity to raise cash, Ellison took a different path—he used his Oracle shares as collateral to secure massive loans, unlocking liquidity while keeping his ownership intact.

This approach may sound counterintuitive, but it’s remarkably effective. By borrowing instead of selling, Ellison retained full control of his company, avoided triggering taxes, and gained the flexibility to invest, spend, or even donate on his own terms. The result: the more he borrows, the richer he becomes.

Turning Risk into Structure

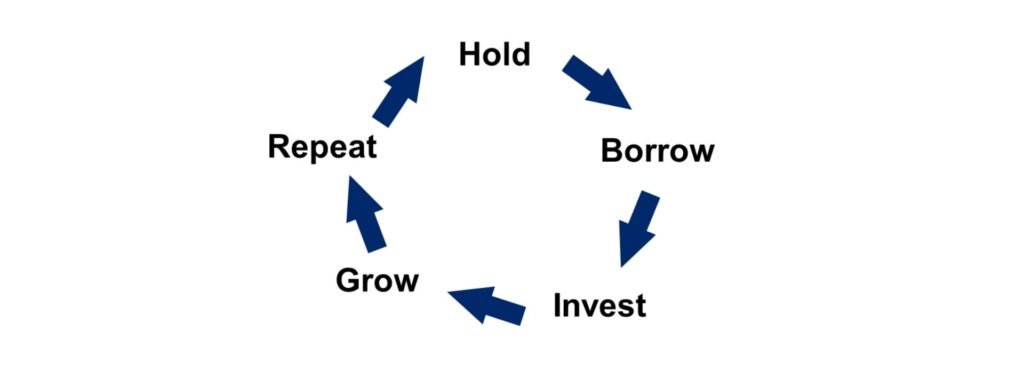

When most people hear “borrowing to invest,” they instinctively think of danger. But in Ellison’s case, risk isn’t avoided—it’s engineered. His wealth doesn’t depend on short-term trades or speculative bets. Instead, it compounds through a structured, self-sustaining cycle:

Hold → Borrow → Invest → Grow → Repeat.

By continuously repeating these five steps, Ellison built a financial ecosystem that keeps his money in motion while his core assets stay untouched. When others build wealth by saving, he builds wealth by structuring—letting his capital flow, multiply, and return.

The Ai Financial Perspective

This is exactly what Ai Financial’s latest webinar explored: the structural logic behind Ellison’s “Wealth Flywheel.” His method isn’t magic—it’s a design.

Our discussion broke his strategy into four key parts:

- The Billionaire Who Borrows to Get Rich – How Ellison leverages loans to grow wealth.

- Reverse Wealth Thinking – Why his approach defies traditional financial advice.

- The Money Loop – How “borrowing” becomes the engine of compounding growth.

- How Ordinary Investors Can Replicate It – Using structure and safety to achieve steady returns.

Ellison’s story offers a timeless lesson: true wealth doesn’t come from luck or austerity—it comes from structure, leverage, and disciplined logic. In an era shaped by changing interest rates, volatile markets, and persistent inflation, understanding the right structure may be the most powerful first step toward building your own financial freedom.

Ai Financial — Turning Structure into Strength.

When your capital is protected and your cash flow moves in a cycle, you’re not just saving money—you’re building a system that works for you.

Part I|The Billionaire Who Borrowed His Way to the Top

— Larry Ellison’s Origins, Leverage, and the Logic Behind His “Borrowed Life”

From Folding Chairs to Oracle

Larry Ellison was born into an ordinary family in Chicago and was raised by his aunt and uncle. He dropped out of college before graduation and started his career repairing computers and writing code. In 1977, with two partners, he rented a small office in California—just a few thousand dollars in startup capital and a few folding chairs—and created the first version of the Oracle database. Few believed the small startup would survive, but fifty years later, Oracle has become one of the world’s most essential enterprise software and AI cloud providers. Today, thousands of banks, hospitals, airlines, and government agencies rely on Oracle systems. Every time you swipe a credit card, book a flight, or register at a hospital, there’s a good chance Oracle’s code is running in the background.

Now at 81, Ellison remains active at the forefront of business. With a net worth of roughly $365 billion, he ranks No. 2 globally on the 2025 Forbes Billionaires List, trailing only Elon Musk.

Long-Term Holding: Turning Stock into a Gold Mine

Unlike many of his peers in Silicon Valley, Ellison has almost never sold his Oracle shares. He treats stock not as a cash dispenser, but as a gold mine—you can withdraw from an ATM until it’s empty, but a mine grows deeper and richer with continued work. Through the dot-com crash and the 2008 financial crisis, he never wavered or sold. Oracle evolved from databases to cloud computing to the AI era, where its cloud business has surged in recent years, driving its stock to record highs.

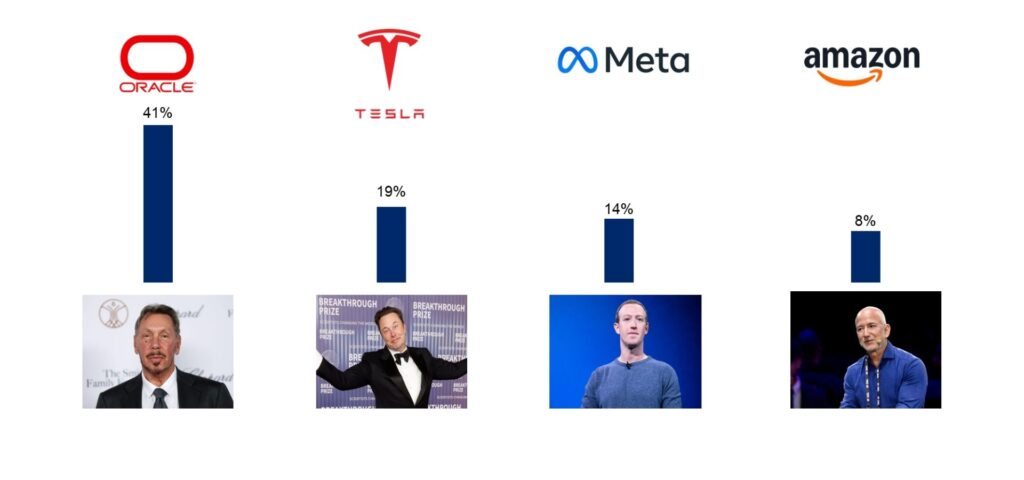

Continuous share buybacks also boosted his control. Over the past 15 years, Oracle has reduced its outstanding shares by more than 30%, passively increasing Ellison’s stake from about 23% to roughly 41%. As a result, his control strengthened even as the company expanded.

Borrowing Instead of Selling: Principal Stays, Cash Flows Move

Ellison’s core strategy defies conventional wisdom: instead of selling shares, he borrows against them. Unlike the traditional “sell–pay tax–lose equity–dilute control” route, stock pledging gives him liquidity without selling, while deferring or eliminating capital gains tax and even deducting loan interest as an expense.

Public filings show that Ellison pledged around 277 million Oracle shares—worth about $82 billion at the time—to raise funds. He then directed that capital into acquisitions, real estate, philanthropy, and long-term research projects. His holdings never shrank, his control never weakened, and his influence kept expanding beyond Oracle’s balance sheet.

Why He Can “Play in Reverse”: The Foundation of Control and Cash Flow

Most companies discourage executives from pledging stock, fearing forced sales during downturns that could threaten control. Ellison, however, received special approval from Oracle’s board and easy access to credit from major banks. The reasons are clear:

- High-quality assets – Oracle generates consistent profits and cash flow.

- High ownership stake – His 41% stake gives him control and stability.

- Disciplined use of leverage – Borrowed funds flow into productive, income-generating assets.

His leverage isn’t reckless; it’s a structure built on a triple foundation of quality assets, strong cash flow, and secure control.

Where the Money Goes: Spending for Assets, Not Appearances

Ellison’s loans didn’t fund consumption—they expanded his empire:

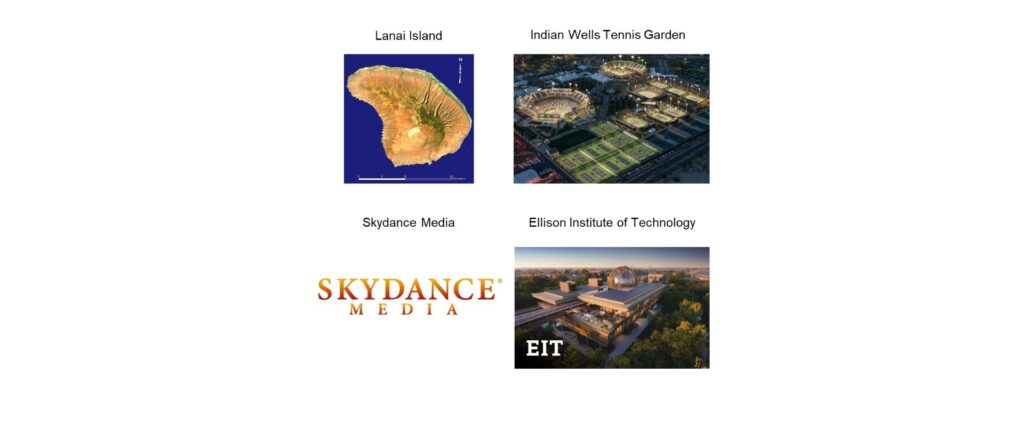

- Real Estate: Two oceanfront mansions in Florida, valued at $170 million and $277 million, serving as prime long-term assets with cash flow potential.

- Media & Entertainment: Funded his son David Ellison’s Skydance Media, which acquired Paramount Pictures for $8 billion—establishing a new content powerhouse.

- Science & Philanthropy: Founded the Ellison Institute, a research partnership with Oxford University focusing on cancer, AI, climate, and food security.

- Sports: Owns the Indian Wells Tennis Garden (the “fifth Grand Slam”) and has openly mused about buying the NBA’s Los Angeles Lakers “just for fun.”

Each of these moves—though they appear to be “spending”—is actually the extension of assets and the creation of new cash flow channels. Real estate appreciation, intellectual property rights, event revenue, and institutional prestige all feed back into his expanding wealth network.

The Core Mechanism: Let the Money’s Shadow Run, Keep the Principal Home

Ellison’s wealth didn’t come from saving or trading—it came from structure. His entire system runs on a disciplined cycle: Hold → Borrow → Invest → Grow → Repeat. He keeps his principal—his Oracle shares and control—secure in his “vault,” while sending the “shadow of money” (borrowed capital) into the outside world to generate returns.

The profits cover interest, strengthen his balance sheet, and fuel the next round of investment. Over time, the flywheel accelerates: the richer he gets, the more he can borrow; the more he borrows, the richer he becomes. It’s a compounding cycle of control, leverage, and growth, not a one-time cash-out game.

A Clear Divide from Conventional Thinking

Most investors pursue “diversification, liquidity, and deleveraging” in the name of safety. Ellison achieves true safety through concentration, structure, and controllable leverage. He keeps risk within assets he understands and manages directly, while allowing growth to unfold in compounding, long-term projects.

In the end, this structured safety proves far more effective than the illusion of stability offered by traditional methods. Ellison’s story is a reminder that wealth isn’t built by avoiding risk—but by designing it.

Part II|Reverse Wealth Thinking: The Billionaire Who Thinks Backwards

The Billionaire Who Thinks Backwards

Larry Ellison’s investment logic overturns almost everything we’ve been taught about personal finance. He borrows money, avoids diversification, refuses to cash out—yet somehow became the second-richest person in the world. His approach runs completely counter to conventional financial wisdom, but his results speak for themselves.

While most people fear debt, volatility, and risk, Ellison uses structure to transform those very “risks” into controllable tools. He leverages debt to expand assets, uses design and discipline to absorb market shocks, and turns ownership control into a stable stream of cash flow.

Others focus on avoiding losses; he focuses on engineering consistency. Others spend their lives “playing defense”; he built a system that plays offense even in chaos. In other words, Ellison isn’t anti-investment—he’s anti-orthodoxy. He challenged the so-called golden rules of finance and proved, through results, that true safety doesn’t come from avoiding risk—it comes from mastering it.

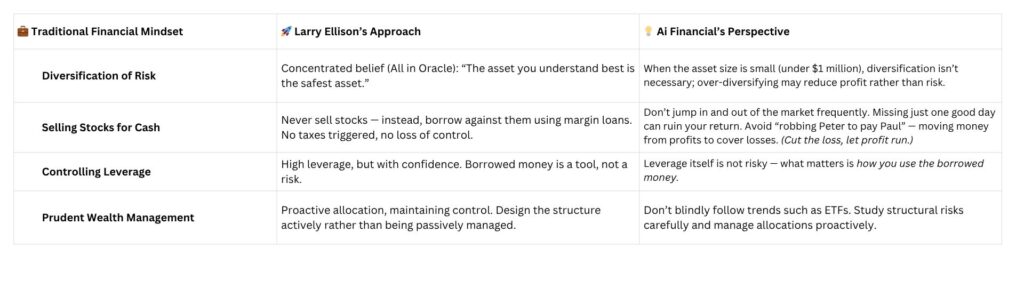

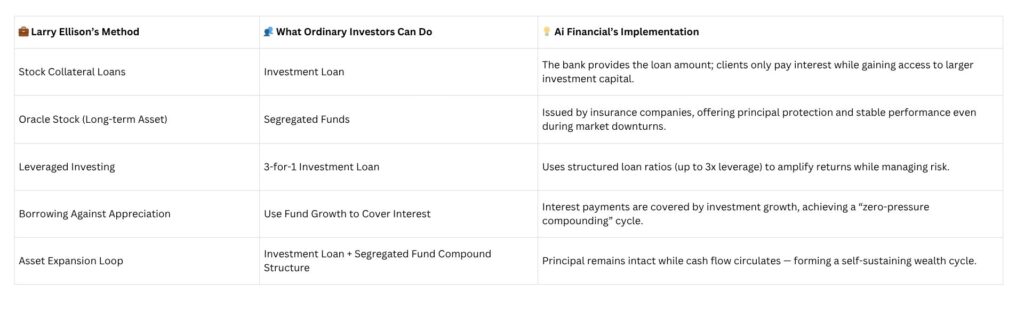

Traditional Finance vs. Ellison’s Model vs. Ai Financial’s Structure

What makes Ellison’s system so powerful is that it exposes a deeper truth: wealth doesn’t grow through saving—it grows through structure.

Below is a comparison of three fundamentally different financial approaches—traditional investing, Ellison’s leveraged system, and Ai Financial’s modern, structured model designed for ordinary investors:

In Ai Financial’s framework, “stability” doesn’t mean staying still — it means structural stability. The principal is protected by insurance companies through Segregated Funds (Seg Funds), while loan capital flows into investments through Investment Loans. Returns cover the interest and flow back into the principal account, forming a secure and sustainable cycle.

This is what we call the “Safe Version of the Ellison Structure” — the principal stays still, cash keeps moving, and compounding continues indefinitely.

Why He Can “Go Against the Rules”

At first glance, borrowing against stock seems risky. Yet Ellison manages to do it safely, thanks to three core strengths:

- High-Quality Assets as a Foundation – Oracle is the backbone of enterprise databases and AI cloud infrastructure, with strong cash flow and high barriers to entry.

- High Ownership Ratio – Holding 41% of Oracle means he controls the company’s destiny; no one can force him to sell.

- Disciplined Borrowing – Every loan is directed toward appreciating, income-generating assets — real estate, technology, media, and research. He never borrows to spend, only to invest.

Most people fear leverage because they lack control, hold unstable assets, or have uncertain cash flow. Ellison’s leverage, however, is structured leverage — risk is contained within the system, while returns exist outside of it.

Ai Financial follows the same logic. Investment loans aren’t about encouraging debt; they’re about letting money work for you within a controlled boundary. Borrowed capital enters a regulated insurance structure, where principal protection and investment growth together cover the interest — creating a system in which “the shadow of money moves outside, while the principal stays safely at home.”

The Ceiling of Traditional Finance vs. the Channel of Structural Wealth

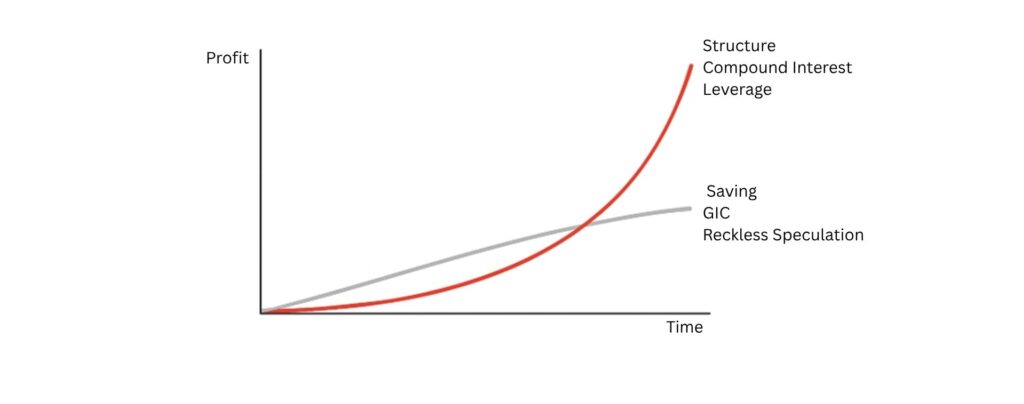

Traditional finance relies on a “savings mindset”: earn a little, save a little, repeat. These wealth curves rise slowly in the beginning, then flatten out — interest is eroded by inflation, and time dilutes the power of compounding.

Ellison’s philosophy follows a “structural mindset.” He doesn’t sell assets; he lets his structure replicate cash flow. The principal stays still while the cash flows; assets never sleep — the structure earns while he holds.

The difference between the two approaches is like the gap between two curves. The gray curve represents “savings-based finance” — steady but stagnant. The red curve represents “structured wealth” — slow at first, but accelerating exponentially once compounding begins.

Ai Financial’s philosophy is to help ordinary investors cross this wealth divide. In traditional finance, the endpoint is safety without growth; in structural wealth, the starting point is safety with growth.

The Shared Logic of Ellison and Ai Financial

Larry Ellison’s success is built on a structured safety system — concentrated ownership, leveraged investing, compounding growth, and a self-reinforcing cycle. Ai Financial applies the same system to everyday investors:

- Principal Protection: Guaranteed by insurance companies through Segregated Funds.

- Cash Flow Movement: Enabled through Investment Loans that power continuous reinvestment.

- Interest Coverage: Returns from investments offset borrowing costs.

- Replicable Structure: You don’t need billions to build a safe, compounding “Ellison flywheel.”

Wealth is not built by saving more — it’s built by designing the right structure.

That is the shared logic between Larry Ellison and Ai Financial.

Part III|The Money Loop: Let the Shadow of Money Move While the Principal Stays Safe

Larry Ellison’s wealth didn’t grow by chance. It’s built on a clear, self-reinforcing structure that he calls his “Wealth Loop.” The system looks simple, yet it has powered his fortune for over half a century:

Hold → Borrow → Invest → Grow → Repeat

He holds his Oracle shares long-term and never sells. He borrows against them to generate cash flow. He invests that money into high-growth sectors like real estate, technology, media, and research. As these industries grow, his assets appreciate and generate returns. He then reinvests those profits, expanding his leverage and restarting the cycle.

These five steps form Ellison’s ongoing wealth engine—his principal remains untouched while his cash flows circulate through the world, multiplying and returning home. He lets “the shadow of money” run outside while keeping his principal safe inside.

You can picture Ellison’s financial system as a living ecosystem with a “heart.” At the center is his 41% ownership of Oracle—a vault that anchors the entire structure. Cash flow is the blood, constantly moving out and back in, keeping the system alive. The principal never moves; only the structure around it does the work.

The key lies in balance: principal security, cash flow mobility, controlled risk, and sustainable growth. His fortune didn’t come from luck or market timing—it came from design. Ellison built a system that never stops, one that makes money work for him. In essence, it’s a structural wealth machine: the principal stays still, the cash flows circulate, the returns cover the costs, and the compounding effect accelerates growth outward while containing risk within the system.

Part IV|How Ordinary Investors Can Replicate It: The Safe Version of the Wealth Structure

Many people hear Ellison’s story and think, “He’s a billionaire—I could never do that.” But the truth is, his logic—principal protection + leverage + structural circulation—can be safely replicated by ordinary investors.

Ai Financial’s role is to translate this “billionaire logic” into a safe, repeatable financial structure that works for everyone.

The foundation of this structure combines two tools:

Investment Loan + Segregated Fund (Seg Fund)

- From Stock-Backed Loans → to Investment Loans

Ellison borrows against his Oracle shares to access liquidity. Ordinary investors can do the same through Investment Loans. In Ai Financial’s system, loans are provided by licensed Canadian banks. Clients only pay the interest while gaining amplified market exposure—putting more money to work without touching their own savings.

- From Oracle Stock → to Segregated Funds

Ellison’s base asset is Oracle stock—a company he knows and trusts. For everyday investors, the safest equivalent is a Segregated Fund, issued by insurance companies with 75%–100% principal protection. Even in volatile markets, the capital remains secure, giving your investment a built-in insurance layer.

- Leverage in a Controlled Structure (3-for-1 Model)

Ellison magnifies his returns through high leverage. Ai Financial offers a similar approach—such as the 3-for-1 structure, where $1 of your capital controls $3 in investments. The key difference is control: AiF’s leverage is safe leverage—no margin calls, no liquidation risk, and all investments remain inside regulated insurance structures.

- Covering Interest Through Growth

Ellison’s loan interest is covered by his investment returns. Ai Financial clients can achieve the same “zero-stress compounding loop.” Growth from Seg Funds covers the interest expense, and the remaining profit is reinvested into the principal. The result is a smooth, self-sustaining cycle—the principal stays still, the cash keeps moving, and the compounding never stops.

- Building Your Own Wealth Flywheel

Over time, the combination of Investment Loans + Segregated Funds creates a stable personal ecosystem:

Principal protected by insurance → Loan generates cash flow → Returns cover interest → Profits reinvested → Wealth grows steadily.

This is the safe version of Ellison’s wealth model—your principal stays secure in the vault while your cash flow circulates within the structure, producing continuous and compounding growth.

Structure: The Key That Lets Everyone Win

Larry Ellison built $365 billion through structure. Ai Financial helps ordinary investors build the same structure, safely and intelligently.

The logic is identical—only the scale differs:

- Ellison’s base asset: Oracle stock.

- AiF clients’ base asset: Segregated Funds.

- Ellison’s leverage: stock-backed loans.

- AiF clients’ leverage: investment loans.

- Ellison’s growth: compounding through control.

- AiF clients’ growth: compounding through structure.

Wealth isn’t a matter of luck or talent—it’s a matter of structure.

When your principal is secure, your cash flows move, and your compounding continues, you too can build your own personal wealth flywheel.

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More