Discover how a Canadian family achieved 239% returns using strategic...

Read MoreLeo: $100k Quick Loan (B2B Bank to Canada Life)

Leo: $100k Quick Loan (Manulife Bank)

Mia and Leo have called Canada home for over a decade. Balancing a business and a family of four, Mia still prioritized her financial education, diligently dollar-cost averaging into index funds.

Yet, a lingering thought persisted: “I could be doing better.”

In early 2024, Mia dialed Ai Financial. What began as a simple inquiry evolved into a two-hour strategic session.

She finally had an outlet for the complex questions she’d held for years—covering investment loans, asset allocation, market cycles, and monetary policy.

Instead of rushing to close a sale, the advisor listened. They offered professional, logical, and comprehensive responses.

“For the first time, I didn’t feel like I was being sold a product,” Mia recalled. “I felt truly understood.”

Mia wasn’t a novice. With a decade of investment experience, she was knowledgeable and passionate. However, previous advisors had offered only vague answers to her technical questions. They never fully resolved her doubts.

Ai Financial was different.

Through their weekly webinars, Mia found the clarity she had been missing. She was won over by their:

After thorough discussions and a detailed assessment with their advisor, Mia and Leo officially launched their investment plan in the second half of 2024.

Phase 1: Securing a $400,000 CAD Investment Loan

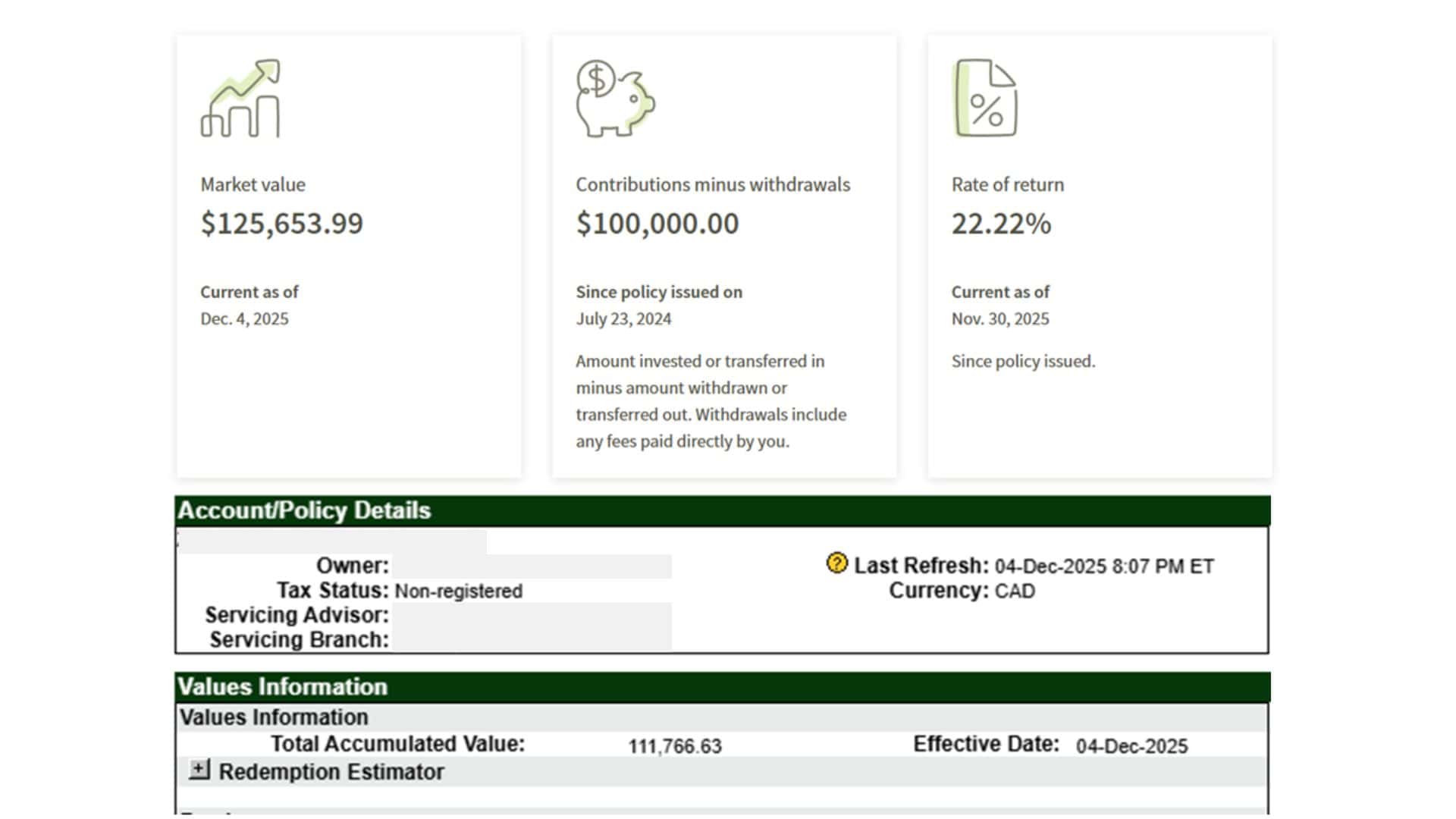

Mia: $100k Quick Loan (B2B Bank to Canada Life)

Mia: $100k Quick Loan (Manulife Bank)

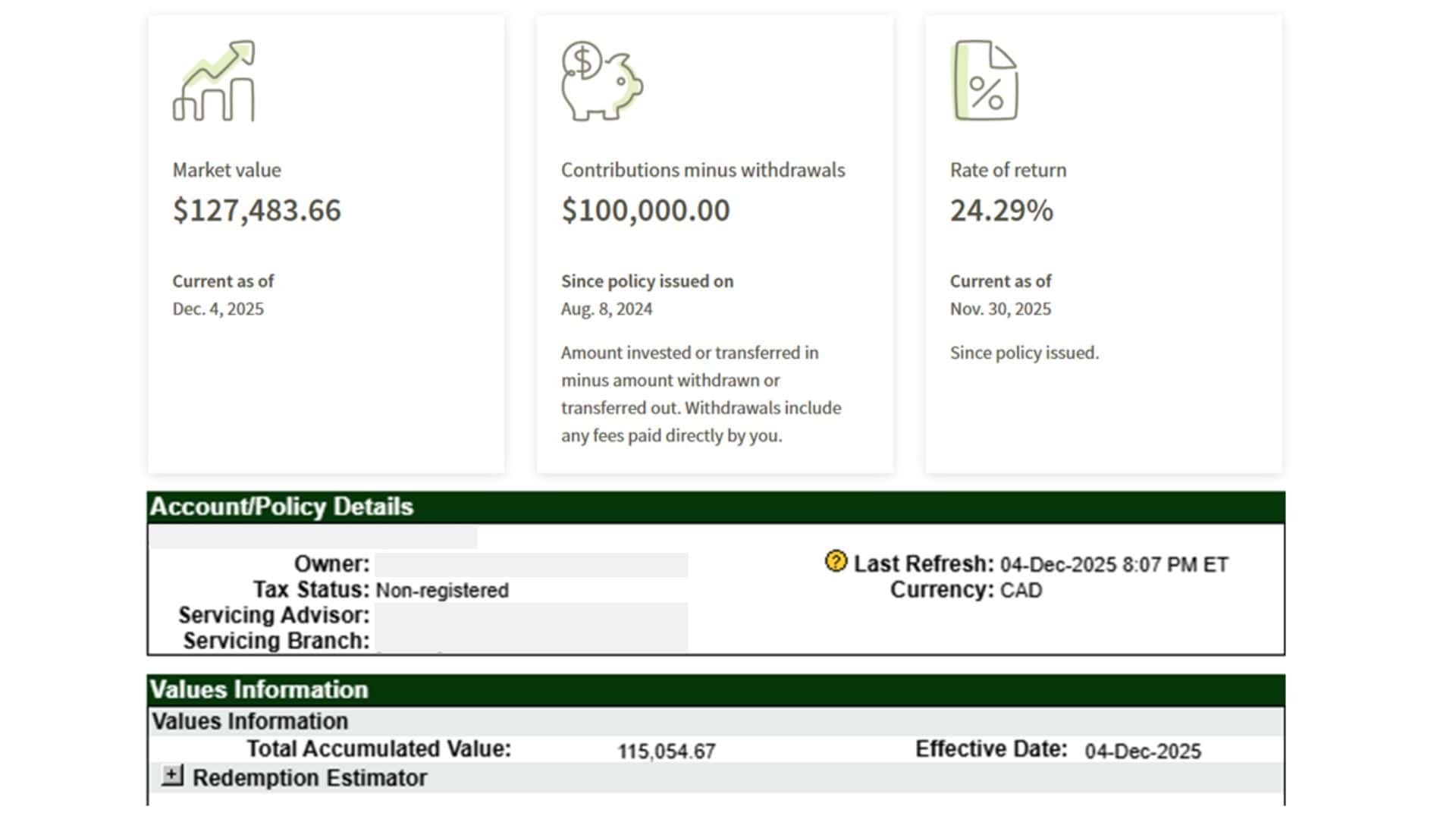

Leo: $100k Quick Loan (B2B Bank to Canada Life)

Leo: $100k Quick Loan (Manulife Bank)

Seeing the potential, they decided to increase their investment intensity.

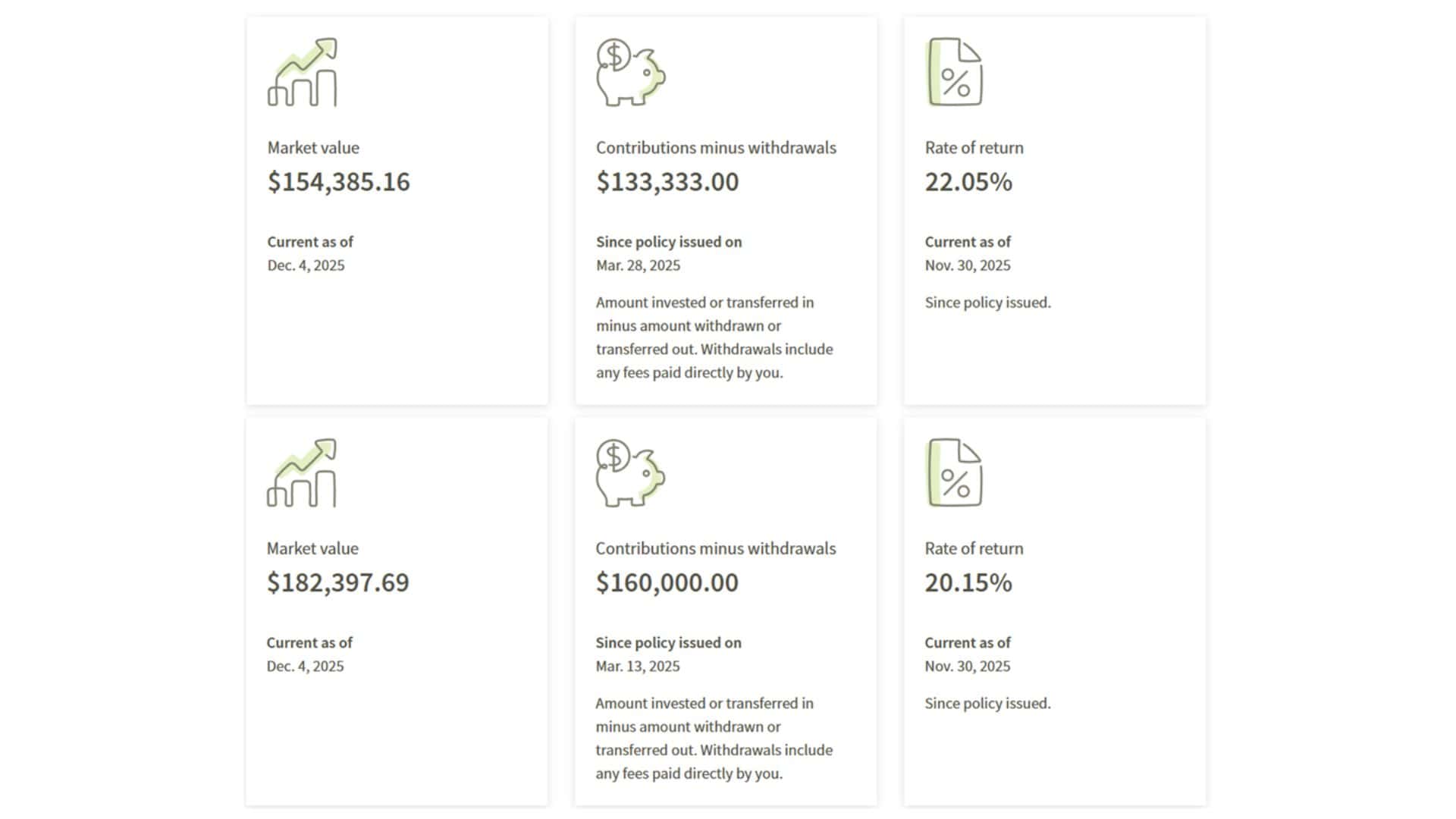

Mia: 3:1 Investment Loan (B2B Bank to Canada Life)

Leo: 3:1 Investment Loan (B2B Bank to Canada Life)

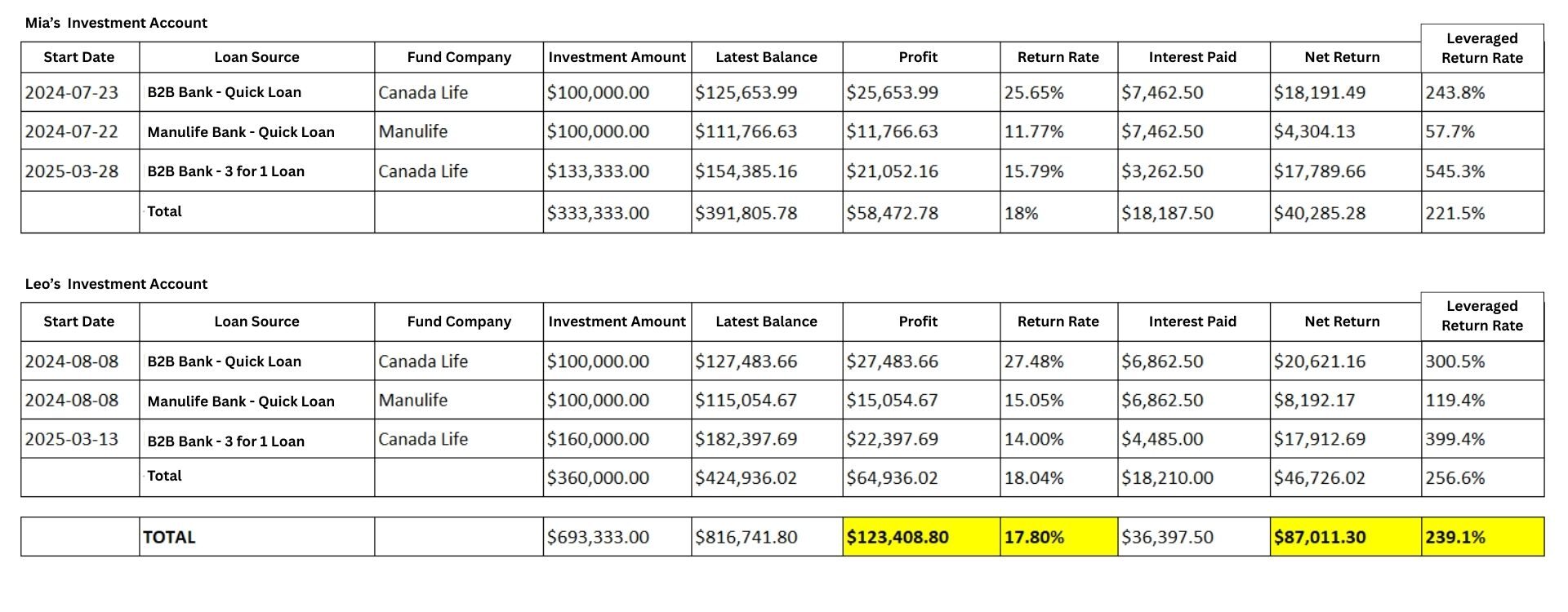

Total Capital Deployed: $693,333 CAD (Personal Savings + Investment Loans)

As of December 2025: ✅ Total Profit: $123,408.80 ✅ Total Return on Investment (ROI) via Leverage: A massive 239.1%

“This wasn’t about high-risk speculation,” Mia noted. “It was a calculated return based on professional analysis, rational decision-making, and the smart use of investment leverage.”

Mia reflected on the experience: “This time, I didn’t just ‘buy a product’; I rebuilt my entire investment mindset. Ai Financial didn’t just teach me to read market trends—they helped organize my family’s entire asset structure.”

“I’m no longer fighting this battle alone. I finally have trusted asset management experts by my side.”

Over the past year, Mia went through the full emotional spectrum: consultation, learning, building trust, taking action, facing market dips, feeling panic, constant communication, finding peace of mind, and finally, gratitude.

Her journey mirrors exactly what many ordinary investors go through. As an independent financial management firm, Ai Financial deeply understands that these emotions are a necessary part of the process.

Throughout this journey, Ai Financial has been right beside her—answering questions, easing fears, and helping her grow her financial knowledge while growing her wealth.

If you find yourself struggling with these issues:

Then do what Mia did—book a chat with an Ai Financial advisor. One call or one webinar could be the turning point for your family’s financial future.

One-Stop Asset Management: Investment Loans + Segregated Funds

✅ Focus on Principal Safety ✅ Professional Asset Allocation ✅ Independent & Neutral Advice ✅ Expanding Capital Efficiency

We don’t sell anxiety; we provide answers. We don’t sell dreams; we let the numbers speak.

📩 If you want to achieve results like Mia and Leo: ✔ Use small capital to leverage massive growth space. ✔ Diversify accounts to balance short-term and long-term gains. ✔ Avoid common pitfalls and seize market opportunities. ✔ Have a professional team regularly review and adjust your portfolio.

Contact Ai Financial today. Let’s build your path to long-term wealth together.

Discover how a Canadian family achieved 239% returns using strategic...

Read MoreZack, a Canadian soldier in his 40s, turned limited savings...

Read MoreDiscover how a millennial actuary couple used investment loans and...

Read MoreHazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreZara, a working mom of three, turned $200K into $259K...

Read More