Discover how a Canadian family achieved 239% returns using strategic...

Read MoreToronto Condo Market Crash: Inventory Surges in the $300k Range as Prices Reset

The Great Toronto Condo Reset: Core Units Plummet as $300k Price Range Re-emerges

During the peak of the pandemic, Grace Chan, a veteran realtor focusing on Yorkville and Downtown Toronto, never saw a condo listed for under $600,000. At that time, 400-square-foot studios were snatched up daily for over $500,000 without a second thought.

Today, the landscape has shifted dramatically. Amid a significant correction in the condo sector, Chan has seen identical units listed as low as $349,000. “The value of micro-condos has evaporated,” she notes. “Price depreciation is now a market-wide reality.”

The cooling trend extends beyond condos to every housing type in the Greater Toronto Area (GTA). According to the Toronto Regional Real Estate Board (TRREB), the average selling price across all home types fell to $973,000 this January—marking the first time in five years that the average has dipped below the $1 million threshold. The frenzied, high-leverage speculation of the pandemic era has vanished, leaving sales at a 25-year low and prices down 27% from the February 2022 peak.

The Condo Market: From Speculative Goldmine to “Falling Knife”

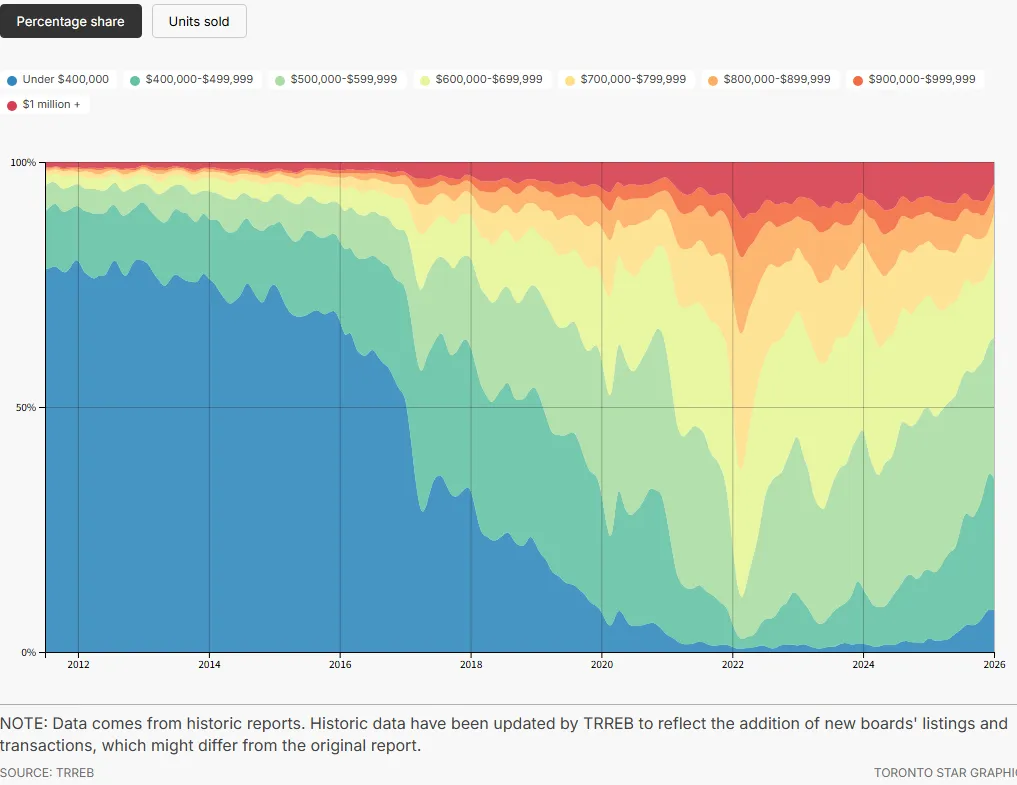

Data from TRREB highlights a stark structural shift. During the pandemic peak, only 2.5% of condos sold for between $400,000 and $499,999. This January, that proportion soared to over 26.9%.

While larger two- and three-bedroom units have shown relative resilience, studios and one-bedroom apartments are struggling. These units were predominantly purchased by investors seeking positive cash flow. However, as interest rates surged and rents softened, investors began an exodus. The result is a massive surplus of “micro-units” that do not appeal to end-user buyers.

Realtor Jarrod Armstrong points out that condos priced under $400,000 are now commonplace. As of early February, MLS data showed 77 units in Downtown Toronto listed under $400,000 and 315 under $500,000. With spring inventory expected to rise, Armstrong suggests we may see units trade below the $300,000 mark this year. “Right now, the condo market is a falling knife that no one wants to catch,” he remarks.

Current interest is largely limited to buyers from outside the GTA—such as London, Peterborough, or Barrie—who are looking for a “crash pad” for work or a residence for children attending university. For these buyers, the purchase is a long-term asset play rather than a cash-flow vehicle.

Detached and Semi-Detached Homes: The Return of the $1M Threshold

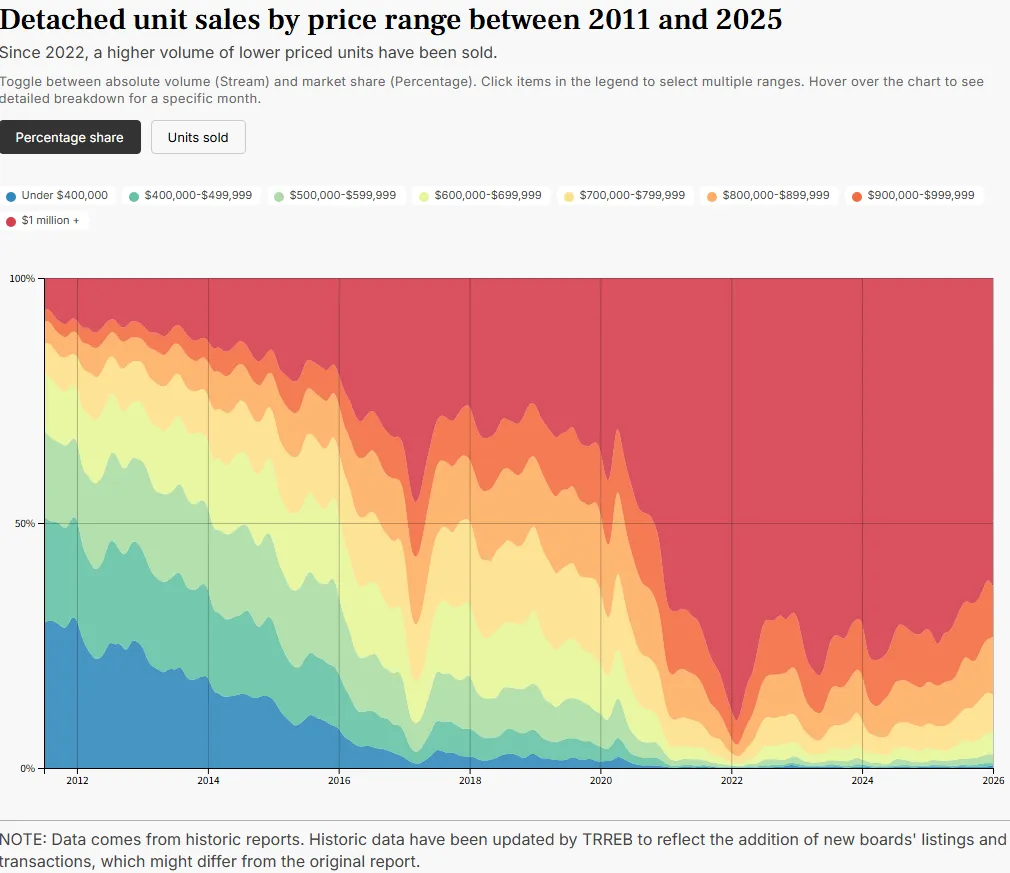

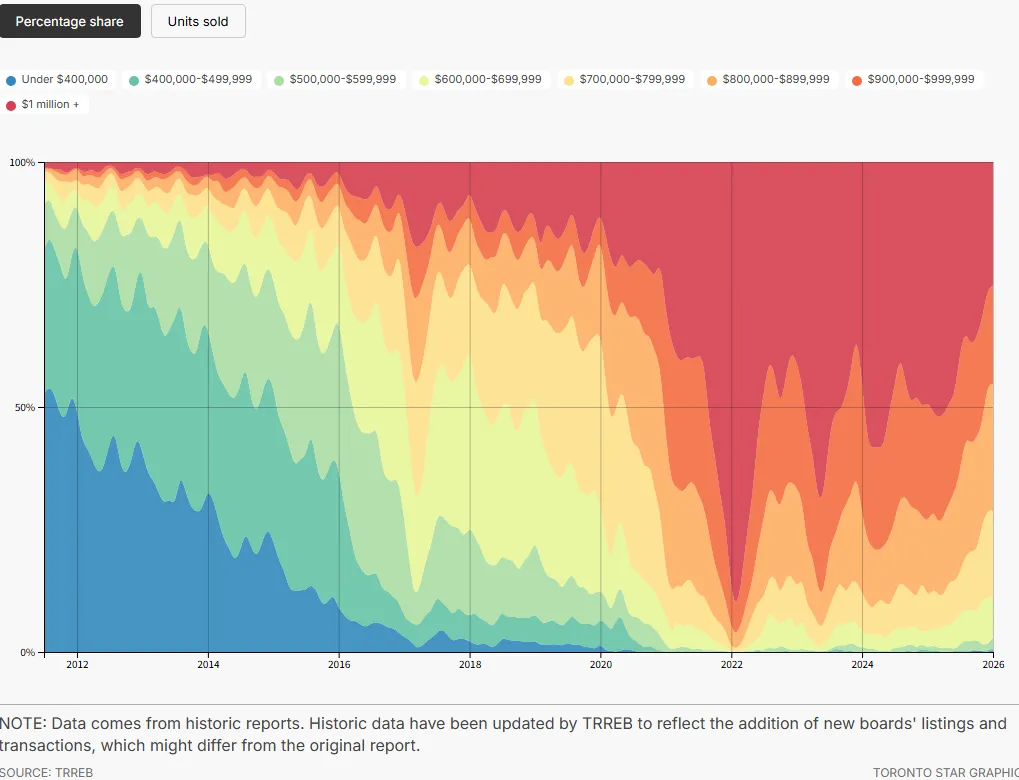

The detached market is witnessing a similar downward migration in price points. In February 2022, only 6.3% of detached homes sold for under $1 million. This January, that figure jumped to 22.2%.

Imran Zaidi, Regional Manager at Right At Home Realty, notes that listings for detached homes under $1 million have increased by 30% year-over-year and surged by 50% compared to two years ago. Semi-detached and townhomes follow the same trajectory, with sales in the $700k–$800k range seeing a massive increase in market share.

“The data speaks for itself,” Zaidi says. “The urgency of 2021 and 2022 is gone. Consumers are cautious, faced with high living costs and elevated interest rates.”

A New Reality for First-Time Buyers

Experts note that detached homes under $1 million are becoming more frequent in areas like East Toronto (East of Coxwell and Gerrard) and Western pockets like Caledonia-Fairbank and North Etobicoke.

Ralph Fox, founder of Fox Marin Associates, believes prices are reverting to 2019 pre-pandemic norms. “For years, first-time buyers were completely priced out of the freehold market,” Fox says. “Now, they are finally seeing a window of opportunity.”

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More