At Berkshire’s 2025 meeting, Warren Buffett emphasized long-term investing, patience,...

Read MoreUnderstanding the Risks of Investment Loans: Why Long-Term Value Investing Matters

Many clients often ask: What are the risks of using investment loan?

Ai Financial’s answer:

- Choosing the wrong advisor and incurring losses.

- Cash flow interruptions, making it hard to pay interest.

- Exiting at market lows due to short-term volatility.

- Selling at market highs due to unsustainable short-term gains.

- Trying to direct the advisor’s decisions based on personal speculation.

Successful investing relies on facts, not guesses.

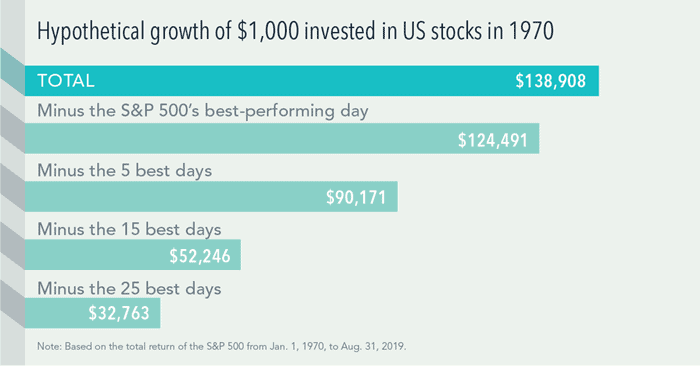

Here’s a study based on the S&P 500 from January 1970 to August 31, 2019:

- A $1,000 investment in January 1970, without leaving the market, would grow to $140,000.

- Missing the best 1 day: $124,491.

- Missing the best 5 days: $90,171.

- Missing the best 15 days: $52,246.

- Missing the best 25 days: $32,763.

Just 25 trading days—a mere month—over 50 years could reduce your returns by over 4x.

Investing requires patience, not brilliance. Don’t try to time the market by jumping in and out; it won’t lead to profits.

Instead, focus on long-term value investing, not short-term speculation.

You may also interested in

CDs vs. High-Yield Savings Accounts: The Smartest Way to Grow Your Savings in 2025

At Berkshire’s 2025 meeting, Warren Buffett emphasized long-term investing, patience,...

Read MoreWhy Canada’s RRSP Reform Could Save Your Retirement

At Berkshire’s 2025 meeting, Warren Buffett emphasized long-term investing, patience,...

Read MoreSmart Shifts: How Canadians Are Rethinking Retirement Goals in 2025

At Berkshire’s 2025 meeting, Warren Buffett emphasized long-term investing, patience,...

Read MoreBest RRSP Investment Options to Maximize Your Future

This post outlines various RRSP investment options for Canadians in...

Read More