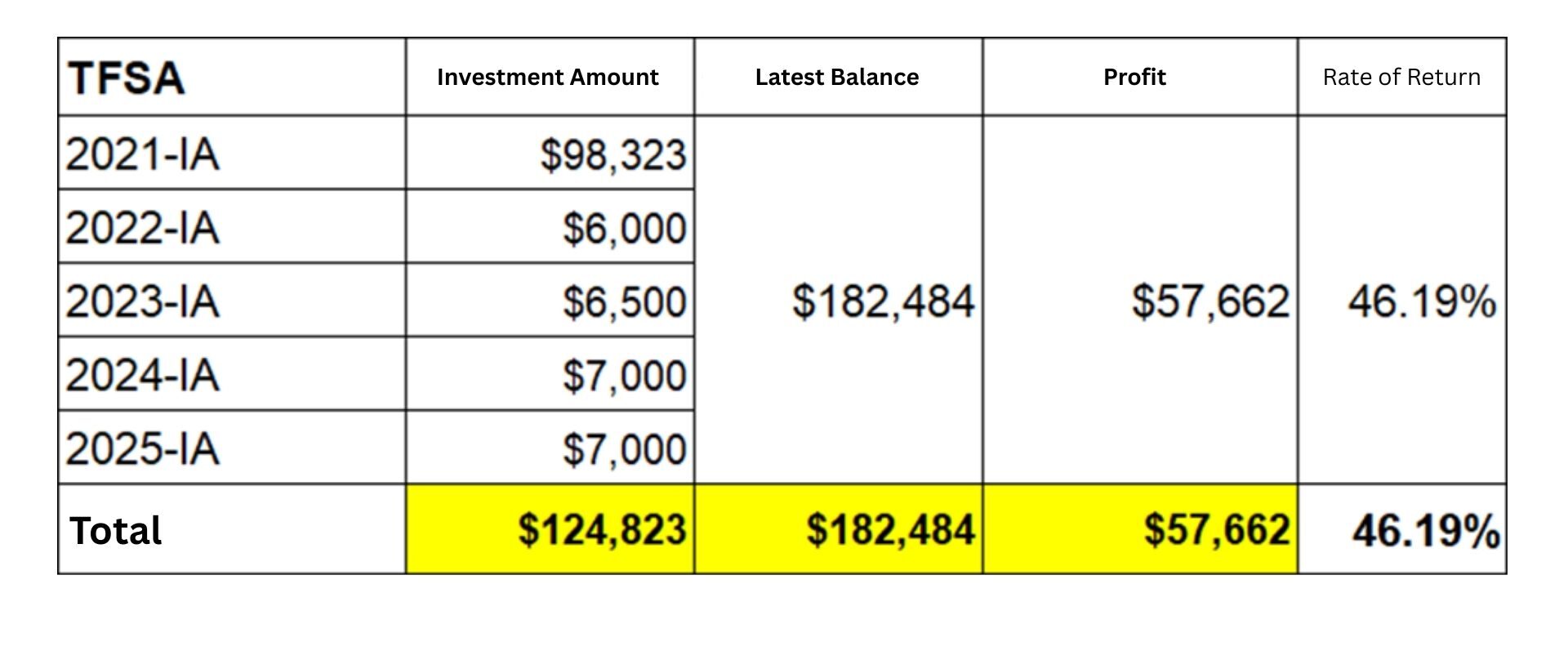

TFSA Growth

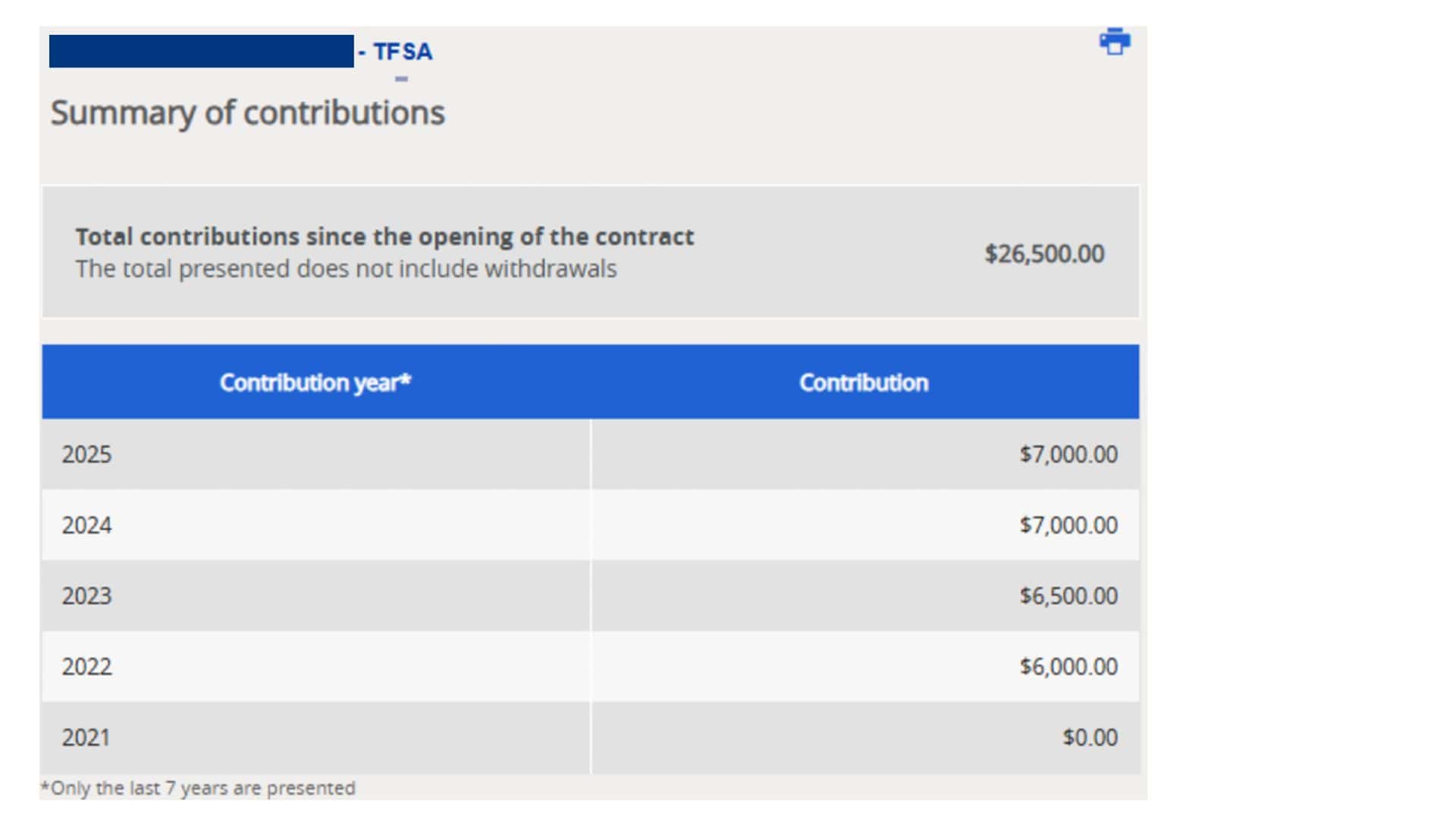

Lisa also maximized her TFSA under Ai Financial’s planning:

- 2021: $80,000 initial contribution

- 2022: $6,000

- 2023: $6,500

- 2024 & 2025: $7,000 each year

✅ Total contributions: $50,000

✅ Net profit by Aug 2025: $58,000

✅ TFSA ROI: 46%

Conclusion: Direction Matters More than Effort

Lisa’s transformation shows that:

- Unlocking policy cash values secures future premiums.

- Selling property avoided real estate downturn risks.

- Partnering with Ai Financial allowed her to plan, diversify, and enjoy compounding returns.

👉 In an era of economic uncertainty, inflation, tight cash flows, and real estate headwinds, Ai Financial’s insurance loan + guaranteed fund solution has proven to be the ultimate family safeguard.

Ai Financial — your trusted partner in building lasting wealth.

The next success story could be yours.

✅ Total Contributions: $82,658

✅ Total Market Value: $107,984

✅ Overall Return: 30.6%

While others her age are still unsure about money, Cindy’s registered accounts have quietly accumulated nearly $100,000 in value — not just numbers, but real financial strength.

Leveraging Smartly: Make Your Money Work Faster

After gaining Canadian permanent residency, Cindy made a bold move: with AiF’s help, she applied for a government-backed investment loan and used it alongside segregated funds to multiply her gains with controlled risk.