Discover how a Canadian family achieved 239% returns using strategic...

Read More$300K in 7 Years: A Story of Investment Loan Strategy and Discipline

Intro: Using an investment loan as a launchpad, Emily and James turned consistent strategy into real wealth. They didn’t come from money, and they weren’t earning six figures. But with the help of Ai Financial, they took out a $100,000 investment loan and combined it with disciplined monthly contributions — quietly growing over $300,000 in just 7 years.

Staying Calm Through Market Turbulence

From 2018 to 2025, Emily and James navigated some of the most volatile market periods in recent history:

- In 2020, COVID triggered four stock market circuit breakers in the U.S.

- In 2022, markets saw the worst correction in nearly five decades.

- In April 2025, a single day saw a record-breaking 2,200-point drop.

Despite these challenges, Emily and James stayed the course — not because they predicted the market, but because they had a process and professional guidance.

The Turning Point — Putting Idle Cash to Work

In 2018, Emily approached Ai Financial with a concern:

“We make decent income, but our money just sits there. The more we save, the more anxious we feel.”

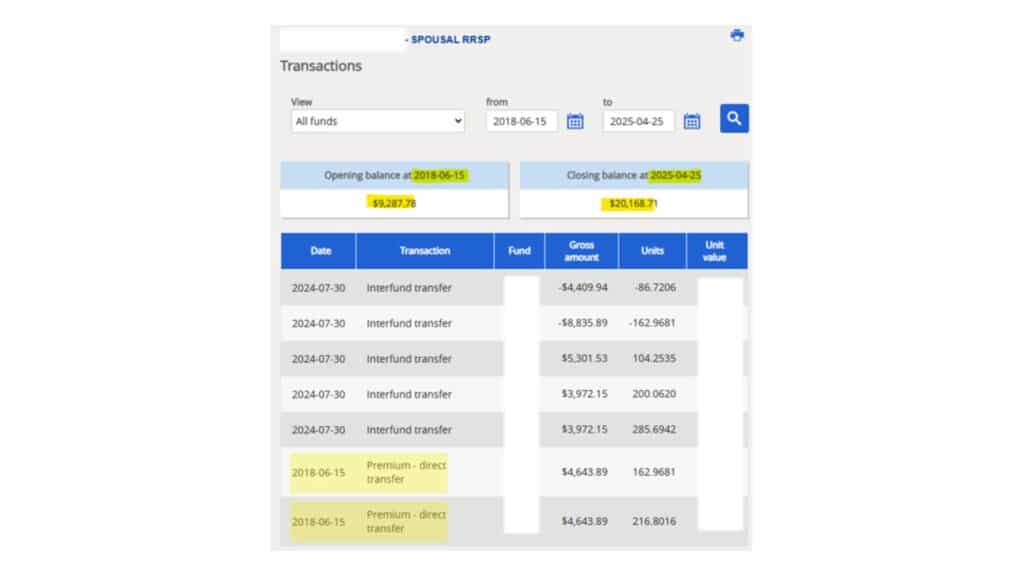

An AiF advisor analyzed their situation and recommended their first structured step: use registered accounts like the Spousal RRSP to reduce taxes and grow wealth systematically.

- Initial investment (2018): $9,288

- Value in 2025: $20,169

- Return: 117%+

This opened the door to a more comprehensive strategy.

Scaling Up with an Investment Loan

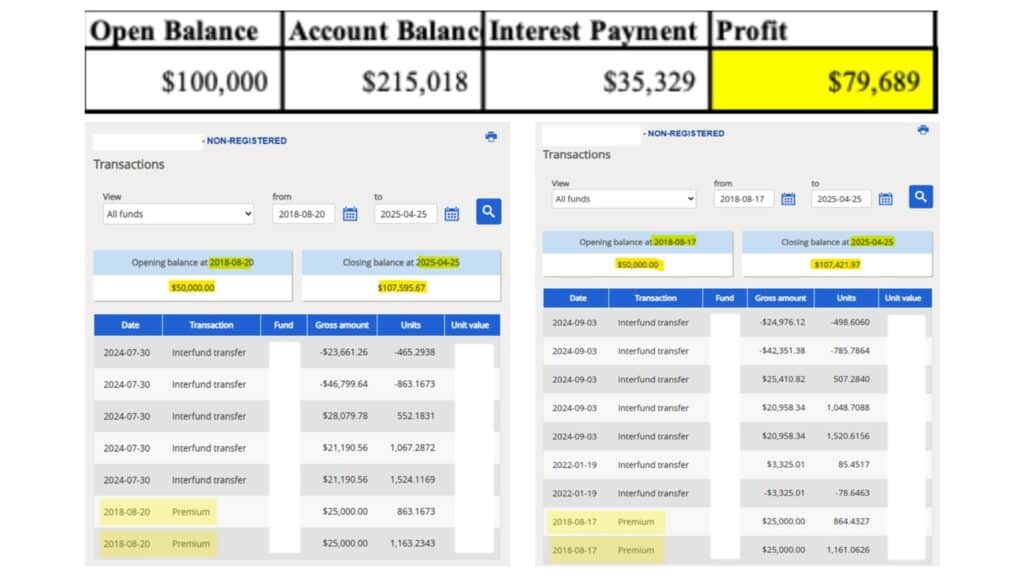

In August 2018, AiF designed a leverage plan for the couple:

- $100,000 investment loan split between them

- Fully allocated to principal-protected segregated funds

Results by April 2025:

- Portfolio value: $215,018

- Loan interest paid: $35,329

- Net profit: $79,689

- ROI from leverage: 226%

The investment loan wasn’t a risk — it was a calculated strategy, guided by advisors who continually adjusted allocations and monitored risk.

Building Quietly with Monthly Contributions

At the same time, Emily and James began automated monthly contributions via PAD (Pre-Authorized Debit), customized to their income and life plans.

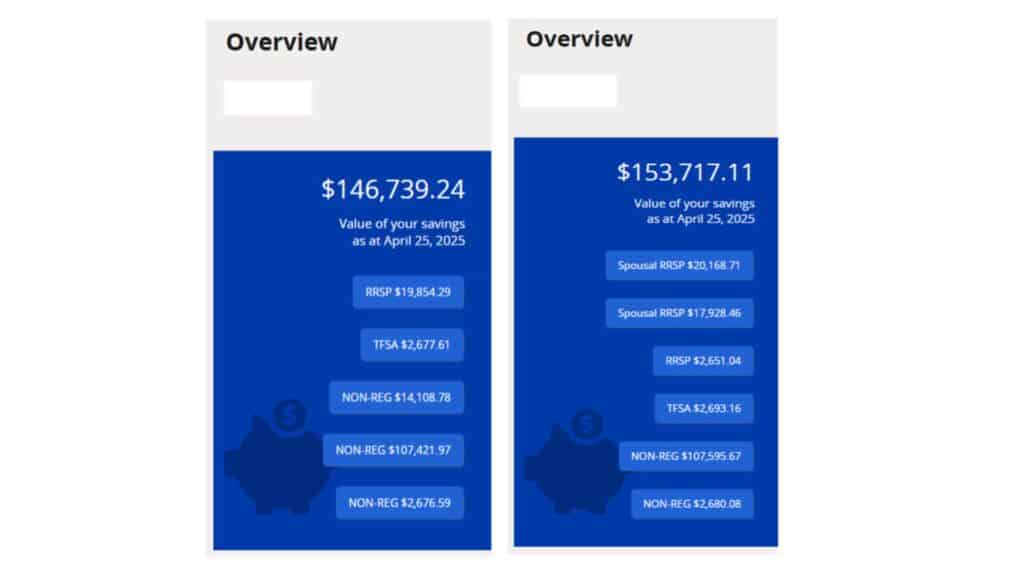

By 2025:

- James’s account value: $146,740

- Emily’s account value: $153,717

These seemingly small monthly actions added up to over $300,000 — driven by long-term planning and execution.

Wealth Isn’t Built by Luck, It’s Built by Strategy

Emily and James didn’t guess the market. They didn’t chase hot stocks. They followed a structured plan, executed with professional guidance.

Their journey shows how an investment loan, paired with consistency and expertise, can create life-changing results.

Ready to Start Your Own Wealth Journey?

📩 Talk to an AiF advisor today and explore how investment loans and disciplined contributions can help you build your future.

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More