Zack, in his early 40s, is an active-duty Canadian soldier.

He has a loving family — a wife who takes care of their home full-time, and four young children growing up quickly.

On duty, Zack is a soldier protecting the country; at home, he is the pillar of his family. Nearly all of his monthly salary goes directly toward household expenses.

“I want to give my children a better future.”

This is the thought Zack carries with him every day.

But reality is harsh. Relying solely on a military paycheck and limited savings, it seemed almost impossible to set aside enough for four children’s education, the mortgage, and future retirement security.

A Chance Encounter: An Investment Seminar

One day, Zack came across Ai Financial’s promotion for investment loans + segregated funds online. Curious, he decided to join one of our Thursday evening online seminars.

For the first time, he saw clearly that:

✅ Even with limited capital, he could leverage funds through an investment loan

✅ By investing in an IA segregated fund, his principal would remain secure

✅ With professional advisors accompanying him, he wouldn’t need to worry about complex financial operations

Zack was moved — but a more personal challenge stood in the way. His wife was deeply concerned about risk and did not support the idea of loan-based investing.

Conflict and Determination: A Responsible Choice for Family

At first, the couple argued about it for a long time. His wife worried: “What if we lose money?”

But Zack had an even greater concern: “What if we do nothing? What will happen to our children’s future?”

As a soldier, Zack understood better than anyone what “responsibility” means. He patiently communicated with his wife again and again, showing her the numbers, explaining step by step, and even sharing reports provided by our advisors.

“This isn’t just for me — it’s for the future of all six of us.”

Eventually, his sincerity and persistence won her over.

The First Step: $100,000 Investment Loan

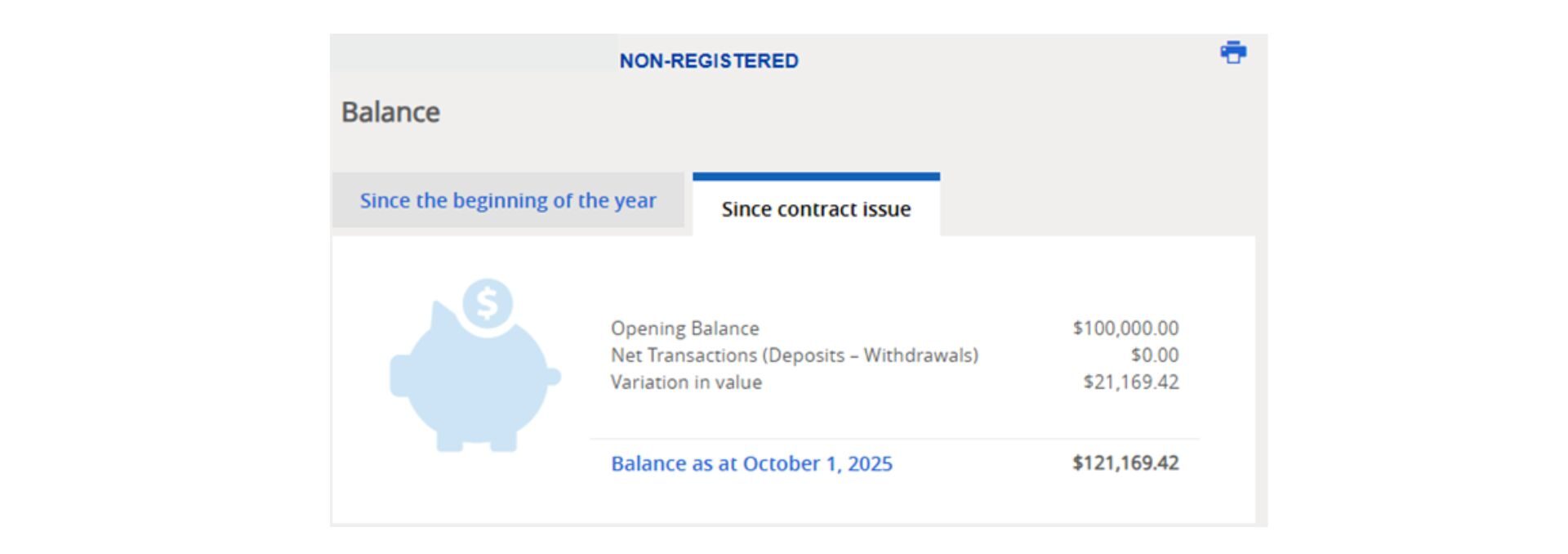

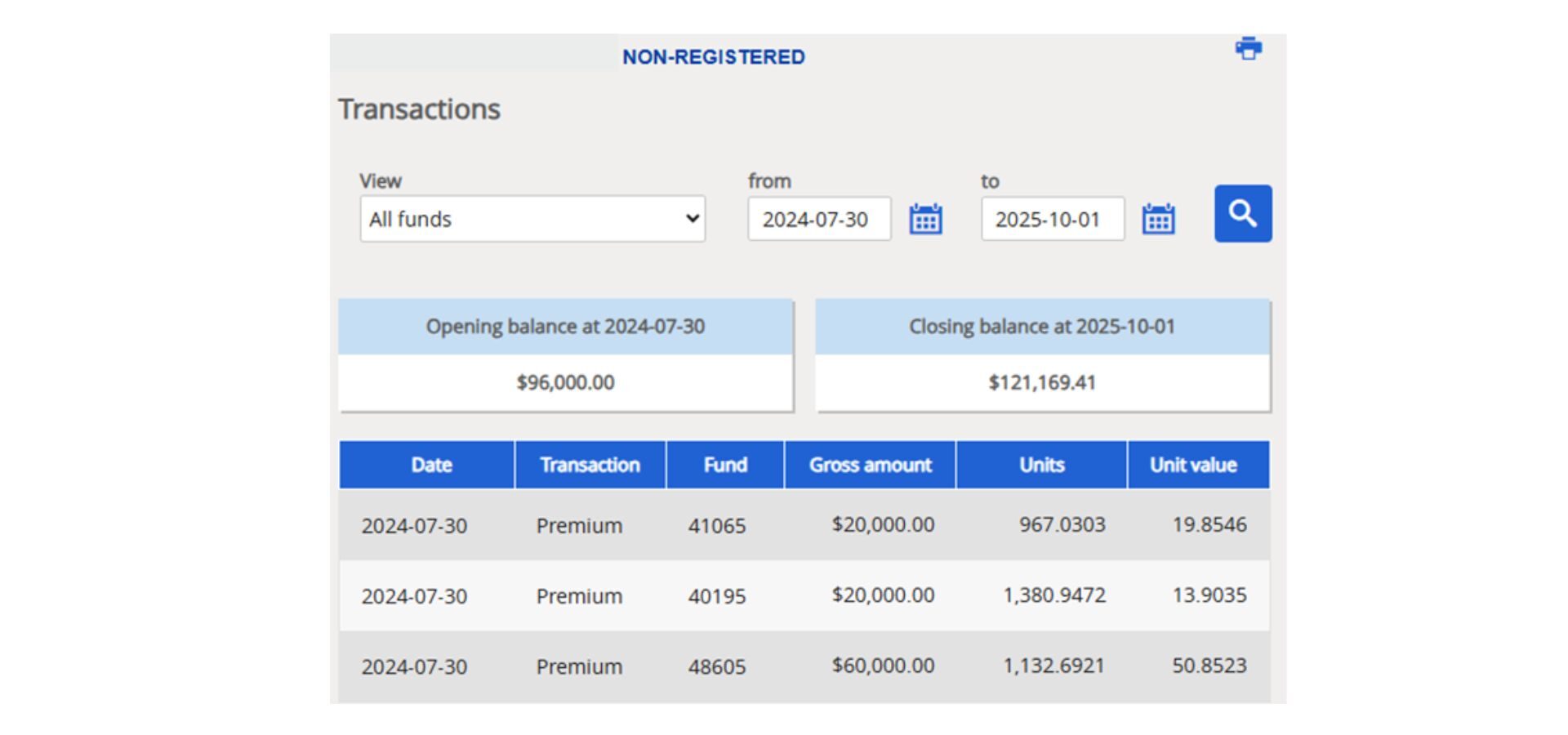

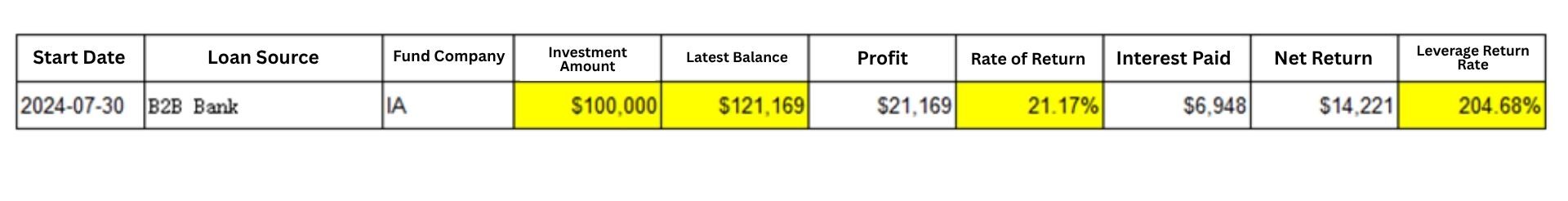

On July 30, 2024, with AiF’s assistance, Zack successfully secured a $100,000 investment loan from the bank and invested it into an IA segregated fund.