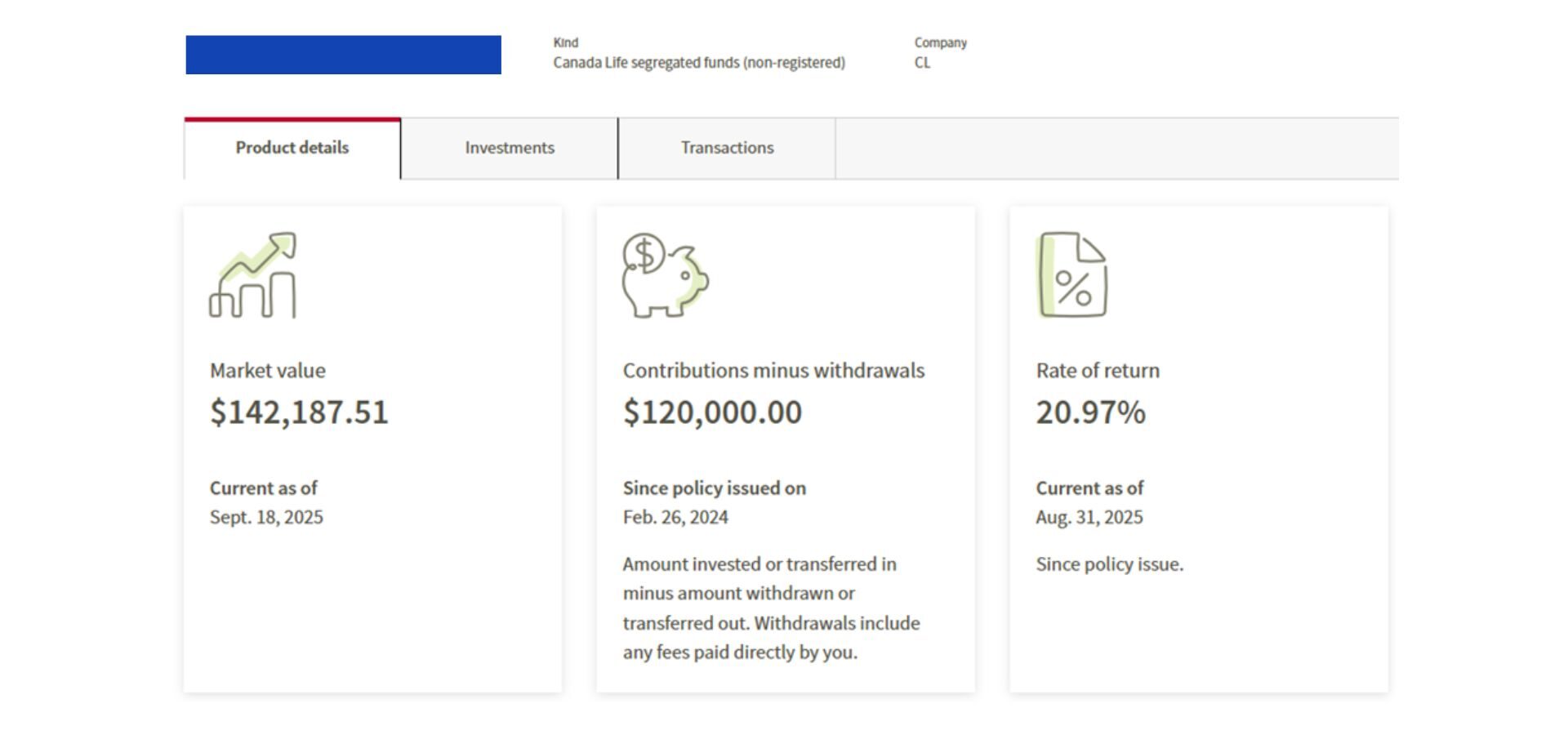

Discover how a Canadian family achieved 239% returns using strategic...

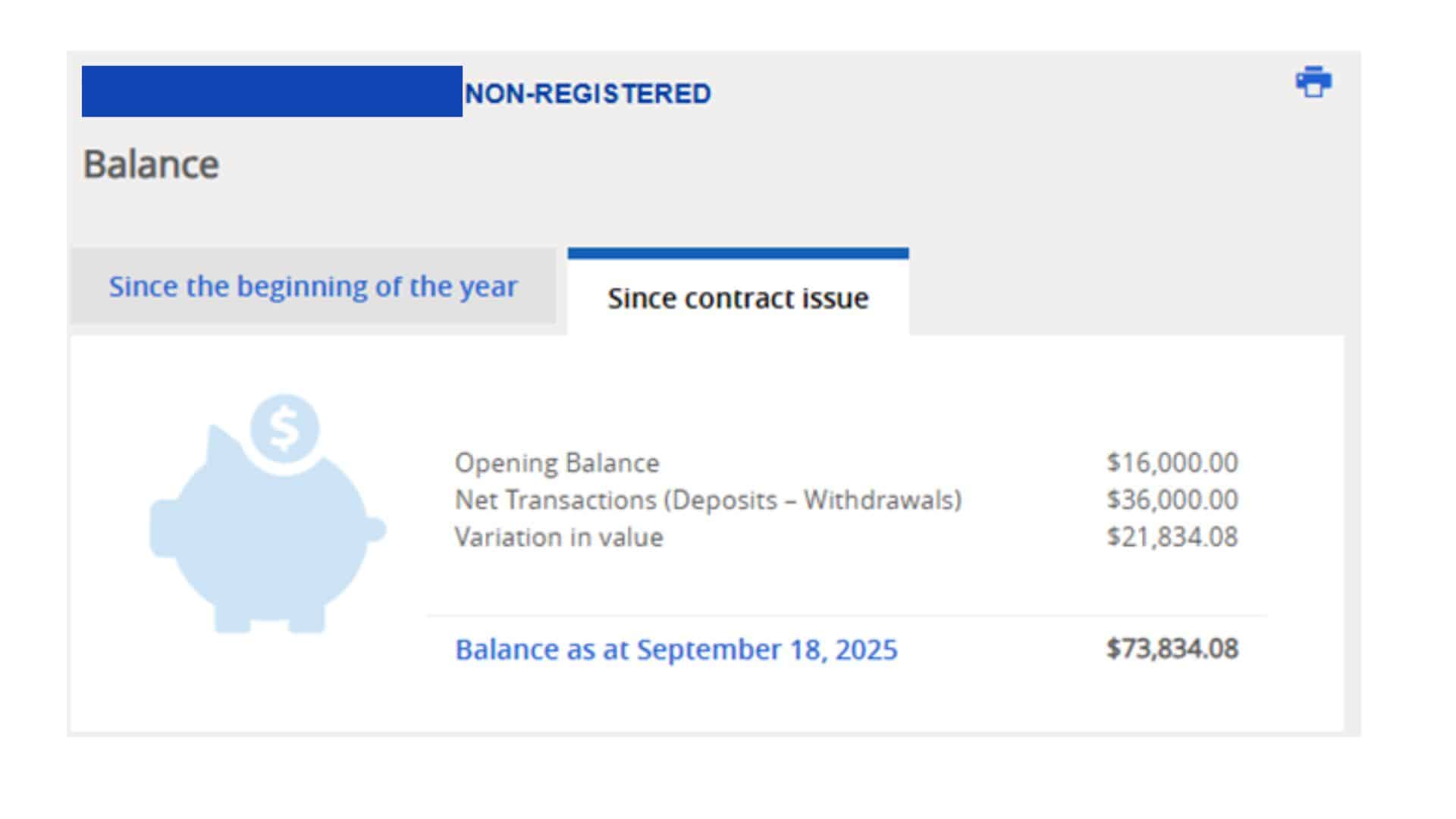

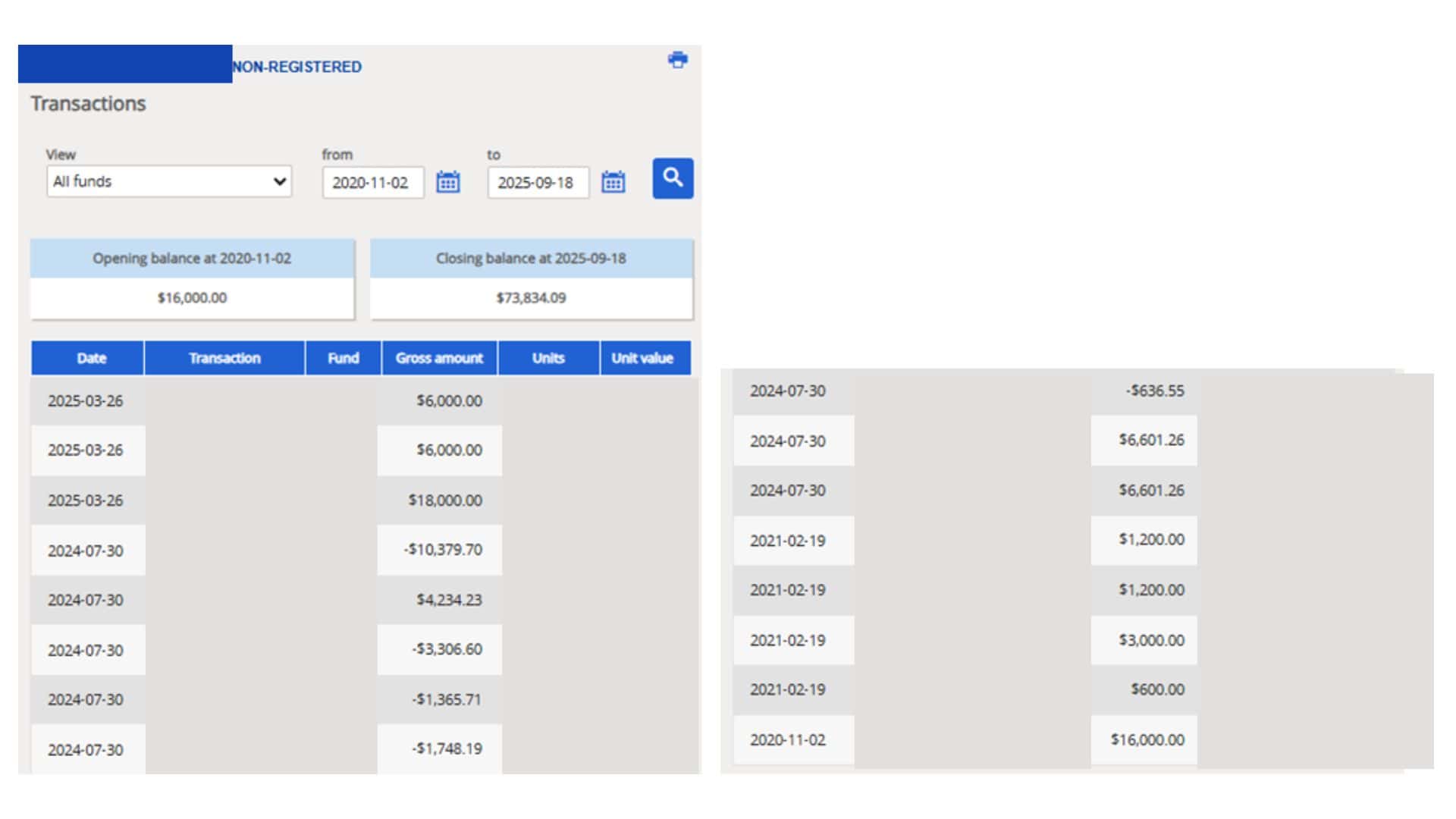

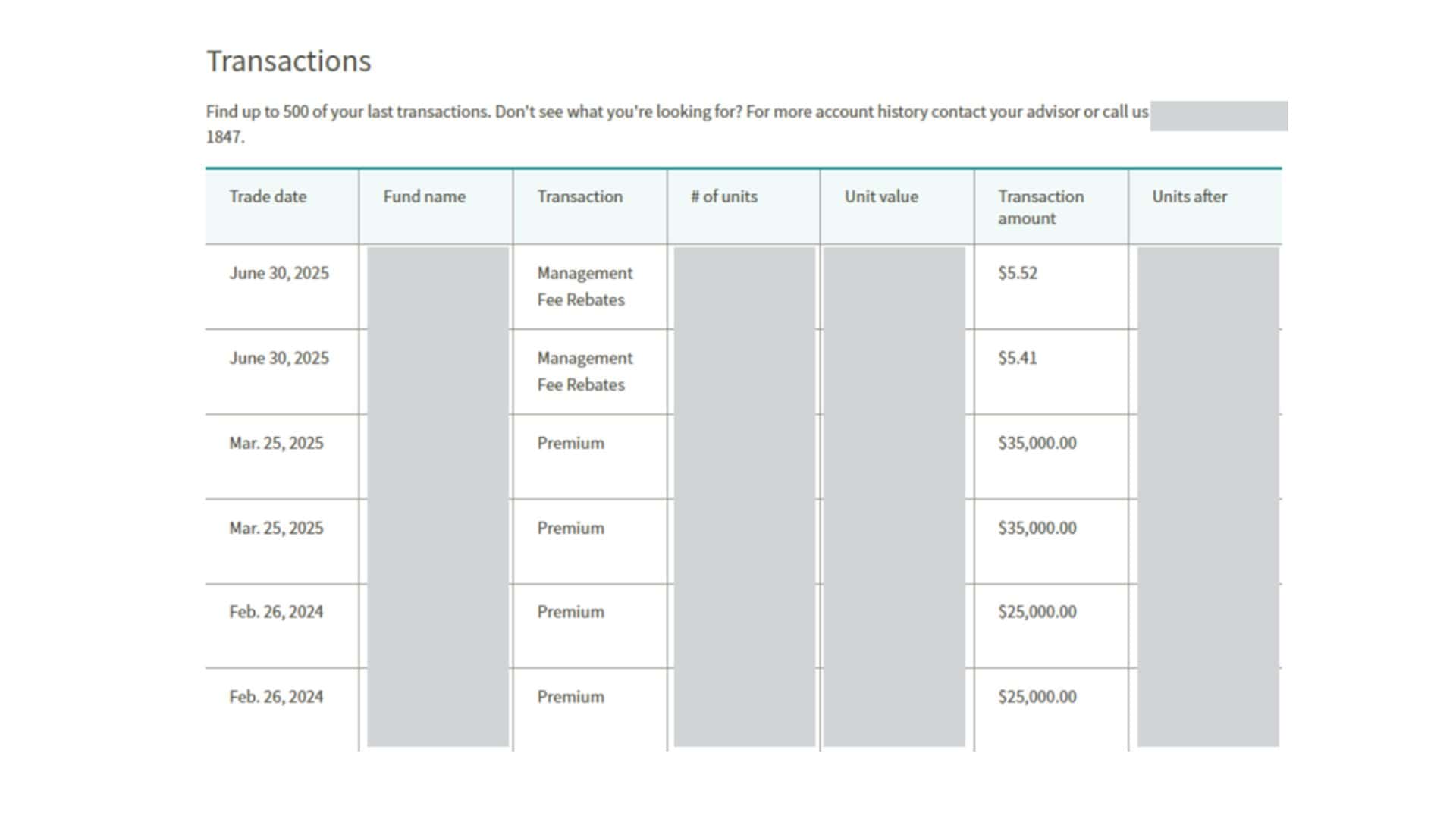

Read MoreTotal invested: CAD $52,000

Balance as of Sept 2025: CAD $73,834

✅ Profit: CAD $21,834

✅ ROI: 42%

Hazel reflected:

“At first, I just wanted to try it out. I didn’t expect the results to be this good. Even with the volatility after the pandemic, my account kept growing. I realized that if money is invested in the right place, I don’t need to panic — staying invested pays off.”

Step 2: Moving Forward After Her Daughter’s Graduation

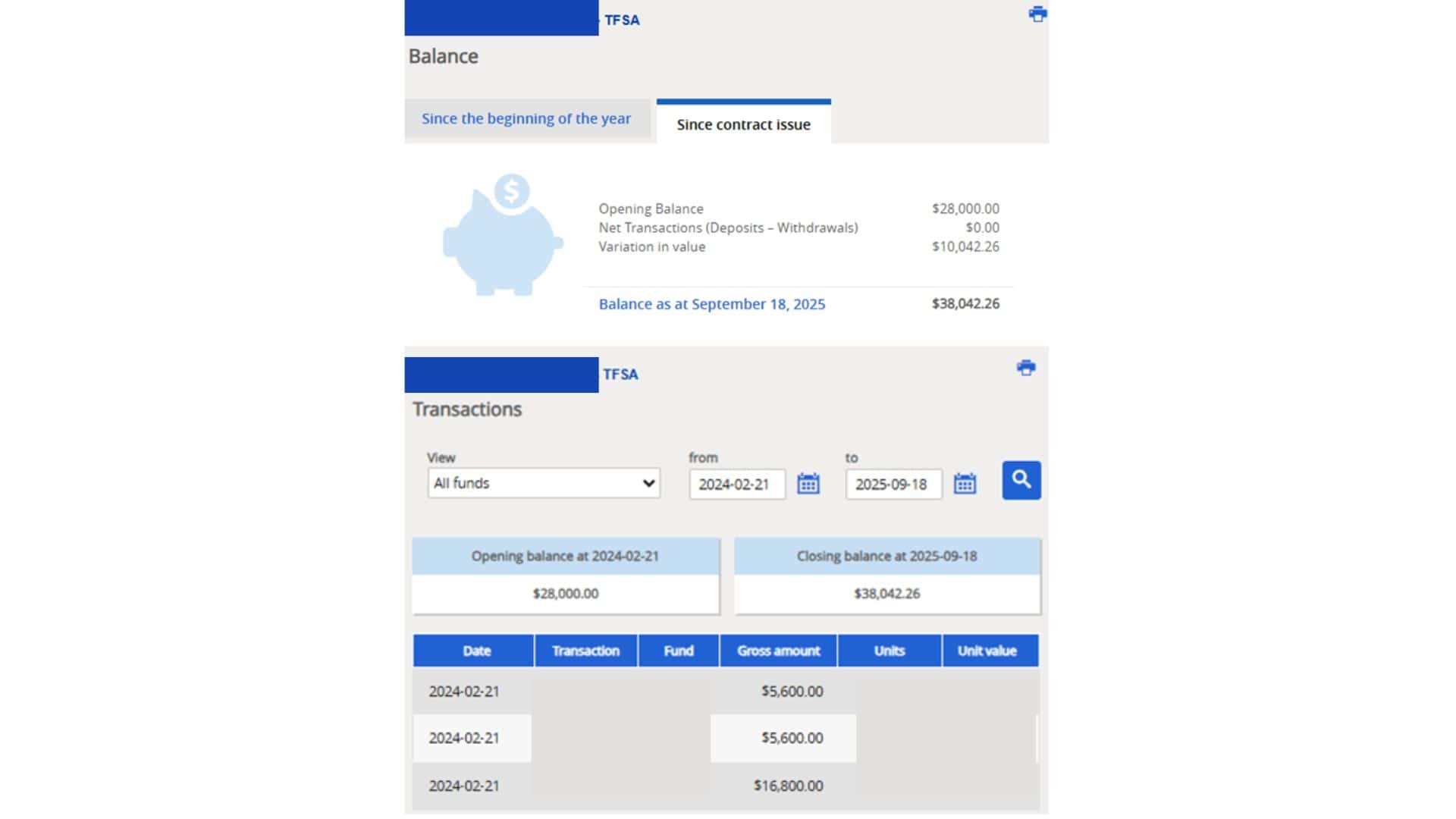

On Feb 21, 2024, Hazel opened a TFSA account for her now-graduated daughter: