In-depth analysis of five decades of Dow Jones Industrial Average...

Read MoreFrom Real Estate to Financial Leverage: A Strategic Shift for Steady Wealth Growth

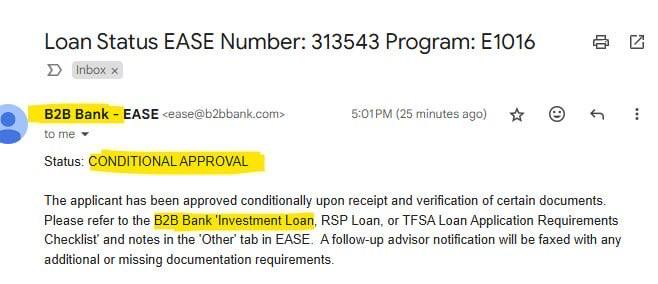

Our client sold their property, dialing down on real estate leverage, and came to us at AiF. With a quick loan approval from B2B Bank (yes, it was that fast 😎), they boosted their financial leverage and invested in a high-liquidity, worry-free segregated public fund. Their moves? Smooth and on-point!

With Canada’s new rate-cut cycle and the U.S. stock market in a bull run, borrowing costs are dropping, and steady investment returns are climbing. By leveraging more capital, staying in the game long-term, and letting compound growth work its magic, they’re building wealth for retirement—one step at a time.

Of course, when it comes to smart leverage, leave it to the pros at AiF!

You may also interested in

How to Make $100 Billion in a Day: What We Can Learn from Oracle’s Larry Ellison | AiF insight

New PWL Capital data shows renters in most Canadian cities...

Read MoreRenters Now Beating Homeowners in Canada: How Investing Outpaces Property Ownership | AiF insight

New PWL Capital data shows renters in most Canadian cities...

Read MoreWhy the Rich Focus and the Poor Get Distracted: The Hidden Law of Wealth | AiF insight

Wealth doesn’t come from chasing every trend. Ai Financial explains...

Read More2025 Canada National Risk Assessment on Money Laundering and Terrorist Financing| AiF Insights

The Government of Canada recently released the 2025 National Risk...

Read More