This post outlines various RRSP investment options for Canadians in...

Read MoreFrom Real Estate to Financial Leverage: A Strategic Shift for Steady Wealth Growth

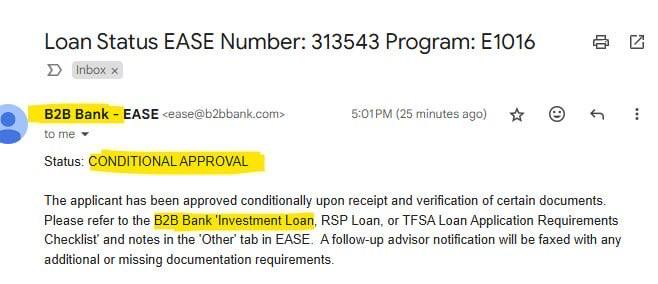

Our client sold their property, dialing down on real estate leverage, and came to us at AiF. With a quick loan approval from B2B Bank (yes, it was that fast 😎), they boosted their financial leverage and invested in a high-liquidity, worry-free segregated public fund. Their moves? Smooth and on-point!

With Canada’s new rate-cut cycle and the U.S. stock market in a bull run, borrowing costs are dropping, and steady investment returns are climbing. By leveraging more capital, staying in the game long-term, and letting compound growth work its magic, they’re building wealth for retirement—one step at a time.

Of course, when it comes to smart leverage, leave it to the pros at AiF!

You may also interested in

Defense Stocks Are a ‘Mega Force.’ NATO, New Tech Make the Case| AiF insight

Driven by rising geopolitical tensions and the race for AI...

Read MoreBond King Bill Gross Predicts a “Little Bull Market” for Stocks and a “Little Bear Market” for Bonds| AiF insight

Renowned bond investor Bill Gross recently issued a new warning:...

Read MoreCanada, Brace for a “Decade of Austerity”| AiF insight

Inflation Eroding Savings, Debt Pressures Mount, Retirement Becomes a Luxury...

Read MoreFed Holds Rates – But a Rally May Be Coming| AiF insight

No cuts yet, but markets stay strong. Rate cuts could...

Read More