Discover how a Canadian family achieved 239% returns using strategic...

Read MoreMost Canadian Investment Funds Lag Behind in 2024, Says S&P Report

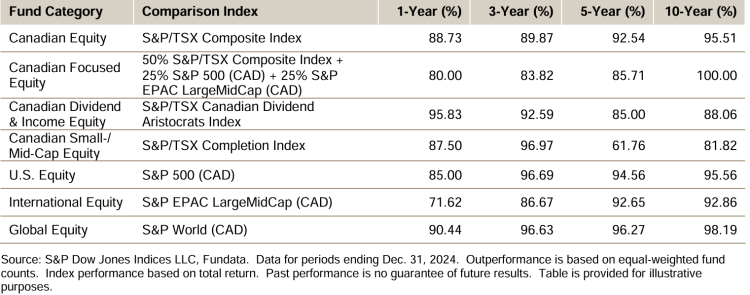

In 2024, most Canadian investment funds failed to outperform their benchmarks, according to a year-end analysis by S&P Dow Jones Indices. The latest Canada SPIVA (S&P Indices Versus Active) Scorecard revealed that 88.7% of Canadian equity funds, 80% of Canadian focused equity funds, and 95.8% of dividend & income equity funds lagged behind their respective indices—despite a year of double-digit returns across the market.

Meanwhile, 71.6% of international equity funds underperformed, showing relatively better results but still a majority.

This widespread underperformance came in a year when major indices posted double-digit returns:

-

The S&P/TSX Composite Index gained 21.7%, and

-

The S&P 500 Index surged 36.4% (in Canadian dollar terms).

S&P Global analysts pointed out that strong benchmark performance doesn’t necessarily cause higher fund underperformance. Rather, Canadian equity fund managers have historically struggled to generate excess returns, regardless of market conditions. Over the past decade, 9 out of 10 years saw a majority of active Canadian equity funds failing to match benchmarks—even in years with low or negative index returns.

The 10-year average underperformance rate for Canadian equity funds (up to December 2024) was 75.5%, indicating a persistent trend.

The study also noted that a narrow group of stocks drove much of the index growth in 2024:

-

Only 29.4% of the S&P 500 constituents had positive returns, and

-

46.9% of the S&P EPAC LargeMidCap index saw gains.

“Despite investor optimism, market volatility and uneven performance in 2024 made it difficult for managers to capture alpha,” the report said. “A select few managers succeeded, but long-term outperformance remains rare.”

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More