Discover how a Canadian family achieved 239% returns using strategic...

Read MoreCanada Could Lose 11,000 Restaurants by 2026 as Industry Faces Deep Reset

Canada’s restaurant industry is entering one of its most challenging periods in decades. According to a new forecast from Dalhousie University, approximately 7,000 restaurants closed in 2025, and another 4,000 are expected to shut down in 2026. If the projection holds, as many as 11,000 restaurants could disappear within just two years.

Sylvain Charlebois, director of Dalhousie University’s Agri-Food Analytics Lab, said the past few years have been “extremely difficult” for restaurants, as inflation, rising food prices, and mounting operating costs continue to erode already-thin margins.

Consumers Pull Back as Dining Out Becomes a Discretionary Cut

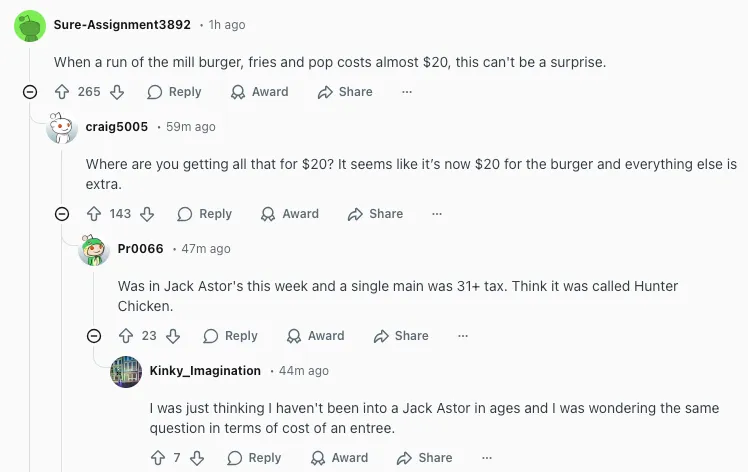

One of the biggest pressures facing restaurants is changing consumer behaviour. Charlebois noted that Canadians are becoming increasingly cautious with their food budgets, and dining out is often one of the first expenses to be reduced.

“When people do dine, they are more likely to eat at home,” he said, pointing to efforts to avoid tipping, expensive alcohol, and added costs. With household budgets under strain, restaurant visits are increasingly viewed as optional rather than routine.

Rising Costs Leave 41% of Restaurants Barely Breaking Even

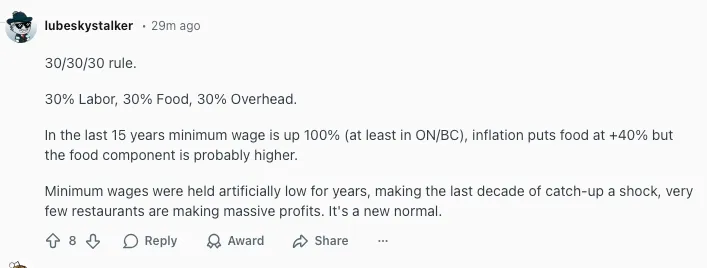

According to Restaurants Canada, the challenges extend well beyond weaker demand. Restaurants are being squeezed by higher rent, wages, insurance premiums, and food costs, creating a situation where profitability is increasingly difficult to achieve.

The organization estimates that 41% of Canadian restaurants are currently operating at a loss or just breaking even. Despite this, many businesses are reluctant to raise prices significantly, knowing that customers are closely watching their spending.

“There is a real affordability challenge for Canadians right now,” said Kelly Higginson, president and CEO of Restaurants Canada. “Less discretionary spending means pulling back on restaurant spending.”

Industry Pushes for Permanent Tax Relief on Food

The restaurant sector has renewed calls for tax relief as a way to stabilize the industry. From December 14, 2024, to February 15, 2025, Ontario temporarily removed GST/HST on restaurant meals, prepared foods, snacks, and some alcoholic beverages.

Restaurants Canada is advocating for that tax break to be reinstated and made permanent. Higginson argued that taxing food during a cost-of-living crisis is poor public policy.

Charlebois echoed that view, saying he believes taxes should be eliminated on all food, regardless of where it is consumed.

Alcohol Sales Decline and “Tip Fatigue” Add More Pressure

Restaurants are also being hit by a sharp decline in alcohol consumption. National retail data shows that alcohol sales fell 10.6% year over year in October, dealing a significant blow to establishments that rely on beverage sales for profitability.

At the same time, growing frustration over tipping practices is weighing on consumer sentiment. Charlebois said many diners are comfortable tipping in sit-down restaurants, but feel irritated when prompted to tip at fast-food counters or quick-service outlets. That frustration has become increasingly visible on social media and is influencing dining decisions.

A Structural Shift, Not a Short-Term Downturn

Taken together, inflation, rising operating costs, weaker consumer demand, tax pressures, and changing habits suggest that Canada’s restaurant closures are not simply a temporary downturn. Industry experts increasingly view the wave of shutdowns as a structural reset, reshaping the sector to align with a higher-cost, lower-growth economic reality.

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More