Discover how a Canadian family achieved 239% returns using strategic...

Read MoreCanadian Home Prices Hit Four-Year Low as New Listings Surge to Record Levels

Canadian Home Prices Fall to Four-Year Low As Inventory Hits a Record High

Canada’s housing market continued to weaken in October, as rising inventory and soft sales pushed prices to their lowest point in four years. According to newly released data from the Canadian Real Estate Association (CREA), a wave of new listings has entered the market at a time when buyer activity remains subdued — reversing much of the price recovery seen last year.

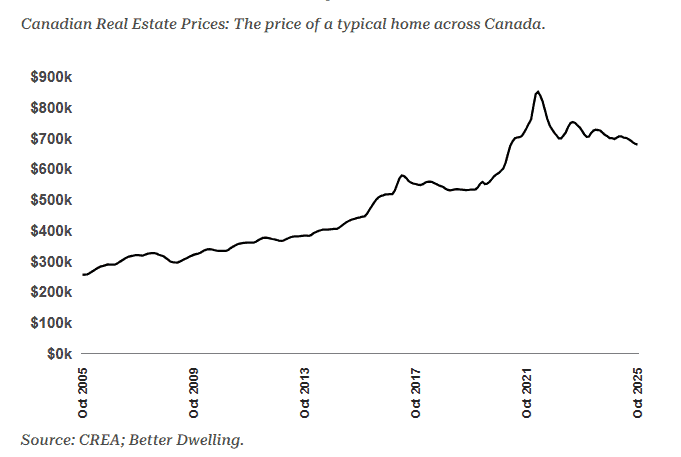

Prices Slide Again, Now Back to 2021 Levels

CREA’s benchmark home price fell 0.4% in October to $679,900, marking a decline of nearly 3% (about $21,000) compared with a year earlier. Prices are now more than 20% below the 2022 peak and have returned to levels last seen in early 2021.

Despite this correction, affordability remains strained across most major markets.

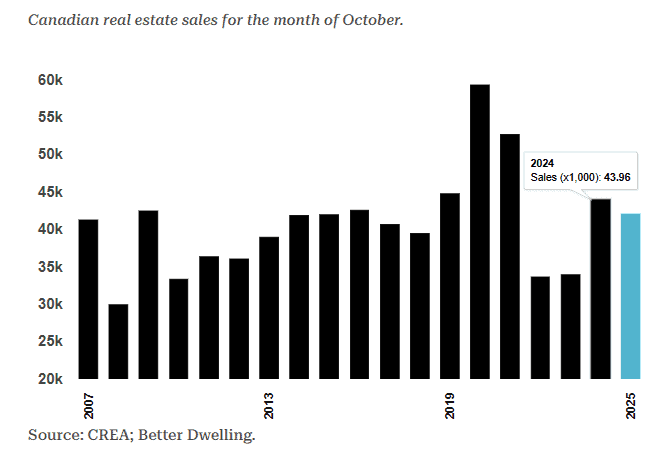

Home Sales Disappoint, Lag Behind Pre-Pandemic Trend

National home sales totalled 42,068 units in October, down 4.3% from last year. Activity is now running about 6% below typical pre-pandemic levels and remains far from the highs set during 2020 and 2021.

By historical standards, October was an unusually quiet month for buyers.

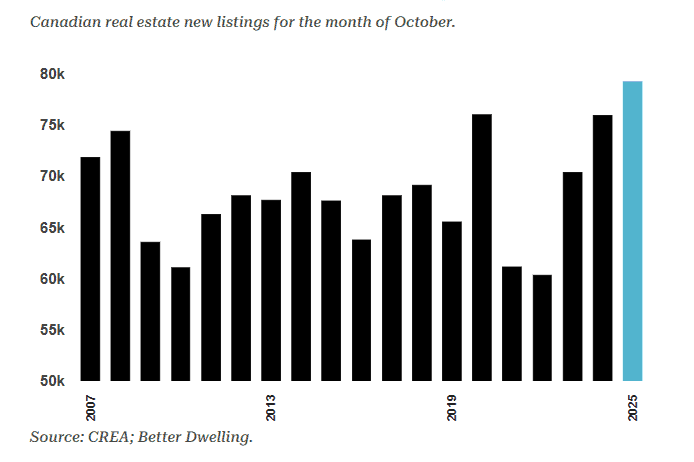

Record-High New Listings Shift the Market Toward Buyers

New listings surged to 79,225, the highest ever recorded for October. The influx of supply has pushed the sales-to-new-listings ratio (SNLR) down to 53%, the weakest reading for the month since 2012.

An SNLR below 55% historically signals downward pressure on prices — a pattern now visible across multiple regions.

A Market Transition That Could Take Years

Although prices have dropped materially from their peak, they remain about 26% higher than a decade ago, reflecting how stretched affordability has become. Even with falling mortgage rates and increased buyer incentives, demand hasn’t rebounded as expected.

Analysts warn that Canada’s housing adjustment could be a multi-year process, as households continue to grapple with high mortgage costs and weaker economic conditions.

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More