Discover how a Canadian family achieved 239% returns using strategic...

Read MoreRenters Now Beating Homeowners in Canada: How Investing Outpaces Property Ownership

In a surprising twist for the Canadian housing market, a new PWL Capital study finds that renters — not homeowners — have seen faster wealth growth in most major cities, including Toronto.

1. Renting Doesn’t Mean Falling Behind

The study examined data from 2005 to 2024 across 12 metropolitan areas, comparing home equity growth with investment returns from renters who invest the difference between rent and mortgage costs.

Nationally, renters achieved 99% of homeowners’ net worth, and in cities like Toronto, Ottawa, and Montreal, renters actually came out ahead.

While homeownership has long been viewed as the safest path to wealth, the study shows that compound investment returns can match or exceed real estate appreciation, especially in markets where property values have stagnated.

2. Why Renters Are Winning

This phenomenon is not about cheap rent — it’s about efficient capital allocation.

When interest rates rise and housing prices plateau, homeowners face growing mortgage, tax, and maintenance costs.

Renters who invest the savings instead gain from steady 8.6% annualized returns on diversified ETFs held in tax-sheltered accounts (RRSP, TFSA, FHSA).

For example, if buying costs $2,000 per month while rent is $1,100, investing the $900 difference can result in higher net wealth over 20 years than property appreciation alone.

3. City-by-City Results

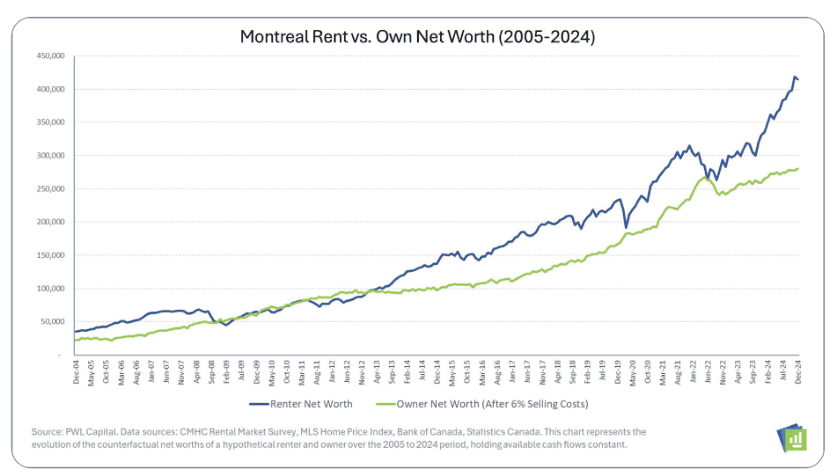

Montreal: Renters hold a clear lead — 48% higher net worth than homeowners.

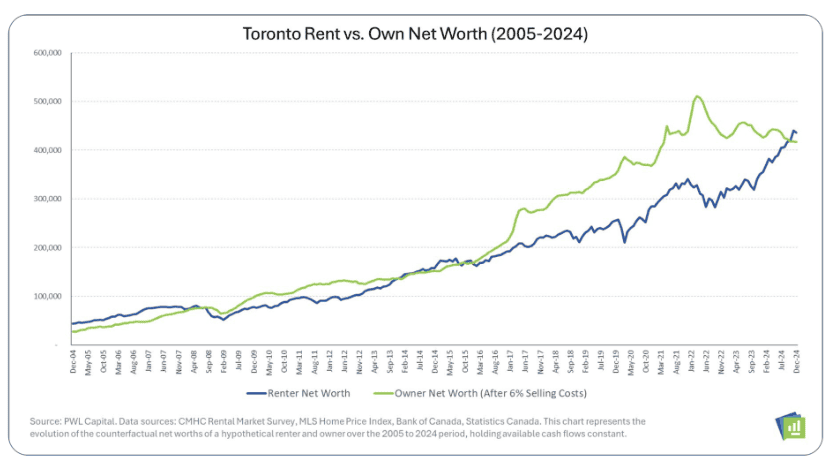

Toronto: Long-term gains for owners have faded; renters slightly outperform in 2024.

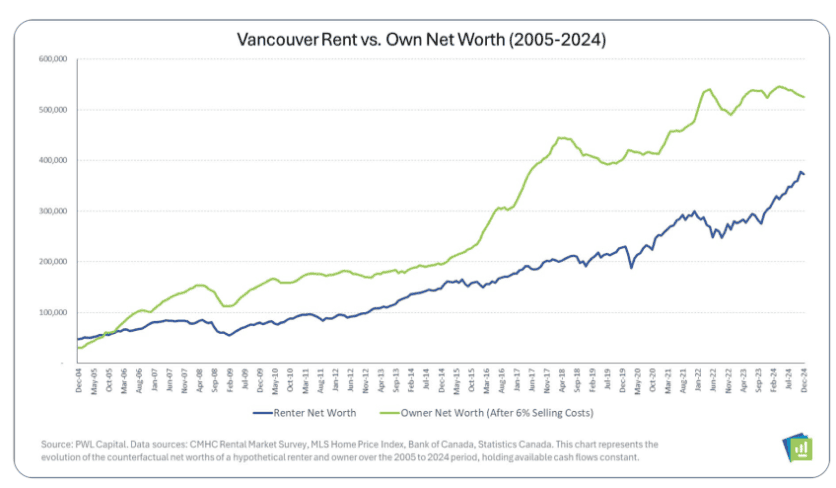

Vancouver: Homeowners dominate (0.71 renter/owner ratio) due to high rents limiting savings.

Calgary: Both groups grow wealth, but homeowners still hold the edge (0.37 ratio).

The study concludes there is no single “winner” across Canada — returns depend on timing, interest rates, and local housing cycles.

4. Compounding Wins Over Real Estate

The math of wealth remains unchanged: time beats timing.

Starting early, even with smaller contributions, outperforms waiting to buy property later.

A $500 monthly investment starting at age 20 can grow to $2.27M by age 67, compared to $2.17M for those starting at age 40 with $2,000 monthly.

Real estate offers leverage — but compound returns offer freedom.

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More