Discover how a Canadian family achieved 239% returns using strategic...

Read MoreVancouver Housing Market Slows: Sales Down 15%, Inventory Piles Up, Prices Soften

November 2025 data shows sales dipping and inventory rising across both Greater Vancouver and Fraser Valley jurisdictions, confirming a sustained buyer’s market.

As 2025 concludes, the real estate market across the Lower Mainland continues to show marked signs of a slowdown. Sales have dipped, inventory is rising, and prices are softening across both major real estate board jurisdictions. The November 2025 housing data reflects a continuation of trends seen earlier in the fall.

Greater Vancouver Realtors (GVR): Sellers Adjusting

According to Greater Vancouver Realtors (GVR), residential sales reached 1,846 units last month—a 15.4% decline from November 2024 and more than 20% below the 10-year seasonal average.

GVR chief economist Andrew Lis described the current climate as one defined by “buyers patiently waiting and sellers adjusting to market conditions not seen in years.”

Inventory Surge: Elevated active listings, up 14.4% year-over-year to 15,149 units, have heightened competition among sellers and are keeping prices under modest downward pressure.

Benchmark Price Slide: The composite home price dropped 3.9% annually to $1.124 million. The steepest decline was seen in apartments (down 5.2%), followed by townhomes (4.4%) and single-family detached houses (4.3%).

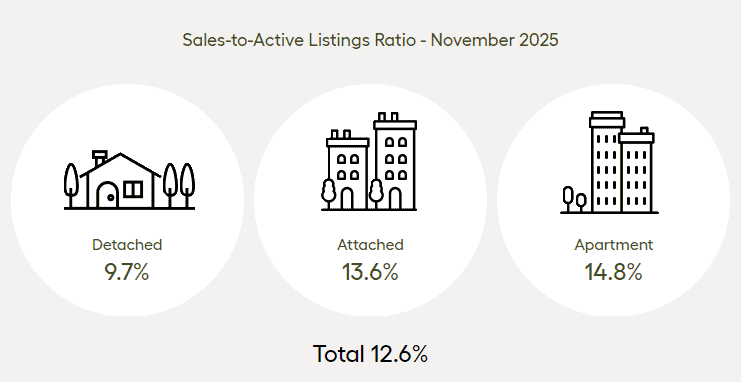

Buyer’s Market Signal: The overall sales-to-active listings ratio fell to 12.6%, nearing the historical threshold that signals potential further price declines.

Lis noted that with borrowing costs expected to hold steady into early 2026, any rebound in demand will rely on shifting buyer sentiment, which is unlikely in the typically quiet month of December.

Fraser Valley (FVREB): Affordability Weighs Heavy

The Fraser Valley Real Estate Board’s (FVREB) jurisdiction saw a similar cooling pattern:

Sales Drop: Sales fell to 943 units, a 17% drop from November 2024.

Market Status: The sales-to-active listings ratio dipped to 10%, cementing the jurisdiction’s status as a buyer’s market.

Price Weakness: The benchmark price for a typical home fell to $0.912 million. Year-over-year drops were severe across all segments, including 6.9% for apartments and 6.8% for townhomes.

FVREB chair Tore Jacobsen pointed out that “Affordability concerns and economic pressures are weighing heavily on many Fraser Valley households.”

Shared Challenges: Longer Sales Cycles

Across the entire Lower Mainland, properties are taking longer to sell. Single-family detached houses spent an average of 51 days on the market in GVR and 52 days in FVREB.

FVREB CEO Baldev Gill emphasized that financing constraints are still shaping the market: “With mortgage conditions tightening, buyers are encountering increased scrutiny and higher down payment expectations from lenders,” which is delaying transactions.

Both jurisdictions are poised for a subdued end to 2025. A more definitive market direction is not expected until early 2026, when interest rate expectations and buyer confidence become clearer.

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More