What’s Next for the Housing and Stock Markets in the Era of Rate Cuts?

On September 18, 2024, the Federal Reserve made its first rate cut in four years, lowering the interest rate from 5.5% to 5%. This has significant implications for both the real estate and stock markets. But first, let’s clarify what interest is.

What is interest?

In simple terms, interest is the cost a borrower pays for using funds, typically calculated as a percentage of the principal. Most mortgages use simple interest, which is only charged on the principal. Compound interest, on the other hand, also charges interest on the interest, making it more expensive. A borrower’s risk profile determines their interest rate—those with lower risk typically receive lower rates.

Simple Interest

Formula: Simple Interest = Principal x Interest Rate x Time

Example: Simple Interest = $1,000,000 x 1% x 12 months = $120,000

Compound Interest

Formula: Compound Interest = P x [(1 + Interest Rate)ⁿ − 1]

P = Principal, n = Number of Compounding Periods

Example: Compound Interest = $1,000,000 [(1 + 1%)¹² − 1]

= $1,000,000 [1.12682 − 1]

= $126,820

So, what impact does this rate cut have on Canada’s housing and stock markets?

Impact of Rate Cuts on the Housing Market

The Federal Reserve’s policies are typically consistent, avoiding frequent rate adjustments. Once rate cuts begin, the future policy direction is clear, indicating a continued trend of rate reductions.

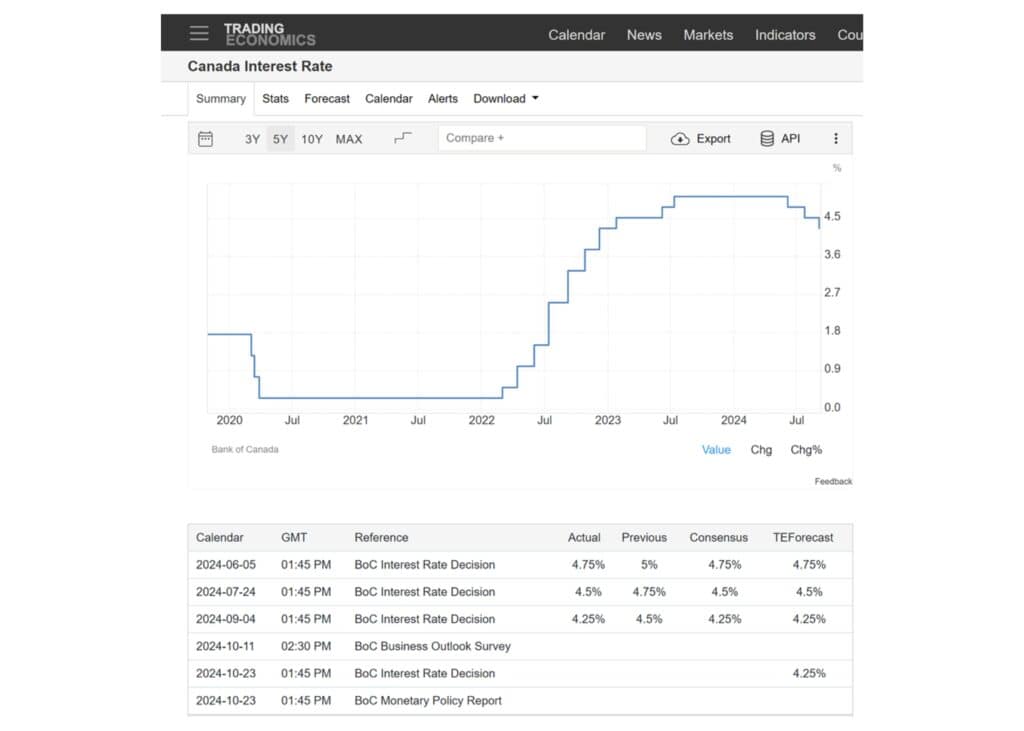

Let’s focus on the impact of rate cuts on Canada’s real estate market. Since the first rate cut on June 5 this year, Canada’s interest rates have dropped from 5% to 4.25%, with three cuts in just three months—faster than the Fed.

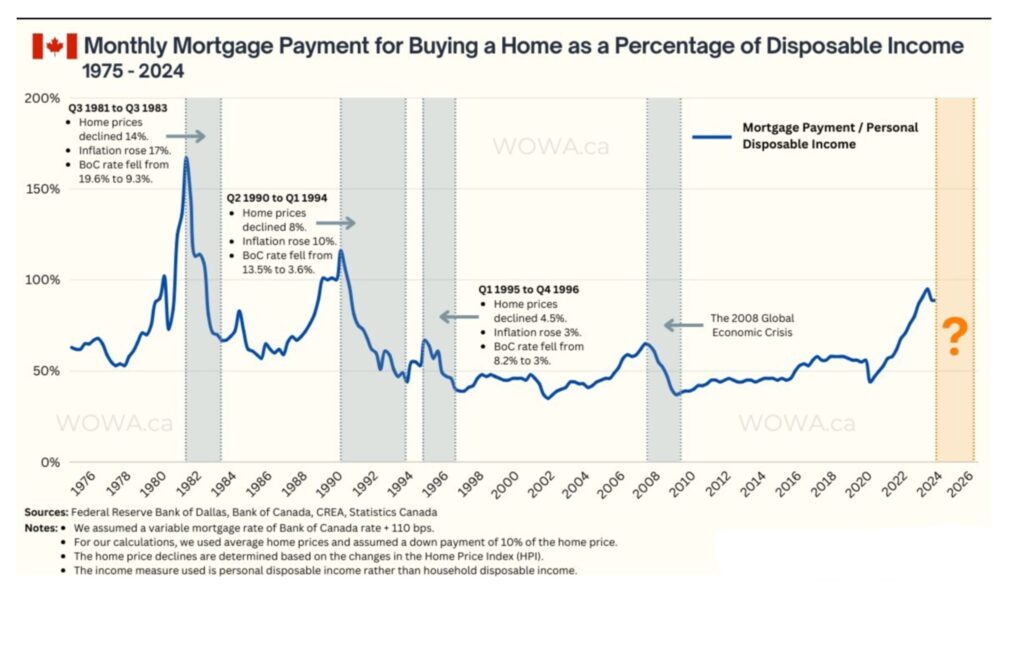

In theory, lower interest rates should reduce mortgage costs. However, the reality is different. Despite the rate cuts, the proportion of mortgage payments to household income remains high. For example, even if the income is 100 dollars, the key factor is how much of that goes toward mortgages. The frequent rate cuts in Canada are driven by the fact that people’s income levels are insufficient to support the high mortgage costs.

Although rate cuts seem to relieve some pressure, they haven’t significantly improved people’s financial situations. Falling home prices mean many homeowners see a decline in their home equity, which impacts their credit availability. The current downward trend in home prices has prompted banks to tighten lending policies, leaving many people with cash flow issues, and some even facing a complete halt in liquidity. So, how are home prices reacting to these changes?

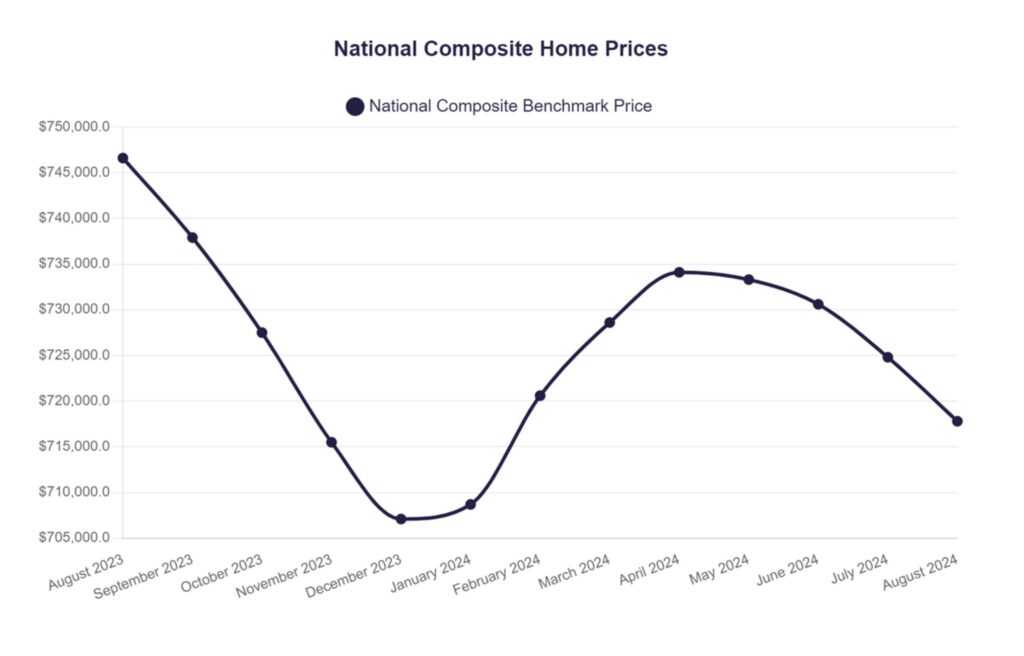

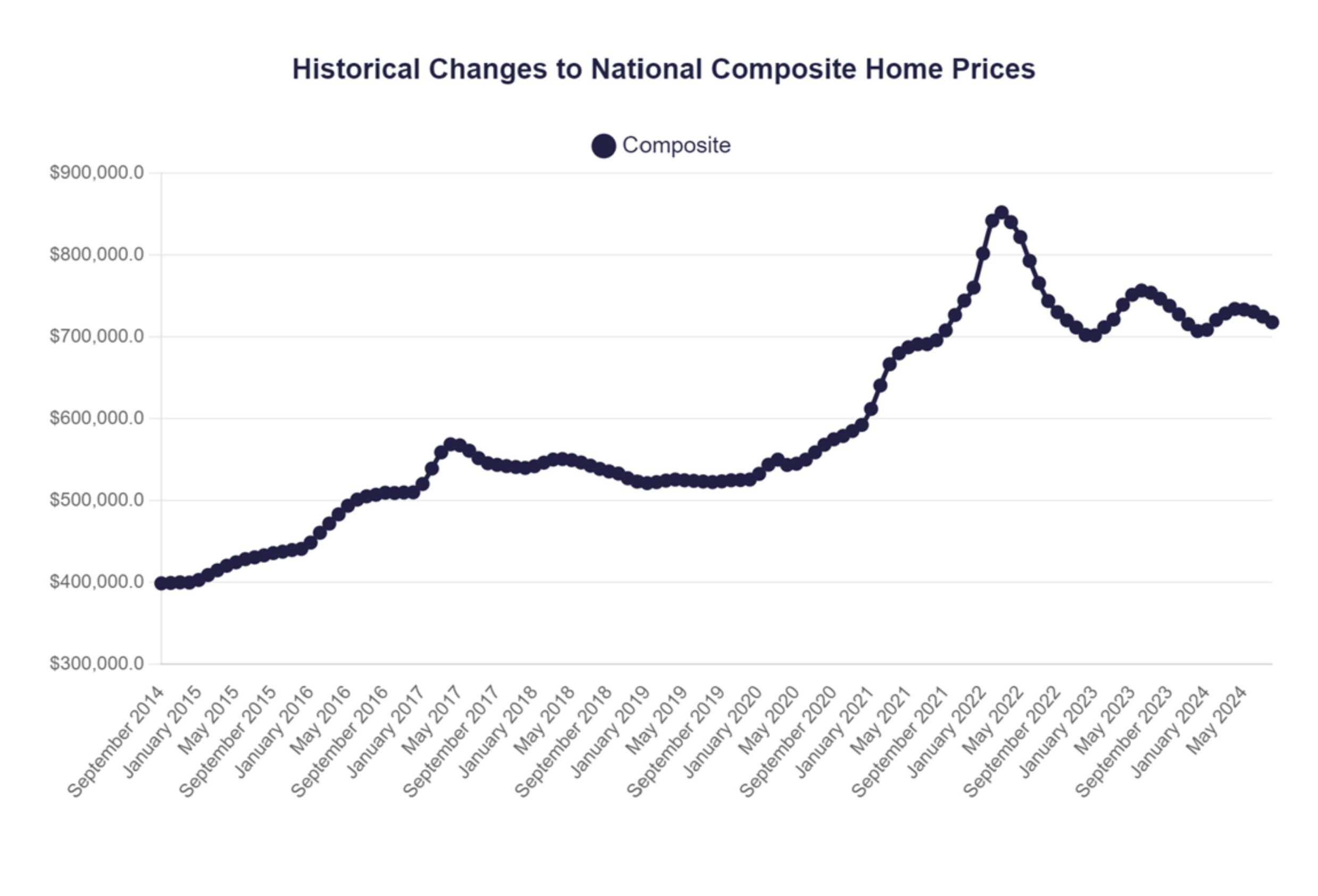

In the chart, the orange line represents the average home price in Canada, while the blue line shows transaction volumes. Since June, despite consecutive rate cuts and expectations of a price rebound, home prices have significantly declined.

Some might wonder if this price drop presents a good buying opportunity. From the blue transaction volume line, we can see that, despite a 10% drop in prices, transaction volumes are actually increasing. This suggests that some individuals are either recognizing issues in the market and choosing to sell early or are forced to sell due to cash flow problems.

Typically, when home prices drop, sellers are reluctant to sell, preferring to wait for a rebound. However, the rising transaction volumes amidst falling prices reveal that more people are exiting the real estate market. The rate cuts since June have not driven prices up; instead, they’ve led to continued declines.

Although there was a brief market rebound at the beginning of 2023 with expectations that rate cuts would bring opportunities, the cuts have failed to support prices as anticipated, worsening the downward trend. The chart clearly shows significant pressure on Canada’s housing market, with prices down about 10% from their peak, dropping from an average transaction price of nearly $400,000 to around $350,000. Now, let’s take a closer look at the latest data.

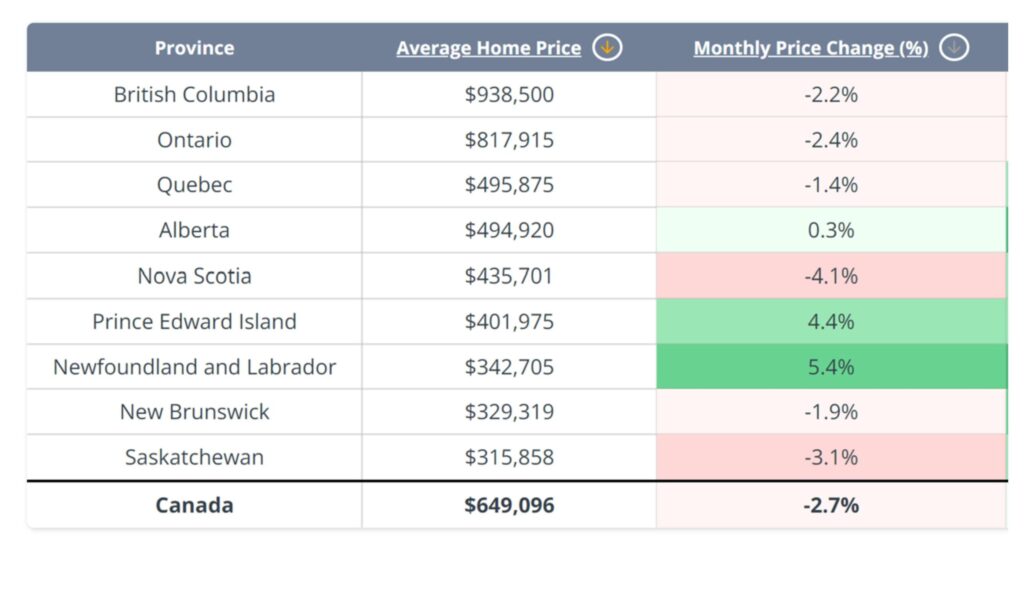

Although the September data has yet to be released, the trends from August are already evident. Monthly price change data reveals that home prices have broadly declined across major provinces in Canada: British Columbia down 2.2%, Ontario down 2.4%, and Quebec down 1.4%. While some smaller provinces have seen price increases, the national average home price still fell by 2.7%, indicating a downward trend in the real estate market.

Since the market peak in May 2022, home prices have not reached new highs but have gradually declined, with occasional rebounds losing momentum, indicating market weakness. As the Federal Reserve began raising interest rates in 2022, home prices followed suit, highlighting their correlation. Even now, during the rate-cutting phase, prices continue to fall, demonstrating a clear trend.

Macroeconomic conditions also affect the real estate market. In 2022, the post-pandemic economic rebound resulted in a strong job market and low unemployment, allowing people to manage their mortgages. However, by 2024, the unemployment rate has climbed to 6.7%, indicating an economic downturn. Although interest rates have decreased, this has not translated into a recovery in home prices. The real issue lies in cash flow disruptions; many individuals are unable to sustain their mortgages due to job loss or reduced income. The increase in market transactions does not reflect restored confidence but rather a response from some investors seeking bargains or homeowners selling due to cash flow issues.

In summary, the interest rate cuts have not altered the overall downward trend. The current economic slump and cash flow challenges are key obstacles to a rebound in the real estate market. So, what impact do these rate cuts have on the stock market?

Impact of Rate Cuts on the Stock Market

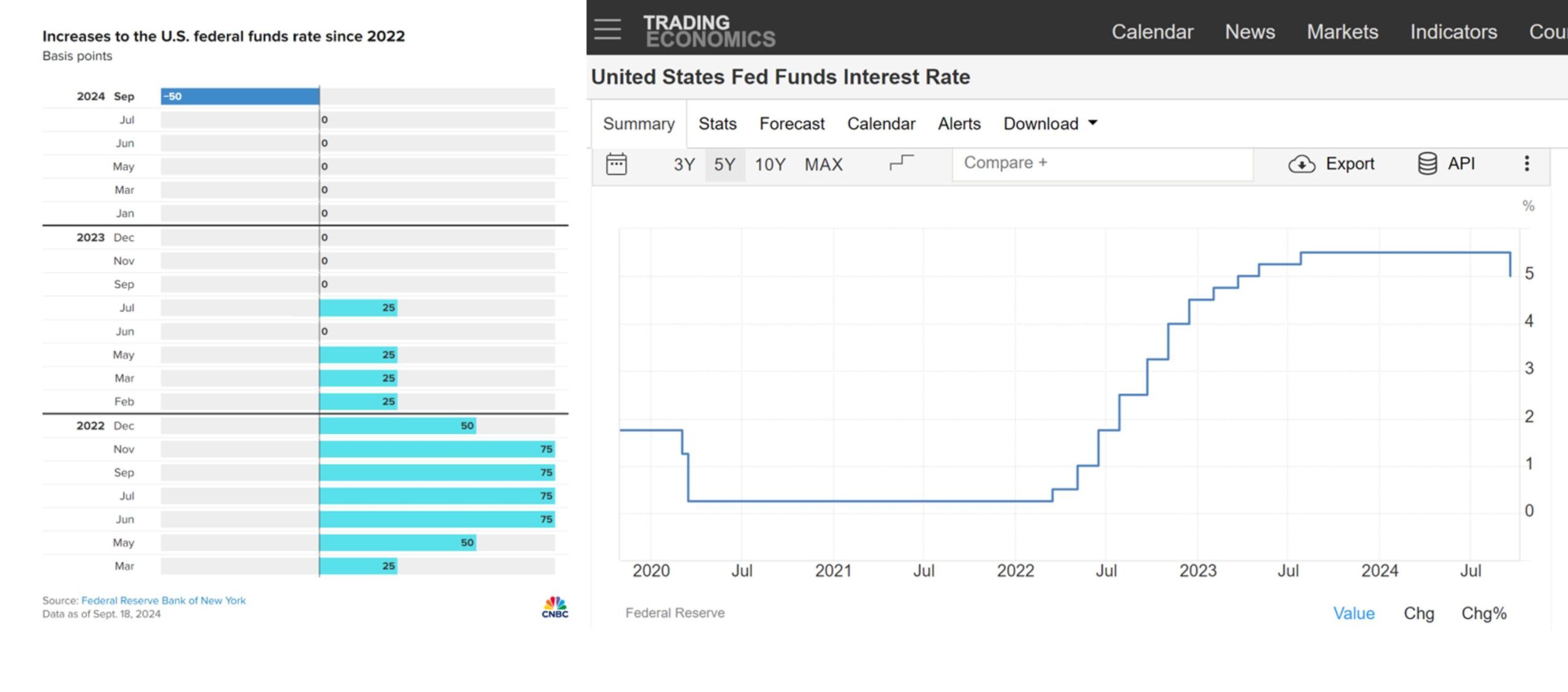

The left chart illustrates the Federal Reserve’s transition from rate hikes to cuts. The Fed raised rates for the first time in March 2022 by 25 basis points, gradually increasing the pace until the first rate cut in September 2023, which was a significant 50 basis points. This move indicates tightening liquidity in the market, with many institutions and individuals facing cash flow issues, compelling the Fed to adopt a more aggressive stance on rate cuts.

The right chart shows the trend of interest rate changes. Since March 2022, the Fed has raised rates 11 times, ultimately reaching 5.5%. By September 2023, the rate was reduced to 5% from this peak. This data clearly reflects the evolution of the Fed’s monetary policy in response to market liquidity.

Overall, rate cuts typically signify heightened concerns about the economic outlook, which directly impacts stock market performance.

The monthly chart of the U.S. Dow Jones Industrial Average shows a decline from March to September 2022 as the Federal Reserve raised interest rates. However, the market began to rebound in October 2022, surpassing its March peak by August 2023 when the Fed paused rate hikes.

Despite initial short-term declines, the stock market adapted and showed recovery potential. Following the halt in rate increases, initial uncertainty gave way to renewed confidence, transitioning into a bull market. Rate cuts enhanced market liquidity, attracting buyers and driving upward momentum, marking the start of a new upward cycle.

In economic slowdowns, rate cuts stimulate financial activity and growth by encouraging borrowing. Lower rates increase disposable income, benefiting the stock market. Many believe these cuts will lead to a bull market, as corporate earnings rise, boosting stock prices.

The Bottom Line

Data suggests the real estate market is reaching its limit while the stock market is recovering, indicating a need to adjust investment strategies. The key to successful investing is direction; hasty decisions can lead to mistakes. Working with professionals can help mitigate risks.

Capital-protected funds and investment loans offer stable returns. Borrowing through investment loans can yield returns that exceed interest expenses, with the gap widening over time. Thus, careful investment planning and professional guidance are crucial for wealth growth.

You may also interested in

What is an investment loan?

Can this loan last a lifetime? Interest-only payments? Tax-deductible? Is it a private loan? Is the threshold high?

Why do you need segregated funds for retirement?

Segregated funds are a popular choice for group savings and retirement plans. They provide access to high-end and unique……

Invest with TFSA

A Tax-Free Savings Account (TFSA) provides you with a flexible way to save for a financial goal, while growing your money tax-free……

Invest in RRSP-Invest wisely, retire early

According to a recent survey by BMO, due to inflation and rising prices, Canadians now believe they need 1.7 million dollars in savings to retire……