Discover how a Canadian family achieved 239% returns using strategic...

Read MoreTariffs Spark Turmoil: How Bulls and Bears Clash in the U.S. Stock Market

In early April 2025, the U.S. stock market entered a period of extraordinary volatility—one of the most dramatic seen in years. On April 2, former President Donald Trump proclaimed “Liberation Day” and launched a sweeping new tariff policy, sending shockwaves through U.S. equities and igniting a fierce standoff between institutional short-sellers and long-term buyers.

Over the next seven days, markets whipsawed violently. While panic rippled through retail investors, Ai Financial (AiF) provided what many lacked: not noise, but clarity. Backed by decades of market experience and a disciplined investment philosophy, AiF helped clients navigate the uncertainty with calm, data-driven conviction.

Tariffs and U.S. Stocks: The Trigger Behind the Bull-Bear Standoff

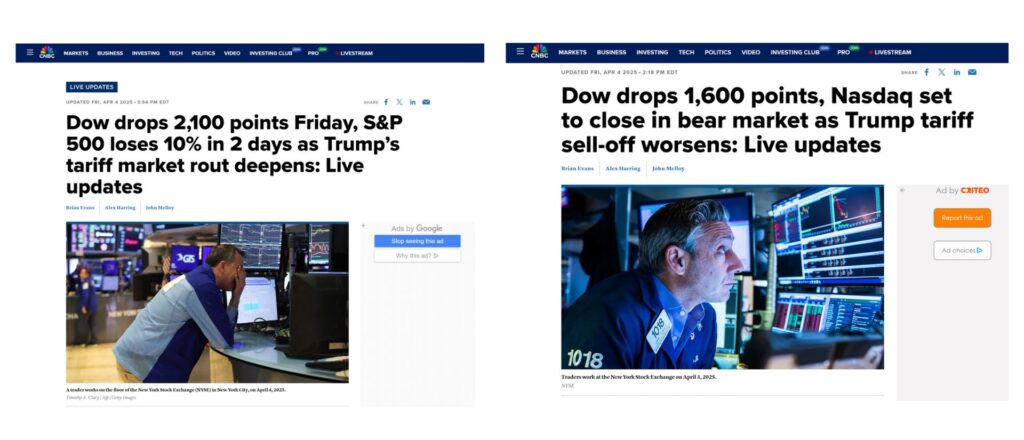

Day 1–2: The Shockwave Begins

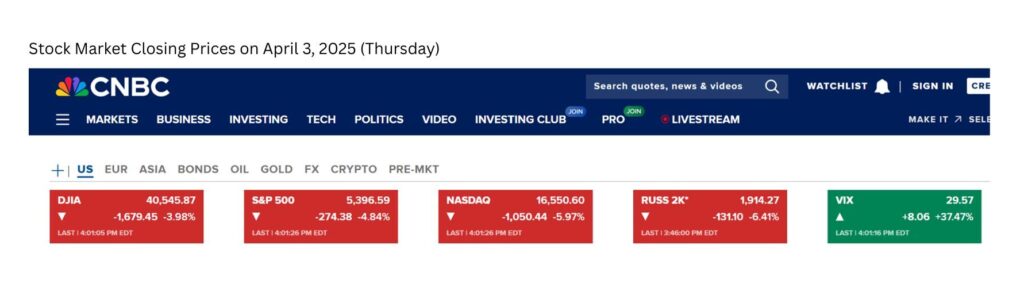

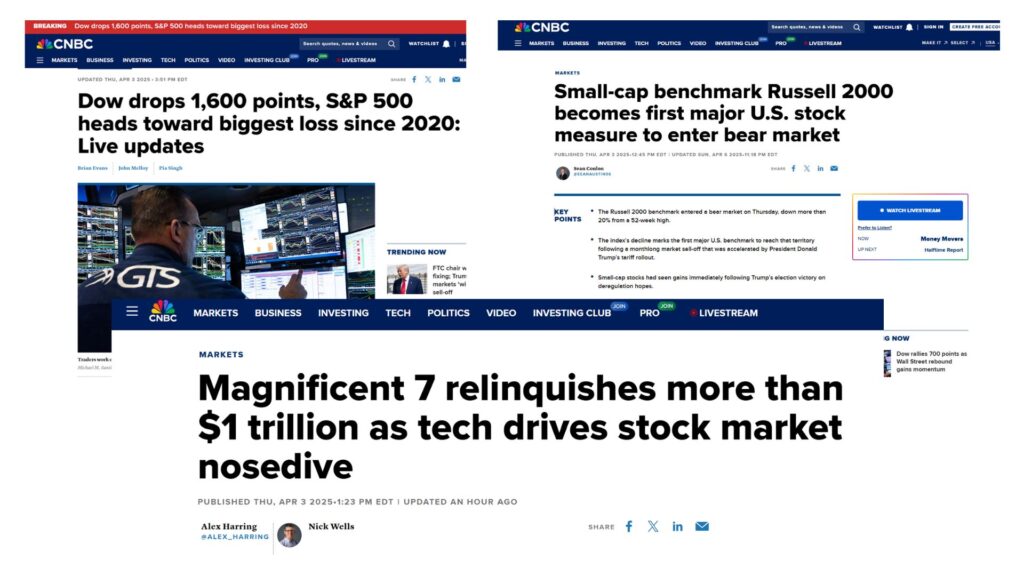

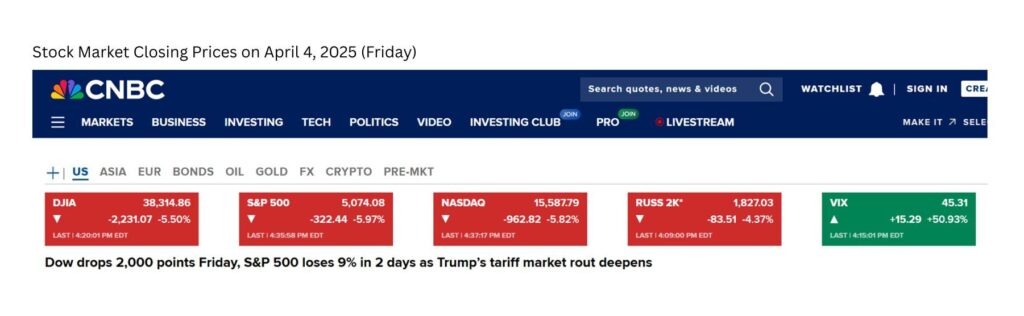

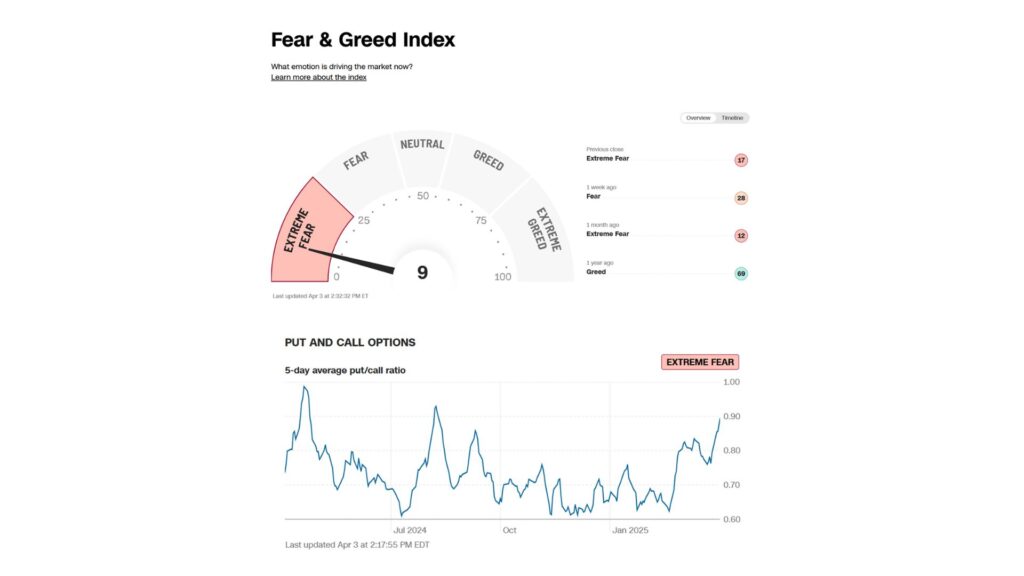

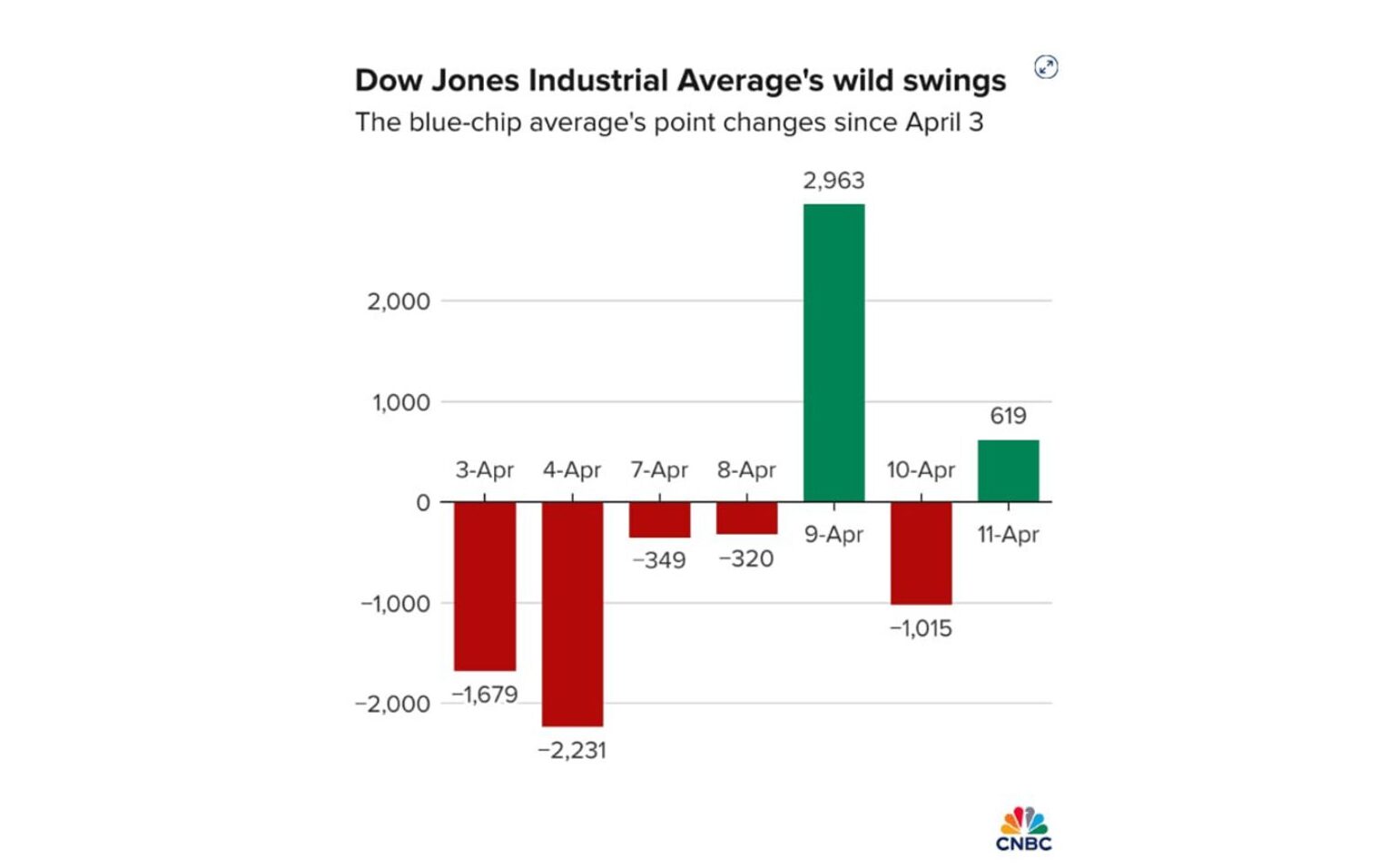

April 3 marked the beginning of the storm. The Dow Jones Industrial Average plunged 1,679 points (down 3.98%), the S&P 500 dropped 4.84%, and the Nasdaq suffered a staggering 5.97% loss—its steepest single-day decline since the 2020 pandemic-driven crash. By April 4, the S&P 500 had dropped a full 10% in just two days. The Russell 2000 small-cap index officially entered bear market territory. Short interest surged; the put/call ratio jumped to 0.9. The MAG 7—seven tech giants—lost a combined $1 trillion in market cap.

Amid this chaos, AiF urged its clients not to flee. We emphasized facts over fear, reminding our audience that market cycles are defined by volatility, and that conviction—not panic—should guide decisions.

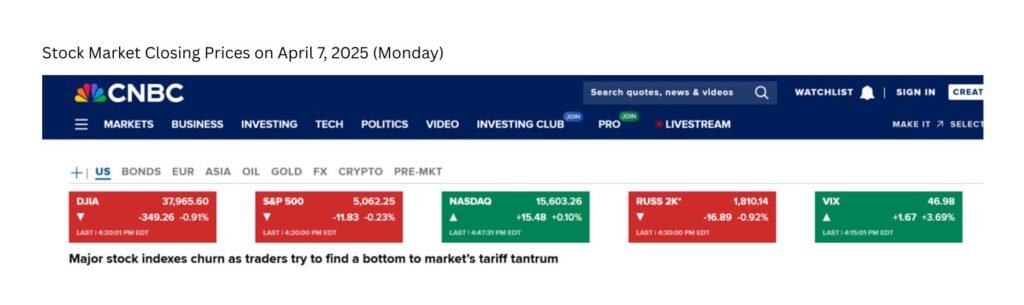

April 7: Standing Firm Amid Panic

On Monday, April 7, pre-market futures signaled another devastating open, dropping over 1,300 points. Investors were in full retreat. Yet AiF stood firm. We called it a once-in-a-generation financial reset and advised clients to see it as an opportunity, not a catastrophe.

Our VP Tiffany quoted Warren Buffett: “If the pond is full of goldfish, bring a bucket, not a thimble.” We reminded investors of 2020 when the market crashed and yet rebounded to record highs. The data showed a market under attack—but also showed the beginning of long-side consolidation. It was time to prepare, not to panic.

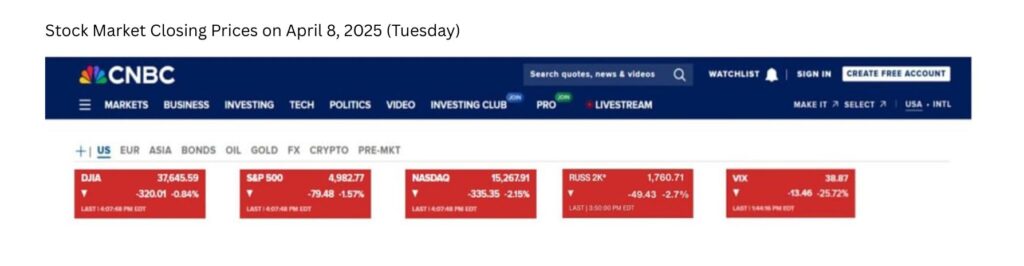

April 8: A False Start

On Tuesday, April 8, the market opened 1,000 points higher. For a moment, relief washed over the market. But it didn’t last. By close, the Dow had erased its gains and finished down 320 points, nearly at the day’s low. It was a classic bull trap.

AiF’s technical team noted the minute-by-minute chart: a sharp opening spike followed by steady deterioration. This wasn’t yet the breakout we expected, but it was a sign: buyers were beginning to return.

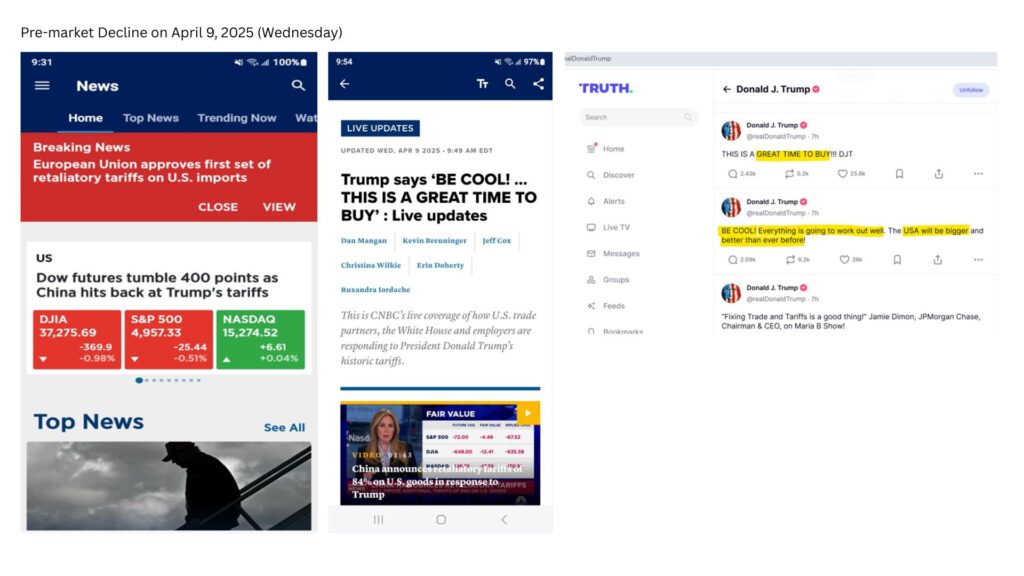

April 9: A Historic Reversal

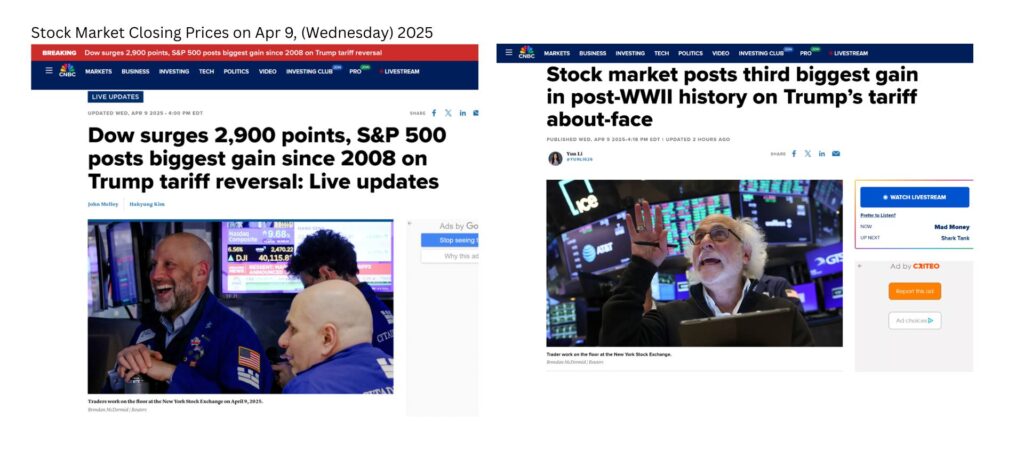

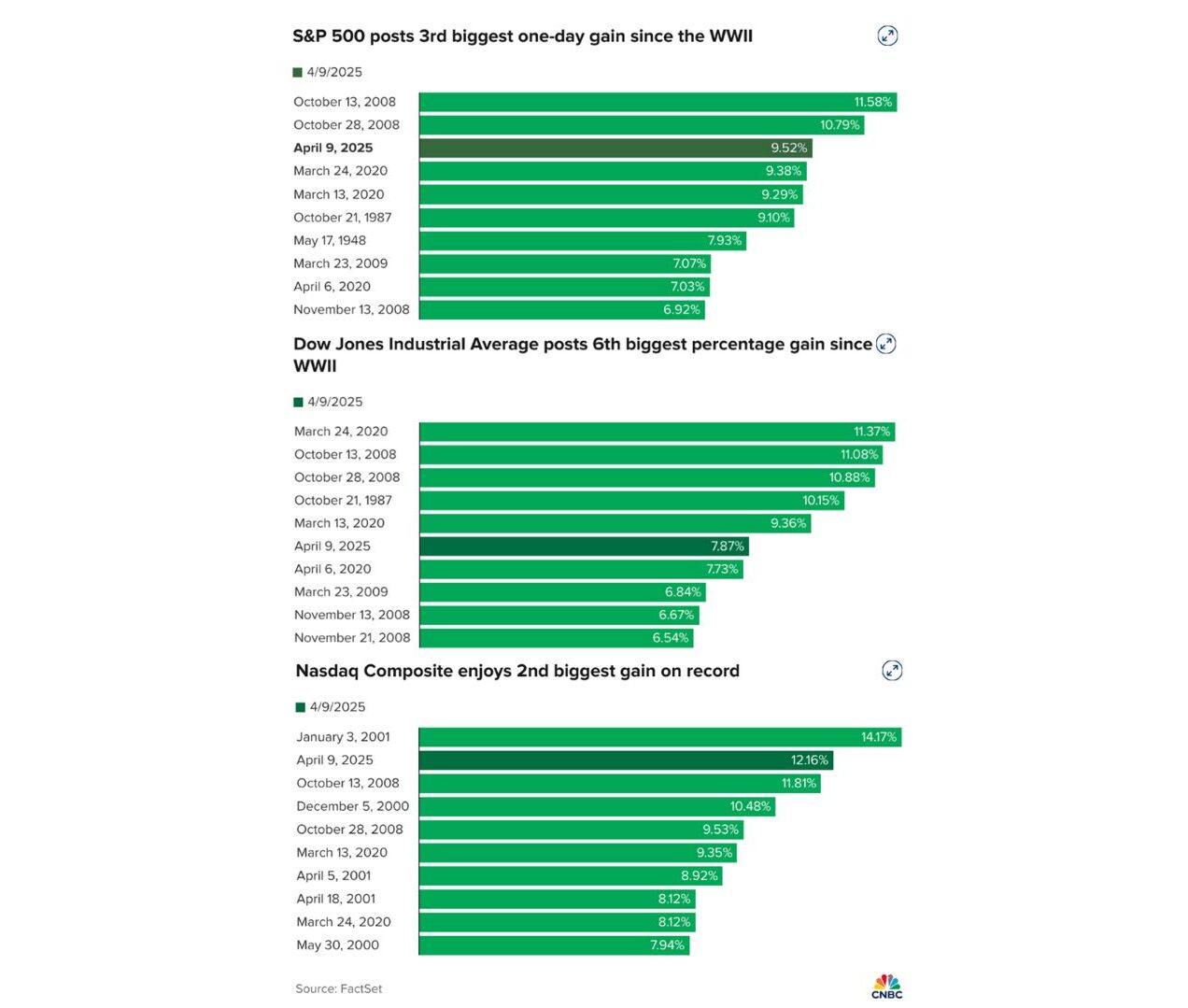

Then came April 9. After three punishing sessions, the Dow exploded upward, closing with a 2,962-point gain. It was one of the largest single-day rallies in Wall Street history. The S&P 500 saw its third-largest gain since World War II. Nasdaq posted its second-largest gain on record.

This wasn’t just a rebound. It was confirmation. Our real-time buy calls, made amid fear and uncertainty, had been validated.

Even Wall Street’s most photographed trader, Peter Tuchman—often called the Einstein of Wall Street—was seen grinning across major news outlets. His image had become symbolic of the market’s extreme emotion, from despair to euphoria.

April 10–11: Volatility Continues, But Momentum Builds

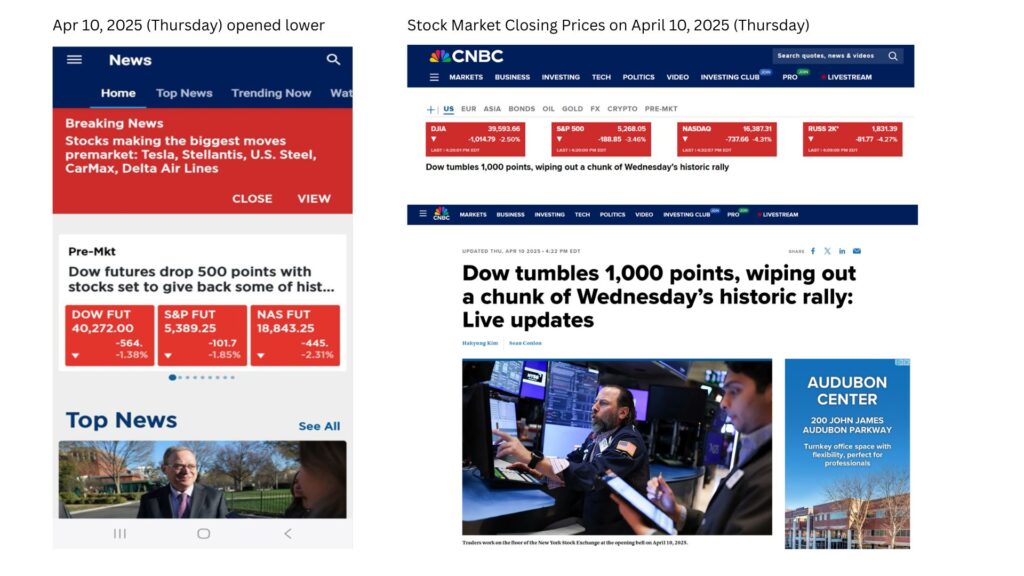

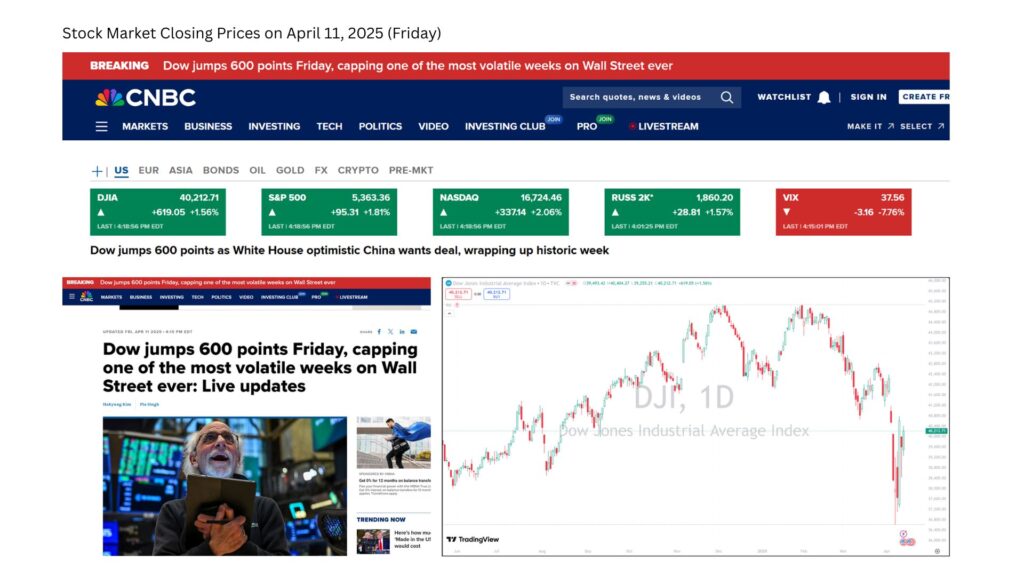

The battle wasn’t over. April 10 saw another 1,000-point drop. But April 11, a Friday, told a different story. The market opened down 2,000 points but began to recover steadily. By the close, the Dow had not only erased the loss—it ended the day up 600 points, closing back above 40,000.

This closing price had symbolic weight. As Tiffany reminded our clients, this wasn’t just a bounce. It was the market confirming that the worst might be over. The longer the selloff lasted, the more likely it was that value was being created.

Our internal charts highlighted the intraday reversal and pointed to waning momentum on the sell-side. Fear was giving way to strategy. On this day, the market didn’t just survive—it reclaimed ground.

Lessons from the Front Line

What did these seven days teach us? First, volatility is not the enemy—emotion is. Second, fundamentals win over forecasts. And third, timing the market rarely works, but time in the market does.

At AiF, we don’t predict—we position. We don’t speculate—we strategize. The Liberation Day market battle proved that those who stay calm in the chaos are the ones who capitalize when the dust settles.

In an age defined by the Fourth Industrial Revolution, where capital is flowing back to the West, those who align their investment behavior with long-term structural shifts—not short-term headlines—will emerge ahead.

Live Q&A Highlights

Q1. If the economy enters a recession, does that necessarily mean the investment market will decline?

A: Yes, if the economy truly enters a recession, the market will inevitably decline — that’s a basic economic principle. However, we must base our judgments on facts. Currently, the data shows that the U.S. economy has not entered a recession. While the market has experienced a recent decline, it has already begun to stabilize and recover. Therefore, we do not believe we are currently in a recessionary phase.

Q2. With China’s rapid development, is it likely to replace the U.S. as the world’s leading power?

A: On the surface, China’s recent development appears impressive. However, based on financial market indicators, China’s A-share index has hovered around the 3,000-point level for years, suggesting limited real wealth growth. In contrast, the U.S. stock market has steadily risen for over 200 years, reflecting true wealth accumulation. Much of China’s apparent growth has come from monetary expansion, with little of that wealth reaching the broader population. As it stands, China cannot replace the U.S. in global leadership, and U.S. equities show no signs of decline.

Q3. Trump’s policy changes seem frequent—does this make the market unstable? Besides mutual funds, are options a good strategy?

A: While policy changes can indeed trigger market volatility, this also signals vitality. Just like a heart monitor, larger spikes suggest a living, breathing system. Options, however, have expiration dates and require constant in-and-out trading, which makes them speculative by nature. We do not recommend options. For long-term, stable investing, we suggest public capital-guaranteed funds held over time.

Q4. Would it be safer to wait until the Federal Reserve officially cuts interest rates before entering the market?

A: This is a common concern. However, the Fed has shown no signs of cutting rates yet, as the economy remains healthy. If you wait for the official rate cut, the market may have already rebounded. We advise against trying to time the market. The best approach is to stay in the market and invest consistently.

Q5. Can China’s infrastructure spending, such as on bridges and highways, boost the stock market?

A: No. Market growth is driven by the creation of real wealth and value—not just capital expenditure. Infrastructure like bridges and roads, while important, do not generate new wealth by themselves. Similarly, assets like Bitcoin or gold do not produce value either. Only productive investments can support long-term market growth.

Q6. The current volatility is affecting investor confidence. When will the market stabilize?

A: Based on our experience, volatility is here to stay and will likely intensify over time. Just like a healthy heartbeat has strong fluctuations, a healthy market also shows large movements. Investors should adjust their mindset and not wait for “calm” that may never come.

Q7. Some say the U.S. also has corruption and inefficiency, so there’s no difference between China and the U.S.—what’s your view?

A: We encourage investors to look beyond domestic narratives and consult reputable English-language sources. Broader exposure to diverse viewpoints often leads to clearer understanding. Don’t let politically charged or narrow perspectives cloud your judgment of markets.

Q8. If this market correction ends up being 30% to 50%, isn’t it too early to buy now?

A: No one can accurately predict whether the market will fall 30% or 50%. At AIF, we do not predict—we act based on facts and experience. If the market is currently in a deeply oversold state, we prefer to enter rather than wait for a “perfect” moment. Major rebounds often follow major drops. The key is response, not prediction.

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More