Will the Stock Market Rise with the Next U.S. President?

The upcoming U.S. presidential election on November 5 will see former President Trump face Vice Presidential candidate Harris. Current polls reveal a clear divide, with some showing Trump in the lead, while others indicate stronger support for Harris. This split has created an unpredictable race, and the final outcome remains uncertain until the votes are officially counted.

From an investment perspective, Ai Financial leans toward a Trump victory. As a relatively right-leaning candidate, Trump’s policies are expected to prioritize economic growth, which could benefit the market. However, Harris also holds a viable chance of winning.

Regardless of who wins, the main concern for investors is how the new president’s policies will impact the U.S. stock market and global economy. The key factor driving economic trends will be whether the next administration can bring favorable conditions to the market and stimulate growth.

This article will analyze the current political landscape and the future direction of the U.S. market from four key angles:

The likelihood of a market surge following the election

In the upcoming presidential election, the primary concern for investors is which candidate’s victory could lead to a stock market surge. This year’s candidates are Trump and Harris, making it essential to analyze their campaign promises.

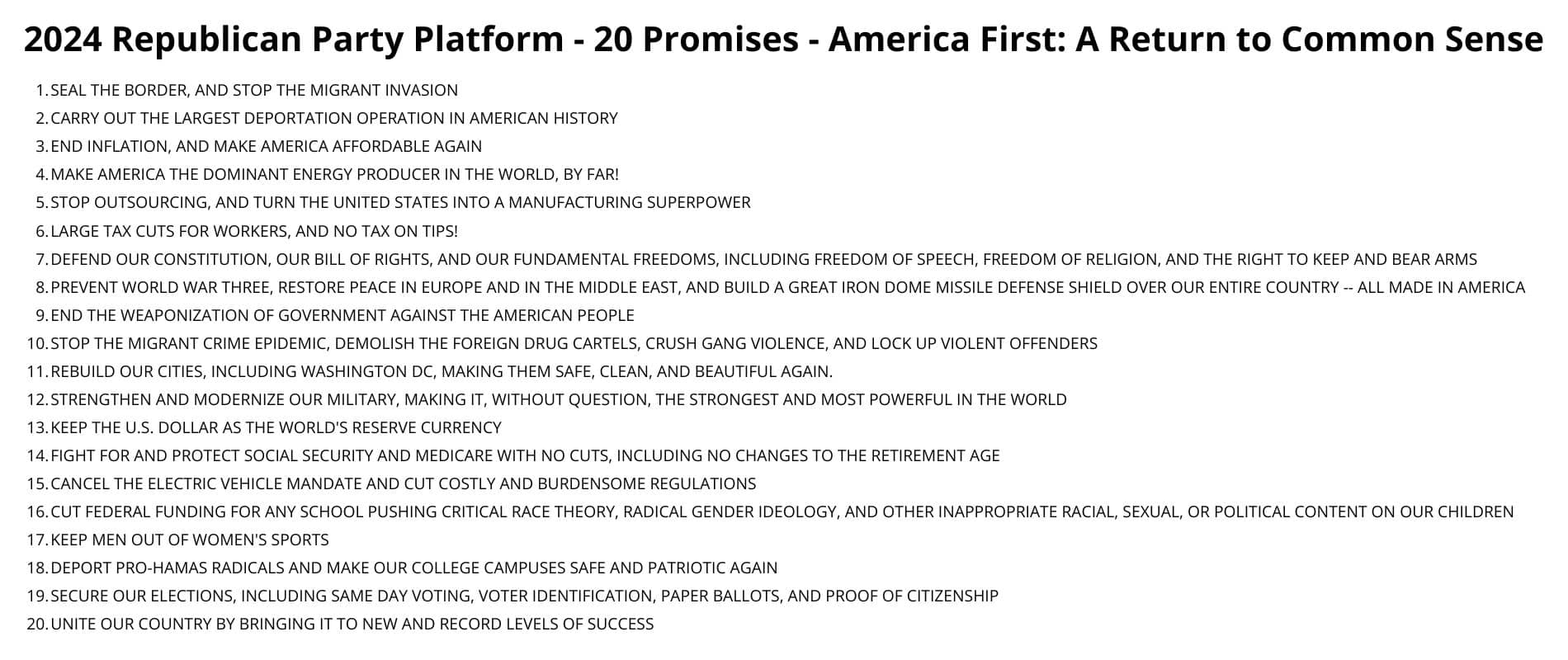

First, let’s look at Trump’s campaign agenda, which outlines around twenty key points. Here, we focus on the top five:

- Border Control and Stopping Illegal Immigration

Trump has pledged to strengthen border control to prevent illegal immigration and initiate large-scale deportations, aiming to protect jobs for American citizens. With domestic employment issues, his stance is to prioritize opportunities for Americans. Tackling illegal immigration is, in essence, about ensuring jobs remain accessible to U.S. citizens.

- Ending Inflation and Making Living Costs Affordable

Trump aims to combat the high inflation rate, a significant issue for the U.S. in recent years. His strategy includes unlocking American energy resources, reducing wasteful spending, and cutting excessive regulations. While not advocating for zero regulation, he supports limiting intervention to allow businesses to self-regulate, as overregulation can stifle corporate growth and counter inflation-reduction efforts.

- Positioning the U.S. as a Global Energy Leader

Trump plans to expand domestic energy production. Currently the largest oil and natural gas producer, the U.S. would benefit economically by lifting restrictions on energy production. This approach promises job creation and lower energy costs. It also suggests potential impacts on the electric vehicle market, as traditional oil-based vehicles could continue to dominate under Trump’s policies.

- Repatriating Manufacturing and Protecting American Workers

Trump’s focus on bringing manufacturing back to the U.S. aims to shield American workers and farmers from unfair trade practices. This shift involves relocating supply chains to the U.S., creating jobs, and promoting global demand for American-made products. A return of manufacturing is envisioned as a major job creation strategy.

- Tax Cuts

Trump has proposed permanent tax cuts to “return wealth to the people,” allowing citizens to benefit directly. This policy not only boosts disposable income but also encourages consumer spending, supporting a cycle of positive economic growth.

In summary, Trump’s platform emphasizes “America First” and a return to economic pragmatism. Each policy is structured to stimulate growth, which would likely support a stock market rally. Through these top five initiatives, Trump’s agenda centers on practical economic measures designed to drive U.S. economic recovery and growth.

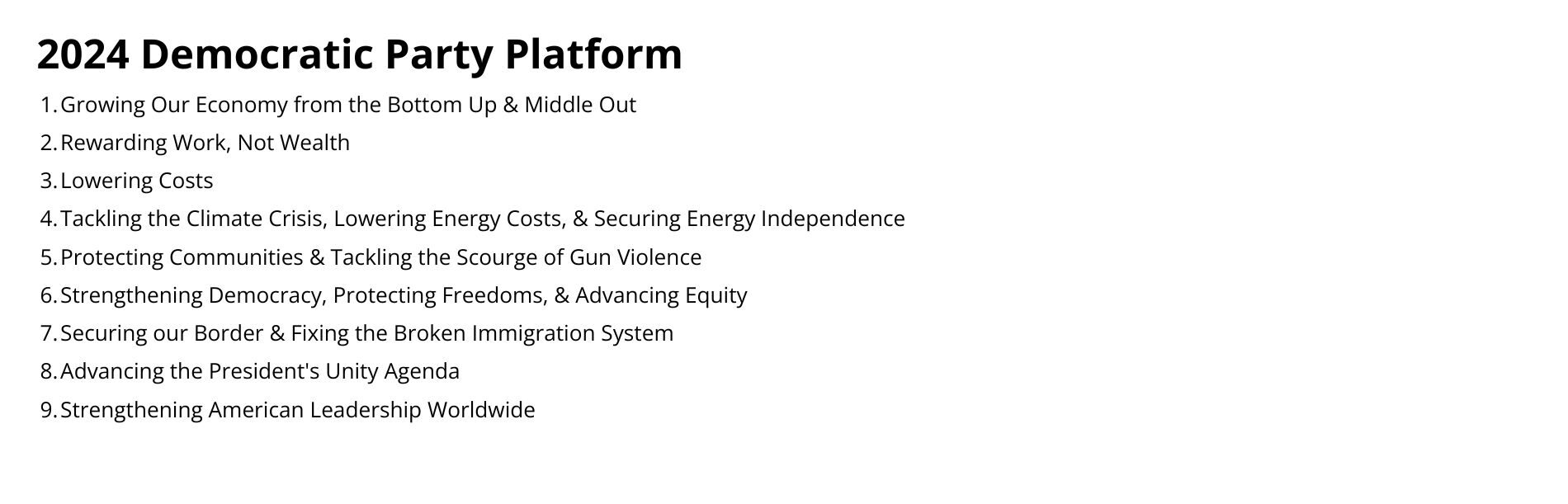

Next, let’s examine the ten points in the campaign platform of Democratic candidate Kamala Harris, starting with the first five. The first point is “to protect Americans from the impacts of COVID-19 and then build a stronger, fairer economy.” This includes achieving affordable, high-quality healthcare, protecting communities through judicial reform, building trust, healing the American spirit, and safeguarding human rights. Regarding economic development, infrastructure investment is essentially about “spending money on construction,” similar to the infrastructure policies promoted by Obama after the 2008 financial crisis. The second point is “to bring back manufacturing and supply chains,” which actually replicates Trump’s policies without any innovation. Job creation is the third point; if manufacturing can return, job opportunities will naturally increase. It can be said that Harris’s economic policies mainly revolve around “spending money” and “encouraging labor,” rather than simply redistributing wealth.

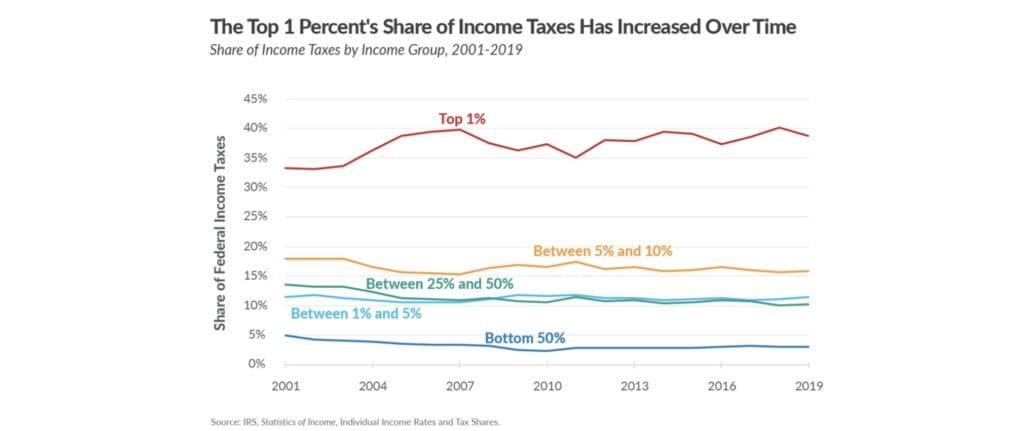

In the point about “rewarding labor, not wealth,” the goal is to provide tax cuts for working families while ensuring that the wealthy and large corporations pay their fair share. Next, let’s look at tax data. According to the IRS, from 2001 to 2019, the proportion of taxes paid by the bottom 50% decreased from 5% to 3%. This means that the middle class and wealthy individuals bear 97% of the tax burden. In reality, the middle class has not received significant tax cuts, while the wealthy’s tax rate has increased from 33% to 38%. If the Democrats are aware of this data, why do they still mention tax cuts in their campaign slogan? Clearly, it is to appeal to voters, especially those at the lower end of the income spectrum.

Next is the goal of achieving affordable healthcare. The healthcare plan previously promoted by Democrats provided insurance for 45 million Americans but was essentially a rehash of Obama’s healthcare reform. Universal healthcare sounds appealing, but who will foot the bill? Ultimately, it may fall on the wealthy, who could evade their tax obligations, making it even harder for the poor to survive.

Now, let’s consider judicial reform. President Biden has used his clemency power to correct mistakes, including pardoning individuals for marijuana possession and use. The Democrats hope to alleviate juvenile criminal records through these policies, believing that young people deserve a second chance. However, is this reasonable? Criminal behavior should not be legalized, and juvenile crimes should be subject to legal consequences rather than being easily overlooked.

Finally, we discuss “human rights equality.” The Biden administration has rejected the Supreme Court’s overturning of Roe v. Wade, claiming it restricts women’s right to abortion. However, overturning Roe v. Wade does not equate to banning abortion; it simply returns the power to the states. The original ruling applied federal legislative authority uniformly to abortion, which is unreasonable.

In summary, Harris’s campaign platform is filled with political games and deviates from common sense. We should focus on the real effects of these policies rather than just slogans.

If Harris is elected, what situation will the U.S. economy and stock market face? Let’s compare two historical presidents: Reagan (Republican) and Clinton (Democrat). Their economic and stock market conditions during their presidencies were different, but we can examine their policies and results.

Reagan served from 1981 to 1989, focusing on tax cuts and reducing government burdens. This led to an economic recovery beginning in 1983, resulting in the longest economic expansion in U.S. history. By cutting taxes and reducing burdens, government revenue actually increased as spending decreased. Reagan’s policies generated significant economic growth. The stock market during his presidency showed a steep upward trend, indicating that Republican policies can rapidly drive U.S. economic development.

In contrast, Clinton served from 1993 to 2001. His policies centered on tax increases and expanding federal government spending. Despite this, Clinton’s administration experienced the longest economic growth on record, achieving a balanced budget with a surplus of $559 billion. The stock market also demonstrated a steep upward trend during this period.

This indicates that whether under Republican or Democratic leadership, differing economic policies can still yield positive economic results.

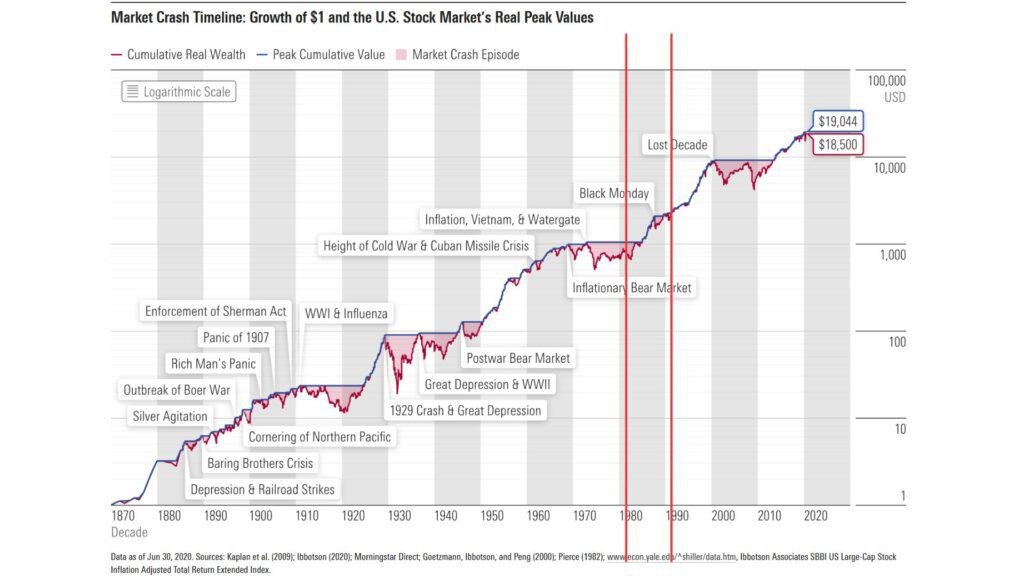

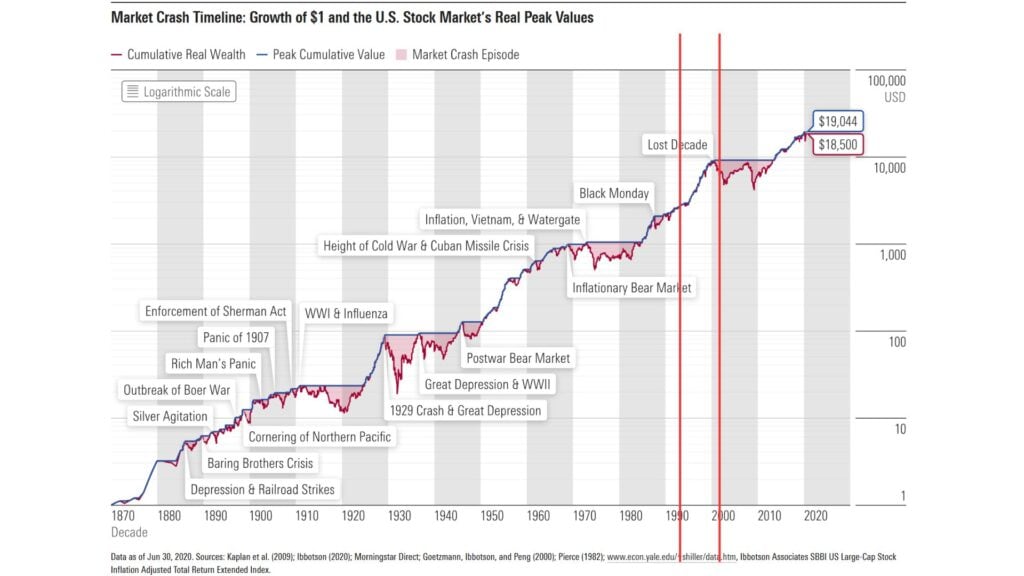

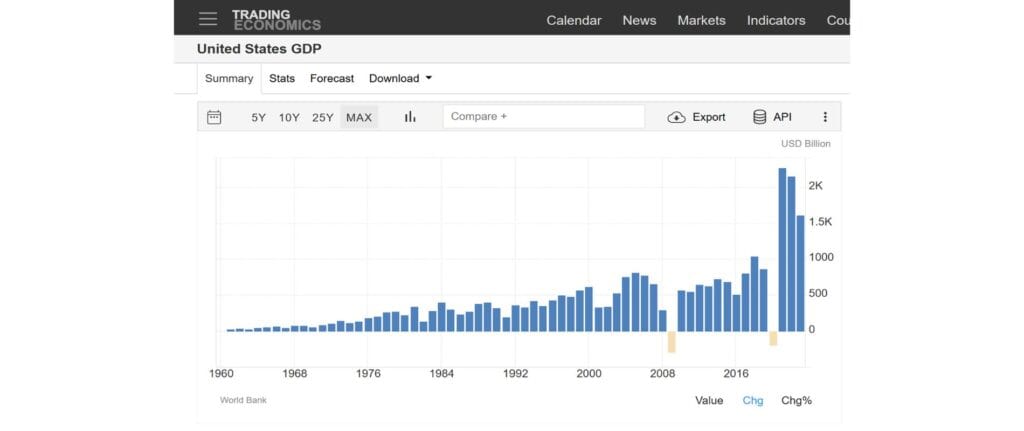

According to the U.S. Bureau of Economic Analysis, over the past 65 years, U.S. GDP growth has mostly been positive, with negative growth occurring only in 2009 and 2020 due to the financial crisis and the pandemic, respectively. This shows that economic development has inertia, with an overall upward trend prevailing.

Combining this analysis, it is clear that regardless of which president is elected in the future, the upward trend in economic development and the stock market is likely to continue. History shows that while there may be fluctuations along the way, the overall trajectory is upward, and no event can halt the stock market’s rise. This is a historical pattern, and economic growth is an inevitable trend.

The financial market's stance

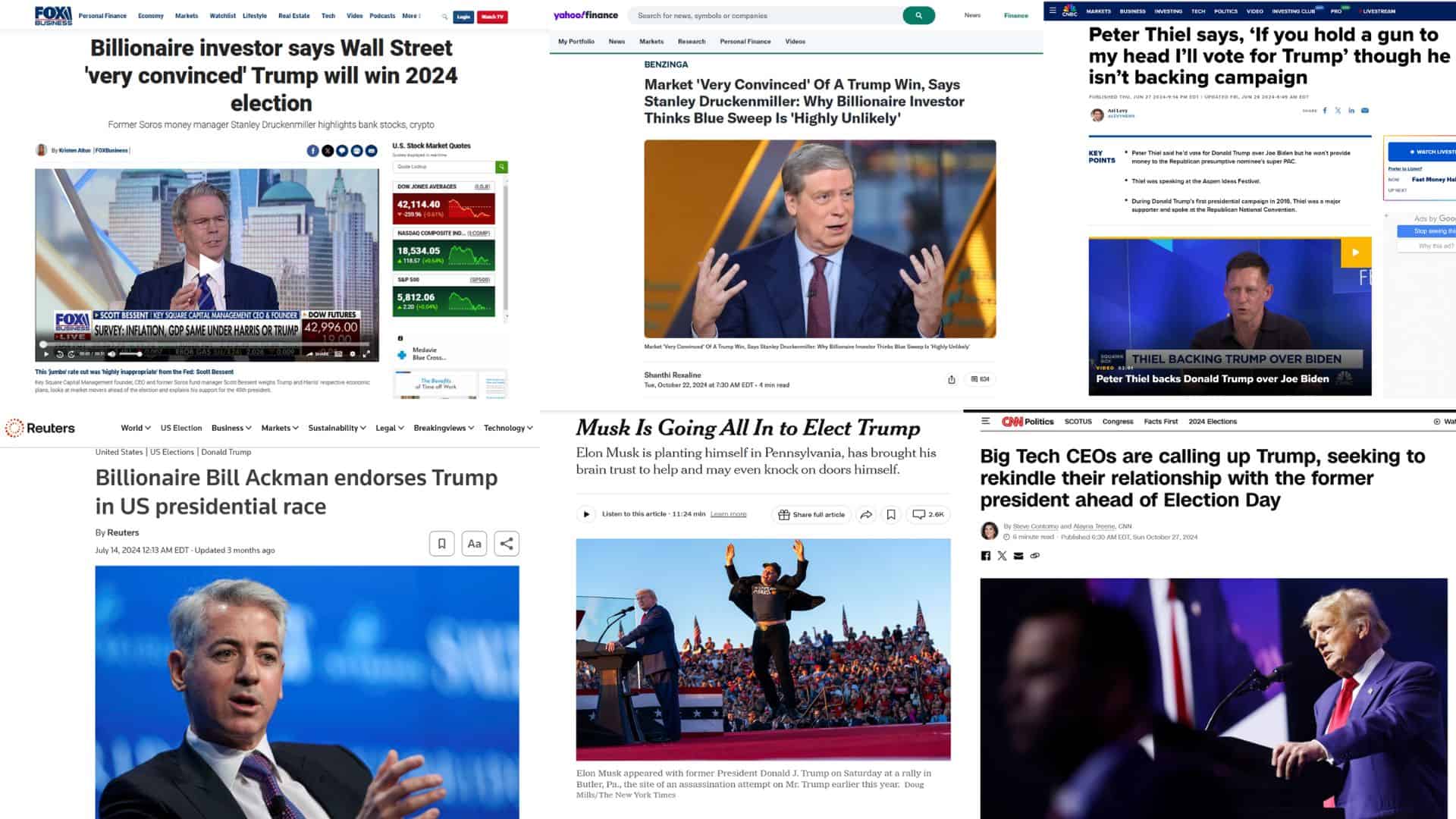

Next, let’s examine the financial market’s attitude toward the current presidential campaign. Currently, Wall Street is clearly optimistic, believing that the stock market is poised for a rise. Investors are generally favorable toward Trump’s election, and this expectation has already begun to manifest in the market. It is evident that Wall Street investors largely believe Trump will emerge victorious.

Additionally, many prominent figures in Silicon Valley have publicly expressed their support for Trump. For instance, renowned investor Peter Thiel stated that he would vote for Trump even if threatened with a gun. This kind of support further underscores Trump’s influence in the market.

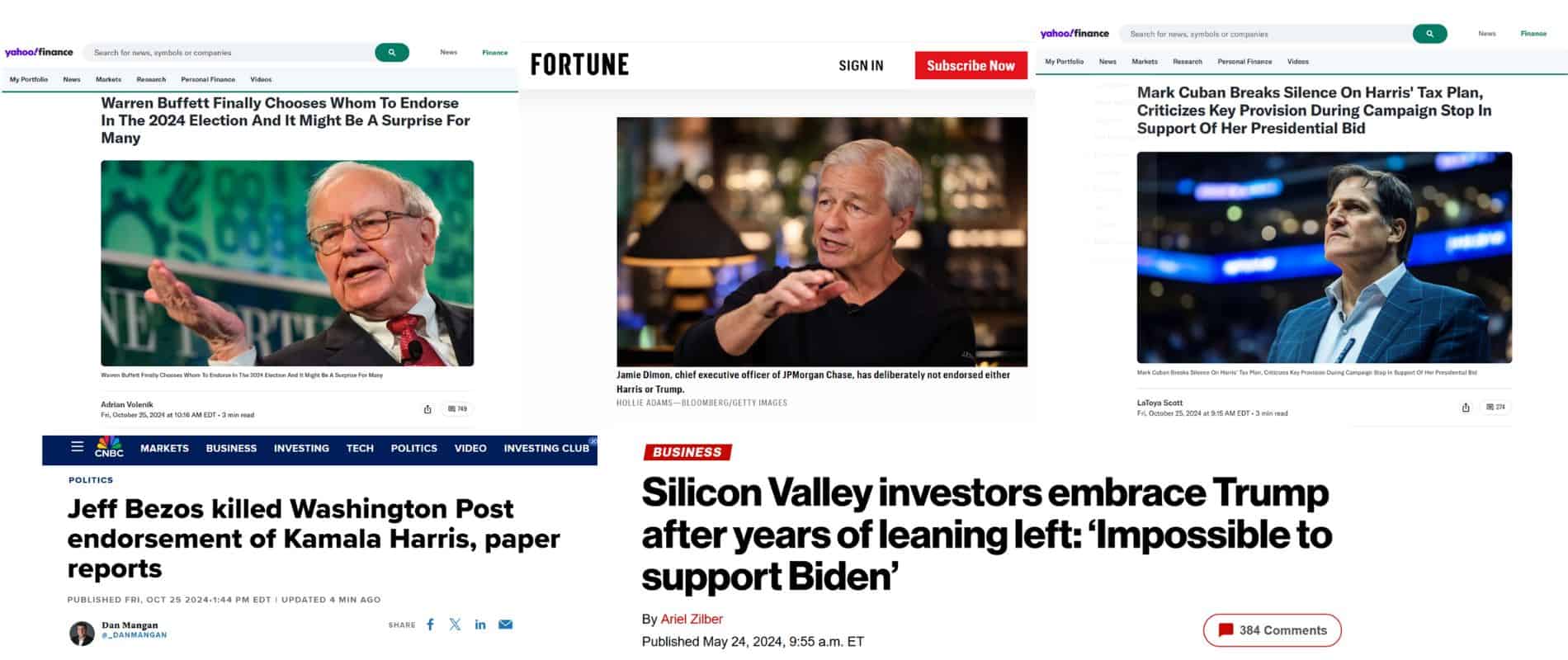

Moreover, Elon Musk has recently indicated his support for Trump, marking a significant shift. More importantly, Warren Buffett, who has long backed the Democratic Party, has publicly announced that he no longer supports them and is instead covertly backing Trump. Buffett voted for Obama in 2008 and 2012 and supported Hillary Clinton in 2016, so this change reflects a notable shift in his stance towards Trump. Similarly, Goldman Sachs’ COO has also distanced himself from the Democratic Party, and Jamie Dimon has begun to lean toward supporting Trump.

Jeff Bezos has clearly withdrawn his support for Harris, and even Mark Zuckerberg, who previously staunchly backed Harris, has now abandoned her. This indicates a significant rightward shift across Silicon Valley and the financial markets, a phenomenon that has been quite rare in the past.

It is noteworthy that even traditionally left-leaning media outlets are now beginning to report positively on Trump. This trend suggests that the market atmosphere is clearly shifting to the right, and many can feel this wave of change. It is precisely this transformation that we often mention in our daily commentary: the current era is driving a significant rightward shift, and many on the left are struggling to adapt. The market’s reaction and tone are remarkably consistent with this trend.

Current stock market conditions

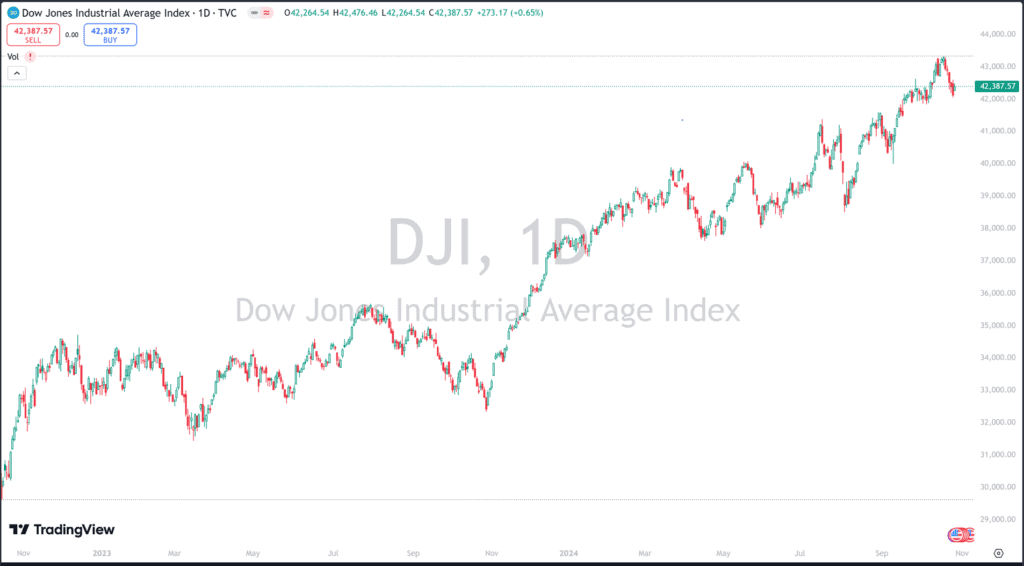

So, how is the stock market currently performing? It’s fair to say the market is on a roll. From 2003 to 2004, the charts show a steady climb to new historical highs, reflecting an extremely healthy and robust U.S. economy.

With both the economy and the market in such a strong position, the election outcome mainly determines who will “ignite” the stock market. Regardless of the winner, we can expect a significant market surge.

How Should We Invest?

For most people, investing is crucial for our future financial security. Not investing almost guarantees financial hardship—investment is essential to avoid economic struggles. Over the past two years, the stock market has performed well, and those who didn’t participate may have missed considerable gains, as the market rose by at least 50%. By staying in the market, there’s a potential for a 50% return, while sitting out can mean a loss in purchasing power due to inflation.

However, caution is necessary—attempting to get rich quickly often leads to scams. The key to avoiding fraud is finding truly skilled professionals who align with your values for investment.

AF specializes in financial investments, following strict disciplines like the “Eight Principles of Avoidance,” helping clients find suitable investment paths, demonstrating our expertise. With the Fourth Industrial Revolution underway, we anticipate a tremendous bull market and a major asset surge. Not participating could mean missing out on significant growth.

Does investing simply mean buying stocks? In reality, buying individual stocks is more like probability betting, which can make profits challenging. To truly invest and avoid speculation, one can choose public segregated funds—an effective investment approach.

Public segregated funds invest in a basket of stocks, not just a single stock. This diversification means that when one stock doesn’t perform, others might, thus reducing risk and enhancing returns. Choosing public segregated funds and seeking professional guidance is essential. Another advantage of these funds is the option to purchase them with investment loans—an option available only through insurance company segregated funds, not banks.

You may also interested in

What is an investment loan?

Can this loan last a lifetime? Interest-only payments? Tax-deductible? Is it a private loan? Is the threshold high?

Why do you need segregated funds for retirement?

Segregated funds are a popular choice for group savings and retirement plans. They provide access to high-end and unique……

Invest with TFSA

A Tax-Free Savings Account (TFSA) provides you with a flexible way to save for a financial goal, while growing your money tax-free……

Invest in RRSP-Invest wisely, retire early

According to a recent survey by BMO, due to inflation and rising prices, Canadians now believe they need 1.7 million dollars in savings to retire……