Canadian pension system: Crisis and Solution

At the end of March, the Canada Pension Plan (CPP) released its 2024 Annual Investment Report, revealing significant issues within Canada’s pension system. The current system is insufficient to support both current and future retirees. Today, we will analyze data from the report to highlight the crisis facing Canada’s pension system.

The report spans over 140 pages and contains extensive information. Instead of covering the entire document, we will focus on key data points. This presentation will be divided into four sections:

Alarming Data

Let’s delve into the first part, which contains a wealth of professional data with high reference value. The numbers we are about to explore are quite shocking.

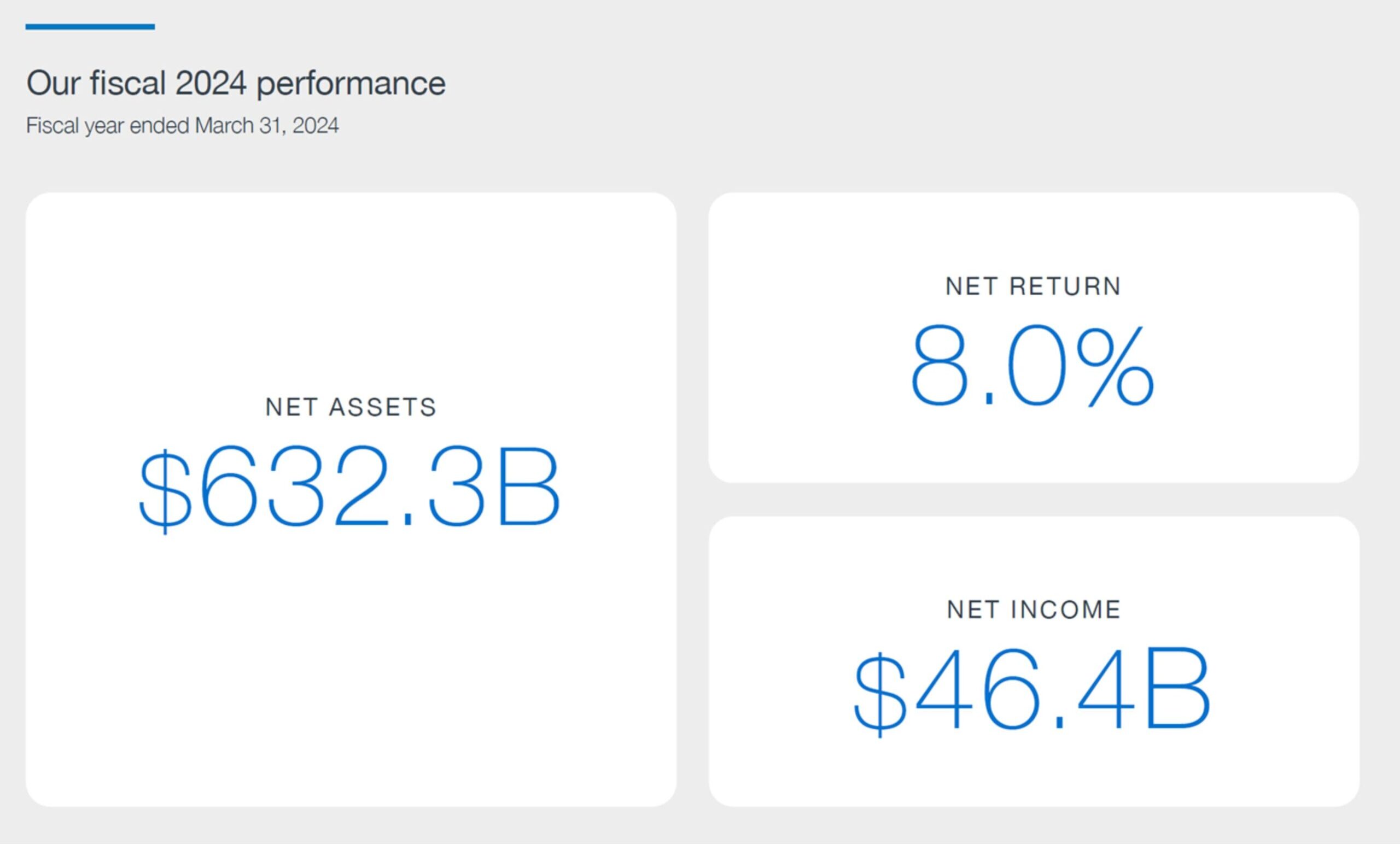

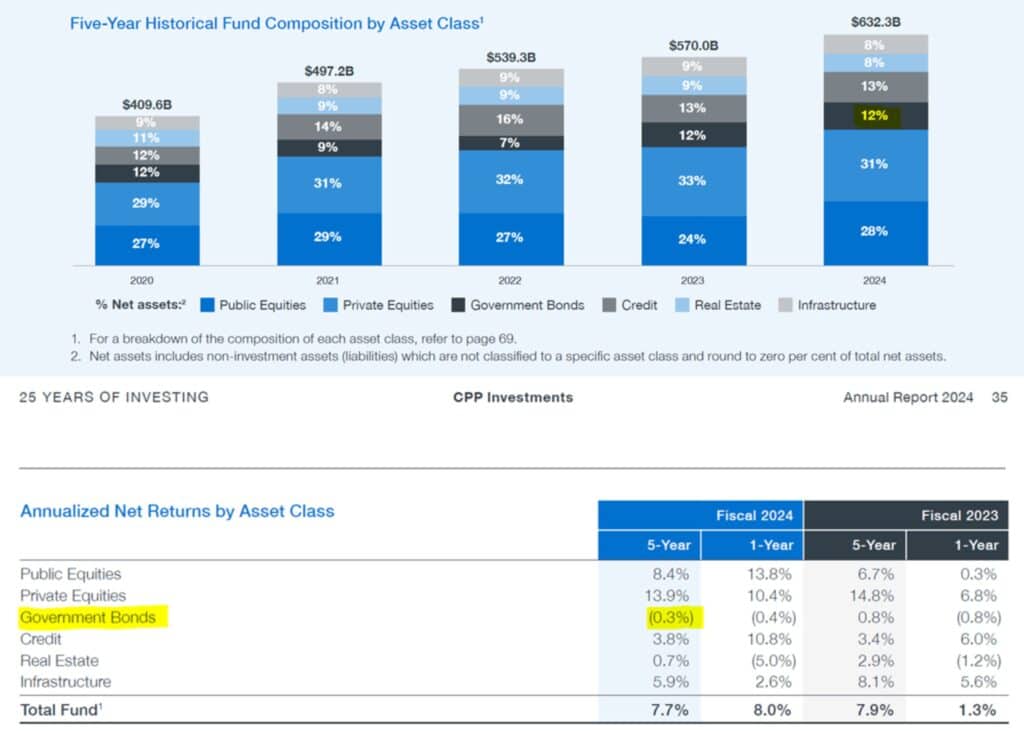

Firstly, CPP released its 2024 performance report. The report shows net assets of CAD 632.3 billion, a return rate of 8%, and a net income of CAD 46.4 billion. Next, we examine the relationship between contributors and beneficiaries.

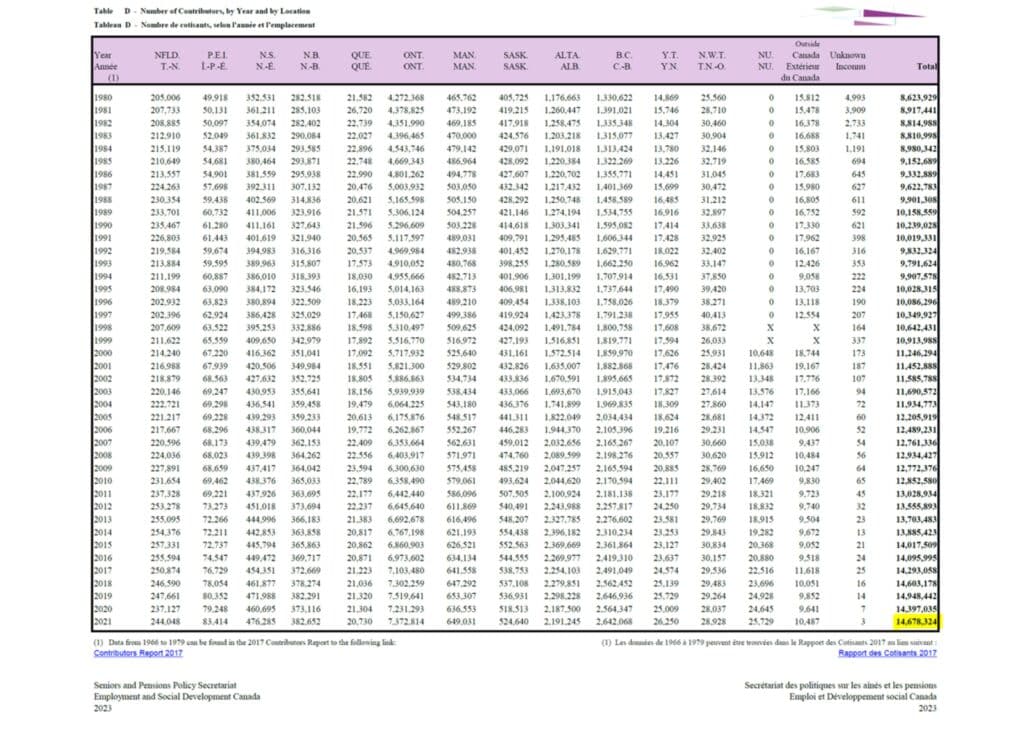

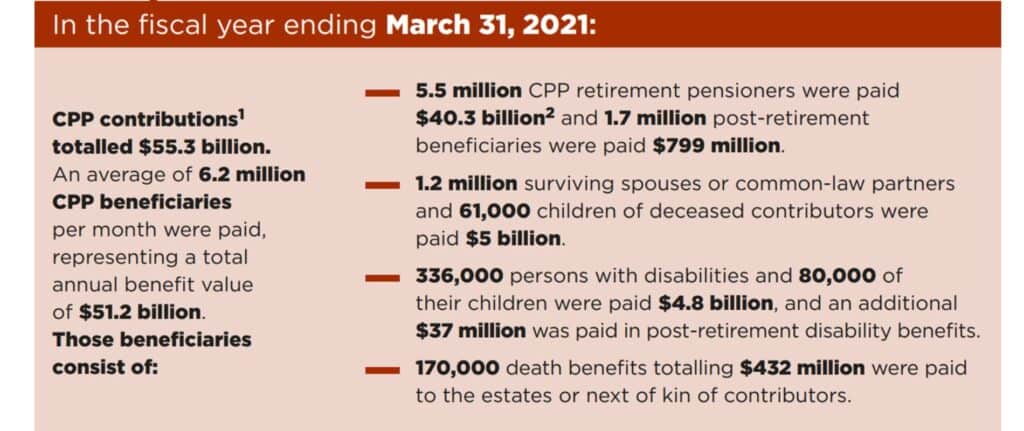

Established in 1999, CPP has been in operation for 25 years, serving around 22 million contributors and beneficiaries. According to the 2021 report, there were approximately 14 million contributors to the CPP. With a total population of 36 million in 2021, only 40% of Canadians contributed to the CPP, meaning that 60% did not contribute and, therefore, will not receive CPP benefits upon retirement.

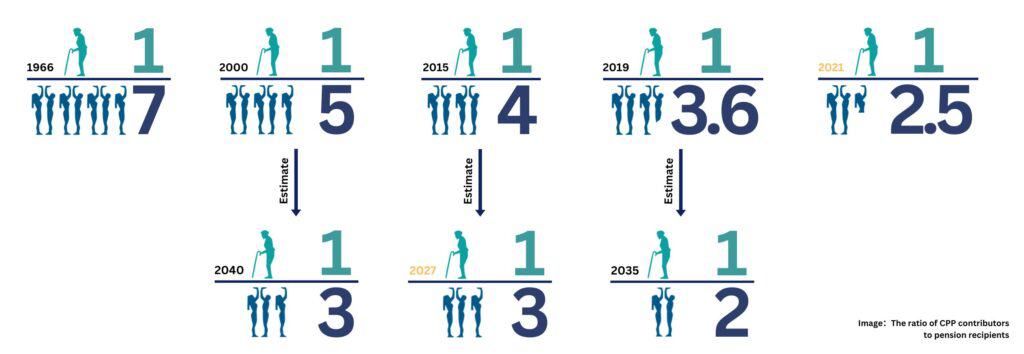

In 2021, there were 6.2 million people receiving CPP benefits, primarily retirees. Dividing this number by the 14 million contributors reveals that approximately 2.5 contributors are needed to support each beneficiary.

This data is crucial as it highlights the historical changes in the ratio of contributors to retirees. In 1966, 7 contributors supported one retiree; by 2000, it was 5; in 2015, it had dropped to 4 workers per retiree. By 2027, it is projected that 3 workers may be needed for each retiree. However, the situation in 2019 already showed a ratio of 3.6 workers per retiree. According to 2021 data, this ratio has further decreased to 2.5 workers per retiree, placing significant pressure on both current and future generations.

Clearly, the original CPP plan designed by the government no longer fits current realities. Returning to the initial data, we see that CPP manages assets totaling CAD 632.3 billion. To put this figure in perspective, let’s break down the specifics.

According to the report, CPP’s contributions for 2024 amount to CAD 65.6 billion, sourced from contributions made in 2023. The total income for CPP in 2024 is CAD 65.6 billion, of which CAD 49.7 billion is allocated to retiree benefits. The remaining CAD 15.9 billion represents net income.

Additionally, the net income of CAD 15.9 billion for 2024, combined with the investment gains of CAD 46.4 billion from 2023, results in a total income of CAD 62.3 billion. By adding this to the total assets of CAD 570 billion at the end of 2023, CPP’s current total assets amount to CAD 632.3 billion.

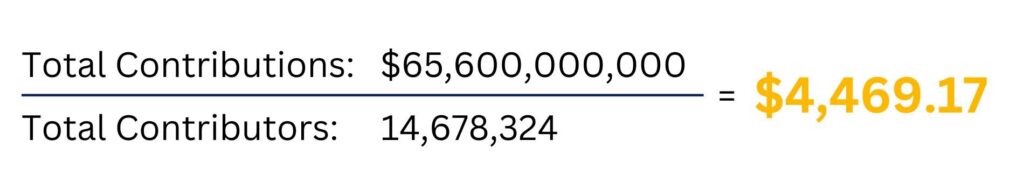

From this data, further analysis is possible. In 2023, the total contributions to CPP amounted to CAD 65.6 billion from approximately 14 million contributors. On average, each contributor paid CAD 4,469.17 per year.

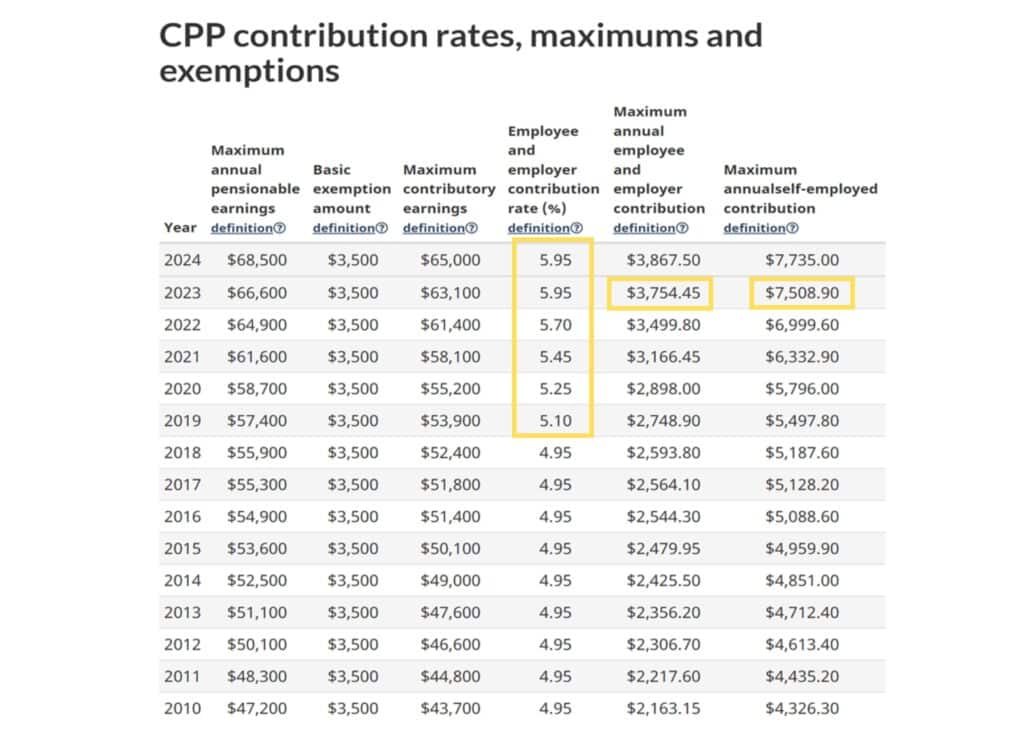

According to data from the official Canadian website, the contribution rate has been increasing annually from 2010 to 2024. Prior to 2018, the contribution rate was 4.95%. Starting in 2019, the rate began to rise annually, reaching 5.95% in 2024. This trend indicates a funding shortfall in CPP, necessitating higher contribution rates each year.

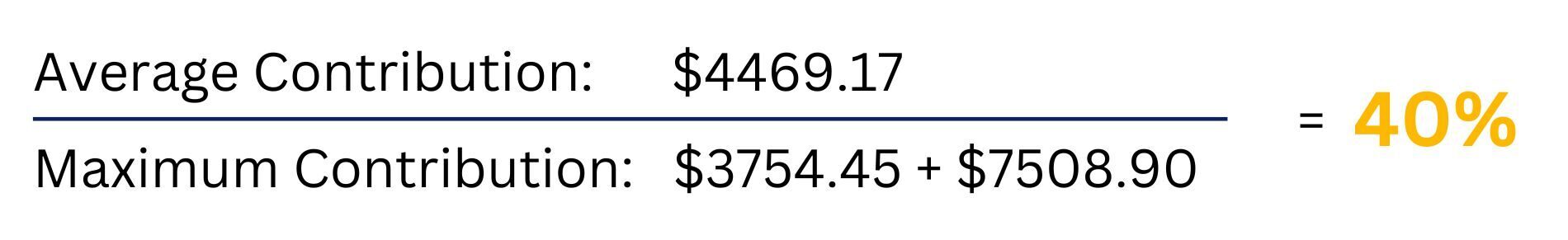

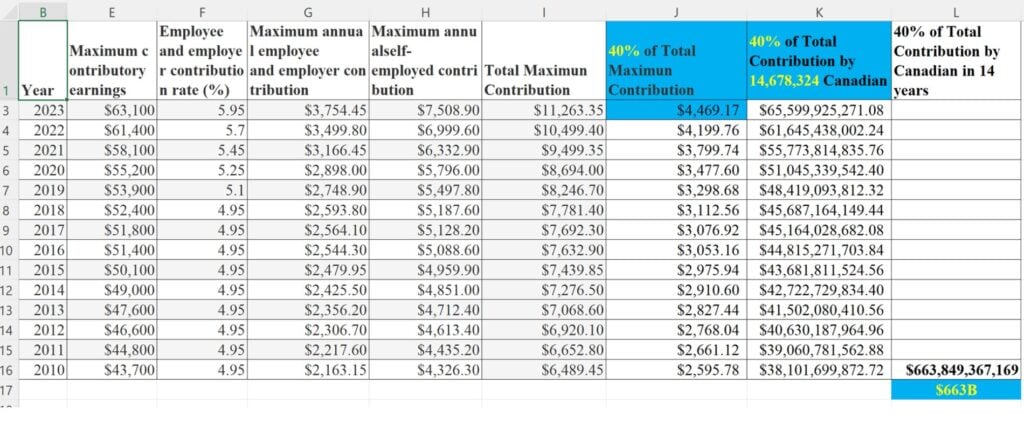

According to government data, the maximum contribution amounts for individuals and business owners in 2023 are CAD 3,700 and CAD 7,500, respectively. Based on the average contribution of CAD 4,469.17, the actual contribution rate is approximately 40% of the maximum allowed. Using this rate and the total of 14 million contributors, we can estimate the annual total contributions to CPP from Canadians.

Over the past 14 years (2010-2023), Canadians have contributed a total of CAD 663 billion to CPP. In contrast, the total assets of CPP over 25 years amount to CAD 6,323 billion. This indicates that funds from 1999 to 2009 are not included in the total assets. These figures clearly demonstrate that there are issues with CPP’s fund management, even suggesting that the principal amount might be missing.

This situation highlights that the current pension system lacks sufficient funds to meet future retirement needs. The conclusion is clear: the funding shortfall must be addressed urgently.

Alberta’s Plan to Exit the CPP

Last September, Alberta submitted a report requesting to exit the entire Canadian Pension Plan (CPP) and plans to establish its own pension system.

Alberta has five main reasons for proposing to exit the CPP:

- High Asset Share: Alberta’s assets in the CPP amount to $334 billion, which represents 53% of the total CPP assets of $632 billion, despite Alberta’s population being only 15% of the national total. Alberta feels it contributes disproportionately more while receiving inadequate returns.

- Disproportionate Returns: Alberta believes that while it contributes a large amount to the CPP, the returns it receives are relatively low.

- Quebec’s Non-Participation: Although the CPP is marketed as a national pension system, Quebec did not join when the system was established in 1966. Alberta argues that if Quebec could opt out, it should have the same right.

- Cost and Security: Alberta believes that creating its own pension system would be more cost-effective and secure. Given Alberta’s significant public funds, establishing a provincial pension plan could reduce the cost per worker.

- Exit Process: Alberta considers the process of withdrawing from the CPP to be straightforward and manageable, involving only the settlement of funds.

After outlining the five reasons for withdrawing, Alberta plans to set up its own pension plan called App. Any funds transferred from CPP to this new App will be invested solely within it, and future profits will remain with the App. Contributions from employers and employees will also go into this App.

To proceed, Alberta might need to hold a public vote on exiting CPP and creating the App. If approved, Alberta must notify CPP three years in advance to allow time for CPP to sell assets and return funds. With Alberta holding over $300 billion, this period is crucial for CPP.

Alberta’s exit would create a significant funding gap for CPP. With Quebec already out and Alberta potentially leaving, CPP’s ability to meet future retirement needs is increasingly in question.

Where Did the Money Go?

You might wonder why, despite large monthly contributions, CPP is facing a funding shortfall. Let’s explore this issue. Given the complexity and volume of the report, we can only highlight some key points.

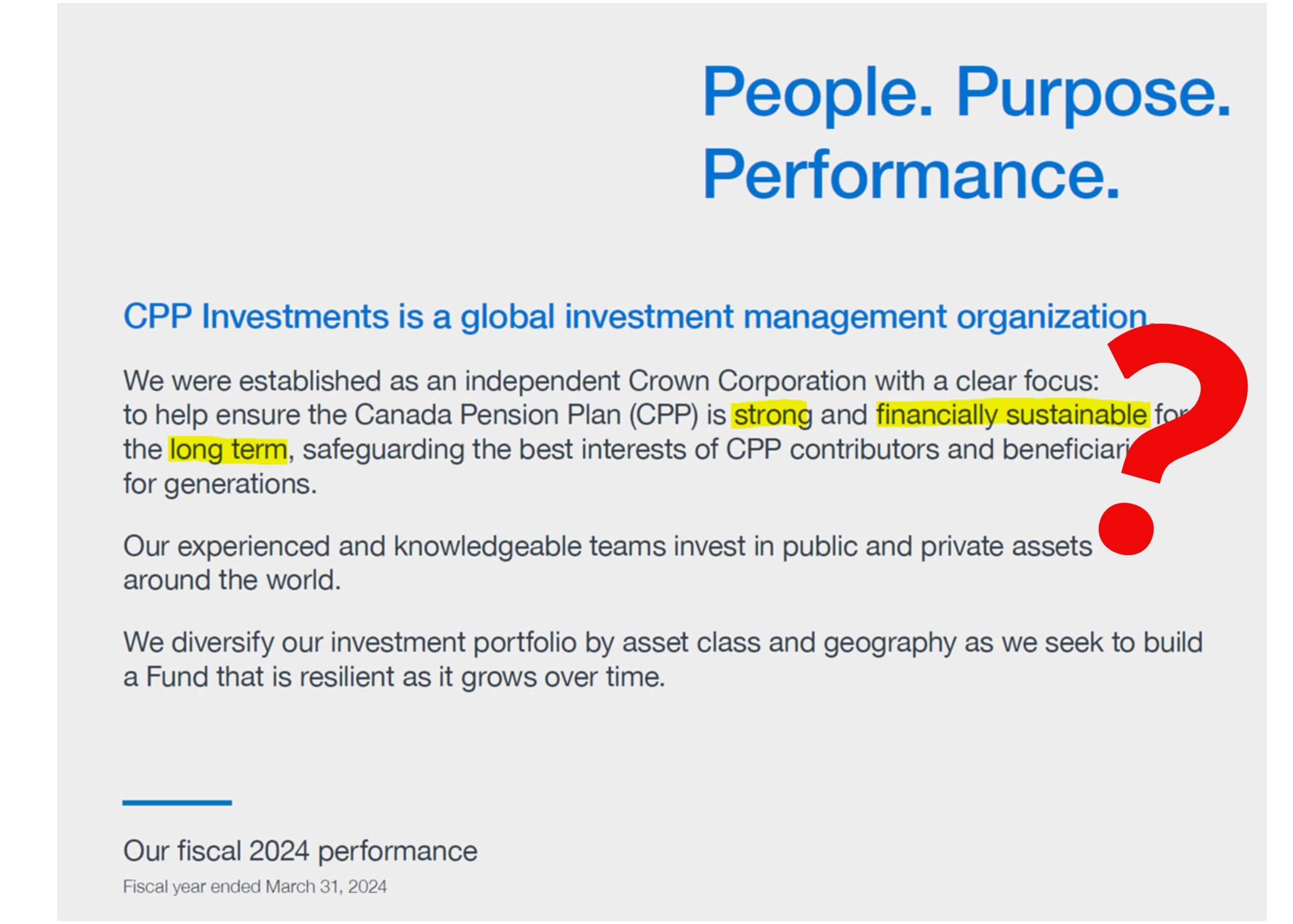

Firstly, CPP promises robust, long-term financial stability. However, the earlier reports suggest the reality is far from reassuring.

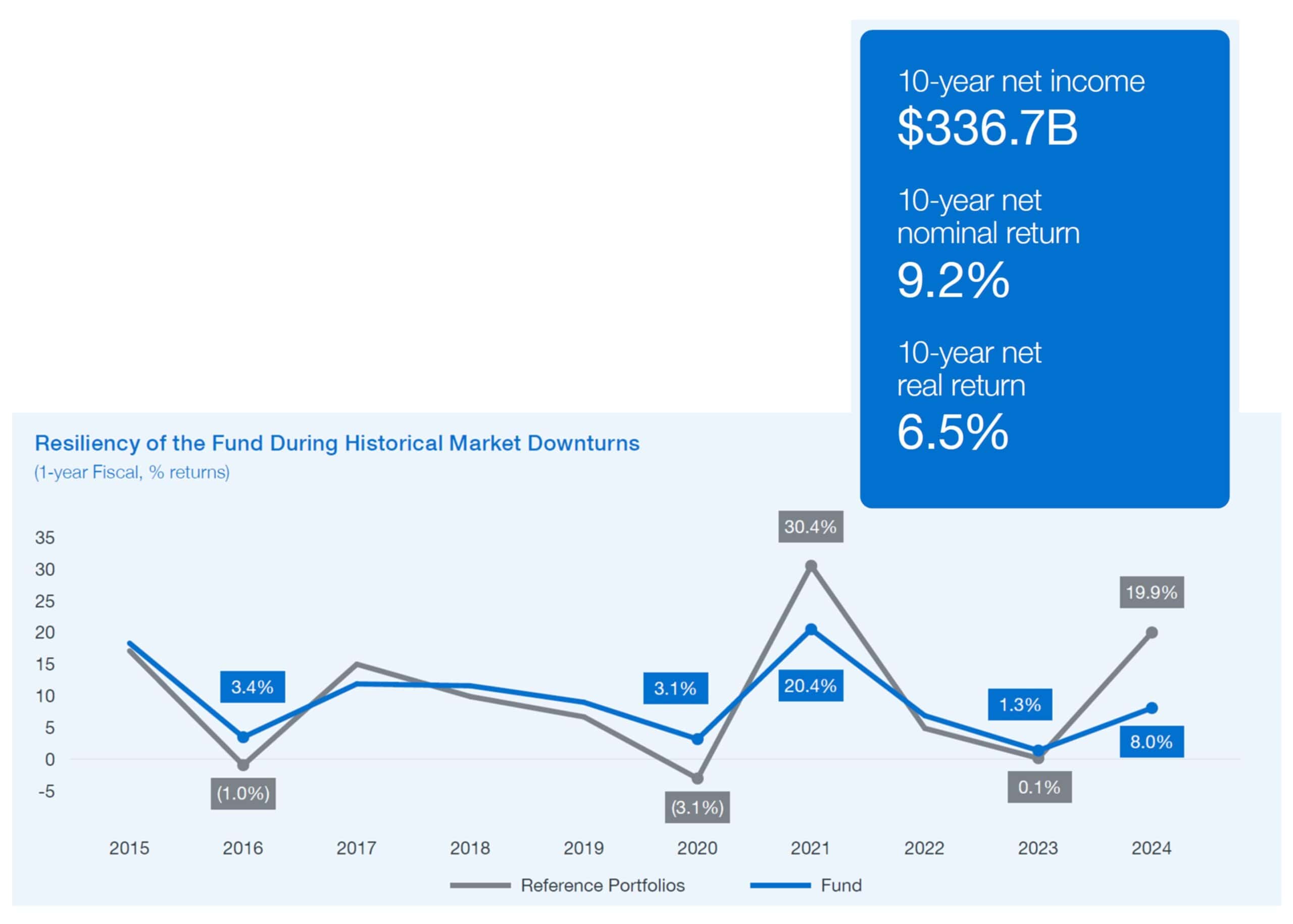

The report shows a 6.5% return rate over the past decade. This year, CPP’s return is 8%, but peers average 19.9%. CPP’s investment performance is below expectations.

The average inflation rate in Canada over the past decade is 2.6%. Subtracting this from the return rate gives a real return of only 3.9%. Given that recent fixed deposit rates are higher, this return is quite low.

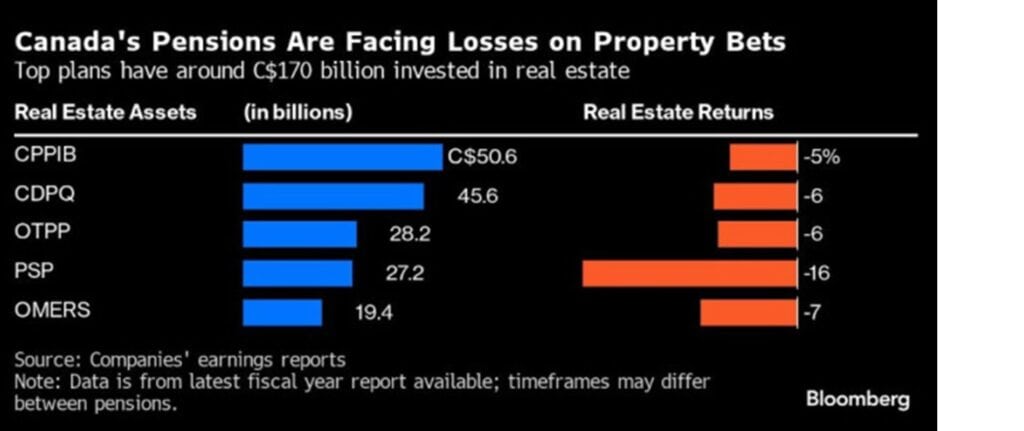

Where did the money go? For instance, CPP invested in real estate and faced a 5% loss, totaling $124 million—its worst since 2008. The pandemic, with increased remote work, severely impacted office and retail properties, leading to significant losses in this sector.

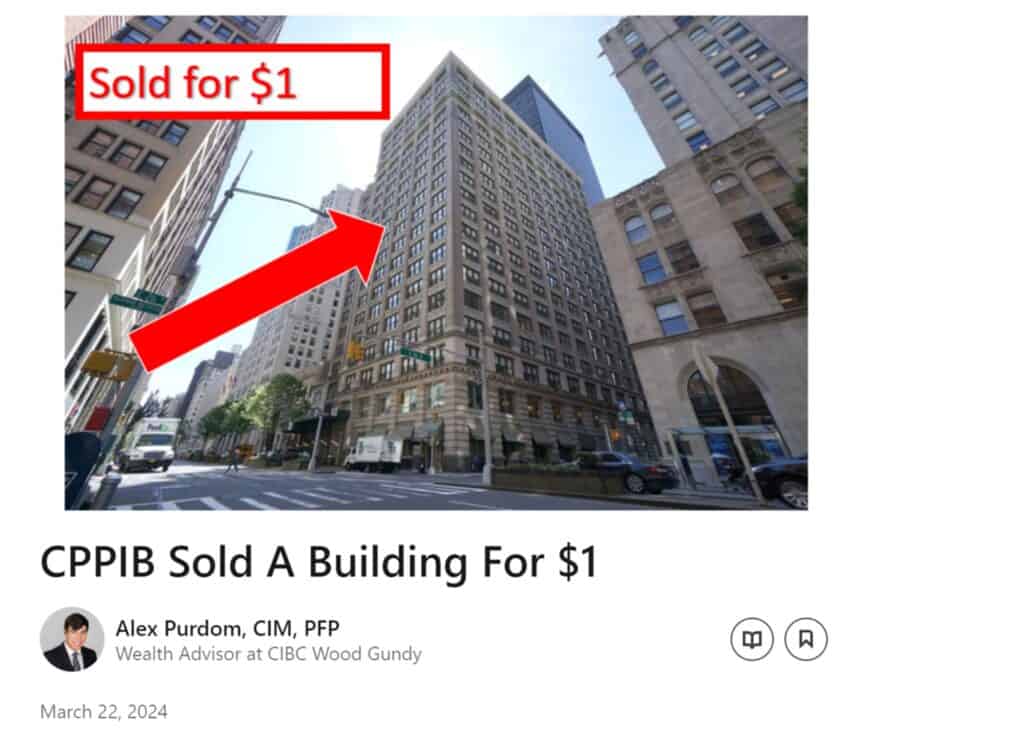

In February, CPP sold a Manhattan office building for just one dollar. Originally purchased for $71 million, it had to be sold at a symbolic price due to liabilities surpassing its value. This major loss reveals a significant misstep in CPP’s real estate investments.

CPP’s error stemmed from a misjudgment of market conditions. They assumed real estate investments were always profitable due to past success. However, the real estate boom has ended, and sectors like office and retail, hit hard by the pandemic and inflation, have not been addressed by CPP’s outdated investment strategy.

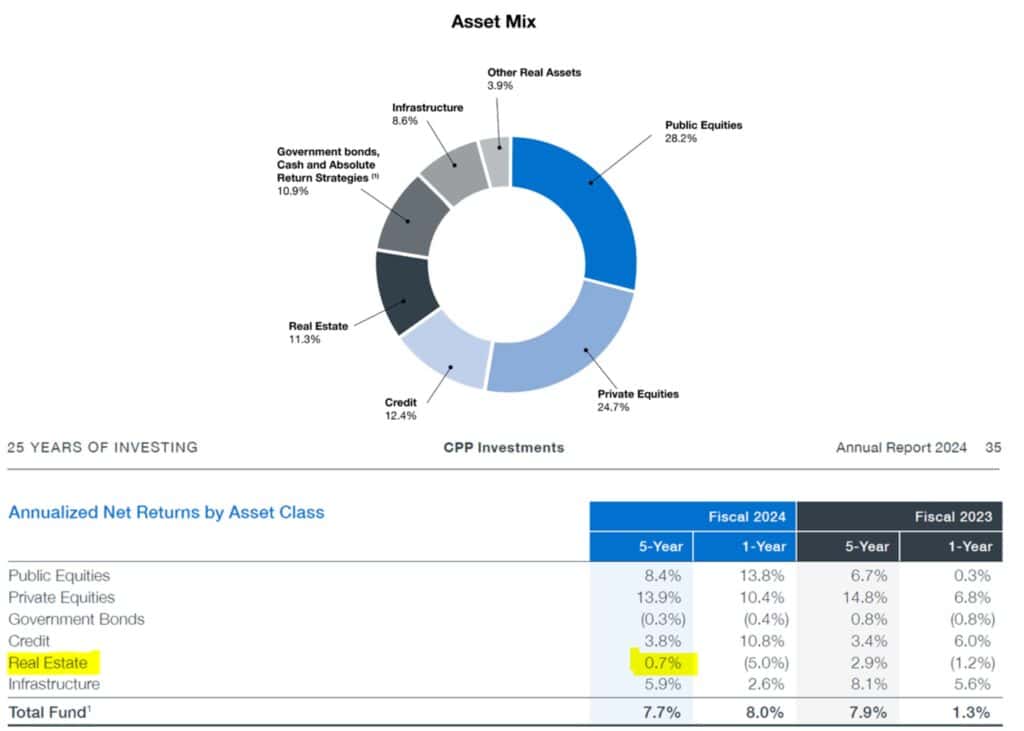

Let’s look at the chart on the left. CPP’s real estate holdings make up 11.3% of its portfolio. Over the past five years, real estate has provided just 0.7% return for CPP, much lower than the market average. This shows CPP’s investment strategy hasn’t adjusted to the end of the real estate boom.

Additionally, CPP’s portfolio includes 12% in government bonds, which have returned -0.3% over the past five years. Combined with real estate investments, which also underperformed, nearly a quarter of CPP’s assets are generating losses.

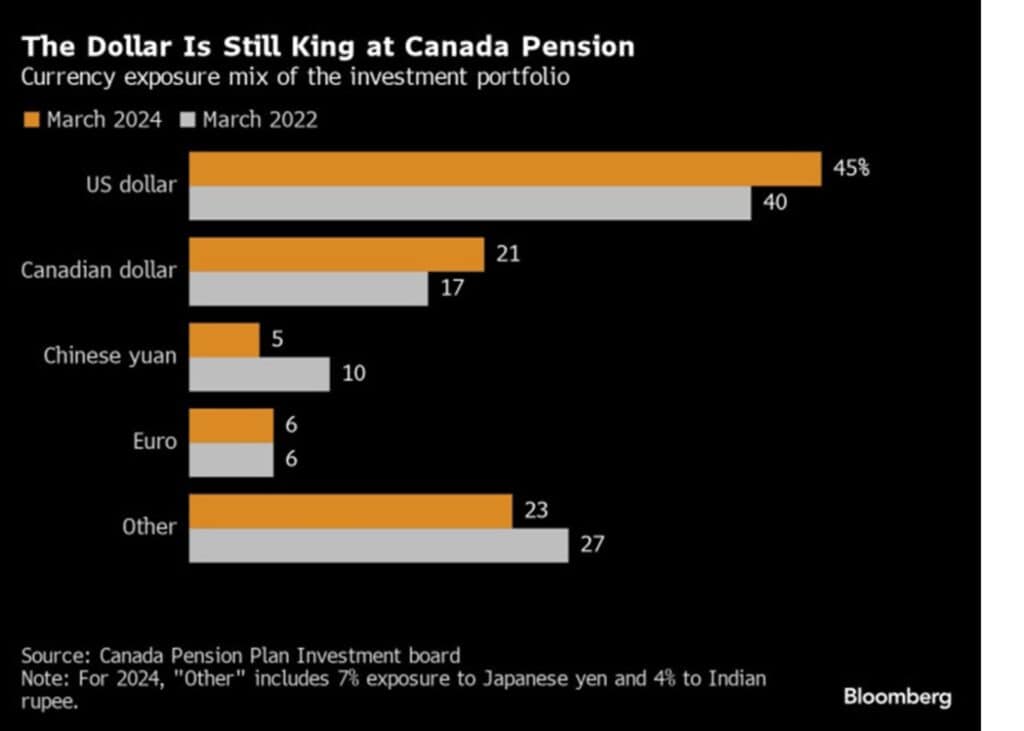

Moreover, as of March 31, CPP reduced its holdings in Chinese assets from 10% to 5% due to China’s economic downturn, leading to significant losses. Investments in other regions have also diminished, with Chinese investments experiencing the most severe losses.

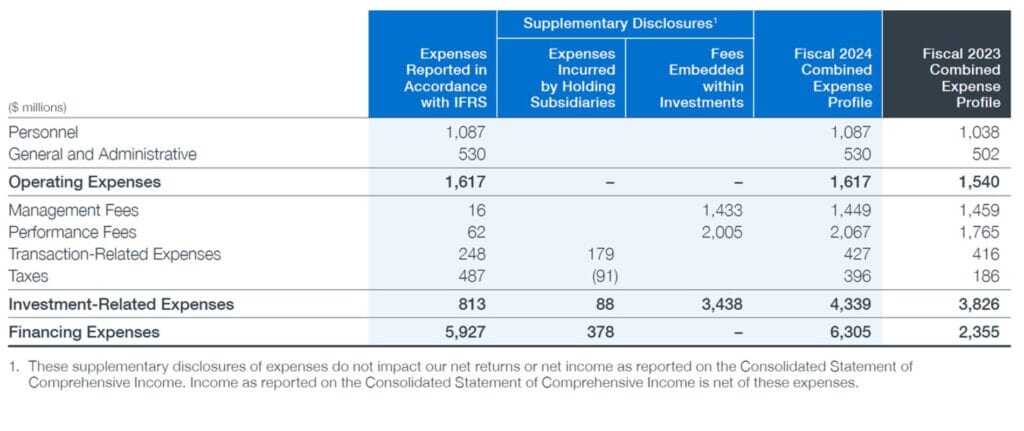

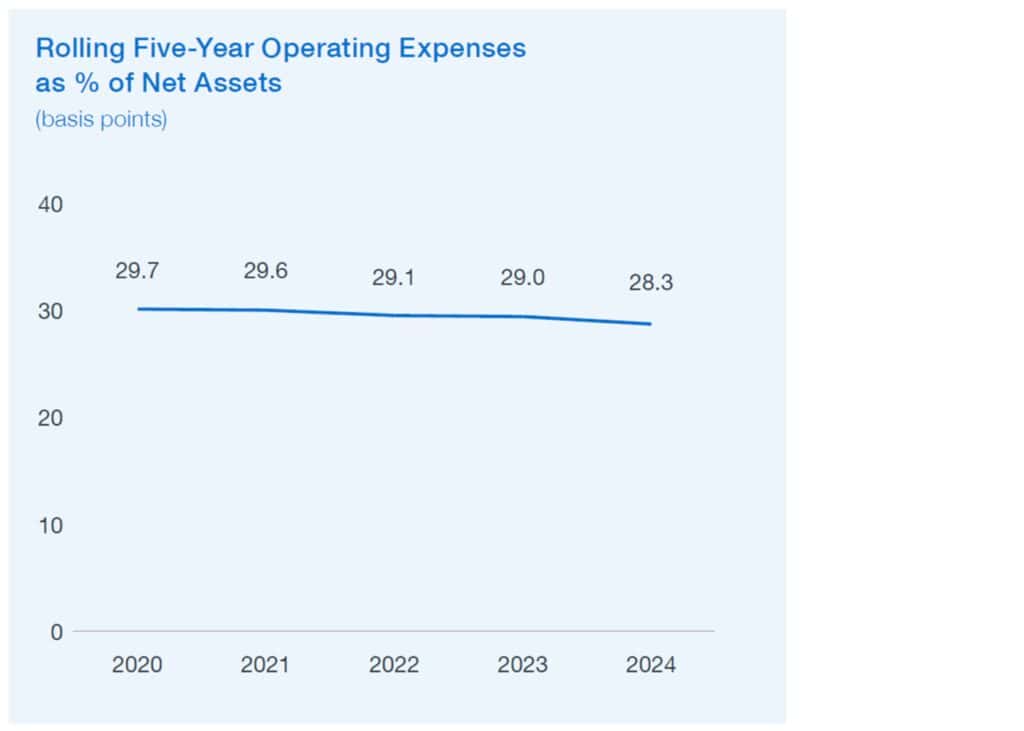

These factors have led to significant losses for CPP. Most of the funds are lost, with operating costs, investment fees, and financing expenses totaling $8.357 billion, or 28.3% of CPP’s assets. This means nearly a third of the assets are used for operational expenses.

In summary, CPP’s funds are depleted by poor investments and high operational costs. Much of the monthly pension contributions are lost this way. Clearly, Canada’s pension system needs reform.

The Need for Pension System Reform

The current system is failing to support even the present retirees, let alone future generations. Today’s pensions are funded by today’s workers, which is unsustainable. Therefore, Canada’s pension system must be reformed.

The government acknowledges the issues with the current pension system and aims for reform. However, reforms within the system face resistance:

- Retirees: They prefer to keep their benefits intact and are unlikely to support cuts.

- Contributors: They do not want their future pensions compromised or past contributions wasted.

Effective reform must focus on helping young workers and earners build their wealth independently. This way, they won’t rely solely on CPP for retirement.

The key is finding ways for these individuals to earn more, with the government planning to use policy measures to facilitate this.

This introduces a crucial concept:

Investment loans. By leveraging investment loans, individuals can potentially grow their wealth and address their own retirement needs. This reduces the burden on the state.

To support this, the government has introduced investment loan policies backed by national endorsement. If individuals can successfully invest and generate income, they can manage their retirement independently.

Following the introduction of the policy, many want to invest but lack initial capital. The government supports this through investment loans from various banks, allowing people to invest and earn returns, thus reducing reliance on government aid.

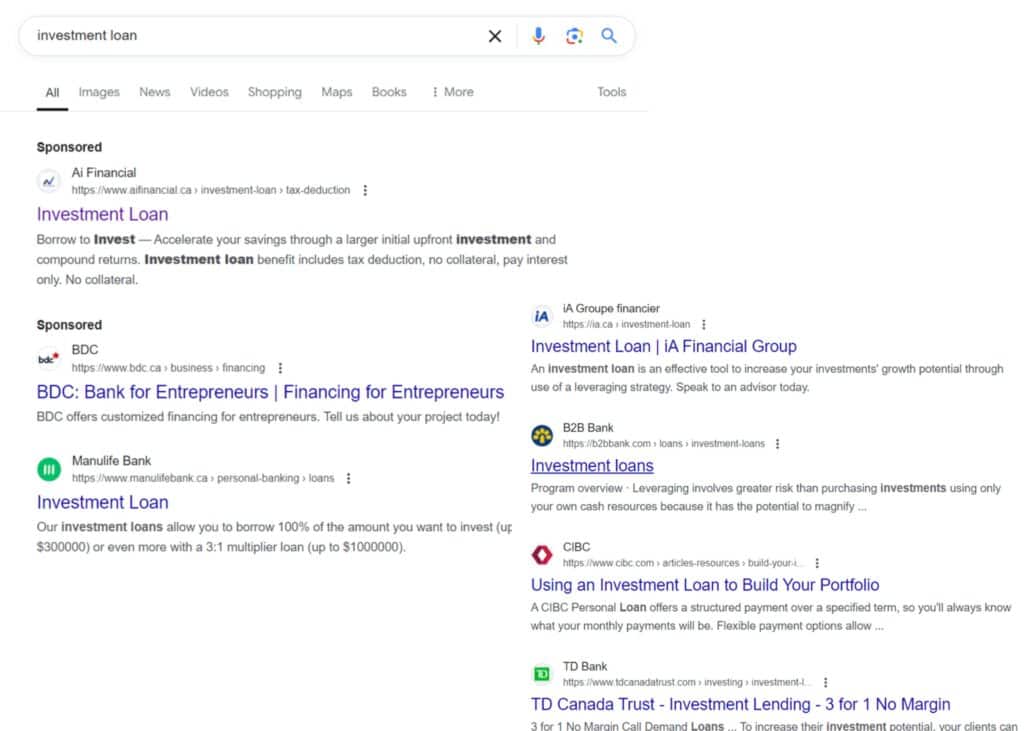

Investment loans are government-endorsed. Information is available from Ai Financial and major banks like BDC, Manulife, IA Trust, B2B, CBC, and TD. These loans help individuals invest and build wealth.

How does it work?

The government backs investment loans provided by banks. These funds are invested in principal-protected funds, ensuring safety. Insurance companies guarantee the principal protection.

Funds are invested through Ai Financial’s system, helping clients earn returns and reducing reliance on government pensions. This creates a win-win for everyone involved.

Ai Financial is committed to improving Canada’s retirement system. Join us to benefit together.

Ai Financial has been in the investment loan business for years. Over the past decade, we’ve achieved a 21.6% return on investment, significantly higher than the highest interest rates.

With interest rates recently rising to nearly 8%, our return rate of 21.6% comfortably covers these costs. This demonstrates the effectiveness of investment loans, aligning with the government’s goals of promoting this strategy.

You may also interested in

What is an investment loan?

Can this loan last a lifetime? Interest-only payments? Tax-deductible? Is it a private loan? Is the threshold high?

Why do you need segregated funds for retirement?

Segregated funds are a popular choice for group savings and retirement plans. They provide access to high-end and unique……

Invest with TFSA

A Tax-Free Savings Account (TFSA) provides you with a flexible way to save for a financial goal, while growing your money tax-free……

Invest in RRSP-Invest wisely, retire early

According to a recent survey by BMO, due to inflation and rising prices, Canadians now believe they need 1.7 million dollars in savings to retire……