Discover how a Canadian family achieved 239% returns using strategic...

Read MoreFrom Canvas to Capital: How AiF Helps Artists Achieve Six-Figure Investment Growth

Mr. W, a passionate artist, had long devoted himself to creative expression while leaving his finances untouched. With little knowledge of financial strategies, he kept most of his money in bank accounts. As a result, his wealth remained stagnant—earning minimal returns and missing out on investment growth opportunities.

A Chance Encounter Opens the Door

One day, through a friend’s recommendation, William met the head of Ai Financial’s investment department. Driven by curiosity, he attended an online seminar hosted by AiF. From initial hesitation to growing trust, William made a bold decision: hand over his financial assets to professionals

Milestone Moment: August 14, 2023

William took his first significant steps toward investment growth:

- Applied for a $100,000 investment loan through AiF

- Transferred his TFSA account (valued at $72,160) from RBC to AiF for unified asset management

This marked the start of a new chapter in his financial journey.

Confidence Through Results

Within a few months, William witnessed the steady investment growth of his account. Encouraged by the results and AiF’s expertise, he took further action in November:

- 💰 Invested an additional $300,000 into a Non-Reg account

- 💳 Added $70,000+ to his TFSA (with a flexible withdrawal of $7,000 for daily living expenses)

Despite having no background in finance, William grasped a key insight:

“It’s more important to choose the right professionals than to explore blindly on your own.

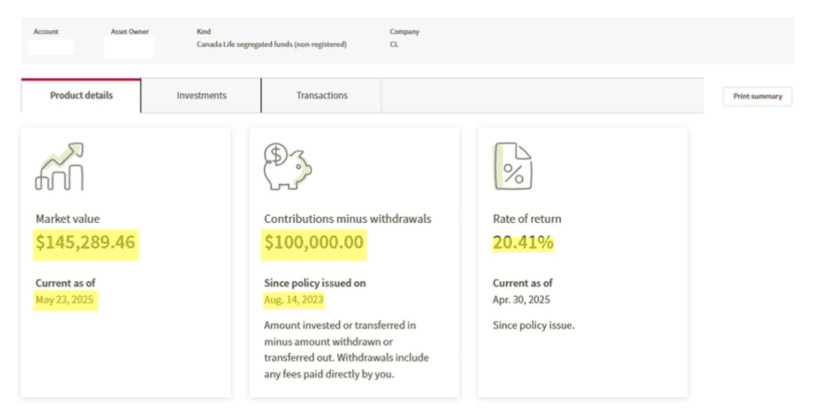

William ‘s Canada Life investment return display:

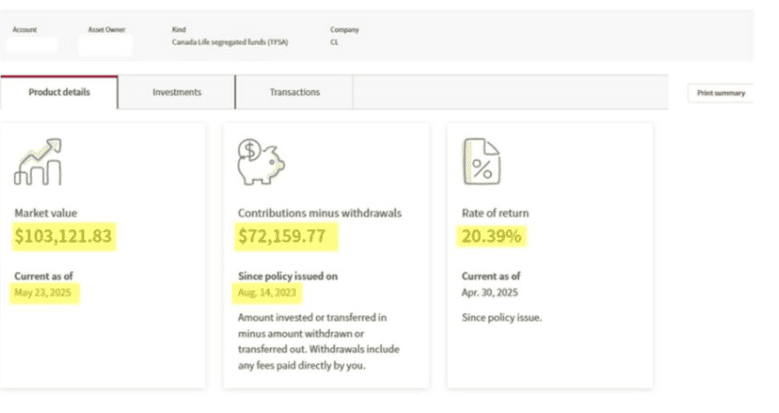

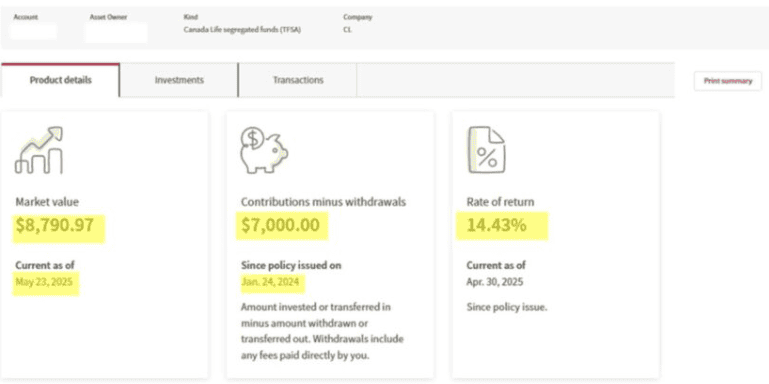

William’s TFSA account return display:

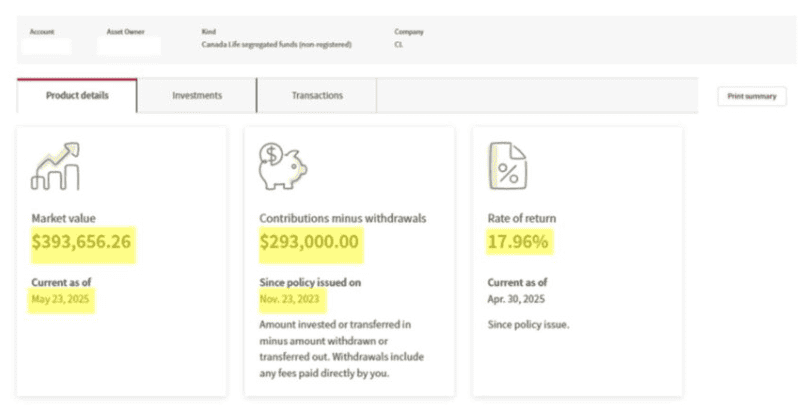

William’s Canada Life additional investment return display:

TFSA additional return display:

From Uncertainty to Clarity

William didn’t spend hours analyzing charts or reading financial news. Instead, he focused on long-term investment growth by relying on AiF’s specialized team. Through consistent asset management and strategic guidance, he turned passive savings into dynamic wealth-building tools.

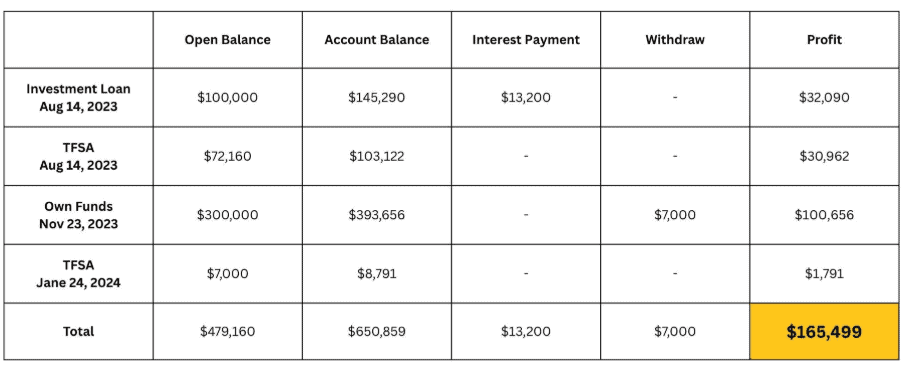

📊 Total Return on Investment Overview:

- Canada Life investment performance

- TFSA account return growth

- Additional contributions and returns breakdown

Each category reflected AiF’s capability to turn dormant funds into active, growing investments.

A Story That Inspires

William’s experience shows that investment growth doesn’t require deep market knowledge—just the right team and a willingness to act. His journey from artistic passion to financial progress proves that success lies in making the right choices at the right time.

“From art to assets, William embraced systematic wealth building through trust—not technical analysis.”

Ready to Star Your Own Journey?

If you’re looking to achieve sustainable investment growth, AiF offers a proven, professional approach:

- ✔️ Use investment loans to maximize capital

- ✔️ Strategically manage registered accounts for retirement

- ✔️ Leverage AiF’s AI-powered asset management platform

With an average annualized return of 21.6% over the past 10 years, AiF has helped clients turn possibility into performance.

📩 Contact AiF today to create your custom wealth strategy and start growing your assets with confidence

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More